Nitheesh NH

Introduction

The Coresight Research team is attending and participating in this year’s World Retail Congress, held on April 5–7, 2022, in Rome, Italy. The event features retail leaders and industry experts from across the globe and is being held in-person for the first time since 2019.In this report, we present our top insights from day one of the show on April 5, 2022.

World Retail Congress 2022 Day One: Coresight Research Insights Retailers Grapple with Managing Cost Increases and Increasing Supply Chain Robustness Deborah Weinswig, CEO and Founder of Coresight Research, moderated a panel discussion titled, “The Roadmap to Build a Better Retail,” featuring panelists that had contributed research reports to the conference. The panel began with a discussion about the extent to which retailers will be willing and able to pass price increases on to consumers. Lower-income consumers were not able to put away as much cash during the pandemic as higher-income consumers may have done. Panelists discussed how the challenges of the last two years prompted retailers to greatly increase the resilience of their supply chains, which leaves them better prepared for future supply chain shocks. The increased robustness of supply chains also puts retailers in a better position to use supply chains to document and manage sustainability. Panelists dispelled the thinking that improving sustainability brings higher costs. In fact, many actions bring little or no cost, and promoting a sustainability mindset brings benefits such as customer acquisition and loyalty: A sizable proportion of Gen Z consumers visit a retailer’s website to analyze their sustainability initiatives, the panelists said. [caption id="attachment_145095" align="aligncenter" width="700"] From left to right: Louisa Murray, COO UK and Europe, Railsbank; Shalini Unnikrishnan, Managing Director and Partner at BCG; Anne Mirenda, Partner of OC&C; Katie Weir, Global Consumer Industry Operations at Deloitte; Silvia Rindone, Retail Lead of UK and Ireland at EY; Deborah Weinswig, CEO and Founder of Coresight Research

From left to right: Louisa Murray, COO UK and Europe, Railsbank; Shalini Unnikrishnan, Managing Director and Partner at BCG; Anne Mirenda, Partner of OC&C; Katie Weir, Global Consumer Industry Operations at Deloitte; Silvia Rindone, Retail Lead of UK and Ireland at EY; Deborah Weinswig, CEO and Founder of Coresight ResearchSource: Coresight Research[/caption] Global GDP Will Decline in 2022 as a Consequence of the Russia-Ukraine War In a mainstage keynote, Simone Romano, an economist at the Organisation for Economic Co-operation and Development (OECD), presented the OECD’s 2022 global GDP forecast. For context, before the Russia-Ukraine conflict, global GDP was steadily recovering, with inflation rising largely due to global supply chain challenges. At the beginning of 2022, it appeared global supply chain issues were easing, and global consumer was demand declining, albeit slightly. The combination of these two factors would have likely eased inflationary pressures. However, because of the Russia-Ukraine War, these inflationary and supply chain challenges have accelerated once more. The price of fossil fuels has risen dramatically. Furthermore, since Ukraine is a major exporter of wheat, inflation in food-at-home categories (such as bread) has vastly accelerated. As a consequence, consumers will have less money to spend on discretionary categories. In aggregate, the OECD predicts that US GDP will decline by 0.8%, Europe’s GDP will decline by 1.4%, and the world’s GDP will decline by 1.1%. [caption id="attachment_145096" align="aligncenter" width="700"]

Christel Delberghe, Director General, EuroCommerce (left) and Simone Romano, Economist, OECD (right)

Christel Delberghe, Director General, EuroCommerce (left) and Simone Romano, Economist, OECD (right)Source: Coresight Research[/caption] Ron Johnson Is Always Looking for the Next Thing Retailing legend Ron Johnson (of Apple, Enjoy, JCPenney and Target) spent 30 minutes answering questions and providing perspective on retail. Here are some of his insights:

- Retail is always about disruption. Retailers are always looking for the next thing; not just what shoppers will buy, but where they will buy it. That is the challenge of retail. There are multiple choices of where to shop. Consumers start digitally and order more online.

- The value of retail is tied up in the last mile. It varies by brand and category. For apparel, about 50% of value is in the last mile; for luxury, about 70%. It is where the brand connects with the customer.

- The future of retail is about experience. We won’t have bad stores—either fast convenience or experiential retail, anything in the middle won’t survive. The biggest challenge is big stores don’t make sense anymore; retail is all about place making and creating experiences. In three years, we will have fewer stores; B malls will be converted to different uses. We will have better stores that place great value on presentation, fewer products and connections with employees.

- The next disruption in commerce is the mobile store and home is the new frontier. With Covid-19, home is where we work; with Peloton, it is where we workout. The last mile is undifferentiated, until Enjoy, which is a commerce-at-home initiative, bringing the full store experience to the home for free today—the convenience of buying online in the comfort of your home with the confidence you get shopping with a trained employee. Enjoy is inventing the next best retail experience that is finetuning the model with telecommunications and consumer electronics.

- Take time to get your team to embrace the strategy; the pace of change reflects the age of the company. At JCPenney, the strategy was right; the decision to go fast was wrong.

- Community, purpose and values drive success. In response to Whole Foods Co-Founder Walter Robb’s question about what the magic or pixie dust is, Johnson replied, “Culture… A company has a clear purpose and core values that employees can embrace that together create community; employees are connected and want to participate.” Collaborating around values and purpose creates community and drives success.

- A great idea takes time. Johnson reminded the audience that when Apple Stores were first launched, no one came, and the same was true with the Genius Bars. He counts only three of his 15 years at Target as “great” as most of the years were spent building toward the strategy. Innovation starts with imagination, doing what has never been done before. Johnson emphasized, “Nothing works as well as you would like the first time; you must stick with it!”

Ron Johnson, CEO and Founder of Enjoy (left) and Lovelda Vincenzi, MC and Moderator (right)

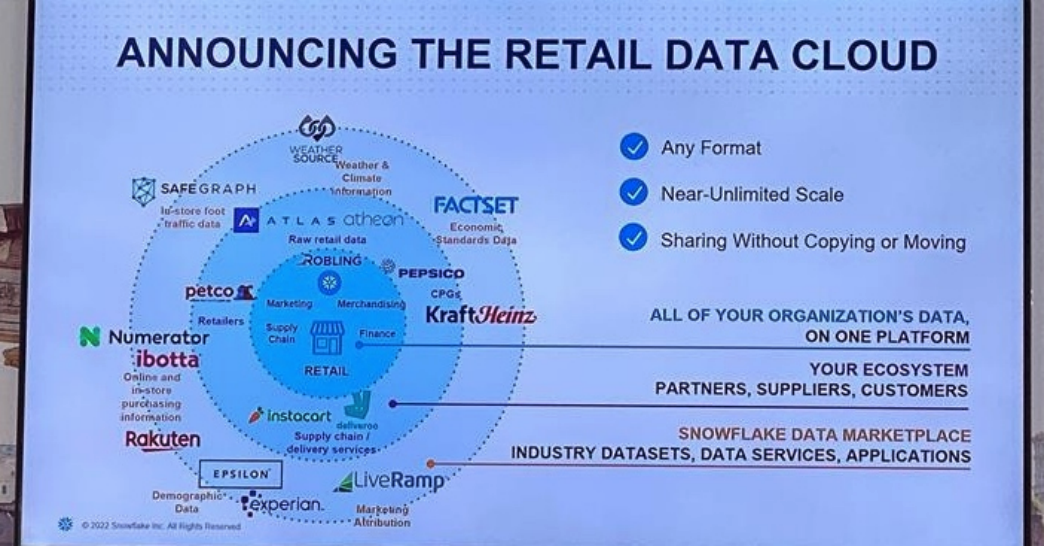

Ron Johnson, CEO and Founder of Enjoy (left) and Lovelda Vincenzi, MC and Moderator (right)Source: Coresight Research[/caption] Snowflake Announces Retail Data Cloud in Europe Cloud-based data platform provider Snowflake re-announced its Data Cloud for Retail, which was officially announced at the Shoptalk conference last week. The product enables retailers and brands to share data and generate insights as from a single database, although the data could be stored across diverse cloud service providers such as AWS (Amazon Web Services), Google Cloud or Microsoft Azure. The data can be manipulated and analyzed in its original location—i.e., without copying it. The solution is of particular appeal in retail, where data may be stored in separate silos for the functional groups, which could be across diverse platforms and cloud providers. The company gave a case study of data sharing among grocery retailer Albertsons and CPG company Kraft Heinz brand: Albertsons is able to provide frequent updates to its demand forecast, which in turn enables Kraft Heinz to make frequent adjustments to its manufacturing plans. [caption id="attachment_145098" align="aligncenter" width="700"]

Illustration of Snowflake Data Cloud for Retail

Illustration of Snowflake Data Cloud for RetailSource: Coresight Research[/caption] Walgreens Is Embarking Down the Path of Consumer Wellness Walgreens is evolving beyond its roots as a 120-year-old drugstore retailer, according to a presentation given by Adam Holyk, the company’s Senior Vice President of Strategy. He disclosed that customers with chronic conditions accounted for 90% of US healthcare spending, six in 10 Walgreens customers (35 million customers) and more than 80% of the company’s revenues. Walgreens is focused on empowering these chronic customers through their wellness journey, and this customer segment includes those with more than five conditions, those with one to five conditions, their caretakers and healthy individuals. To accomplish this, Walgreens is transforming digitally to create differentiated omnichannel experiences to drive digital and physical traffic, such as focusing on its 96 million loyalty program members and using its personalization engine on the healthcare side. In its physical stores, the company is refreshing its physical stores, modernizing its technology and optimizing its footprint and use of real estate. [caption id="attachment_145099" align="aligncenter" width="700"]

Adam Holyk, Senior Vice President of Strategy at Walgreens

Adam Holyk, Senior Vice President of Strategy at WalgreensSource: Coresight Research[/caption] Whole Foods Emphasizes the Importance of Retailers’ Understanding Their Purpose Matt Shay, President of the US National Retail Federation (NRF), interviewed Walter Robb, former Co-CEO of Whole Foods. Echoing comments from other presenters, Robb said that he founded the company to “bring healthier choices to the world, bring love and respect,” and that the most important thing is for retailers to understand their purpose; making money will happen at the same time. Robb claimed that Whole Foods achieved its success through adopting a stakeholder philosophy; listening to customers, team members and the environment; maintaining quality standards—“not all food is created equal”—and empowering employees. He stated that the role of company leadership is to support team members, who support customers. Robb claimed credit for Whole Foods’ changing consumers’ relationship with food in two ways. First, the retailer made shopping fun. Second, it sold good food, taking the unusual move of featuring produce at the front of the store. Looking ahead, retailers need to meet consumers where they are and build on the one-to-one experience and the connection with the consumer and the community, Robb said. [caption id="attachment_145101" align="aligncenter" width="700"]

Walter Robb, formerly Co-CEO of Whole Foods (left), and Matt Shay, President and CEO of NRF (right)

Walter Robb, formerly Co-CEO of Whole Foods (left), and Matt Shay, President and CEO of NRF (right)Source: Coresight Research[/caption] Student-Led Sustainability Initiatives Reimagine Fast Fashion Before the opening remarks at World Retail Congress, graduate students representing five different countries presented pitch ideas in the Future Retail Challenge, sponsored by global fashion retailer Tendam. The students featured in the event represented the following universities and countries:

- Hong Kong Polytechnic Institute, Hong Kong

- London College of Fashion, London

- ESCP Business School, Italy

- University of Amsterdam, Netherlands

- EDHEC Business School, France

- Implementing a Rent-In-Store Experience—This first pillar would entail customers entering select H&M stores. Within these stores would be a dedicated area called the “Conscious Area” where items from collaborations would be displayed. Customers entering a subscription-based rental model would be granted the opportunity to rent clothes, creating a longer lifespan for the select items.

- Resale Marketplace—The second pillar implements an H&M-owned resale marketplace, where customers can resell items and H&M is able to collect a portion of the resale, also allowing for a longer lifespan for clothing items. Customers are rewarded for bringing their clothes in for resale by earning “conscious points,” which they can accumulate and redeem to enter collaborations with creators to design their own clothing line.

- Entering the Metaverse—The third pillar encourages customers to explore the metaverse, where customers can purchase clothing through NFTs for their own digital avatars. Should they wish to also possess the physical piece of clothing for themselves, customers are able to place the order, and H&M would produce these pieces of clothing on demand, to make sure there is no dead stock.

From left to right: Aurora Macchi, Diletta Sveva Tamagnone, Delia Negri, ESCP Business School, Antonis Kyprianou, International Franchise Director, Tendam

From left to right: Aurora Macchi, Diletta Sveva Tamagnone, Delia Negri, ESCP Business School, Antonis Kyprianou, International Franchise Director, TendamSource: Coresight Research[/caption]