DIpil Das

The Coresight Research team is in Amsterdam this week, attending and participating in the 2019 World Retail Congress, running May 14-16.

The World Retail Congress brings together leaders from the global retail industry – from domestic and international powerhouses to game-changing start-ups and disruptors. The congress provides an unrivalled high-level forum for senior retailers to learn, share insights and shape the retail future.

These are some of the highlights from day 2:

Tech comes with humanity

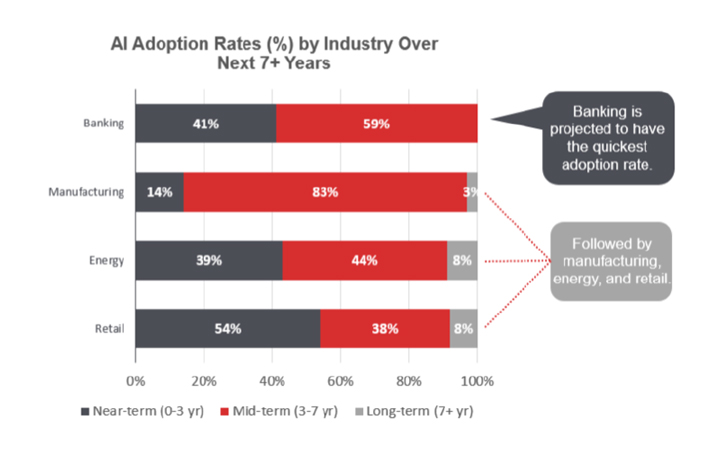

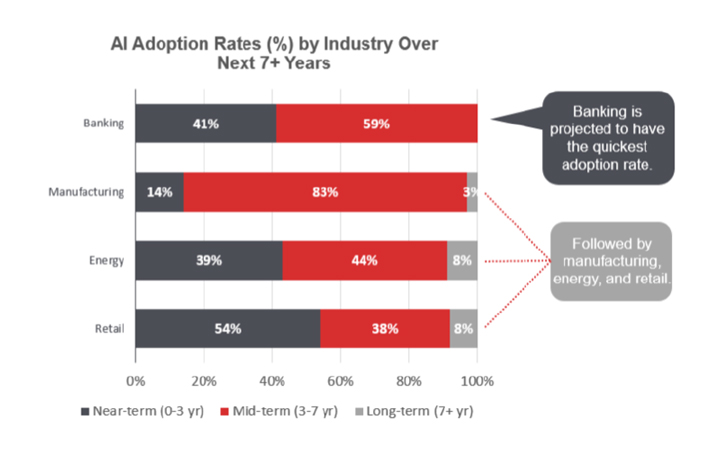

Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion on tech with humanity. Consumers, particularly millennials, are increasingly dismissive of technologies that are more gimmicky than practical. How should retailers approach the cutting edge of technology to ensure it is customer centric and above all useful? Technologies such as AI are blending art and science.

AI creates better consumer experiences by eliminating friction in the shopping process, deepening engagement with customers, enriching the consumer journey in real-time and closing the information gap between e-commerce and physical stores.

Increasingly consumers, notably millennials, are dismissive of technologies that are more gimmicky than practical. At the Tech With Humanity panel, Daniil Kolesnikov said voice tech should focus on the query, not apps. Marry new tech with new integration, not old paradigms. One query that is successful in Russia is, “How much does it cost?” used by 1.7 million people monthly.

Some of the companies leveraging AI include Walmart and Alibaba.

Walmart uses AI to organize inventory data and analytics, for product pricing and optimizing routes for delivery and solving other operational problems. Alibaba uses AI through a smart speaker assistant called the Tmall Genie, plus a FashionAI digital consultant, in its product recommendation software, to manage promotions on the company’s online marketplaces and to support supply chain logistics.

[caption id="attachment_87959" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex about tech with humanity.

Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex about tech with humanity.

Source: Coresight Research.[/caption] Technology is driving faster, more effective and more sustainable supply chains Coresight Research’s Deborah Weinswig moderated a lunch session looking at opportunities to leverage new and emerging technology to improve supply chain operations. Panelists discussed the global state of retail, the pressure and scrutiny retailers increasingly face for producing excess inventory and material waste and how to balance those challenges against the need for faster supply chains enabled by technology. Data analytics, virtual 3D end-to-end design and predictive analytics tools are helping retailers speed supply chains, increase sell-through rates, and reduce inventory waste. The emergence of new technology is enabling supply chain digitalization and promises exciting, sustainable innovation across the product development cycle. Succeeding in China

Chinese consumers and millennials are becoming increasingly sophisticated in their consumption of brands and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce share in 2016 to 50% in 2019. With changing tastes and the rise of digital commerce, all brands are having to work much harder by adopting new models and strategies to capture the rapidly growing millennial market.

Chinese young affluents are fueling market growth, and they are different from their parents: They are far less frugal, far more interested in experiences then objects, and enthusiastically embrace digital omnichannel shopping – especially via mobile device, which accounts for over 80% of all online transactions in China. They are twice as likely to have traveled overseas than their older counterparts, twice as likely to check information online before making a purchase decision, and far more interested in luxury (the average age of the Chinese luxury consumer is 25).

Consumers under the age of 35 are expected to account for some 53% of all domestic retail sales in China by 2020.

Sabrina Fung, Group MD of Fung Retailing Group, advises retailers and brands to think about China like a sheet of white paper, full of enormous possibility. Deborah Weinswig recommends that companies partner strategically when entering China.

Key opinion leaders are especially influential in China, and a carefully planned KOL strategy is crucial to success in China’s domestic market.

Gucci, for example, successfully enlisted online fashion celebrities to promote its products. Gucci offered exclusive online sales via Bu Da Jing Xuan, a WeChat mini-app run by online celebrity Gogoboi. Within five days, all the promoted items were sold out, comparable to all of Givenchy’s sales for an entire month.

[caption id="attachment_87961" align="aligncenter" width="720"]

Succeeding in China

Chinese consumers and millennials are becoming increasingly sophisticated in their consumption of brands and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce share in 2016 to 50% in 2019. With changing tastes and the rise of digital commerce, all brands are having to work much harder by adopting new models and strategies to capture the rapidly growing millennial market.

Chinese young affluents are fueling market growth, and they are different from their parents: They are far less frugal, far more interested in experiences then objects, and enthusiastically embrace digital omnichannel shopping – especially via mobile device, which accounts for over 80% of all online transactions in China. They are twice as likely to have traveled overseas than their older counterparts, twice as likely to check information online before making a purchase decision, and far more interested in luxury (the average age of the Chinese luxury consumer is 25).

Consumers under the age of 35 are expected to account for some 53% of all domestic retail sales in China by 2020.

Sabrina Fung, Group MD of Fung Retailing Group, advises retailers and brands to think about China like a sheet of white paper, full of enormous possibility. Deborah Weinswig recommends that companies partner strategically when entering China.

Key opinion leaders are especially influential in China, and a carefully planned KOL strategy is crucial to success in China’s domestic market.

Gucci, for example, successfully enlisted online fashion celebrities to promote its products. Gucci offered exclusive online sales via Bu Da Jing Xuan, a WeChat mini-app run by online celebrity Gogoboi. Within five days, all the promoted items were sold out, comparable to all of Givenchy’s sales for an entire month.

[caption id="attachment_87961" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Source: Coresight Research.[/caption] Chinese customers also expect localized products: One example is a Snickers bar made with Sichuan pepper and chili – a spicy and sweet combination that proved extremely popular. Sales of “Spicy Snickers” hit $1.43 million in the first eight months, and 92% of consumers gave the snack positive feedback. Winning the food wars the next battleground As the biggest portion of consumer spending, food retail is at the very center of industry transformation. Meeting steadily rising customer expectations around choice, experience, value, convenience, quality, multiple channels and rapid delivery is growing ever more challenging. In the Netherlands, Picnic, a popular online-only supermarket and the 2019 winner of Retailer of the Year at Shop-Award in Germany, focused on three values: all your groceries at the lowest price with free delivery to your front door. In one year, its share of the online grocery market went from 20% to 30% in the Netherlands, driven by its compelling value proposition, according to Picnic co-founder Gerard Scheij. However, food convenience is growing faster than online and sustainability is top of mind for consumers: The real opportunity is at the high end for luxury groceries, said Steven Hamilton, Digital Commerce Director of Europe for Diageo. US-based Kroger is one example of how grocers are adapting. In the last four years, Kroger has made several strategic alliances and focused on enhancing its online order system and home delivery service. In October 2018, the company announced a partnership with Walgreens to test online order pickup at 13 Walgreens stores. In partnership with Instacart, Kroger plans to offer same-day grocery delivery from an additional 75 stores by late October. Kroger has also teamed up with robotics company Nuro to introduce grocery delivery by self-driving car. Kroger announced its biggest e-commerce partnership, with British e-grocer Ocado, in May 2018. The partnership is designed to strengthen Kroger’s delivery business with the construction of up to 20 automated warehouses over three years. Like major rivals such as Walmart, Kroger has so far focused on in-store grocery pickup, and the Ocado partnership represents a shift of focus to home delivery.

Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex about tech with humanity.

Coresight Research CEO and Founder Deborah Weinswig speaks to Kent Wong, Managing Director of Hong Kong-based jewelry retailer Chow Tai Fook, Eoin Harrington, former SVP Innovation Restoration Hardware, and Danill Kolesnikov, Head of VA Alice, Yandex about tech with humanity.Source: Coresight Research.[/caption] Technology is driving faster, more effective and more sustainable supply chains Coresight Research’s Deborah Weinswig moderated a lunch session looking at opportunities to leverage new and emerging technology to improve supply chain operations. Panelists discussed the global state of retail, the pressure and scrutiny retailers increasingly face for producing excess inventory and material waste and how to balance those challenges against the need for faster supply chains enabled by technology. Data analytics, virtual 3D end-to-end design and predictive analytics tools are helping retailers speed supply chains, increase sell-through rates, and reduce inventory waste. The emergence of new technology is enabling supply chain digitalization and promises exciting, sustainable innovation across the product development cycle.

Succeeding in China

Chinese consumers and millennials are becoming increasingly sophisticated in their consumption of brands and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce share in 2016 to 50% in 2019. With changing tastes and the rise of digital commerce, all brands are having to work much harder by adopting new models and strategies to capture the rapidly growing millennial market.

Chinese young affluents are fueling market growth, and they are different from their parents: They are far less frugal, far more interested in experiences then objects, and enthusiastically embrace digital omnichannel shopping – especially via mobile device, which accounts for over 80% of all online transactions in China. They are twice as likely to have traveled overseas than their older counterparts, twice as likely to check information online before making a purchase decision, and far more interested in luxury (the average age of the Chinese luxury consumer is 25).

Consumers under the age of 35 are expected to account for some 53% of all domestic retail sales in China by 2020.

Sabrina Fung, Group MD of Fung Retailing Group, advises retailers and brands to think about China like a sheet of white paper, full of enormous possibility. Deborah Weinswig recommends that companies partner strategically when entering China.

Key opinion leaders are especially influential in China, and a carefully planned KOL strategy is crucial to success in China’s domestic market.

Gucci, for example, successfully enlisted online fashion celebrities to promote its products. Gucci offered exclusive online sales via Bu Da Jing Xuan, a WeChat mini-app run by online celebrity Gogoboi. Within five days, all the promoted items were sold out, comparable to all of Givenchy’s sales for an entire month.

[caption id="attachment_87961" align="aligncenter" width="720"]

Succeeding in China

Chinese consumers and millennials are becoming increasingly sophisticated in their consumption of brands and are expected to make up 40% of the global luxury market by 2024. They’re also extremely tech-savvy and already the top contributors of online sales, jumping from 20% of global e-commerce share in 2016 to 50% in 2019. With changing tastes and the rise of digital commerce, all brands are having to work much harder by adopting new models and strategies to capture the rapidly growing millennial market.

Chinese young affluents are fueling market growth, and they are different from their parents: They are far less frugal, far more interested in experiences then objects, and enthusiastically embrace digital omnichannel shopping – especially via mobile device, which accounts for over 80% of all online transactions in China. They are twice as likely to have traveled overseas than their older counterparts, twice as likely to check information online before making a purchase decision, and far more interested in luxury (the average age of the Chinese luxury consumer is 25).

Consumers under the age of 35 are expected to account for some 53% of all domestic retail sales in China by 2020.

Sabrina Fung, Group MD of Fung Retailing Group, advises retailers and brands to think about China like a sheet of white paper, full of enormous possibility. Deborah Weinswig recommends that companies partner strategically when entering China.

Key opinion leaders are especially influential in China, and a carefully planned KOL strategy is crucial to success in China’s domestic market.

Gucci, for example, successfully enlisted online fashion celebrities to promote its products. Gucci offered exclusive online sales via Bu Da Jing Xuan, a WeChat mini-app run by online celebrity Gogoboi. Within five days, all the promoted items were sold out, comparable to all of Givenchy’s sales for an entire month.

[caption id="attachment_87961" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.

Coresight Research CEO and Founder Deborah Weinswig speaks to Sabrina Fung, Managing Director of Fung Retailing Group, and Marc Compagnon, Senior Advisor, Fung Group, about winning China-market strategies.Source: Coresight Research.[/caption] Chinese customers also expect localized products: One example is a Snickers bar made with Sichuan pepper and chili – a spicy and sweet combination that proved extremely popular. Sales of “Spicy Snickers” hit $1.43 million in the first eight months, and 92% of consumers gave the snack positive feedback. Winning the food wars the next battleground As the biggest portion of consumer spending, food retail is at the very center of industry transformation. Meeting steadily rising customer expectations around choice, experience, value, convenience, quality, multiple channels and rapid delivery is growing ever more challenging. In the Netherlands, Picnic, a popular online-only supermarket and the 2019 winner of Retailer of the Year at Shop-Award in Germany, focused on three values: all your groceries at the lowest price with free delivery to your front door. In one year, its share of the online grocery market went from 20% to 30% in the Netherlands, driven by its compelling value proposition, according to Picnic co-founder Gerard Scheij. However, food convenience is growing faster than online and sustainability is top of mind for consumers: The real opportunity is at the high end for luxury groceries, said Steven Hamilton, Digital Commerce Director of Europe for Diageo. US-based Kroger is one example of how grocers are adapting. In the last four years, Kroger has made several strategic alliances and focused on enhancing its online order system and home delivery service. In October 2018, the company announced a partnership with Walgreens to test online order pickup at 13 Walgreens stores. In partnership with Instacart, Kroger plans to offer same-day grocery delivery from an additional 75 stores by late October. Kroger has also teamed up with robotics company Nuro to introduce grocery delivery by self-driving car. Kroger announced its biggest e-commerce partnership, with British e-grocer Ocado, in May 2018. The partnership is designed to strengthen Kroger’s delivery business with the construction of up to 20 automated warehouses over three years. Like major rivals such as Walmart, Kroger has so far focused on in-store grocery pickup, and the Ocado partnership represents a shift of focus to home delivery.