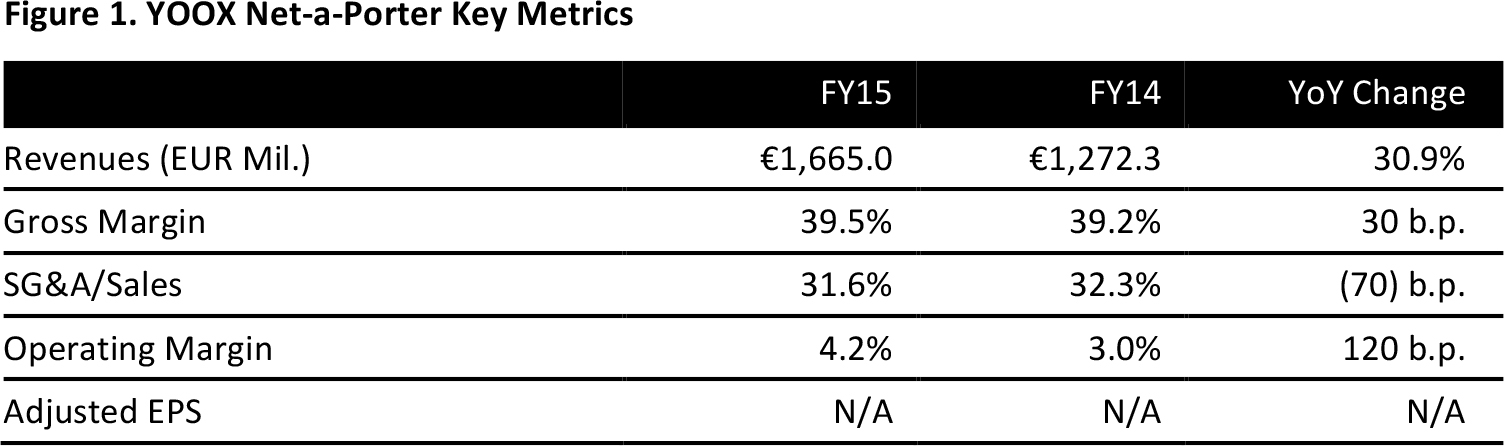

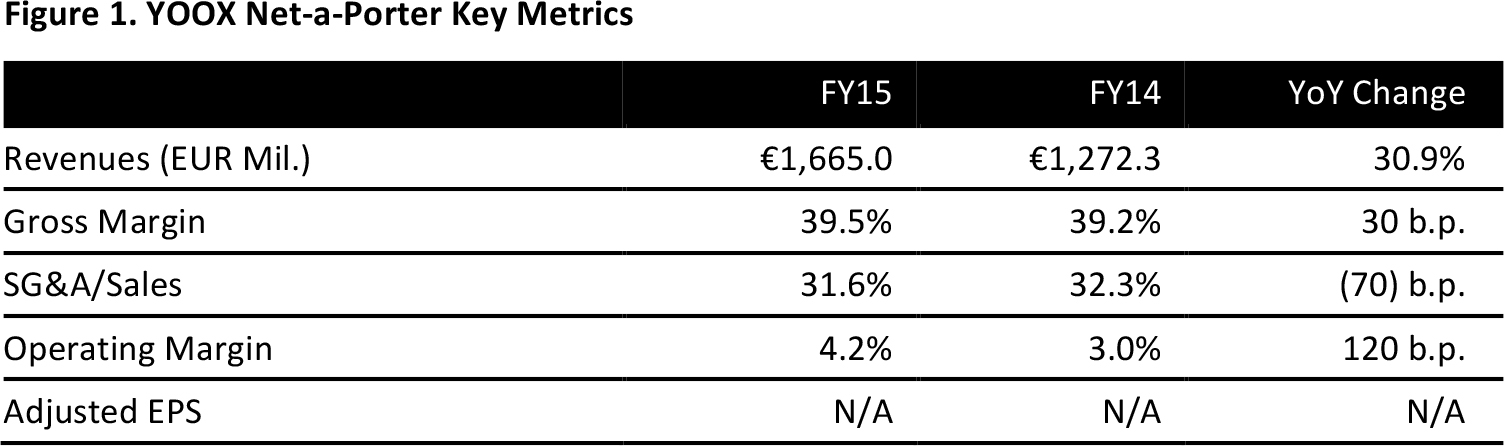

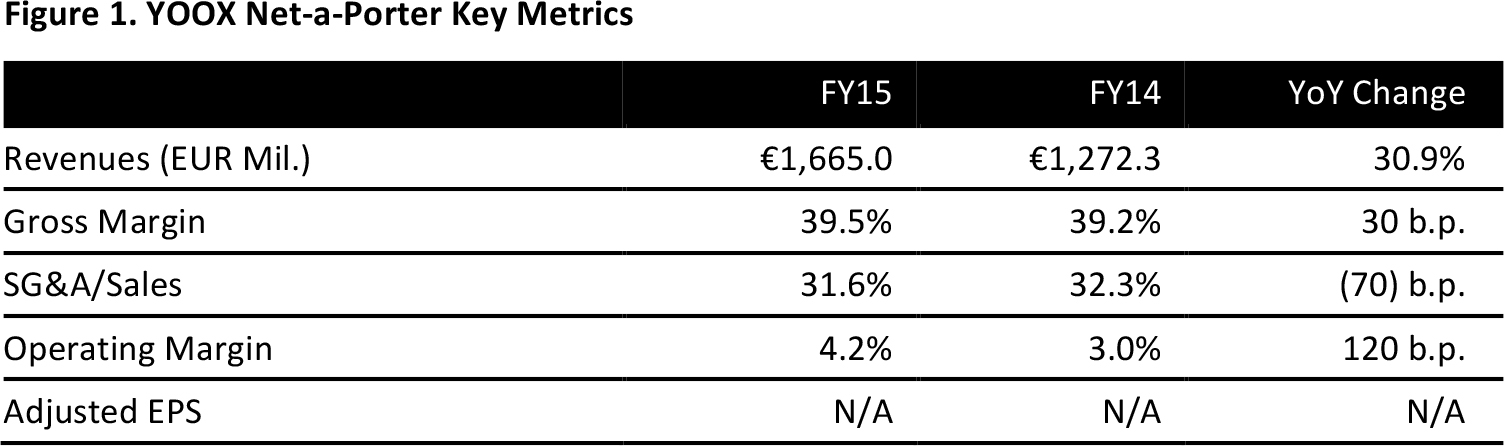

Fiscal years end December 31.

Source: Company reports

FY15 RESULTS

Italian online fashion retailer YOOX Net-a-Porter recorded reclassified pro forma net revenues of €1,665 million in FY15, up 30.9% year over year at current exchange rates and beating the consensus estimate of €1,662 million.

The company’s gross margin rose by 30 basis points year over year and its operating margin rose by 120 basis points, while its SG&A margin fell by 70 basis points.

The adjusted net income for FY15 was €59.7 million, up 37.8% from €43.3 million in FY14 and beating the consensus estimate of €35.7 million.

The company did not declare earnings per share.

YOOX and Net-a-Porter merged to form YOOX Net-a-Porter Group in October 2015.

NET REVENUES BY BUSINESS LINE

Year over year, multibrand in-season product sales climbed by 36.9%, multibrand off-season sales climbed by 26.1% and online flagship store sales increased by 19.2%. The majority of the company’s revenue—about 54%, or €893.3 million—came from multibrand in-season sales, including sales from Net-A-Porter.com, MrPorter.com, TheCorner.com and ShoeScribe.com.

The increase in revenues was mainly attributable to the exceptional performance of Net-A-Porter.com and MrPorter.com, which introduced the Tom Ford, Tod’s and Brunello Cucinelli ready-to-wear collections.

About 36%, or €596.4 million, of the company’s revenues came from multibrand off-season sales on Yoox.com and TheOutnet.com. Marketing investments in Yoox.com and the introduction of brands such as Proenza Schouler and Oscar de la Renta resulted in increased sales.

KEY PERFORMANCE INDICATORS

The average number of monthly unique visitors across the company’s sites rose by 14.7%, from 23.6 million in FY14 to 27.1 million in FY15. This resulted in a record 7.1 million orders, up 21.9% compared to 5.8 million in FY14.

The average order value excluding VAT was €352, up 10.9% compared to €317 in FY14. The company had a total of 2.5 million active customers at the end of FY15, compared to 2.1 million at the end of the previous year.

4Q15 RESULTS

Revenues in 4Q15 were €483.3 million, up 27.8% from €378.2 million in the year-ago period and beating the consensus estimate of €474.8 million. Adjusted net income for the quarter was €27.3 million, up 25.4% from €21.8 million in 4Q14 and beating the consensus estimate of €13.6 million.

GUIDANCE

In a press release, the company stated that it expects to achieve further revenue growth and an improvement in its adjusted EBITDA margin in FY16, but it did not state any explicit numbers. It also expects to invest about €150 million in improving its technology and logistics through the year.

Analysts expect the company to generate revenues of €1,990 million, EBIT of €92.1 million and normalized EPS of €0.42 in FY16.