Web Developers

The Fung Global Retail & Technology team attended a warehouse tour and Capital Markets Day event hosted by Germany-based online apparel retailer Zalando. Here, we wrap up our key takeaways from both events.

Our View

Amazon is sometimes cited as a potential threat to Zalando, but we found that the presentations at Zalando’s Capital Markets Day collectively underlined how different these companies are in the apparel category.- Proposition: Zalando tailors its offerings to the market, uses its scale with brands to design exclusive products in partnership with them, uses artificial intelligence (AI) to improve online advice and service, and seeks to incite passion among its shoppers, including through marketing designed to make it a “loved” brand.

- Operations: Zalando enjoys an apparel specialization in logistics and is attempting to overhaul supply chains. It offers a differentiated marketplace model where there is no competition between sellers, and it is expanding into a number of B2B services.

Strategy Highlights: Moving Beyond Retailing

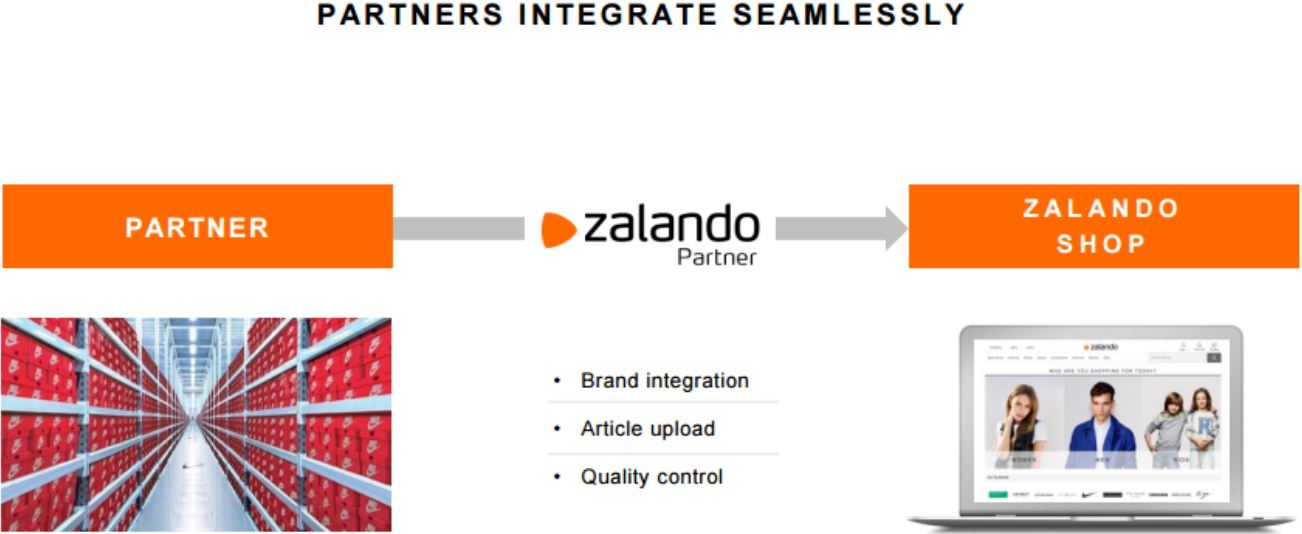

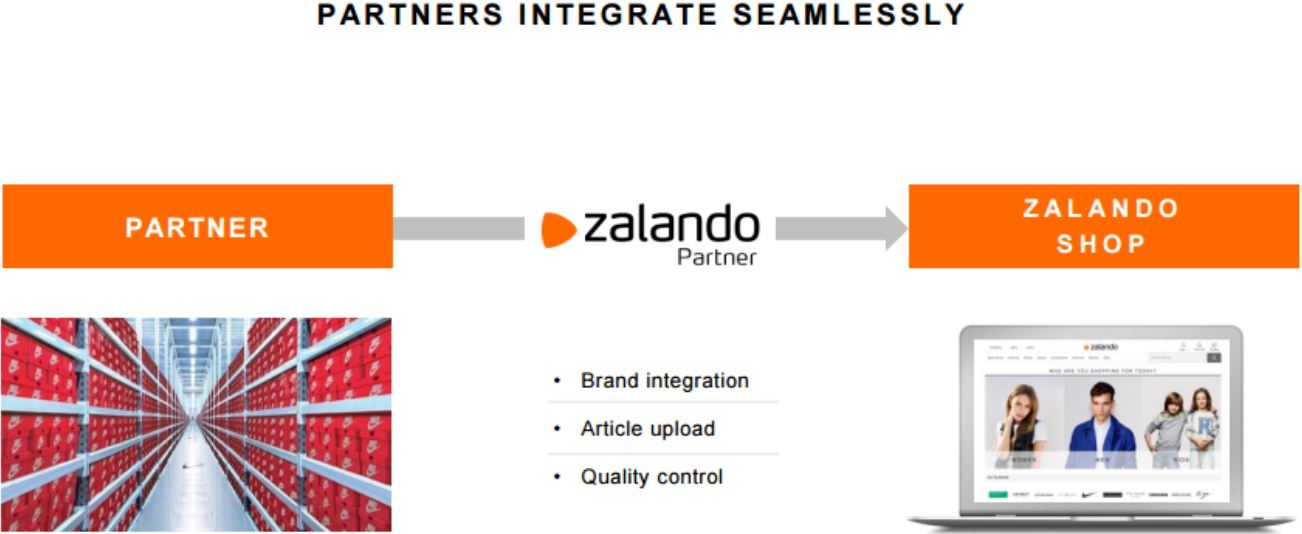

- From retail to marketplace: Zalando is moving beyond its traditional model of retailing whereby third-party suppliers wholesale to Zalando and it holds the stock for resale. Its Partner Program allows brands and retailers to list and dispatch their own inventory. Inditex’s Oysho is among the retailers now listing their products on Zalando. The program enables brands to hold and ship the stock themselves, or to make use of the Zalando Fulfillment Solutions service, whereby Zalando holds and dispatches the third-party stock. However, management remarked that one distinction sets Zalando apart from other online marketplaces: there is only ever one seller of each product on Zalando. Partner brands’ own inventory is called upon only if or when Zalando’s own inventory for a specific product is exhausted. Zalando Fulfillment Solutions is in the rollout stage.

- Offering services to brands: Beyond the Partner Program, Zalando showcased the opportunities in B2B services. Co-CEO Robert Gentz outlined how the company is “modularizing” its assets and offering them as services to brands. This includes targeted advertising under Zalando Media Solutions; Zalando Fulfillment Solutions, which holds and dispatches third party-owned stock; and the company’s Consumer and Shopper Insights Tool, which enables Zalando to leverage its data with the goal of becoming “the Nielsen for fashion.”

- Other levers for growth: Private-label business zLabels, factory-to-consumer app Movmnt and AI provide further opportunities for growth.

- Fluid supply chains: VP of Logistics Products Jan Bartels said Zalando wants fashion “to flow like water.” The current supply chain is full of friction points, he said, from sourcing to delivery. The company aims to “melt the ice” with three solutions: a hub-and-spoke warehouse model, local delivery networks that include integration of inventory in local stores under the Partner Program and “atomizing” the last mile and reassembling it via technology.

Zalando’s Partner Program Source: Zalando 2017 Capital Markets Day presentation

Zalando Fulfillment Solutions Source: Zalando 2017 Capital Markets Day presentation

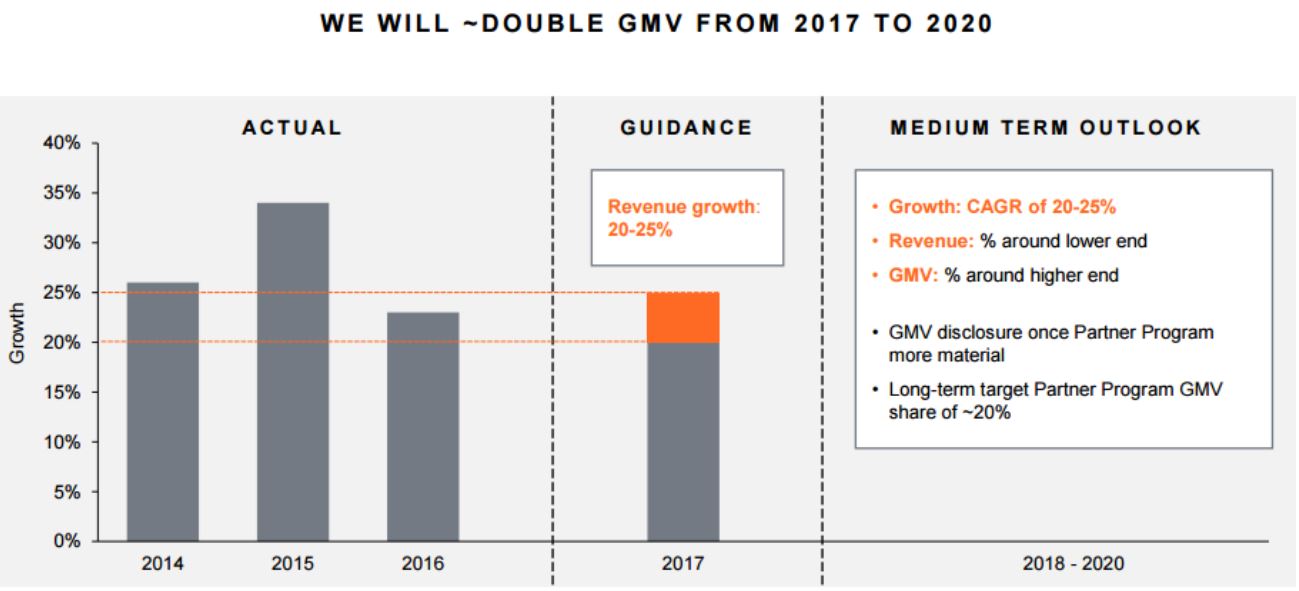

Guidance and Targets: Doubling Gross Merchandise Volume (GMV) by 2020

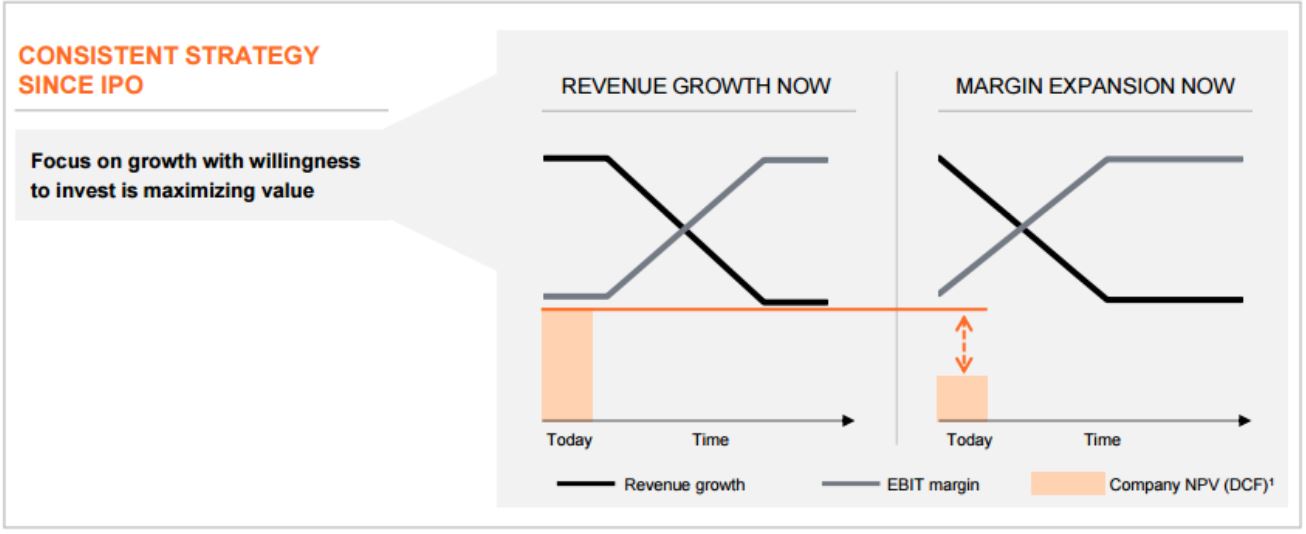

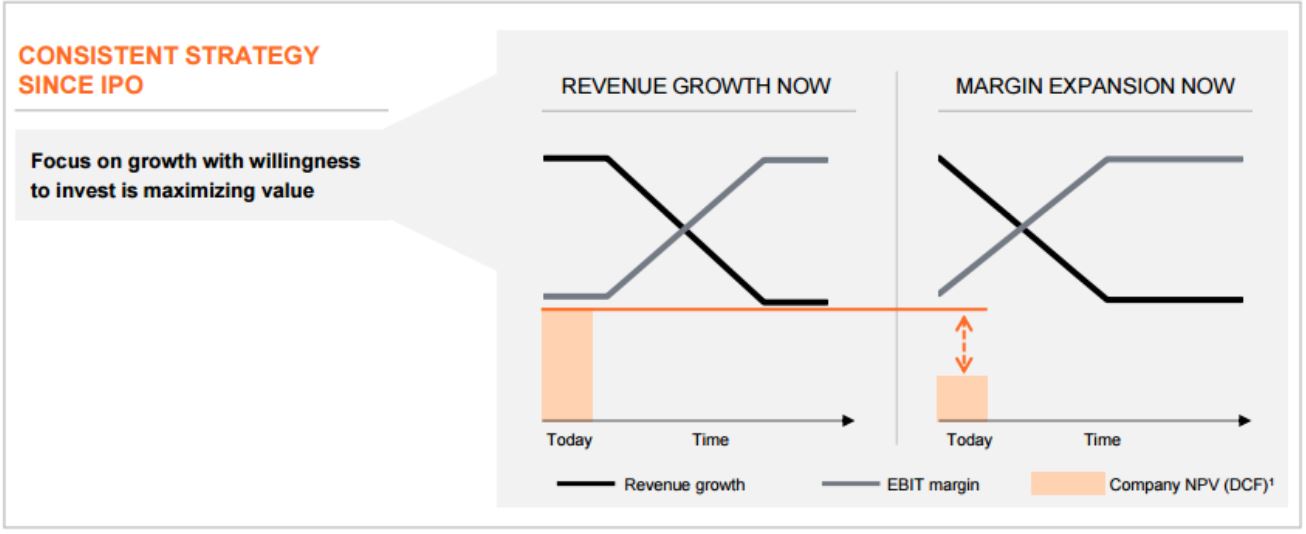

Zalando pursues profitable growth at scale. It continues to prioritize revenue growth over margin growth in the near term. Birgit Haderer, SVP of Finance, said that Zalando expects revenues to grow at two to three times market growth rates, and that it expects EBIT to grow strongly in absolute terms. The company will seek margin expansion when its revenue growth is in line with the market and, thereafter, it expects a 10% EBIT margin in its traditional wholesale segment.

Revenue growth versus margin growth. Source: Zalando 2017 Capital Markets Day presentation

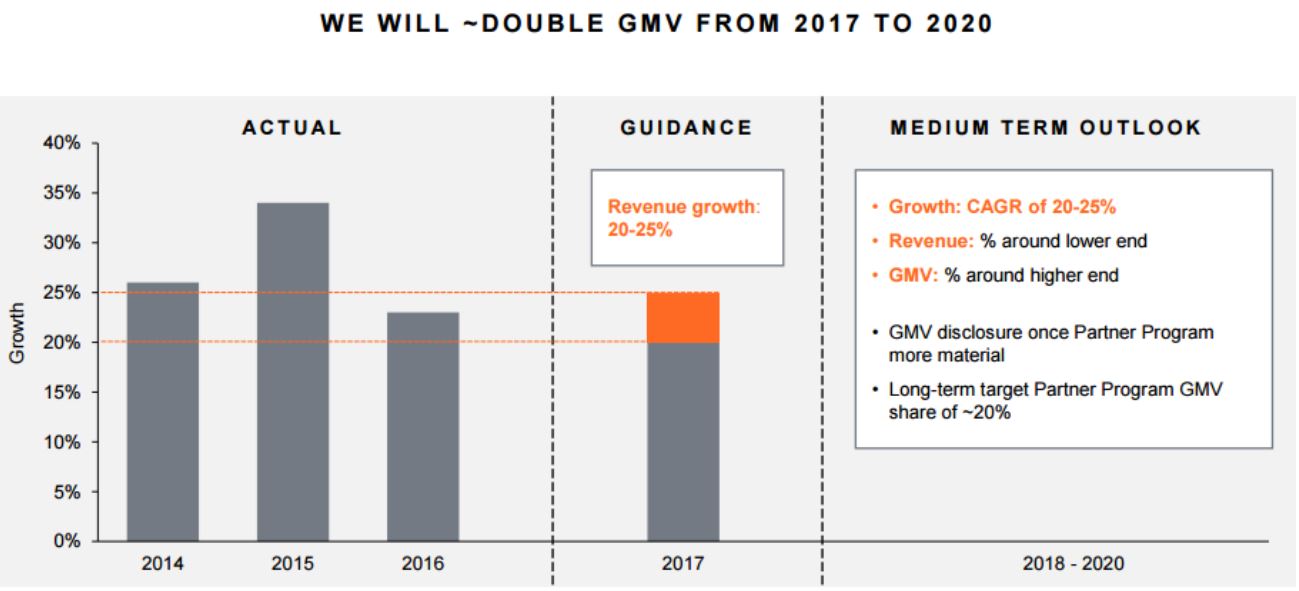

The company expects to grow fiscal 2017 revenues at the lower end of the 20%–25% range and GMV, which includes third-party sales, at the upper end of that range. This is effectively a shift from previous guidance for 20%–25% revenue growth in 2017. Haderer emphasized that the company’s goal is to double GMV by 2020, supported by the Partner Program. Between 2018 and 2020, the company expects to grow sales by a compound annual growth rate (CAGR) of 20%–25%, with revenue at the lower end of this scale and GMV at the upper end. The company will start breaking out GMV once it becomes material.

Zalando guidance Source: Zalando 2017 Capital Markets Day presentation

Warehouse Tour Key Takeaways

We attended a tour of Zalando’s distribution center in Mönchengladbach, Germany, hosted by the company the day before the Capital Markets Day event. Our key takeaways from the tour include:- The company serves Europe through a hub-and-spoke model, with large hub warehouses of around 130,000 square meters holding the bulk of inventory, and smaller spoke warehouses of around 20,000 square meters holding fewer lines and focusing on popular products.

- The company now offers same-day delivery and return-on-demand services in 10 cities.

- Zalando’s returns rate is still about 50%, despite the company having expanded outside Germany, a market that typically sees high returns due to the legacy of catalog shopping.

- Management pointed to challenges with getting robots to pick, handle and identify soft products such as garments, and noted that human judgment is needed to review whether returned items can be resold. Zalando continues to use human labor for picking, sorting and packing, but it is working with robotics startups.

- On our tour, one visitor asked management about the challenge of competing with Amazon. Management responded that Zalando enjoys several advantages in the area of logistics. For example, Zalando’s centers are custom built for apparel—which means they are designed to deal with products of a certain size that have certain characteristics. Zalando also enjoys economies of scale in its handling of apparel, because it specializes in just the one category.

- Management remarked that capacity is the greatest constraint on Zalando’s top-line growth.

- One way the company tailors its proposition to different markets is by offering a range of payment options. Just one day before Amazon announced its new Prime Wardrobe service, which allows customers to try on apparel at home before paying, the Zalando management team that served as our tour guides pointed to Zalando’s own pay-later option, which gives shoppers 14 days (or 30 days in Switzerland) to try on and return garments before they are billed.

Key Themes

Below, we offer greater detail from selected presentations given at the Capital Markets Day event.Product Offering Is Broad, with Multiple Price Points and Exclusive Ranges

Dalbir Bains, VP of Trading and Assortment, talked through Zalando’s “unique and democratic” fashion ethos. Bains said that the company’s approach is democratic because it aims to offer fashion for all consumers, and she highlighted four ways in which the company executes on this front:- 1Zalando provides a wide fashion offering from more than 2,000 brands, with more than 860 new products added to the selection every day. Fully 95% of Zalando’s product offering is new to the season. Private-label ranges capture a share of sales that is “in the teens.”

- Zalando’s offering is diverse in terms of sizing. In 2015, the company launched a special sizes category that spans tall petite, plus-size and maternity.

- The company offers a high/low pricing range, with choices spanning various price points. Bains said that Zalando is “uniquely able” to offer such choice due to the breadth of brands it works with.

- The company offers locally-tailored brand selections and marketing.

- Product freshness: Streamlined shipping routes are among the means by which Zalando is bringing products to market more quickly.

- Optimizing availability: This includes the company’s Partner Program.

- Exclusives: Zalando’s scale enables it to collaborate on exclusives with major brands. It will launch more than 80 exclusive capsules this year.

Demographics Are Diverse, but Skewed Toward Younger Shoppers

Co-CEO Rubin Ritter noted the following characteristics of Zalando’s 20 million active shoppers:- Fully 70% are female. Although male shoppers account for only 30% of Zalando’s customers, they are now catching up.

- Confirming Zalando’s democratic positioning, the shopper age range is broad, with 35% of customers aged 29 or younger. A further 28% are ages 30–39, while 24% are 40–49, 10% are 50–59 and 3% are 60 or older.

- However, consumers under the age of 30 make up a disproportionate 41% of new customers.

Scope for Growth

Finally, Ritter made two additional points that underline Zalando’s growth potential:- Zalando’s average shopper spends €227 per year with the retailer, while spending €1,650 on apparel in total, implying that the company has scope to capture a greater share of its shoppers’ spending.

- The company maintains a long-term goal of capturing a 5% share of the overall European fashion market.