albert Chan

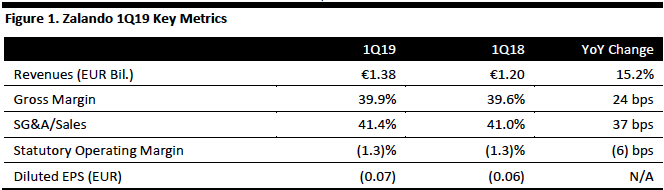

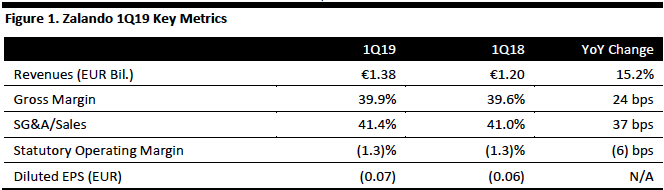

[caption id="attachment_86151" align="aligncenter" width="664"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Zalando reported strong growth in revenues but posted a net loss for the first quarter of 2019. Highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Zalando reported strong growth in revenues but posted a net loss for the first quarter of 2019. Highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Zalando reported strong growth in revenues but posted a net loss for the first quarter of 2019. Highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Zalando reported strong growth in revenues but posted a net loss for the first quarter of 2019. Highlights are as follows:

- Zalando grew total sales 15.2% year over year to €1.38 billion, in line with the consensus estimate recorded by StreetAccount. The company grew its gross merchandise volume (GMV) 23.1% year over year to €1.76 billion, driven by increases in active customers as well as average orders per active customers, aided by growth in its Partner Program.

- Gross margin expanded 24 basis points (bps) to 39.9%.

- Zalando reported a statutory operating loss of €18.4 million, compared to an operating loss of €15.2 million in the same quarter of the previous year, due to higher fulfilment and administrative costs.

- Higher fulfilment costs were due to continued expansion of the company’s European logistics network, such as the ramp up of fulfilment centres in Sweden and Poland. Higher administrative expenses were due to increased share-based expenses and restructuring costs.

- After adjusting for equity-settled share-based payments, restructuring costs and other one-time expenses, operating income grew 1,500% to €6.4 million, with an operating margin of 0.5%.

- The company reported a loss per share of €0.07 (from a net loss of €17.6 million), compared to a loss per share of €0.06 (from a net loss of €15.0 million) in the same quarter of the previous year, and below the consensus of €(0.01) recorded by StreetAccount.

- The company’s active customers in the reporting period increased 14.1% year over year to 27.2 million.

- Average order per active customer in the last twelve months (LTM) increased 11.5% year over year to 4.5, while LTM average basket size fell 3.9% year over year to €57.1.

- The fashion store segment grew revenue by 16% year over year to €1.27 billion, aided by strong performances across both the DACH region (Germany, Austria and Switzerland) and rest of Europe, due to strong growth in active customers and average order per active customer.

- The fashion store segment’s adjusted operating income was €8.4 million, compared to €(0.2) million in the same quarter of the previous year. Within the segment, DACH grew adjusted operating income 58.4% to €26.3 million, while rest of Europe posted an adjusted operating loss of €18.0 million.

- The segment grew revenue 13.6% year over year to €136.8 million.

- Adjusted operating income fell 55.3% to €3.8 million.

- The segment grew revenue 2.8% year over year to €102.6 million.

- The segment posted an adjusted operating loss of €6.2 million, compared to €8.3 million in the prior period quarter.

- Zalando expects FY19 GMV growth in the range of 20% to 25% and revenue growth at the low end of the 20% to 25% range.

- It expects FY19 adjusted operating income in the range of €175 million to €225 million.

- The company plans for FY19 capex of about €300 million.