*Nonadjusted

Source: Company reports/Coresight Research

*Nonadjusted

Source: Company reports/Coresight Research

2Q18 Results

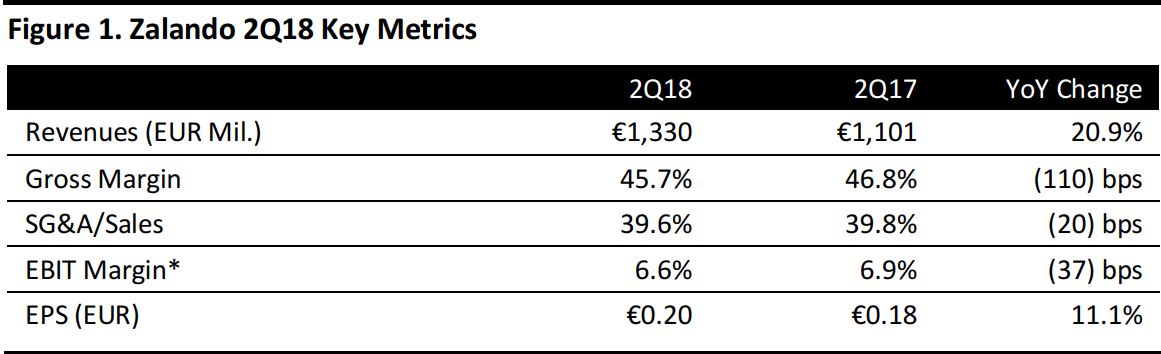

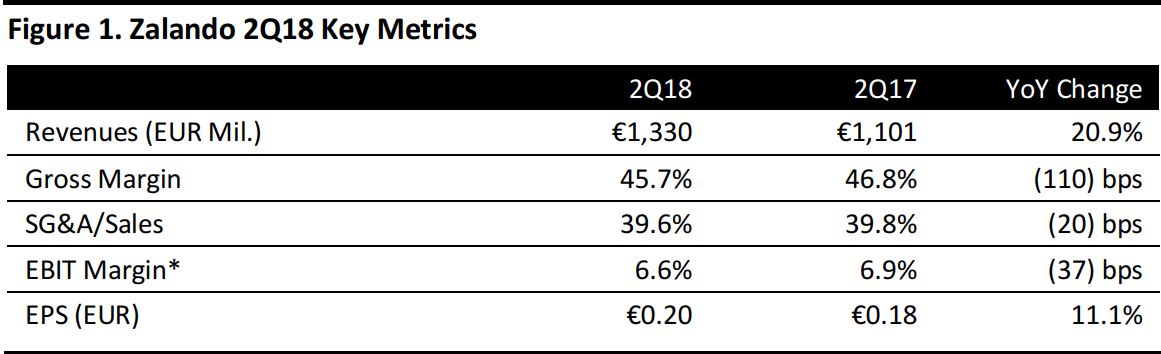

Zalando grew revenues by 20.9% year over year to €1.33 billion in 2Q18, below the consensus estimate of a 24.1% increase to €1.37 billion and slowing sequentially from 22.0% growth in 1Q18. The company grew EBIT by 14.4% to €87.3 million in 2Q18. Adjusted EBIT, which strips out share-based payments, restructuring costs and non-operating one-time effects, came in at €94.0 million, above the consensus estimate of €92.7 million.

Management attributed a 110-basis-point decline in the gross margin to a higher average discount rate. The EBIT margin was further pressured by an increase in the fulfilment cost ratio due to development of its logistics network and investment in services such as same-day delivery.

Diluted EPS of €0.20 lagged expectations of €0.23.

Zalando again changed its reporting segments, splitting out Offprice from All Others. By segment, Zalando reported the following:

- Fashion Store: Comprising its core, full-price websites, this segment grew revenues by 21.3% year over year and reported an adjusted EBIT margin of 7.5%.

- Offprice: The Offprice segment grew revenues by 39.3% year over year and reported an adjusted EBIT margin of 6.5%.

- All Others: This segment includes private labels and various emerging businesses, with the majority of revenues arising from intra-company sales of private-label merchandise to the Fashion Store segment. It grew revenues by 23.1% year over year and posted an adjusted EBIT margin of (7.4)%.

Outlook

Management adjusted its guidance for FY18, stating that it expects full-year revenue growth to be in the lower half of its previously stated 20%–25% target range. It now anticipates reporting adjusted EBIT at the low end of its previously stated €220–€270 million range.

*Nonadjusted

Source: Company reports/Coresight Research

*Nonadjusted

Source: Company reports/Coresight Research