What’s the Story?

On March 16, 2021, the Coresight Research team attended Zalando’s annual Capital Markets Day, which was held virtually. In this report, we present insights on the following three key themes from the event:

- Zalando’s “starting point for fashion” vision

- The company’s new targets for 2025

- Zalando’s sustainability goals

Zalando Capital Markets Day 2021: Key Insights

1. Fashion Market Vision

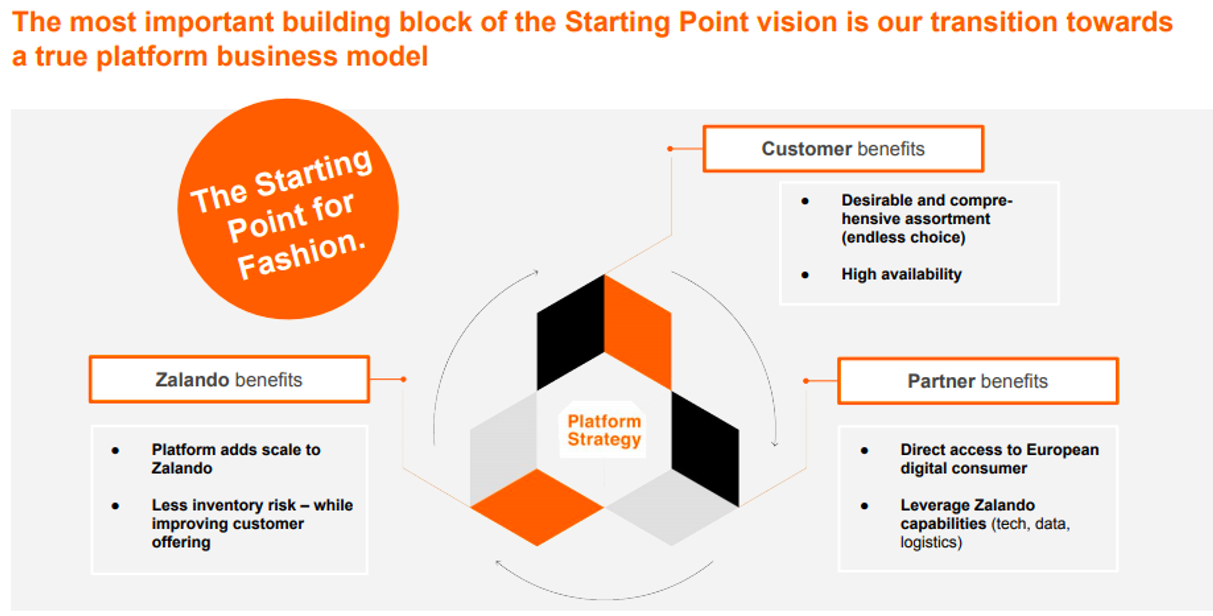

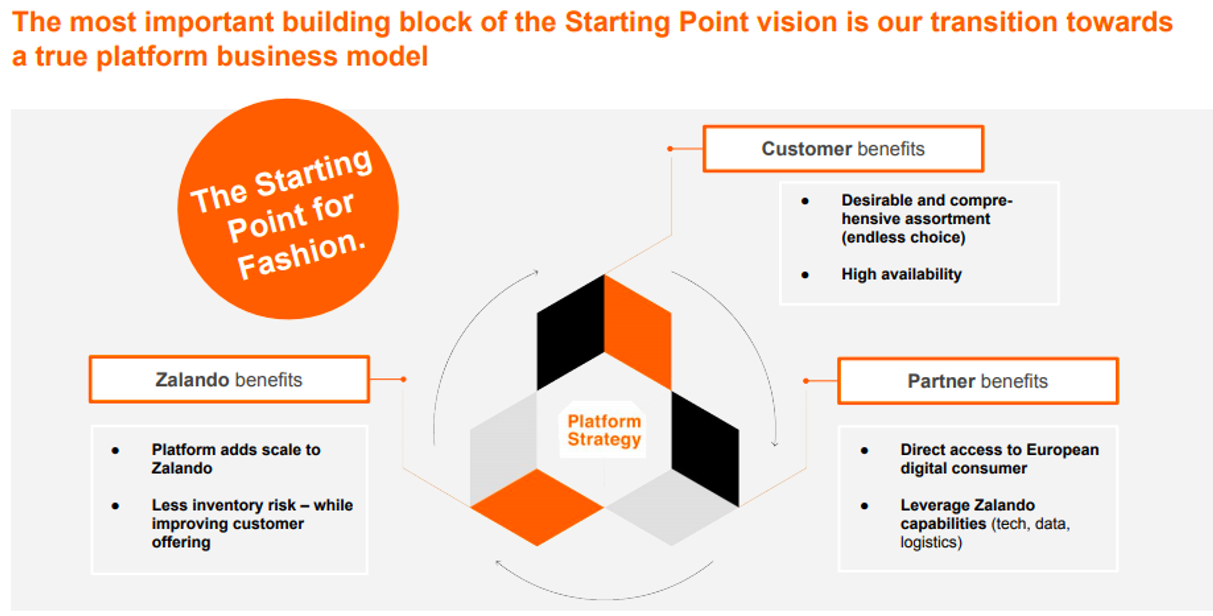

Zalando re-emphasized its ambition to become the “starting point for fashion.” The company’s Co-CEO Robert Gentz compared Zalando to dominant platforms that aggregate offerings in other categories, such as Spotify for music, Booking.com for hotels and Google for Internet searching. The company expects fashion shoppers to increasingly turn to multi-brand sites in a mobile-focused world, as they offer the widest fashion assortment through a single app.

In order to become the starting point for fashion, Zalando is looking to enhance its platform model. Gentz stated that the improvements will add scale to Zalando and reduce inventory risk, amongst other benefits. From a partner perspective, the improvements will enable direct access to European online consumers and allow partners to capitalize on Zalando’s technology, data and logistics platform. Furthermore, consumers will benefit from high availability and a comprehensive assortment of inventory.

[caption id="attachment_124711" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

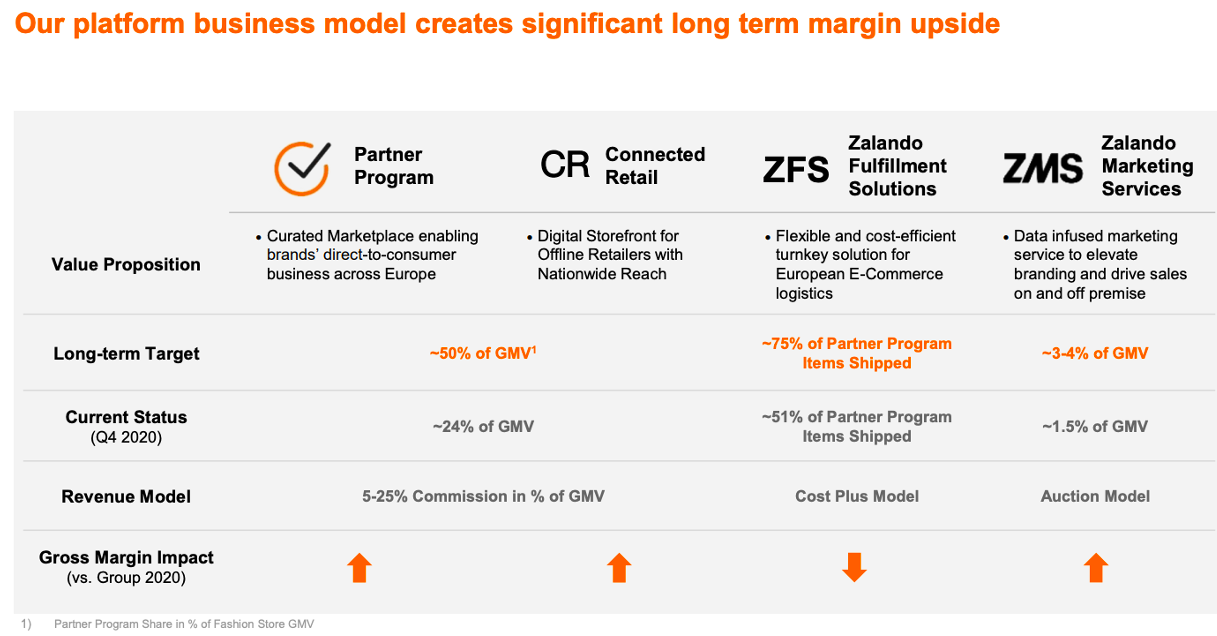

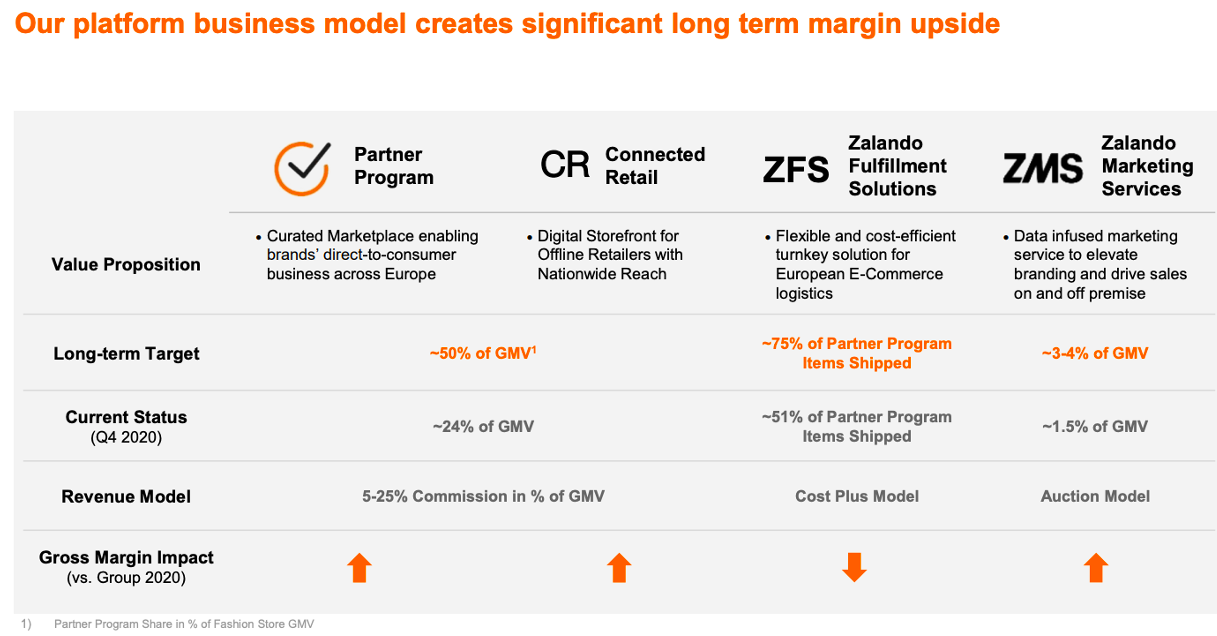

To scale its dominance in the European fashion market, Zalando wants to attract more brands onto its Partner Program and Connected Retail program. The programs comprise its marketplace offerings that allow brands to sell directly to consumers on Zalando sites. Over the long term, the company expects its Partner Program and Connected Retail program to contribute nearly 50% of Fashion Store gross merchandise value (GMV), from 24% in 2020. Fashion Store is the company’s main sales channel, comprising Zalando apps and its website. The company’s off-price segment, Zalando Lounge, makes up a very small part of its business. Moreover, the company plans to convert more of its partner retailers to ZFS clients, whereby Zalando holds and ships stock on behalf of the retailer or brand. Zalando’s long-term target is to ship 75% of all partner items, compared to 51% at present.

Furthermore, Zalando aims to expand these partner brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business. Currently, ZMS revenues account for around 1.5% of the company’s GMV and Gentz stated that management expects it to contribute 3–4% of GMV over the long-term. This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, according to the company. The growth of high-margin ZFS and ZMS services will also grow profits. From the consumer perspective, these platform services will lead to greater choice, better availability and improved convenience.

[caption id="attachment_124712" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

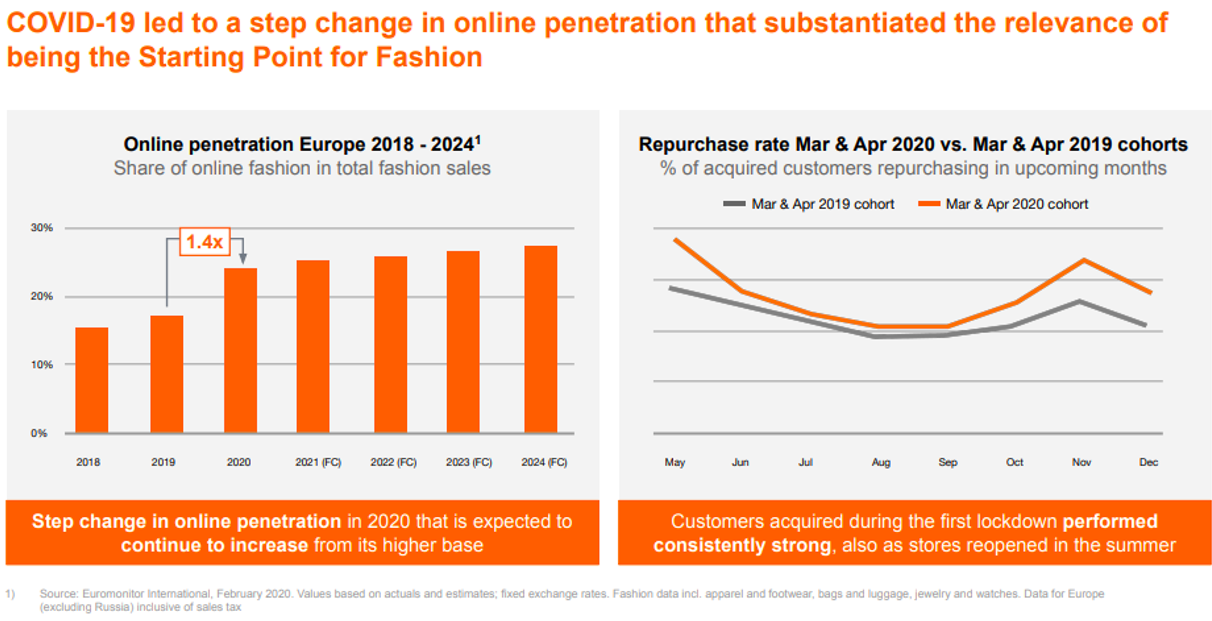

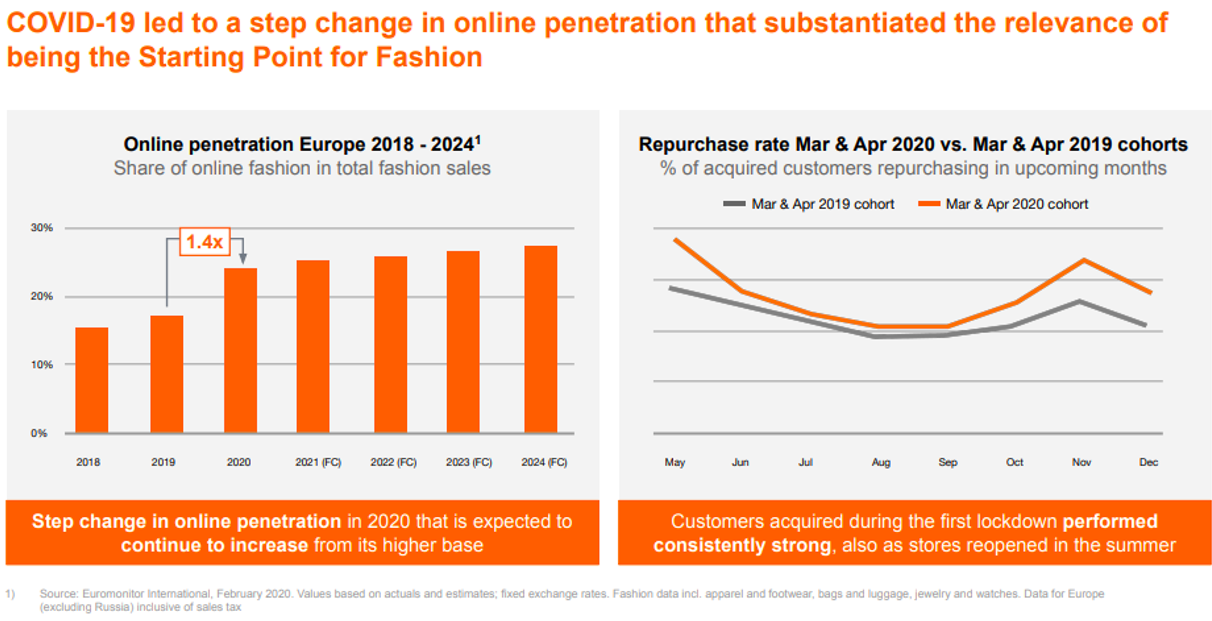

Online penetration in the European fashion market increased from 17% in 2019 to 24% in 2020, according to Euromonitor International data cited in Zalando’s reports. Management expects this level of online penetration to increase further over the next few years and that it is unlikely to return to pre-Covid levels. Gentz also stated that the online customers Zalando acquired during lockdowns in 2020 consistently outperformed all other cohorts.

[caption id="attachment_124713" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

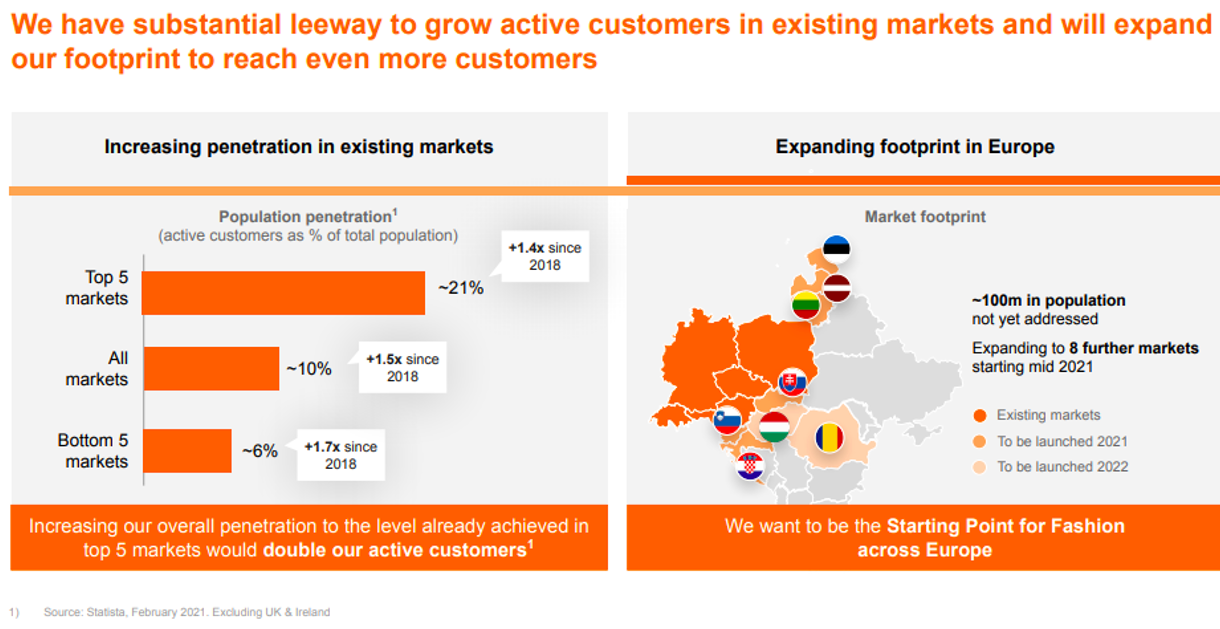

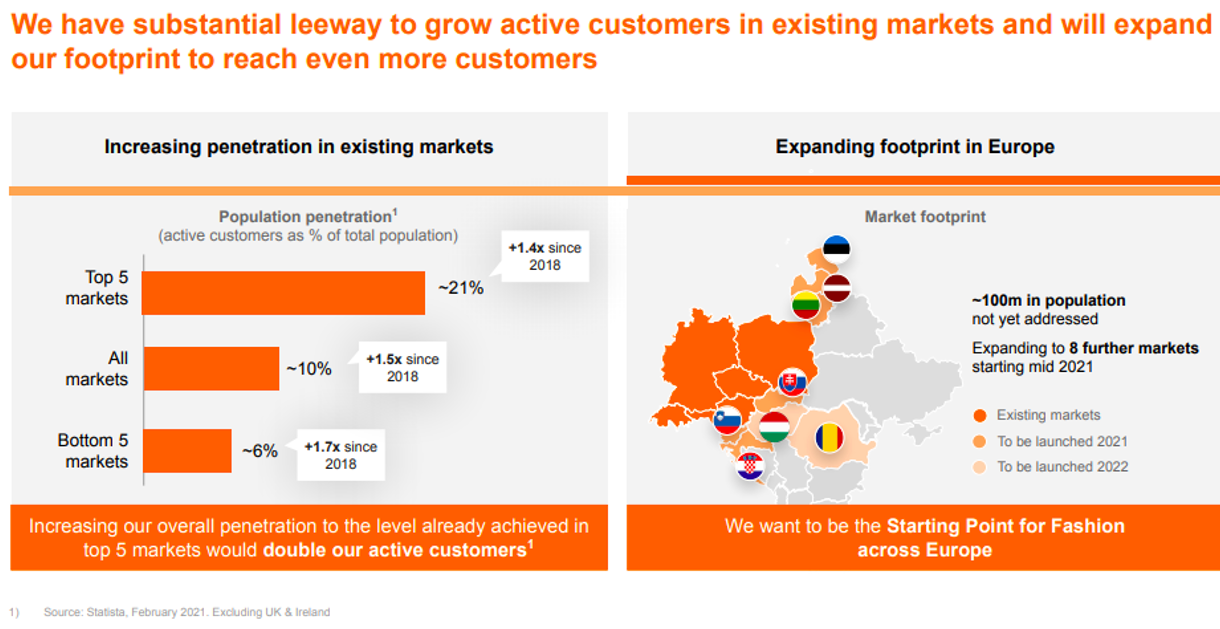

Zalando sees strong growth opportunities, both in existing markets and by expanding its footprint to reach more customers. The company noted that it has a 6% population penetration (active customers as a percentage of total population) in France and Italy versus 21% population penetration in its top five markets, which include Austria, Germany and Switzerland—providing strong opportunities to expand its reach in those bottom markets. Zalando is looking to expand its operations to eight new markets in Europe starting from mid-2021, including Croatia, Hungary and Romania.

[caption id="attachment_124714" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

2. New Five-Year Ambitions

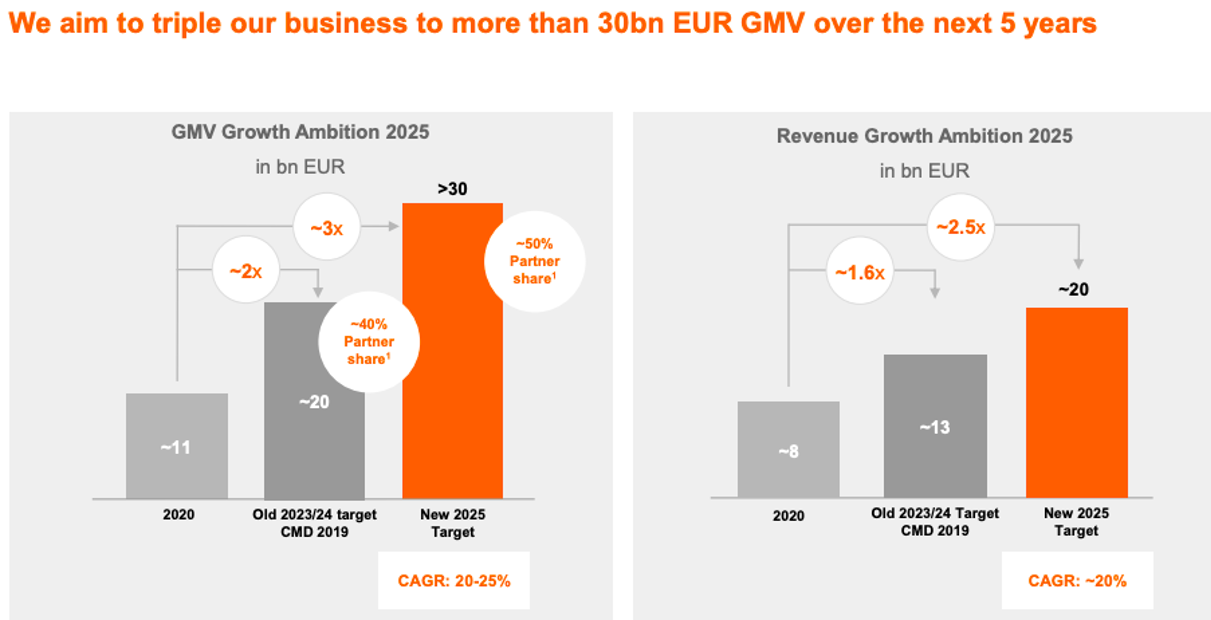

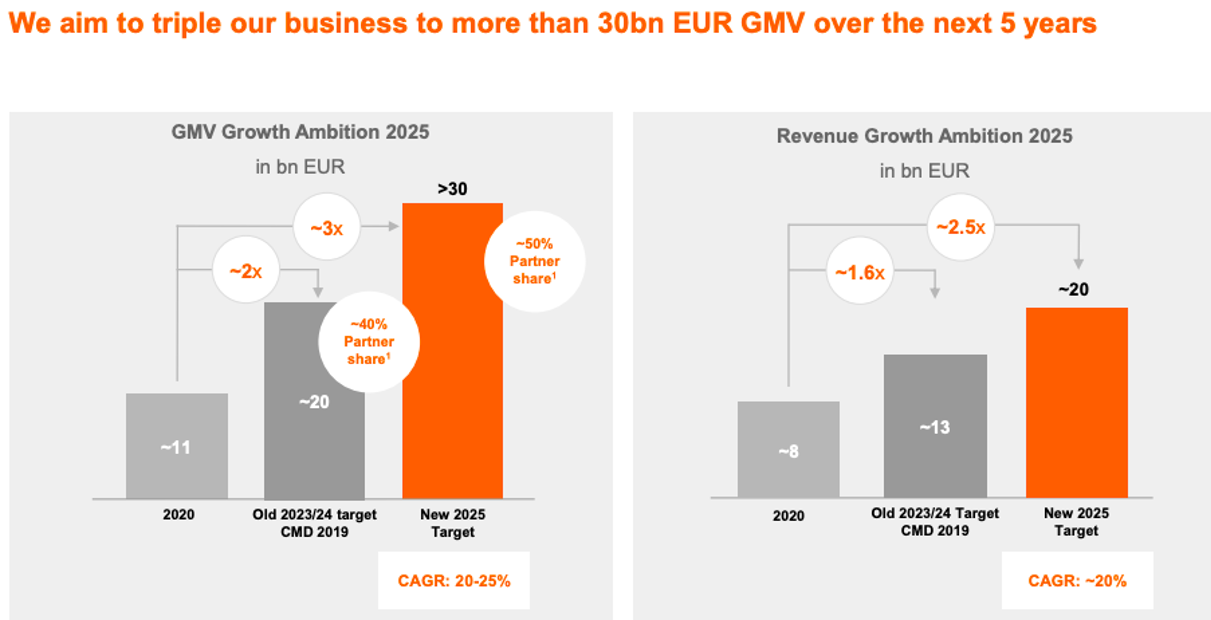

By 2025, Zalando aims to report annual revenues of €20 billion ($24 billion), from about €8 billion ($10 billion) in 2020, equating to a revenue CAGR of around 20%. The company aims to grow its GMV from €11 billion ($13 billion) in 2020 to more than €30 billion ($36 billion) by 2025, at a CAGR of 20–25%.

[caption id="attachment_124715" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

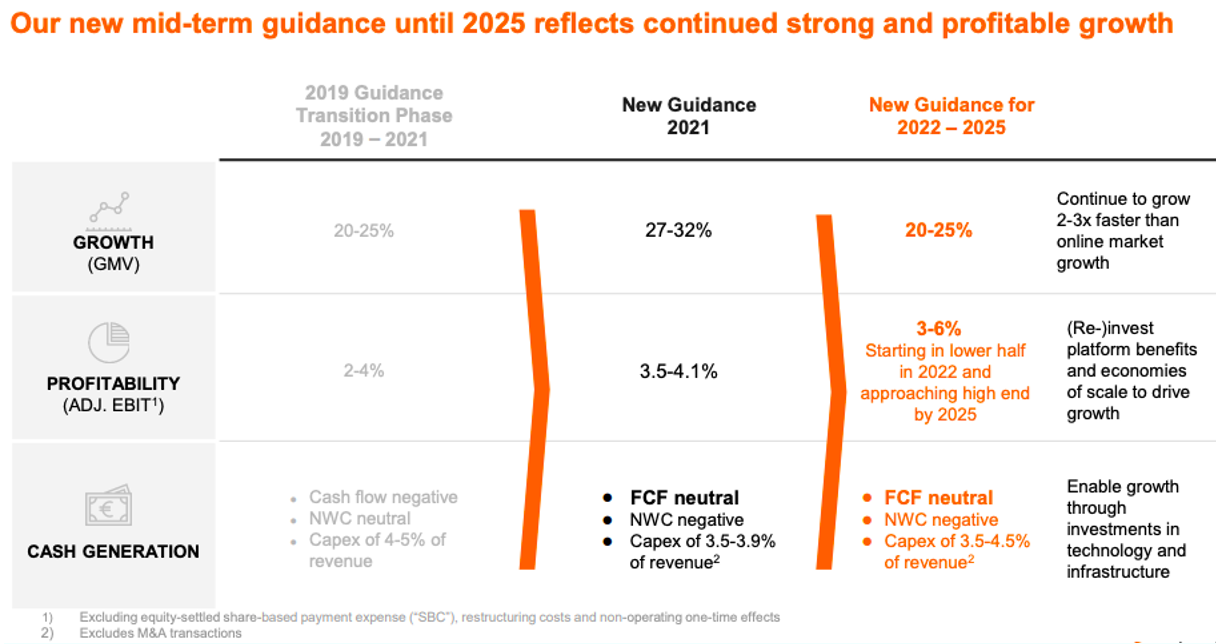

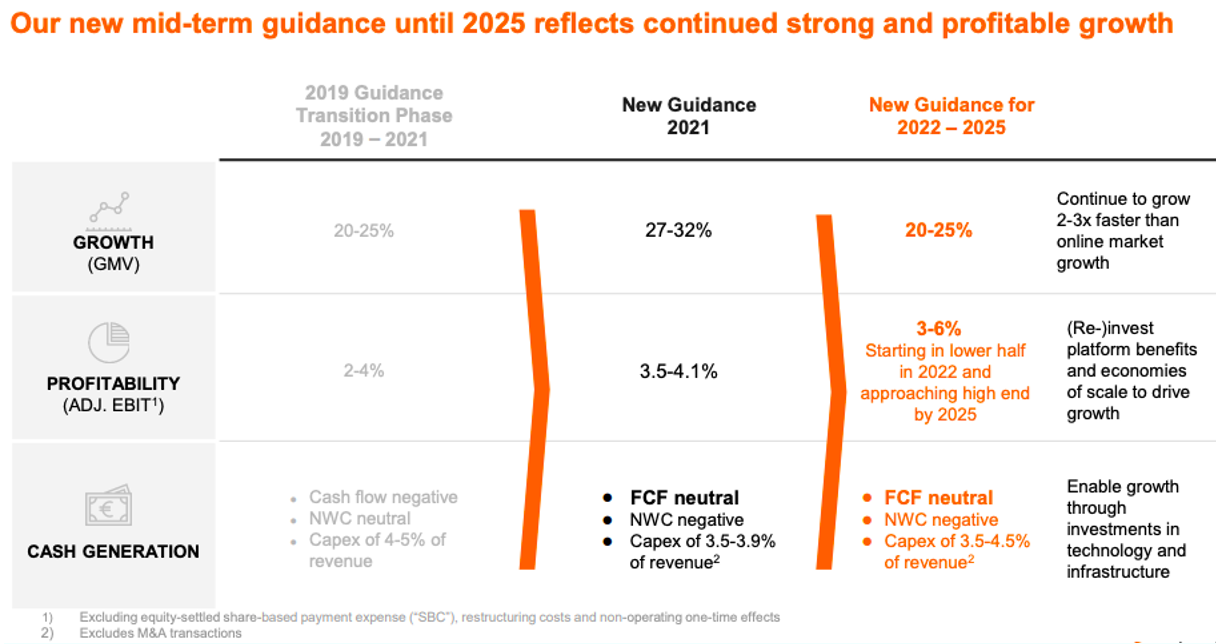

The company outlined its mid-term guidance and long-term targets, as well as four key infrastructure and capabilities to achieve its 2025 ambitions, which we discuss below.

Mid-Term Guidance

For 2021, Zalando expects GMV growth of 27–32% and an adjusted operating margin of 3.5–4.1%. From 2022 to 2025, the company expects GMV growth of 20–25% and an adjusted operating margin of 3–6%. Zalando’s GMV growth guidance is expected to outperform the European online apparel market by two to three times.

[caption id="attachment_124717" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

Long-Term Target

The company sees a strong growth opportunity in the €450 billion ($539 billion) European fashion market. Zalando aims to gain a share of over 10% of the market in the long term, expanding from 3% at present. To drive market share, the company will continue to invest in expanding technology and infrastructure, and enhancing customer experience as well as partner propositions. CFO David Schröder stated that the company will continue to target growth that significantly outperforms the online European fashion market.

[caption id="attachment_124716" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

The company discussed the following four key infrastructure and capabilities to achieve its 2025 ambitions:

Zalando has a European logistics network with 10 fulfillment centers across five countries. The company plans to add one new fulfillment centers each in Spain and the Netherlands in 2021. Moreover, the company currently has 12 warehouses that fulfill €14 billion ($17 billion) of GMV. In 2021, Zalando plans to spend €1 billion to build seven additional warehouses, enabling it to fulfill €23 billion ($28 billion) in GMV.

- Technology and Data Platform

At the event, Gentz said that Zalando will continue to invest in its scalable, proprietary cloud-based technology platform, which covers the whole value chain of fashion commerce for the company and its partners. Gentz expects the platform to continue to enable the company to drive data-based value creation, such as fitting and sizing advice to its customers or targeted marketing services for its partners.

- Access to Fashion Supply Inventory

Zalando noted that it has strong access to a global fashion supply through multiple sources. The company can directly source wholesale inventory from brands, tap into brand inventory lying in its regional warehouses through its Partner Program, and can also capitalize on off-line fashion inventory with the Connected Retail program. Schröder stated that the company will continue to further strengthen and capitalize on this capability going forward to scale its business in a more efficient and flexible manner.

Zalando sees strong potential to develop its payments platform further and externalize the platform’s capability to power its partners’ businesses outside of the Zalando platform. In 2020, the company saw a processing payment volume of about €20 billion ($24 billion) for all customers and partners. Zalando also offers a proprietary buy now pay later service, with an offering rate of over 70% across 11 countries. Schröder expects the company’s payment platform to be a key driver of Zalando’s customer satisfaction growth and profitability going forward.

[caption id="attachment_124718" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

3. Sustainability Remains a Priority

Zalando wants to build a truly sustainable platform, according to Co-CEO Rubin Ritter.

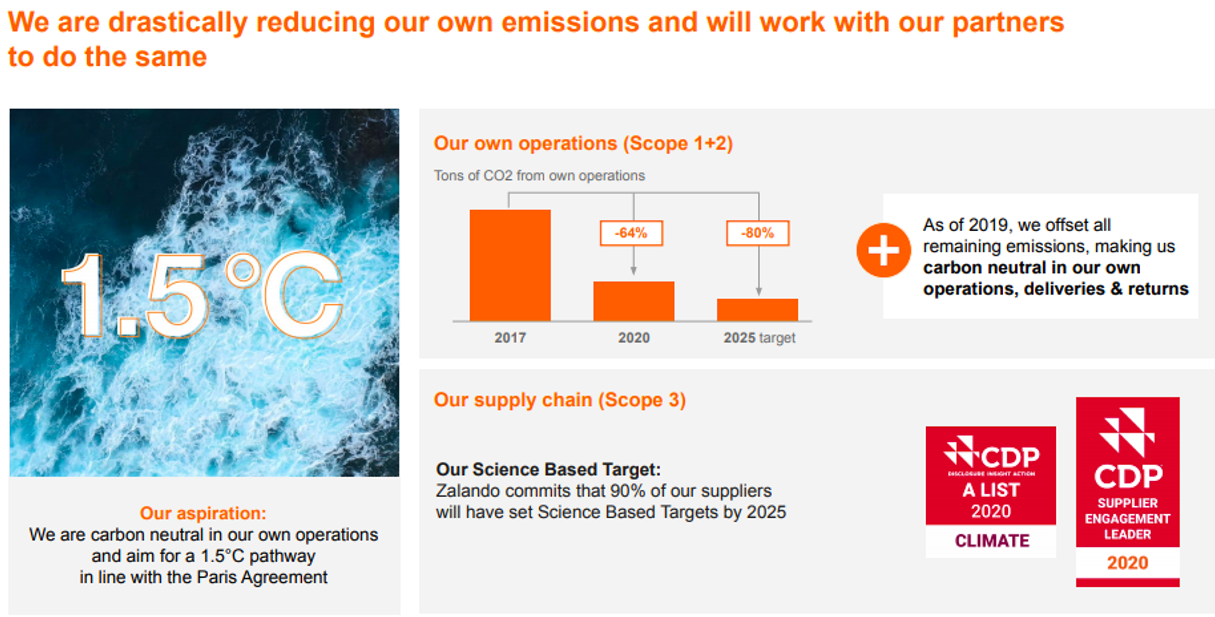

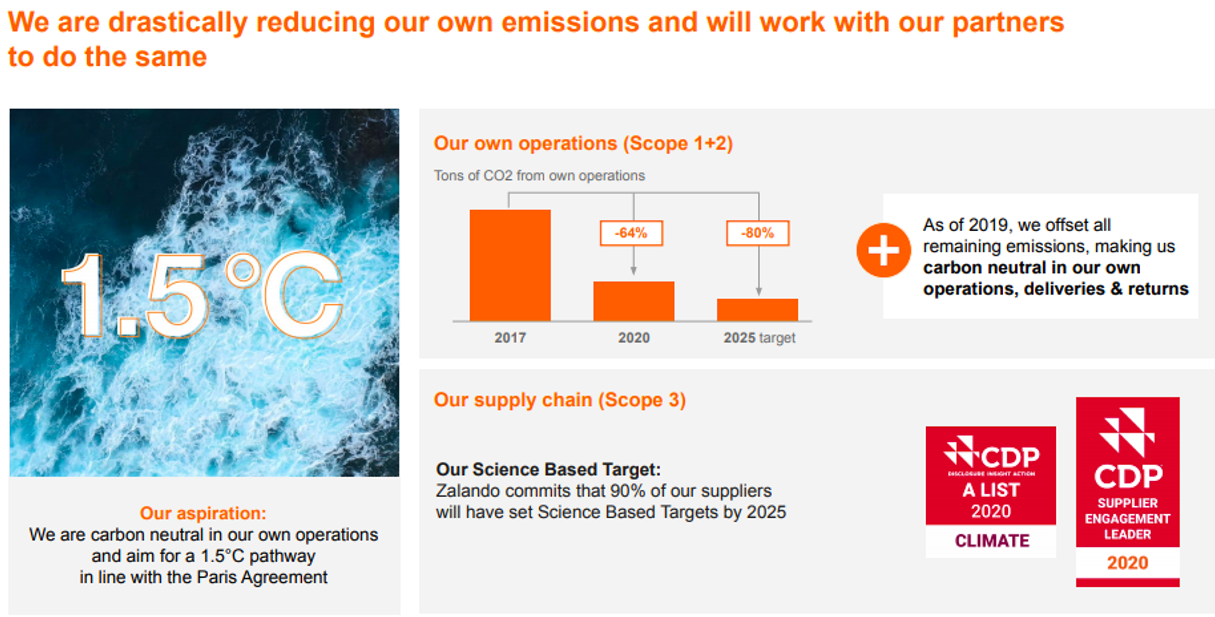

Ritter reported that Zalando aims to reduce the carbon emissions emerging from its business by 80% by 2025 as compared to 2017. Zalando wants to contribute to a 1.5 degrees Celsius temperature pathway, in line with the Paris Agreement, which sets out a goal of limiting global warming to 1.5 degrees Celsius compared to pre-industrial levels. To commit to this goal, Ritter stated that 90% of the suppliers Zalando works with will have emissions-based targets by 2025.

[caption id="attachment_124719" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

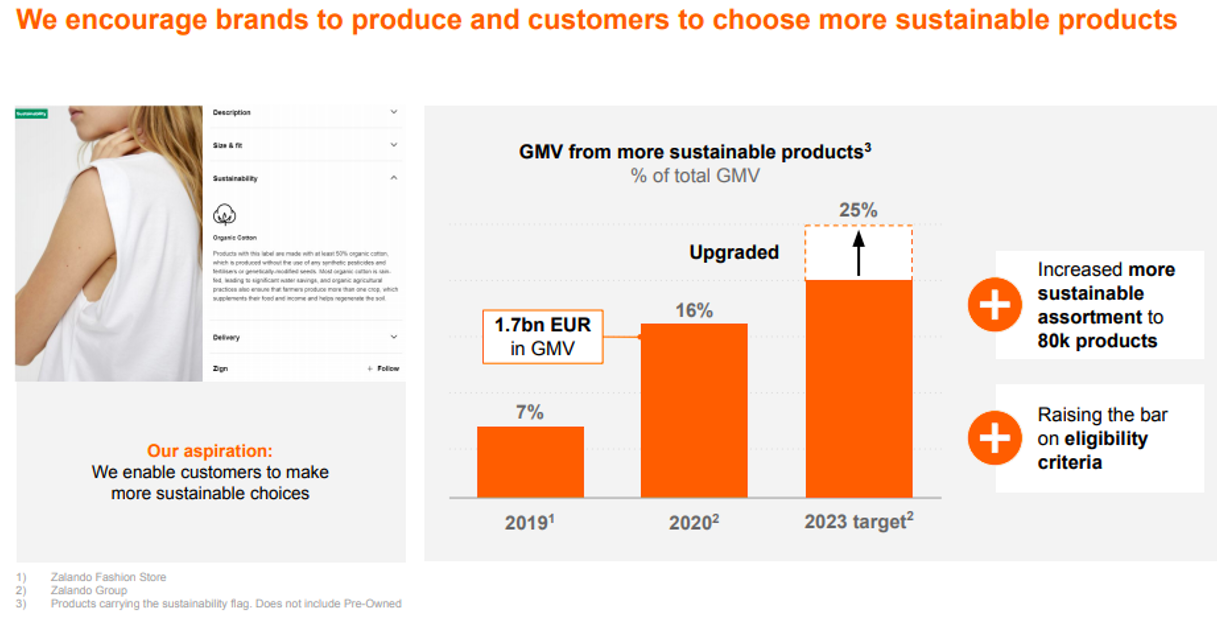

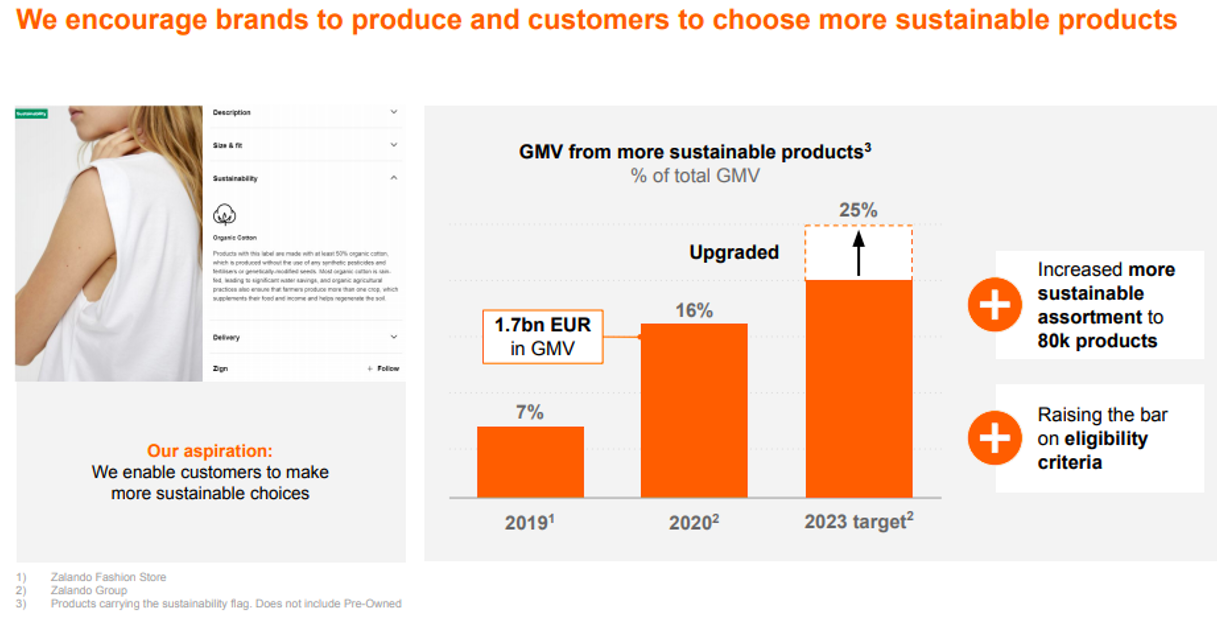

Zalando is looking to expand its sustainable product assortments from 16% of its GMV in 2020 to 25% by 2023. Furthermore, the company has raised the content requirement standard of its products branded recycled from 20% to 30%.

[caption id="attachment_124720" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

At the event, the company also discussed its aspiration to contribute to moving away from a linear fashion industry toward a circular pattern of consumption, through recycling and reuse. Zalando aims to extend the lifespan of over 50 million of its products by 2023. We believe that these sustainable initiatives will help Zalando in attracting customers, investors and employees.

[caption id="attachment_124721" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

Source: Company reports[/caption]

To scale its dominance in the European fashion market, Zalando wants to attract more brands onto its Partner Program and Connected Retail program. The programs comprise its marketplace offerings that allow brands to sell directly to consumers on Zalando sites. Over the long term, the company expects its Partner Program and Connected Retail program to contribute nearly 50% of Fashion Store gross merchandise value (GMV), from 24% in 2020. Fashion Store is the company’s main sales channel, comprising Zalando apps and its website. The company’s off-price segment, Zalando Lounge, makes up a very small part of its business. Moreover, the company plans to convert more of its partner retailers to ZFS clients, whereby Zalando holds and ships stock on behalf of the retailer or brand. Zalando’s long-term target is to ship 75% of all partner items, compared to 51% at present.

Furthermore, Zalando aims to expand these partner brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business. Currently, ZMS revenues account for around 1.5% of the company’s GMV and Gentz stated that management expects it to contribute 3–4% of GMV over the long-term. This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, according to the company. The growth of high-margin ZFS and ZMS services will also grow profits. From the consumer perspective, these platform services will lead to greater choice, better availability and improved convenience.

[caption id="attachment_124712" align="aligncenter" width="720"]

Source: Company reports[/caption]

To scale its dominance in the European fashion market, Zalando wants to attract more brands onto its Partner Program and Connected Retail program. The programs comprise its marketplace offerings that allow brands to sell directly to consumers on Zalando sites. Over the long term, the company expects its Partner Program and Connected Retail program to contribute nearly 50% of Fashion Store gross merchandise value (GMV), from 24% in 2020. Fashion Store is the company’s main sales channel, comprising Zalando apps and its website. The company’s off-price segment, Zalando Lounge, makes up a very small part of its business. Moreover, the company plans to convert more of its partner retailers to ZFS clients, whereby Zalando holds and ships stock on behalf of the retailer or brand. Zalando’s long-term target is to ship 75% of all partner items, compared to 51% at present.

Furthermore, Zalando aims to expand these partner brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business. Currently, ZMS revenues account for around 1.5% of the company’s GMV and Gentz stated that management expects it to contribute 3–4% of GMV over the long-term. This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, according to the company. The growth of high-margin ZFS and ZMS services will also grow profits. From the consumer perspective, these platform services will lead to greater choice, better availability and improved convenience.

[caption id="attachment_124712" align="aligncenter" width="720"] Source: Company reports[/caption]

Online penetration in the European fashion market increased from 17% in 2019 to 24% in 2020, according to Euromonitor International data cited in Zalando’s reports. Management expects this level of online penetration to increase further over the next few years and that it is unlikely to return to pre-Covid levels. Gentz also stated that the online customers Zalando acquired during lockdowns in 2020 consistently outperformed all other cohorts.

[caption id="attachment_124713" align="aligncenter" width="720"]

Source: Company reports[/caption]

Online penetration in the European fashion market increased from 17% in 2019 to 24% in 2020, according to Euromonitor International data cited in Zalando’s reports. Management expects this level of online penetration to increase further over the next few years and that it is unlikely to return to pre-Covid levels. Gentz also stated that the online customers Zalando acquired during lockdowns in 2020 consistently outperformed all other cohorts.

[caption id="attachment_124713" align="aligncenter" width="720"] Source: Company reports[/caption]

Zalando sees strong growth opportunities, both in existing markets and by expanding its footprint to reach more customers. The company noted that it has a 6% population penetration (active customers as a percentage of total population) in France and Italy versus 21% population penetration in its top five markets, which include Austria, Germany and Switzerland—providing strong opportunities to expand its reach in those bottom markets. Zalando is looking to expand its operations to eight new markets in Europe starting from mid-2021, including Croatia, Hungary and Romania.

[caption id="attachment_124714" align="aligncenter" width="720"]

Source: Company reports[/caption]

Zalando sees strong growth opportunities, both in existing markets and by expanding its footprint to reach more customers. The company noted that it has a 6% population penetration (active customers as a percentage of total population) in France and Italy versus 21% population penetration in its top five markets, which include Austria, Germany and Switzerland—providing strong opportunities to expand its reach in those bottom markets. Zalando is looking to expand its operations to eight new markets in Europe starting from mid-2021, including Croatia, Hungary and Romania.

[caption id="attachment_124714" align="aligncenter" width="720"] Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

The company outlined its mid-term guidance and long-term targets, as well as four key infrastructure and capabilities to achieve its 2025 ambitions, which we discuss below.

Mid-Term Guidance

For 2021, Zalando expects GMV growth of 27–32% and an adjusted operating margin of 3.5–4.1%. From 2022 to 2025, the company expects GMV growth of 20–25% and an adjusted operating margin of 3–6%. Zalando’s GMV growth guidance is expected to outperform the European online apparel market by two to three times.

[caption id="attachment_124717" align="aligncenter" width="720"]

Source: Company reports[/caption]

The company outlined its mid-term guidance and long-term targets, as well as four key infrastructure and capabilities to achieve its 2025 ambitions, which we discuss below.

Mid-Term Guidance

For 2021, Zalando expects GMV growth of 27–32% and an adjusted operating margin of 3.5–4.1%. From 2022 to 2025, the company expects GMV growth of 20–25% and an adjusted operating margin of 3–6%. Zalando’s GMV growth guidance is expected to outperform the European online apparel market by two to three times.

[caption id="attachment_124717" align="aligncenter" width="720"] Source: Company reports[/caption]

Long-Term Target

The company sees a strong growth opportunity in the €450 billion ($539 billion) European fashion market. Zalando aims to gain a share of over 10% of the market in the long term, expanding from 3% at present. To drive market share, the company will continue to invest in expanding technology and infrastructure, and enhancing customer experience as well as partner propositions. CFO David Schröder stated that the company will continue to target growth that significantly outperforms the online European fashion market.

[caption id="attachment_124716" align="aligncenter" width="720"]

Source: Company reports[/caption]

Long-Term Target

The company sees a strong growth opportunity in the €450 billion ($539 billion) European fashion market. Zalando aims to gain a share of over 10% of the market in the long term, expanding from 3% at present. To drive market share, the company will continue to invest in expanding technology and infrastructure, and enhancing customer experience as well as partner propositions. CFO David Schröder stated that the company will continue to target growth that significantly outperforms the online European fashion market.

[caption id="attachment_124716" align="aligncenter" width="720"] Source: Company reports[/caption]

The company discussed the following four key infrastructure and capabilities to achieve its 2025 ambitions:

Source: Company reports[/caption]

The company discussed the following four key infrastructure and capabilities to achieve its 2025 ambitions:

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Zalando is looking to expand its sustainable product assortments from 16% of its GMV in 2020 to 25% by 2023. Furthermore, the company has raised the content requirement standard of its products branded recycled from 20% to 30%.

[caption id="attachment_124720" align="aligncenter" width="720"]

Source: Company reports[/caption]

Zalando is looking to expand its sustainable product assortments from 16% of its GMV in 2020 to 25% by 2023. Furthermore, the company has raised the content requirement standard of its products branded recycled from 20% to 30%.

[caption id="attachment_124720" align="aligncenter" width="720"] Source: Company reports[/caption]

At the event, the company also discussed its aspiration to contribute to moving away from a linear fashion industry toward a circular pattern of consumption, through recycling and reuse. Zalando aims to extend the lifespan of over 50 million of its products by 2023. We believe that these sustainable initiatives will help Zalando in attracting customers, investors and employees.

[caption id="attachment_124721" align="aligncenter" width="720"]

Source: Company reports[/caption]

At the event, the company also discussed its aspiration to contribute to moving away from a linear fashion industry toward a circular pattern of consumption, through recycling and reuse. Zalando aims to extend the lifespan of over 50 million of its products by 2023. We believe that these sustainable initiatives will help Zalando in attracting customers, investors and employees.

[caption id="attachment_124721" align="aligncenter" width="720"] Source: Company reports[/caption]

Source: Company reports[/caption]