Nitheesh NH

[caption id="attachment_94043" align="aligncenter" width="700"] Based on statutory EBIT

Based on statutory EBIT

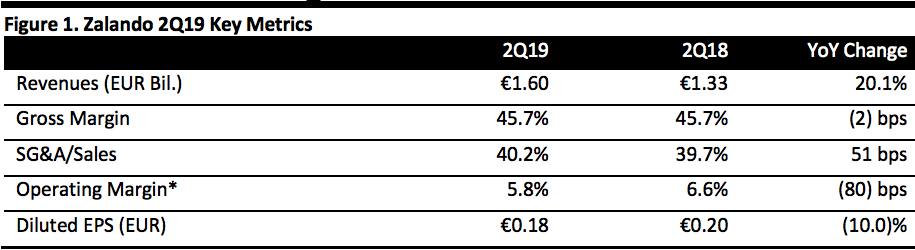

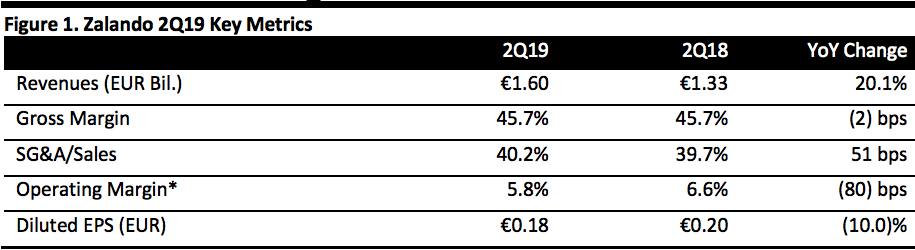

Source: Company reports/Coresight Research[/caption] 2Q19 Results In 2Q19, Zalando reported strong growth in revenues and consensus-beating EBIT that prompted management to raise EBIT guidance for the full year:

Based on statutory EBIT

Based on statutory EBITSource: Company reports/Coresight Research[/caption] 2Q19 Results In 2Q19, Zalando reported strong growth in revenues and consensus-beating EBIT that prompted management to raise EBIT guidance for the full year:

- Zalando grew total sales by one-fifth year over year to €1.6 billion, in line with the consensus estimate recorded by StreetAccount. The company grew its gross merchandise volume (GMV) 23.7% year over year to €2.04 billion, driven by a 15.2% increase in active customers and a 9.2% increase in average orders per active customer, partly offset by a further decline, of 2.6%, in the average basket size.

- Gross profit rose in line with sales yielding a flat gross margin.

- Reversing the trend of a rising fulfilment cost ratio we saw in prior quarters, fulfilment costs as a proportion of revenues declined by 1 percentage point year over year, supported by a favorable assortment mix and higher warehouse efficiency. However, the marketing cost ratio rose 1.7 percentage points year over year.

- The result was adjusted EBIT of €101.7 million, up 8.2% year over year and comfortably ahead of consensus of €97 million. Adjusted EBIT excludes equity-settled share-based expenses, restructuring costs and non-operating one-time effects.

- Zalando reported net income of €45.5 million, down 12.2% year over year and behind expectations of €57.2 million.

- The fashion store segment grew revenue 19.8% year over year to €1.48 billion. Sales rose 17.0% in the DACH region (Germany, Austria and Switzerland) and 22.8% in the rest of Europe.

- The segment reported an EBIT margin of 6.5%, down 60 basis points year over year.

- The segment grew revenue 35.9% year over year to €156 million.

- The EBIT margin declined to 3.8% from 6.2% in the year-ago period, due to higher fulfilment costs and administrative expenses.

- This segment was impacted by the shift of the private-label business to the fashion store segment, causing segment revenue to fall 55.2% year over year to €45 million. The segment posted an EBIT margin of (20.9)%.