DIpil Das

The Coresight Research team is attending the 14th annual Women’s Wear Daily Apparel and Retail CEO Summit, which runs October 29-30 this year. The conference brings together over 200 global retail and apparel executives speaking on the transformation of the retail industry, shifts in consumer behavior and brand collaborations that are helping retailers keep up with fast-changing consumer expectations.

These are the top four insights from the second day:

Sustainability continues to gain momentum as more companies switch to more responsible sourcing and manufacturing practices – and consumers expect it

Banana Republic is also offering clothing rental services in stores

Banana Republic is also offering clothing rental services in stores

Source: Banana Republic [/caption] The new era of brand globalization means more collaboration Left: John McPheters, Co-Chief Executive Officer and Co-Founder of Stadium Goods, discusses redefining resale through elevated storytelling and globalization; Right: Shoe gallery in Stadium Goods’ store in New York City

Left: John McPheters, Co-Chief Executive Officer and Co-Founder of Stadium Goods, discusses redefining resale through elevated storytelling and globalization; Right: Shoe gallery in Stadium Goods’ store in New York City

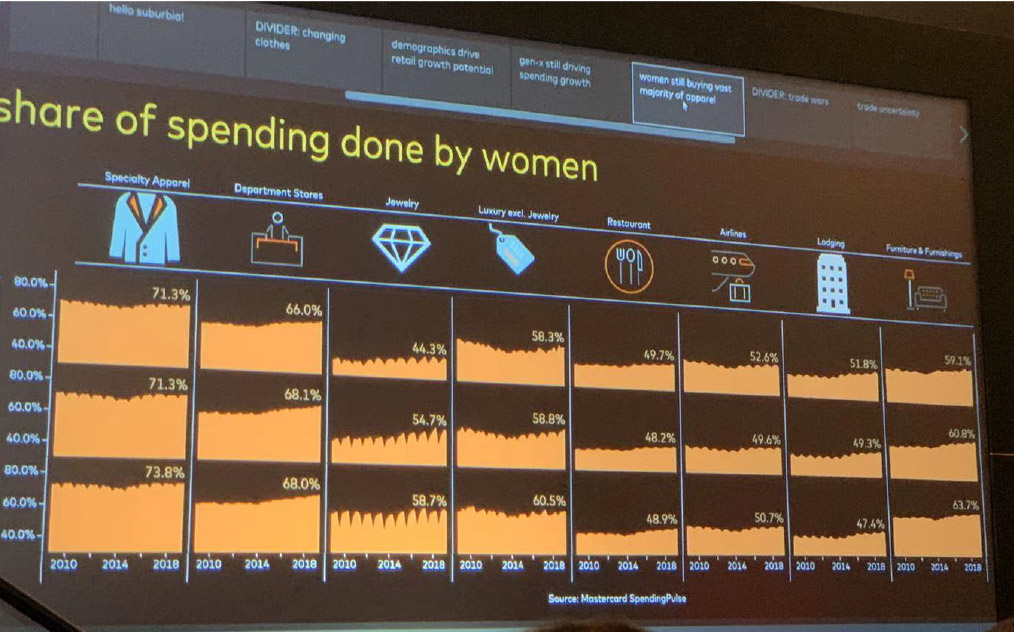

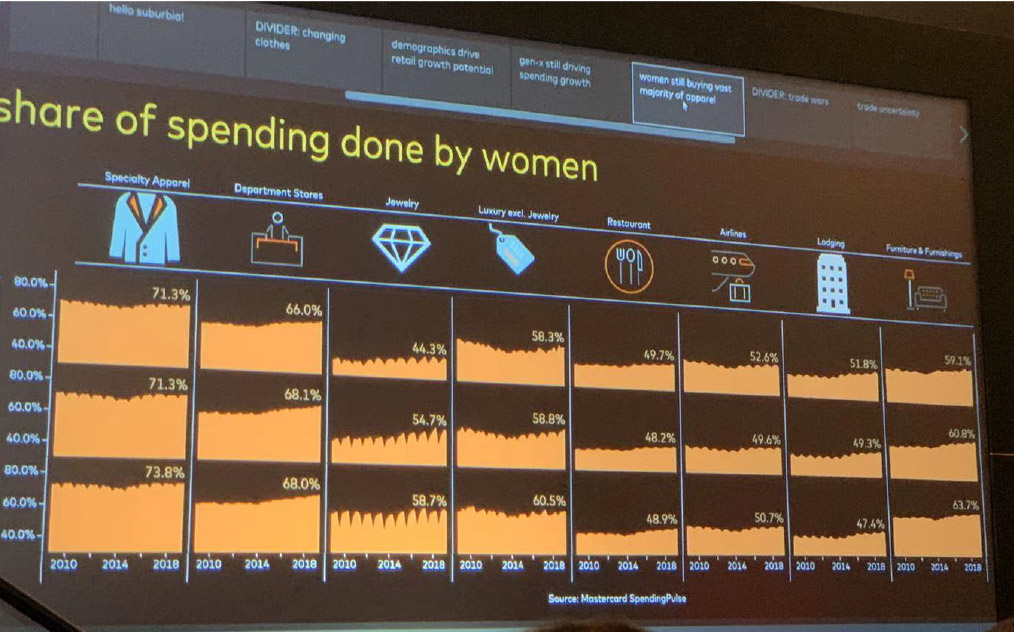

Source: Coresight Research/Stadium Goods [/caption] Gen X is still driving apparel spending growth in the US, and women still buy the vast majority of apparel The top three categories women spent money on are specialty apparel, department stores and furniture and furnishings

The top three categories women spent money on are specialty apparel, department stores and furniture and furnishings

Source: Mastercard SpendingPulse [/caption] Service is a key differentiator, both online and offline New York’s Nordstrom flagship opened its signature restaurant Wolf, with a wide range of food selections from beef tartare to American wagyu with peperonata

New York’s Nordstrom flagship opened its signature restaurant Wolf, with a wide range of food selections from beef tartare to American wagyu with peperonata

Source: Nordstrom [/caption]

- Art Peck, President & Chief Executive Officer of Gap, kicked off the second day of the event talking about changes to business models that are creating a more sustainable industry, such as Banana Republic’s Style Passport subscription service that allows the customer to rent three garments a month for a fixed price of $85 dollars. By renting, garments end up back in circulation after the “owner” tires of the look – instead of in the landfill.

- According to the World Bank, 20% of the world’s water pollution is caused by textile processing, making it the second biggest polluter of freshwater resources on the planet. Peck believes buy less and buy responsibly won’t solve the problem: Designers have to separate stretch from cotton, be constructively responsible and work sustainably.

Banana Republic is also offering clothing rental services in stores

Banana Republic is also offering clothing rental services in stores Source: Banana Republic [/caption] The new era of brand globalization means more collaboration

- John McPheters, Co-Chief Executive Officer and Co-Founder of Stadium Goods (acquired by Farfetch in December 2018), discussed how companies are redefining resale through elevated storytelling and globalization. Today, China is Stadium Goods’ second-largest country in terms of revenue, after the US. The retailer collaborated with Alibaba-owned Tmall to launch its products in China.

- Stadium Goods ships 200-300 pair of sneakers per day to be distributed through a network of partners in China. The company has a team of five dedicated to growth and strategy in China, and works with the Shanghai agency Magic Panda to plot localized campaigns and influencer work.

Left: John McPheters, Co-Chief Executive Officer and Co-Founder of Stadium Goods, discusses redefining resale through elevated storytelling and globalization; Right: Shoe gallery in Stadium Goods’ store in New York City

Left: John McPheters, Co-Chief Executive Officer and Co-Founder of Stadium Goods, discusses redefining resale through elevated storytelling and globalization; Right: Shoe gallery in Stadium Goods’ store in New York City Source: Coresight Research/Stadium Goods [/caption] Gen X is still driving apparel spending growth in the US, and women still buy the vast majority of apparel

- Bricklin Dwyer, Senior Vice President of Economic & Market insights at Mastercard, demonstrated (using its data analytics platform SpendingPulse) that Gen Xers are still driving apparel spending growth in the US – and women still buy vast majority of apparel; the top three sectors, as measured by the share of spending accounted for by women, are specialty apparel, department stores, and furniture and furnishings.

The top three categories women spent money on are specialty apparel, department stores and furniture and furnishings

The top three categories women spent money on are specialty apparel, department stores and furniture and furnishings Source: Mastercard SpendingPulse [/caption] Service is a key differentiator, both online and offline

- In both brick-and-mortar and online retail circles, everyone is taking about experiential retail. Immersive, interactive, technology-enhanced retail is the ultimate objective. Retailers can yield different benefits from different types of experiences. Deploying paid-for services such as food or entertainment helps retailers or shopping-center owners compete for consumers’ “experience dollars” and so increases the categories in which they are competing; for instance, restaurants are a big part of the experience at Nordstrom. Meanwhile, service-driven experiential retail primarily represents intra-retail competition – it provides a point of differentiation versus more functional competitors, including, in some cases, online-only rivals.

New York’s Nordstrom flagship opened its signature restaurant Wolf, with a wide range of food selections from beef tartare to American wagyu with peperonata

New York’s Nordstrom flagship opened its signature restaurant Wolf, with a wide range of food selections from beef tartare to American wagyu with peperonata Source: Nordstrom [/caption]