Source: Company reports/Coresight Research

FY17 Results

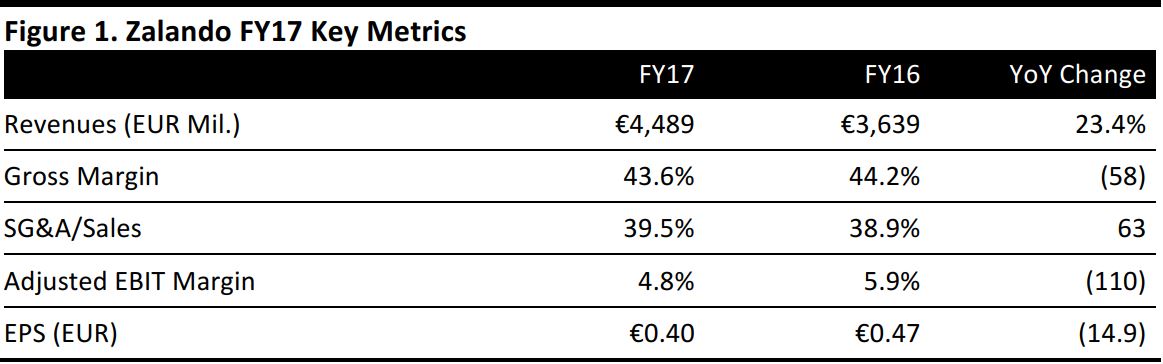

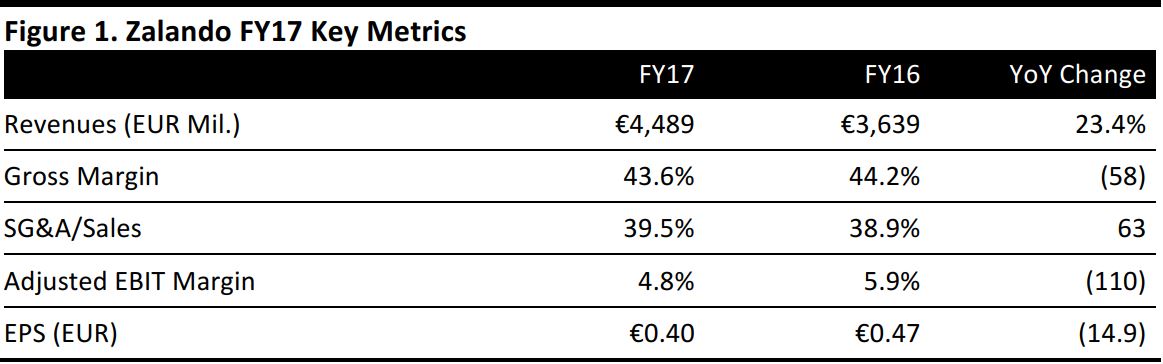

Zalando announced sales and profit data for FY17 on March 1. The company had already announced preliminary FY17 revenue and EBIT growth in January.

In its latest release, the company announced the following details for FY17:

- Revenues were up 23.4%, toward the upper end of the company’s 20%–25% guidance and in line with analysts’ expectations.

- The company grew revenues by 18.3% in its most mature region, which includes Germany, Austria and Switzerland.

- Rest of Europe revenues grew by 25.7%.

- Revenue growth was driven by an increase in customers and more order numbers. Active customer numbers grew from 19.9 million in 2016 to 23.1 million in 2017. Average orders per customer increased from 3.5 in 2016 to 3.9 in 2017.

- The company grew GMV, which includes sales by third-party sellers on Zalando, by 26.5%.

The gross margin declined slightly, due to greater discounting, which was driven by the mix effects, as sales ramped up in the more price-focused Rest of Europe segment.

Fulfillment costs increased from 23.3% of revenues in 2016 to 26.0% in 2017, as the company invested in new fulfillment centers and enhanced services such as same-day delivery.

Adjusted EBIT of €215 million was broadly level with the prior year and was just ahead of analysts’ expectations of €210 million. However, adjusted EBIT margins contracted from 5.9% in 2016 to 4.8% in 2017, with management attributing this largely to higher fulfillment costs.

Pretax profit and net income undershot expectations. Net profit fell by 15.7% versus analysts’ estimates of a 2% increase.

Outlook

In 2018, management expects to grow revenues by 20%–25% and to report adjusted EBIT of €220–€270 million. At the midpoint of those ranges, guidance implies revenues of €5.5 billion and an adjusted EBIT margin of 4.5%, which represents a further decline in margin.