albert Chan

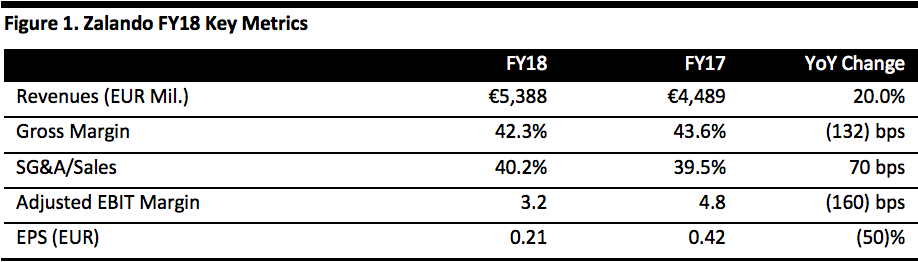

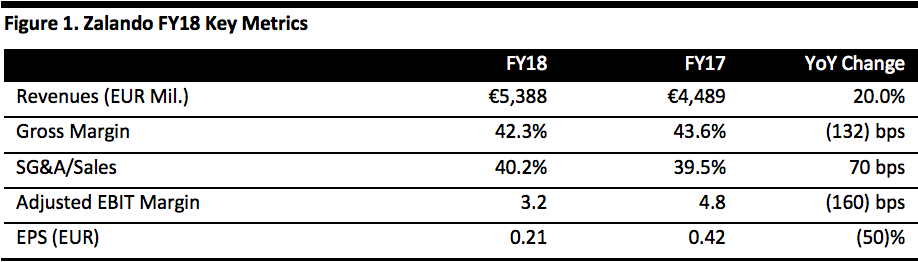

[caption id="attachment_79231" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

On February 28, 2019, Zalando published its 4Q18 and FY18 results, and hosted a Capital Markets Day in Berlin.

4Q18 and FY18 Results

Zalando reported a very strong final quarter, with revenue growth of 24.6%, versus 11.7% in the third quarter. 4Q18 revenues of €1.66 billion came in ahead of the consensus estimate of €1.64 billion recorded by StreetAccount. At the company Capital Market Day, Birgit Haderer, SVP of Finance, characterized it as a “good conclusion to a bumpy 2018” and noted that growth was supported by “very strong” customer key performance indicators, such as customer growth and purchase frequency.

In 4Q18, the company reported adjusted group EBIT of €117.8 million, up 4.6% year over year and comfortably ahead of the StreetAccount consensus of €105.8 million. This yielded an adjusted EBIT margin of 7.1%, down 130 bps year over year but ahead of the 6.4% consensus.

4Q18 Segment Performance:

Source: Company reports/Coresight Research[/caption]

On February 28, 2019, Zalando published its 4Q18 and FY18 results, and hosted a Capital Markets Day in Berlin.

4Q18 and FY18 Results

Zalando reported a very strong final quarter, with revenue growth of 24.6%, versus 11.7% in the third quarter. 4Q18 revenues of €1.66 billion came in ahead of the consensus estimate of €1.64 billion recorded by StreetAccount. At the company Capital Market Day, Birgit Haderer, SVP of Finance, characterized it as a “good conclusion to a bumpy 2018” and noted that growth was supported by “very strong” customer key performance indicators, such as customer growth and purchase frequency.

In 4Q18, the company reported adjusted group EBIT of €117.8 million, up 4.6% year over year and comfortably ahead of the StreetAccount consensus of €105.8 million. This yielded an adjusted EBIT margin of 7.1%, down 130 bps year over year but ahead of the 6.4% consensus.

4Q18 Segment Performance:

Source: Company reports/Coresight Research[/caption]

On February 28, 2019, Zalando published its 4Q18 and FY18 results, and hosted a Capital Markets Day in Berlin.

4Q18 and FY18 Results

Zalando reported a very strong final quarter, with revenue growth of 24.6%, versus 11.7% in the third quarter. 4Q18 revenues of €1.66 billion came in ahead of the consensus estimate of €1.64 billion recorded by StreetAccount. At the company Capital Market Day, Birgit Haderer, SVP of Finance, characterized it as a “good conclusion to a bumpy 2018” and noted that growth was supported by “very strong” customer key performance indicators, such as customer growth and purchase frequency.

In 4Q18, the company reported adjusted group EBIT of €117.8 million, up 4.6% year over year and comfortably ahead of the StreetAccount consensus of €105.8 million. This yielded an adjusted EBIT margin of 7.1%, down 130 bps year over year but ahead of the 6.4% consensus.

4Q18 Segment Performance:

Source: Company reports/Coresight Research[/caption]

On February 28, 2019, Zalando published its 4Q18 and FY18 results, and hosted a Capital Markets Day in Berlin.

4Q18 and FY18 Results

Zalando reported a very strong final quarter, with revenue growth of 24.6%, versus 11.7% in the third quarter. 4Q18 revenues of €1.66 billion came in ahead of the consensus estimate of €1.64 billion recorded by StreetAccount. At the company Capital Market Day, Birgit Haderer, SVP of Finance, characterized it as a “good conclusion to a bumpy 2018” and noted that growth was supported by “very strong” customer key performance indicators, such as customer growth and purchase frequency.

In 4Q18, the company reported adjusted group EBIT of €117.8 million, up 4.6% year over year and comfortably ahead of the StreetAccount consensus of €105.8 million. This yielded an adjusted EBIT margin of 7.1%, down 130 bps year over year but ahead of the 6.4% consensus.

4Q18 Segment Performance:

- Fashion Store: This segment, which comprises full-price websites, grew revenues by 25.1% year over year and reported EBIT of €110.9 million, or a margin of 7.2%.

- Off price: This segment grew revenues by 36.0% year over year and reported EBIT of €11.1 million, a margin of 7.4%.

- All Others: This segment, which includes private labels and various emerging businesses, reported a 50.0% year-over-year increase in revenues and posted an EBIT of €(4.0) million, or a margin of (3.0)%.