Source: Company reports/Coresight Research

1Q18 Results

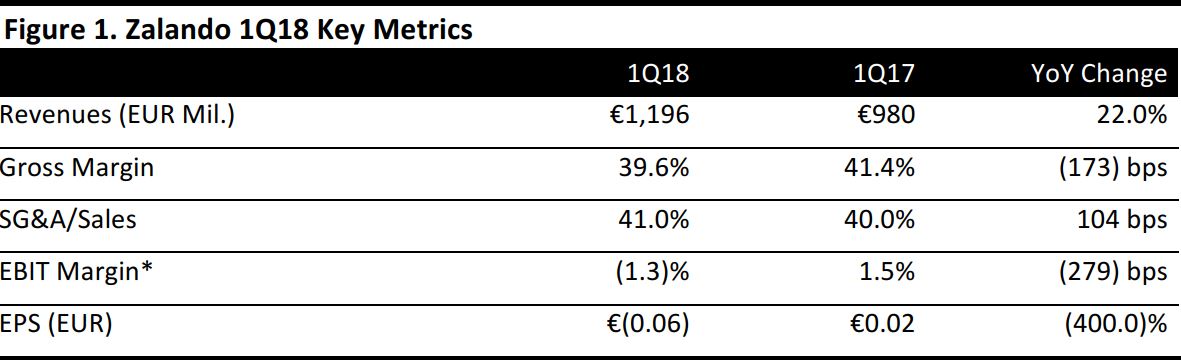

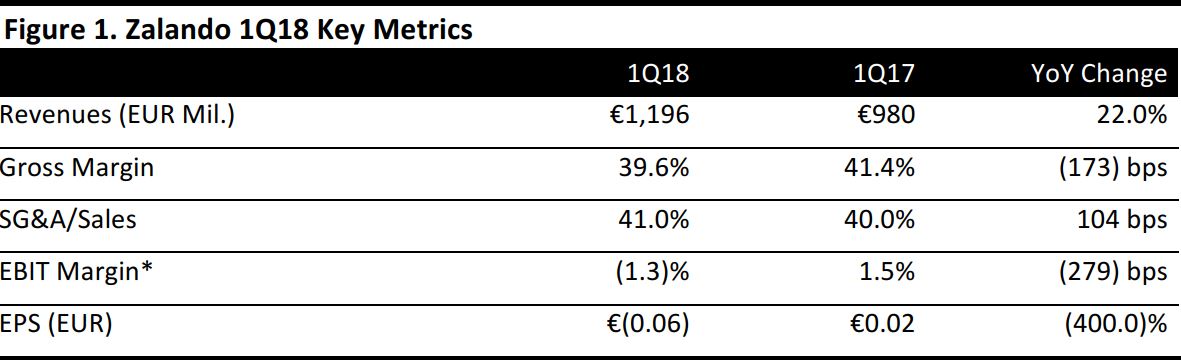

In the first quarter, Zalando grew sales by 22.0% year over year, but its gross margin declined by 173 basis points and SG&A expenses climbed by 25.2%, leading to an operating loss of €15 million. The company stated that the gross margin was hit by higher discounting, which in turn was partly driven by the cold weather seen in Europe in the first quarter. Operating costs were higher, due to raised logistics costs associated with new fulfillment centers.

Revenues of €1.2 billion were ahead of analysts’ expectations of €1.1 billion. Adjusted EBIT, which strips out share-based payments and the impacts from business transactions, came in at €0.4 million, well behind expectations of €13.0 million and yielded an adjusted EBIT margin of 0.0%, down from 2.1% in 1Q17.

The company changed its reporting structure to provide details on channels rather than regions. It reported the following:

- Fashion Store segment: Comprising its core, full-price websites, this segment grew revenues by 20.4% year over year,but reported an unadjusted operating margin of (1.3)%.

- Other segment: The Other segment, which includes off-price channels, private labels and various emerging businesses, grew revenues by 40.5% year over year and posted an unadjusted operating margin of (0.7)%.

Outlook

Management reiterated its previous guidance for FY18 revenue growth of 20%–25% and adjusted EBIT of €220–€270 million. At the midpoint of those ranges, guidance implies revenues of €5.5 billion and an adjusted EBIT margin of 4.5%.