DIpil Das

Coresight Research participated in an event jointly hosted by WPP Plc. and Alibaba Group on April 24 in New York City. Coresight Research CEO and Founder Deborah Weinswig discussed the many ways in which China is reshaping retail, focusing on the five trends you need to know to succeed in this fast-growing mega market.

[caption id="attachment_87552" align="aligncenter" width="720"] Deborah Weinswig, CEO and Founder of Coresight Research, presents on How China is Reshaping Retail

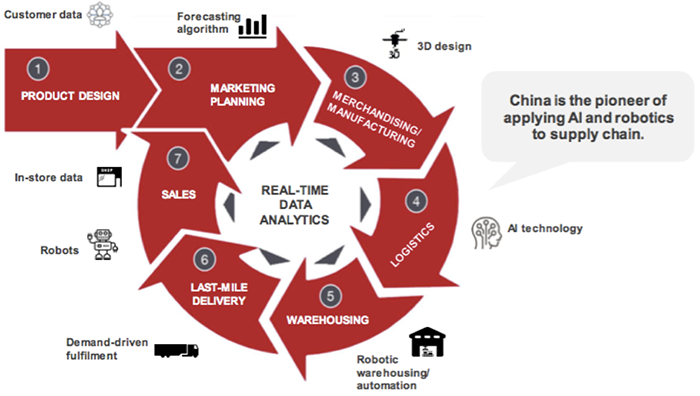

Deborah Weinswig, CEO and Founder of Coresight Research, presents on How China is Reshaping Retail Source: VMLY&R [/caption] 1. Data, social commerce and speed are fundamental to China’s New Retail. Chinese consumers have embraced mobile e-commerce: More than 90% of China’s total e-commerce retail transactions now take place via mobile. As many transactions take place via merchants’ sites within social media apps, these consumers are more connected to other consumers, and are more influenced by friends, relatives and online personalities. Retailers can collect data from seven billion consumer/brand daily interactions daily, which makes it imperative for retailers to have systems to glean useful insights from this massive amount of data. Real-time data analytics can also make the supply chain more efficient. [caption id="attachment_87745" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. E-commerce is rapidly gaining traction and Alibaba, Amazon, Google and Walmart will be the companies who most impact retail in this area.

Sales on Alibaba’s marketplaces hit $768 billion in the 2018 fiscal year, while total US e-commerce sales in US reached $466 billion in the same period, according to the US Department of Commerce. Part of Alibaba’s success is due to its collaboration with entrepreneurs, and a finance arm that lends money to small business owners using AI technology to determine eligibility.

And China’s success in e-commerce is inspiring Western counterparts to emulate some of the tactics, such as a livestreaming marketplace with purchasing functionality.

[caption id="attachment_87554" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

2. E-commerce is rapidly gaining traction and Alibaba, Amazon, Google and Walmart will be the companies who most impact retail in this area.

Sales on Alibaba’s marketplaces hit $768 billion in the 2018 fiscal year, while total US e-commerce sales in US reached $466 billion in the same period, according to the US Department of Commerce. Part of Alibaba’s success is due to its collaboration with entrepreneurs, and a finance arm that lends money to small business owners using AI technology to determine eligibility.

And China’s success in e-commerce is inspiring Western counterparts to emulate some of the tactics, such as a livestreaming marketplace with purchasing functionality.

[caption id="attachment_87554" align="aligncenter" width="720"] Jon Bird, Chief Retail & Commerce Officer in VMLY&R, is using JIE DI Qi to motivate brands to connect with consumers

Jon Bird, Chief Retail & Commerce Officer in VMLY&R, is using JIE DI Qi to motivate brands to connect with consumers Source: VMLY&R [/caption] 3. Shopping starts on Taobao/Tmall and extends to different parts of the Alibaba system. Consumer-centricity drives New Retail, a term Alibaba has invented to describe the new face of retailing, eliminating friction between retailers / brands and consumers. Using personalized channels, shoppers discover relevant products, further engaging with the Alibaba system. Online to offline, the consumer is at the center, and in China, an average of 12 datapoints are touched on the path to purchase (versus four data touchpoints in the average US consumer’s path to purchase). Here are some key things retailers and brands should do:

- Use the power of data to create totally new products.

- Elevate exclusivity by recognizing the influence and extensive reach of platforms.

- Bring the best product, brand experience and service.

- Find new ways to generate and convert demand.

- Connect content to the point of purchase seamlessly across channels.

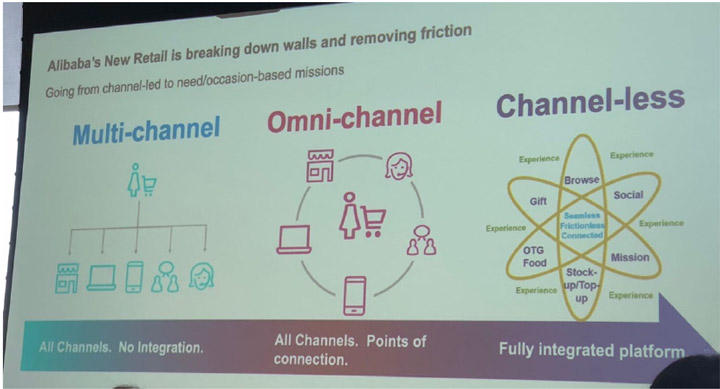

Alibaba is going from channel-led to need/occasion-based missions

Alibaba is going from channel-led to need/occasion-based missions Source: Coresight Research [/caption] 4. Brands need to work harder to capture Chinese consumers’ attention: They want every aspect of their shopping journey to be personalized. China’s demographic of young, tech-savvy, more digitally connected consumers is growing. While their parents often had little variety from which to choose, the younger generation has an abundance of choice and are heading to the top end of the market. Premiumization and trading down are two aspects in China’s stratified spending phenomena, and both are likely to continue into the next five years. This mirrors Weinswig’s Hourglass theory, articulated more than a decade ago, of the bifurcation of the US consumer market. Data-driven retail is arming the Chinese consumer with the data required to make informed purchase decisions on quality and brand. Retailers and brands in the middle lacking meaningful differentiators are losing share to sharper value/price offerings, and with the savings, trading up to a few choice brands that provide the personalized connection consumers aspire to. The graph below illustrates how outperformance in retail is increasingly polarized at the high and low ends in China, while the middle market is pinched. [caption id="attachment_87597" align="aligncenter" width="720"]

Source: Coresight Research [/caption]

5. Coresight Research identified five trends that brands and retailers need to know about China: luxury purchasing, plus-sized expansion, the rise of male beauty, community buying and urban farming.

Coresight Research CEO and Founder Deborah Weinswig focused on new buying behavior and new shopper journeys, detailing five trends:

Source: Coresight Research [/caption]

5. Coresight Research identified five trends that brands and retailers need to know about China: luxury purchasing, plus-sized expansion, the rise of male beauty, community buying and urban farming.

Coresight Research CEO and Founder Deborah Weinswig focused on new buying behavior and new shopper journeys, detailing five trends:

- In the fast-growing domestic China luxury market, which Bain estimates at $170 billion in 2018, local luxury brands are capturing share in tandem with a more educated and sophisticated Chinese consumer who demands quality, not a mere luxury brand logo, and whose average age is 35, about 10 years younger than luxury shoppers in developed countries. Luxury watches and jewelry that hold value are seeing a pickup in demand and sales of these goods are expected to approach $20.3 billion by 2022, up from $19.6 billion in 2018.

- China’s retailers are creating new lines catering to a growing plus size population, ages 25-40. The women’s plus-size market in China will be worth around $4.8 billion in 2019, but we estimate the total addressable market is worth over $10 billion.

- Urban Chinese men, particularly millennials, are increasingly image-conscious – and are spending more on beauty products. The average urban Chinese man spent about $28 a month on beauty products in the past year, according to Prosper Insights & Analytics. This drove category growth of 59% in 2017 and 54% in 2018.

- Group buying is taking off, especially in lower-tier cities and by small shops who use the online platform to offer a wider product range than they otherwise could (buyers purchase in groups through a group leader, often a small shop, and collect products delivered to the group buying leader).

- Urban and indoor farming are booming. According to China’s Ministry of Agriculture, residents of 35 major cities grew over 125 tons of vegetables, supplying local residents with as much as 70% of their annual consumption.