Nitheesh NH

The Coresight Research team was in Amsterdam attending and participating in the 2019 World Retail Congress, May 14-16. More than 1,300 key industry people were there listening to presentations from more than 180 speakers addressing today’s supersonic retail speed, or “High Velocity Retail,” as the conference organizers termed it.

The World Retail Congress brings together leaders from the global retail industry – from domestic and international powerhouses to game-changing start-ups and disruptors. The congress provides an unrivalled high-level forum for senior retailers to learn, share insights and shape the future of retail.

This year, Nike secured the coveted Retailer of the Year award: This serves as a good example of many of the themes we saw at the event around innovation, technology, the in-store experience, spectacular retail and brand execution at every consumer touchpoint, clear brand positioning and strong consumer relationships.

Nike’s House of Innovation 000 in New York City spreads out over 68,000 square feet on six floors, each integrating innovative retail concepts. The Nike Speed Shop uses local data to restock items and shoppers can also use the Nike app to scan an item, have it sent to a fitting room to try on, then pay and walk out. The app also lets shoppers reserve items and pick them up from lockers in the store. DTC is emerging as Nike’s focused growth strategy, with apps and House of Innovation brand houses supporting its consumer outreach and delivering innovative experiences.

These are some of the other themes we heard:

Cross-border best practices: Western companies are leveraging cross-border opportunities such as that offered by the massive popularity of online shopping in China’s booming domestic market.

[caption id="attachment_89505" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO eShopWorld, and Kelsey Groome, Managing Director of Traub.

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO eShopWorld, and Kelsey Groome, Managing Director of Traub.

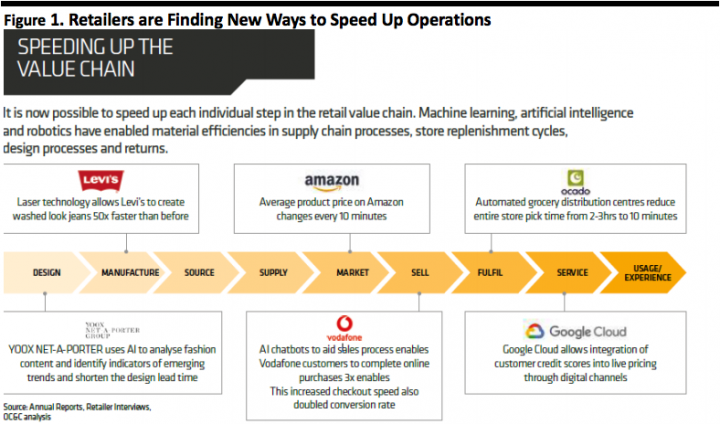

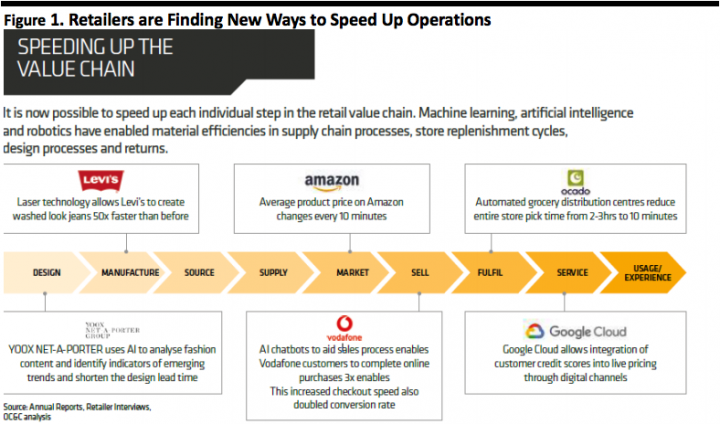

Source: Coresight Research[/caption] One example is China’s Singles’ Day, which began as a festival of young Chinese people celebrating their pride in being single but has grown to become the world’s largest 24-hour online shopping event in terms of GMV. In 2018, Amazon Prime Day generated $4.2 billion in 36 hours. Alibaba’s Tmall generated $30.8 billion in just 24 hours during the 2018 Singles’ Day shopping festival, while JD.com reported US$23 billion in GMV. eShopWorld CEO Tommy Kelly discussed how his firm helps brands expand into global markets while feeling local, creating a seamless buyer journey, unencumbered by currency and duties, and locally relevant in terms of search words and pricing. Purpose is emerging as retail’s North Star: Some 74% of millennials believe that successful business requires genuine purpose and 81% of 13-34 year olds reject the concept of conspicuous luxury, according to the World Retail Congress. A paradigm shift in values is emerging, and that is influencing consumer behavior. As younger people become more mindful in pursuit of a more meaningful existence, they look for purpose-driven brands as well, and sustainability takes center stage. Coresight Research has created its BEST framework for reimagining physical stores: Brand building, Experiences, Service and Technology integration. Flagship stores can be temples to the brand, where shoppers interact with a brand’s raison d’être. They are a showcase for brand values and heritage as well as product. Judith McKenna, President and CEO of Walmart International, spoke about the need for businesses to adapt to the values of their consumers, that it is integral to serving your customer, deepening relationships and creating customer loyalty. Technology increases transparency so companies can both better understand their customers and also more easily demonstrate their company values. Dilys Maltby, Senior Partner at Circus, said purpose should be at the heart of business decisions. Purpose is a higher need in Maslow’s hierarchy of needs theory and it is what today’s consumer is looking for. By purchasing a product imbued with meaning, the specific meaning/value becomes a part of the individual’s persona. Sharing common values deepens brand/consumer relationships. For Kelly Stickel, Founder and CEO of Remodista, brands that offer consumers meaning, something they can believe in, are part of spectacular retail. Stickel spoke about using technology and robotics to free up associates’ time so they can engage with customers, as well as creating a foundation for better informed associates. High-end velocity: Coresight Research Managing Director of Luxury & Fashion Marie Driscoll hosted a panel discussion called High End, High Velocity: Adapting to The New World of Luxury, looking at the many trends and market changes influencing high-end products. The themes that came up the most we around the in-store experience, service offerings such as wellness and spas, as well as super informed sales associates that deepen loyalty. At Harrods, beauty is the entry point for today’s aspiring luxury shoppers, and CEO Michael Ward is executing a £200 million refurbishment of the store’s first floor to attract and retain luxury shoppers. This is in addition to Harrod’s Wellness Clinic on the 4th floor, where about 14,500 square feet are dedicated to wellness, or inner and outer beauty. Off-price is also emerging as a springboard for new consumers to enter the luxury market. Sylvie Freund Pickavance, Strategy and Business Development Director at Value Retail, noted that the company has captured data that shows a visit to a value retail center is often followed by a visit to a brand store in urban flagship locations: A first experience of a luxury brand at value retail may be less intimidating than flagship locations for new luxury shoppers. Rania Masri, Chief Transformation Officer, Chalhoub Group, addressed the importance of customer relationships and using digital tools to free up staff to reach and serve consumers where they are. [caption id="attachment_89506" align="aligncenter" width="720"] Source: OC&C Strategy Consultants[/caption]

New Retail: Invented in China, now coming to the West: “New Retail” is a term coined by China’s Alibaba Group to describe the integration of online retail with offline. Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. At the World Retail Congress, retailers as varied as Ahold Delhaize, Orchard Mile, and Walmart (to name just a few) noted they are using data to better connect with their shoppers and enhance the shopping experience.

[caption id="attachment_89507" align="aligncenter" width="720"]

Source: OC&C Strategy Consultants[/caption]

New Retail: Invented in China, now coming to the West: “New Retail” is a term coined by China’s Alibaba Group to describe the integration of online retail with offline. Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. At the World Retail Congress, retailers as varied as Ahold Delhaize, Orchard Mile, and Walmart (to name just a few) noted they are using data to better connect with their shoppers and enhance the shopping experience.

[caption id="attachment_89507" align="aligncenter" width="720"] Source: Coresight Research[/caption]

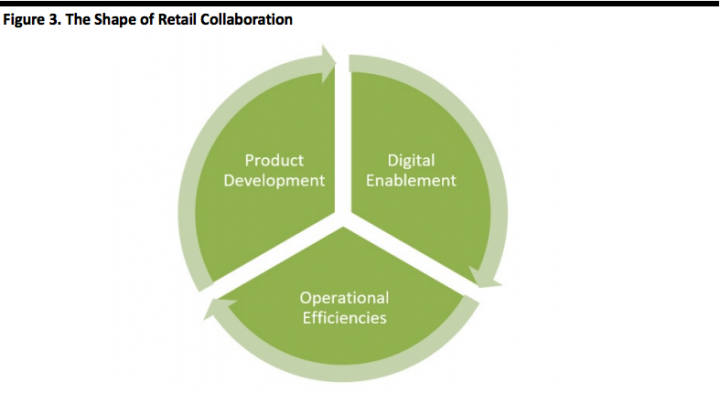

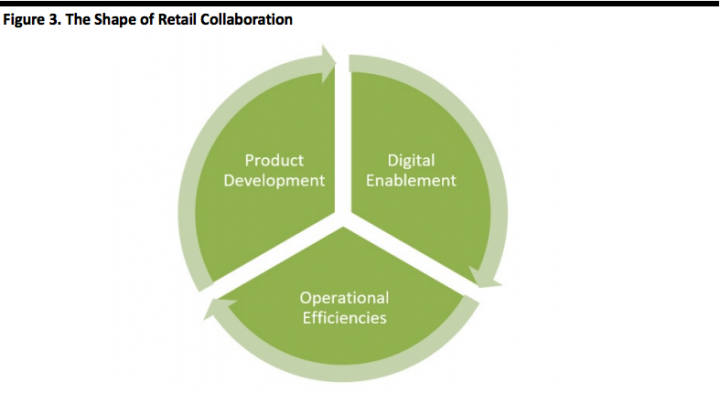

The future of retail is collaboration: In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Speaking at the panel discussion Disrupt or Be Disrupted, Jennie Baik, Cofounder and CEO of Orchard Mile, a luxury marketplace where shoppers curate the shopping experience with the brands and boutiques they love, said collaboration allows partners to focus on and excel at the things they are good at. At Orchard Mile, that means bringing great products to the platform and celebrating hyper-localization.

[caption id="attachment_89508" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

The future of retail is collaboration: In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Speaking at the panel discussion Disrupt or Be Disrupted, Jennie Baik, Cofounder and CEO of Orchard Mile, a luxury marketplace where shoppers curate the shopping experience with the brands and boutiques they love, said collaboration allows partners to focus on and excel at the things they are good at. At Orchard Mile, that means bringing great products to the platform and celebrating hyper-localization.

[caption id="attachment_89508" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Tech comes with humanity: Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion on tech with humanity. Consumers, particularly millennials, are increasingly dismissive of technologies that are more gimmicky than practical. Danil Kolesnikov, Head of VA Alice, Yandex suggested that to be more human and resonate with users (and increase adoption rates) voice technology should focus on the query and not on the app.

[caption id="attachment_89509" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Tech comes with humanity: Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion on tech with humanity. Consumers, particularly millennials, are increasingly dismissive of technologies that are more gimmicky than practical. Danil Kolesnikov, Head of VA Alice, Yandex suggested that to be more human and resonate with users (and increase adoption rates) voice technology should focus on the query and not on the app.

[caption id="attachment_89509" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex, about tech with humanity.

Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex, about tech with humanity.

Source: Coresight Research[/caption] Technology is driving faster, more effective and more sustainable supply chains: Coresight Research’s Weinswig moderated a lunch session looking at opportunities to leverage new and emerging technology to improve supply chain operations. Data analytics, virtual 3D end-to-end design and predictive analytics tools are helping retailers speed supply chains, increase sell-through rates, and reduce inventory waste. The emergence of new technology is enabling supply chain digitalization and promises exciting, sustainable innovation across the product development cycle. Succeeding in China: Chinese consumers and millennials are becoming increasingly sophisticated and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce in 2016 to 50% in 2019. Reaching them means leveraging digital channels (especially social media via mobile device), KOLs, localizing product offerings and ensuring speedy delivery. [caption id="attachment_89510" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Source: Coresight Research[/caption] Winning the Food Wars the next battleground: As the biggest portion of consumer spending, food retail is at the very center of industry transformation. Meeting steadily rising customer expectations around choice, experience, value, convenience, quality, multiple channels and rapid delivery is growing ever more challenging. Grocery chains are working hard to digitize, striking alliances and integrating new technology solutions. Wouter Kolk, CEO Europe and Indonesia for Ahold Delhaize, spoke about the need to build scalable technology that can be implemented by every vendor, brand and partner, and which can simplify and reduce costs. At Ahold Delhaize, they are re-assorting stores, adding food options as they move non-food to the dot.com sites. Local brands are seeing an uptick as Ahold Delhaize emphasizes authenticity, real ingredients and markets fresh, locally grown produce, and organic options featured along with artisan bakeries. Remastering the art of fulfilment: Beyond drones, AI, blockchain (and even robots): Customers don’t see channels, they just want to shop anytime, anywhere, anyhow. To deliver on these demands (and survive in today’s world) retailers must be seamless and connected across digital and physical from supply chain to commerce front end. Facing high costs, large delivery volumes, shifting consumer expectations and increased competition, companies are investing heavily in last-mile innovation. Big retailers and logistics providers have made acquisitions and are developing new technologies and models in-house, while startups are also entering the space. [caption id="attachment_89511" align="aligncenter" width="720"] JD.com drone delivery

JD.com drone delivery

Source: 3g.163.com[/caption]

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO eShopWorld, and Kelsey Groome, Managing Director of Traub.

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO eShopWorld, and Kelsey Groome, Managing Director of Traub.Source: Coresight Research[/caption] One example is China’s Singles’ Day, which began as a festival of young Chinese people celebrating their pride in being single but has grown to become the world’s largest 24-hour online shopping event in terms of GMV. In 2018, Amazon Prime Day generated $4.2 billion in 36 hours. Alibaba’s Tmall generated $30.8 billion in just 24 hours during the 2018 Singles’ Day shopping festival, while JD.com reported US$23 billion in GMV. eShopWorld CEO Tommy Kelly discussed how his firm helps brands expand into global markets while feeling local, creating a seamless buyer journey, unencumbered by currency and duties, and locally relevant in terms of search words and pricing. Purpose is emerging as retail’s North Star: Some 74% of millennials believe that successful business requires genuine purpose and 81% of 13-34 year olds reject the concept of conspicuous luxury, according to the World Retail Congress. A paradigm shift in values is emerging, and that is influencing consumer behavior. As younger people become more mindful in pursuit of a more meaningful existence, they look for purpose-driven brands as well, and sustainability takes center stage. Coresight Research has created its BEST framework for reimagining physical stores: Brand building, Experiences, Service and Technology integration. Flagship stores can be temples to the brand, where shoppers interact with a brand’s raison d’être. They are a showcase for brand values and heritage as well as product. Judith McKenna, President and CEO of Walmart International, spoke about the need for businesses to adapt to the values of their consumers, that it is integral to serving your customer, deepening relationships and creating customer loyalty. Technology increases transparency so companies can both better understand their customers and also more easily demonstrate their company values. Dilys Maltby, Senior Partner at Circus, said purpose should be at the heart of business decisions. Purpose is a higher need in Maslow’s hierarchy of needs theory and it is what today’s consumer is looking for. By purchasing a product imbued with meaning, the specific meaning/value becomes a part of the individual’s persona. Sharing common values deepens brand/consumer relationships. For Kelly Stickel, Founder and CEO of Remodista, brands that offer consumers meaning, something they can believe in, are part of spectacular retail. Stickel spoke about using technology and robotics to free up associates’ time so they can engage with customers, as well as creating a foundation for better informed associates. High-end velocity: Coresight Research Managing Director of Luxury & Fashion Marie Driscoll hosted a panel discussion called High End, High Velocity: Adapting to The New World of Luxury, looking at the many trends and market changes influencing high-end products. The themes that came up the most we around the in-store experience, service offerings such as wellness and spas, as well as super informed sales associates that deepen loyalty. At Harrods, beauty is the entry point for today’s aspiring luxury shoppers, and CEO Michael Ward is executing a £200 million refurbishment of the store’s first floor to attract and retain luxury shoppers. This is in addition to Harrod’s Wellness Clinic on the 4th floor, where about 14,500 square feet are dedicated to wellness, or inner and outer beauty. Off-price is also emerging as a springboard for new consumers to enter the luxury market. Sylvie Freund Pickavance, Strategy and Business Development Director at Value Retail, noted that the company has captured data that shows a visit to a value retail center is often followed by a visit to a brand store in urban flagship locations: A first experience of a luxury brand at value retail may be less intimidating than flagship locations for new luxury shoppers. Rania Masri, Chief Transformation Officer, Chalhoub Group, addressed the importance of customer relationships and using digital tools to free up staff to reach and serve consumers where they are. [caption id="attachment_89506" align="aligncenter" width="720"]

Source: OC&C Strategy Consultants[/caption]

New Retail: Invented in China, now coming to the West: “New Retail” is a term coined by China’s Alibaba Group to describe the integration of online retail with offline. Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. At the World Retail Congress, retailers as varied as Ahold Delhaize, Orchard Mile, and Walmart (to name just a few) noted they are using data to better connect with their shoppers and enhance the shopping experience.

[caption id="attachment_89507" align="aligncenter" width="720"]

Source: OC&C Strategy Consultants[/caption]

New Retail: Invented in China, now coming to the West: “New Retail” is a term coined by China’s Alibaba Group to describe the integration of online retail with offline. Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. At the World Retail Congress, retailers as varied as Ahold Delhaize, Orchard Mile, and Walmart (to name just a few) noted they are using data to better connect with their shoppers and enhance the shopping experience.

[caption id="attachment_89507" align="aligncenter" width="720"] Source: Coresight Research[/caption]

The future of retail is collaboration: In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Speaking at the panel discussion Disrupt or Be Disrupted, Jennie Baik, Cofounder and CEO of Orchard Mile, a luxury marketplace where shoppers curate the shopping experience with the brands and boutiques they love, said collaboration allows partners to focus on and excel at the things they are good at. At Orchard Mile, that means bringing great products to the platform and celebrating hyper-localization.

[caption id="attachment_89508" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

The future of retail is collaboration: In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Speaking at the panel discussion Disrupt or Be Disrupted, Jennie Baik, Cofounder and CEO of Orchard Mile, a luxury marketplace where shoppers curate the shopping experience with the brands and boutiques they love, said collaboration allows partners to focus on and excel at the things they are good at. At Orchard Mile, that means bringing great products to the platform and celebrating hyper-localization.

[caption id="attachment_89508" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Tech comes with humanity: Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion on tech with humanity. Consumers, particularly millennials, are increasingly dismissive of technologies that are more gimmicky than practical. Danil Kolesnikov, Head of VA Alice, Yandex suggested that to be more human and resonate with users (and increase adoption rates) voice technology should focus on the query and not on the app.

[caption id="attachment_89509" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Tech comes with humanity: Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion on tech with humanity. Consumers, particularly millennials, are increasingly dismissive of technologies that are more gimmicky than practical. Danil Kolesnikov, Head of VA Alice, Yandex suggested that to be more human and resonate with users (and increase adoption rates) voice technology should focus on the query and not on the app.

[caption id="attachment_89509" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex, about tech with humanity.

Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex, about tech with humanity.Source: Coresight Research[/caption] Technology is driving faster, more effective and more sustainable supply chains: Coresight Research’s Weinswig moderated a lunch session looking at opportunities to leverage new and emerging technology to improve supply chain operations. Data analytics, virtual 3D end-to-end design and predictive analytics tools are helping retailers speed supply chains, increase sell-through rates, and reduce inventory waste. The emergence of new technology is enabling supply chain digitalization and promises exciting, sustainable innovation across the product development cycle. Succeeding in China: Chinese consumers and millennials are becoming increasingly sophisticated and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce in 2016 to 50% in 2019. Reaching them means leveraging digital channels (especially social media via mobile device), KOLs, localizing product offerings and ensuring speedy delivery. [caption id="attachment_89510" align="aligncenter" width="720"]

Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.Source: Coresight Research[/caption] Winning the Food Wars the next battleground: As the biggest portion of consumer spending, food retail is at the very center of industry transformation. Meeting steadily rising customer expectations around choice, experience, value, convenience, quality, multiple channels and rapid delivery is growing ever more challenging. Grocery chains are working hard to digitize, striking alliances and integrating new technology solutions. Wouter Kolk, CEO Europe and Indonesia for Ahold Delhaize, spoke about the need to build scalable technology that can be implemented by every vendor, brand and partner, and which can simplify and reduce costs. At Ahold Delhaize, they are re-assorting stores, adding food options as they move non-food to the dot.com sites. Local brands are seeing an uptick as Ahold Delhaize emphasizes authenticity, real ingredients and markets fresh, locally grown produce, and organic options featured along with artisan bakeries. Remastering the art of fulfilment: Beyond drones, AI, blockchain (and even robots): Customers don’t see channels, they just want to shop anytime, anywhere, anyhow. To deliver on these demands (and survive in today’s world) retailers must be seamless and connected across digital and physical from supply chain to commerce front end. Facing high costs, large delivery volumes, shifting consumer expectations and increased competition, companies are investing heavily in last-mile innovation. Big retailers and logistics providers have made acquisitions and are developing new technologies and models in-house, while startups are also entering the space. [caption id="attachment_89511" align="aligncenter" width="720"]

JD.com drone delivery

JD.com drone deliverySource: 3g.163.com[/caption]