albert Chan

The Coresight Research team is in Amsterdam this week, attending and participating in the 2019 World Retail Congress, May 14-16.

The World Retail Congress brings together leaders from the global retail industry – from domestic and international powerhouses to game-changing start-ups and disruptors. The congress provides an unrivalled high-level forum for senior retailers to learn, share insights and shape the retail future.

These are some of the highlights from day 1:

Cross-border best practices

Coresight Research CEO and Founder Deborah Weinswig moderated a lunch session looking at best practices for cross-border retailing – especially in China’s booming domestic market.

The conversation covered the key trends and consumer expectations that are affecting global retail expansion and some innovative approaches the world’s best companies are using to meet consumer expectations in local markets.

[caption id="attachment_87775" align="aligncenter" width="646"] Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO of eShopWorld, and Kelsey Groome, Managing Director of Traub.

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO of eShopWorld, and Kelsey Groome, Managing Director of Traub.

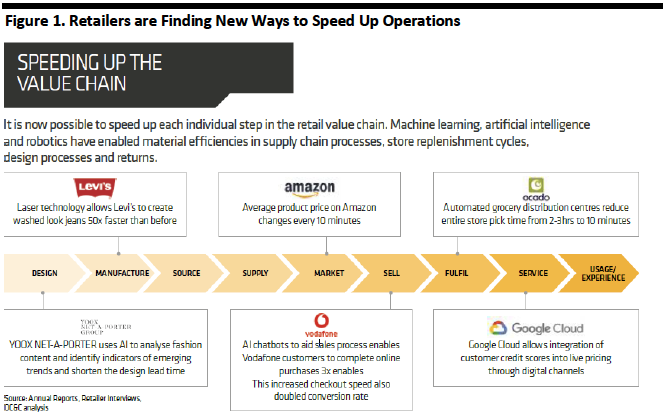

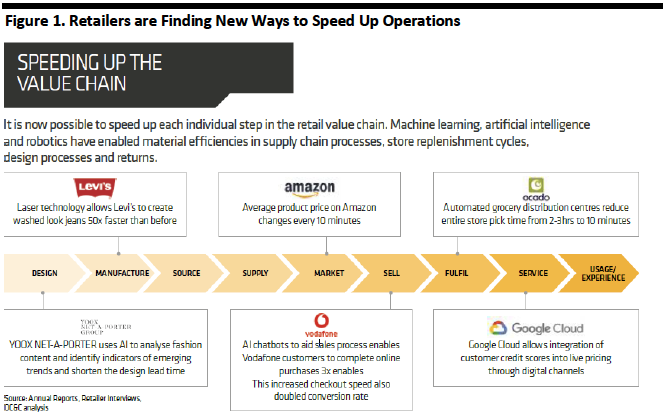

Source: Coresight Research[/caption] One example is China’s Singles’ Day, which began as a festival of young Chinese people celebrating their pride in being single but has grown to become the world’s largest 24-hour online shopping event in terms of GMV. In 2018, Amazon Prime Day generated $4.2 billion in 36 hours. Alibaba’s Tmall generated $30.8 billion in just 24 hours during the 2018 Singles’ Day shopping festival, while JD.com reported US$23 billion in GMV. In fact, Singles’ Day, or 11.11 as the festival is also known, has grown to be so huge it can serve as a strategic entry point to the China market: There were 237 brands on Alibaba’s platform in 2018, up from 167 brands the year before. Over 40% of purchases on Singles’ Day were of international brands. The top sources of imported products were Australia, Germany, Japan, Korea and the US. Notable new entrants in 2018 included US sportswear retailer Footlocker and grocery chain Kroger, both of which participated via Alibaba’s Tmall. Purpose is emerging as retail’s North Star Everyone is talking about purpose – but what does it mean? Some 4% of millennials believe that successful business requires genuine purpose and 81% of 13-34 year olds reject the concept of conspicuous luxury. A paradigm shift in values is emerging, and that is influencing consumer behavior. As younger people become more mindful in pursuit of a more meaningful existence, they look for purpose-driven brands as well, and sustainability takes center stage. Shoppers increasingly expect brands to be environmentally friendly – and luxury is no exception. According to a Cotton Inc Supply Chain Insights report released in May, 2018, around half of consumers said they paid more to buy clothing made from natural fibers. In fact, luxury’s higher price tag means consumers expect more in terms of sustainability and social responsibility: In a survey of 966 luxury shoppers, Jean-Noël Kapferer from Northwestern University found 71.4% of respondents agree with the statement that luxury should be exemplary in terms of sustainability, while some 69.0% said they would be shocked if luxury brands weren’t sustainable given their price. High-end velocity Coresight Research Managing Director of Luxury and Fashion Marie Driscoll hosted a panel on high-end velocity, looking at the shape of new luxury and what luxury brands need to do to keep ahead of changing consumer perceptions. Digital is a given, and experiential has become non-negotiable. How can an industry that is often slow to adapt update its strategies – and do it quickly? Retail has been speeding up for a long time. Inditex ripped up the traditional rules of the supply chain in the 1990s when it cut product lead times from six months to five weeks. In 2009, Amazon introduced same-day delivery in the US. Ocado and its automated warehouse solutions will celebrate its 20th birthday next year. For retailers, good is no longer enough: Being great can lead to success, but being average can be punished hard. The good news is that retailers recognize change is needed: 75% believe they need to fundamentally change their business models to keep up with the pace of evolution in the industry. Winners are focusing on being the best at something that matters to customers and avoiding the pitfalls of trying to do everything, badly. High-velocity retailers no longer simply speed up traditional processes, but work out how to completely rewire elements of traditional retail to improve both speed and efficiency. They selectively deploy capital against priority areas and select partners that provide capability outside their heartlands. [caption id="attachment_87794" align="aligncenter" width="666"] Source: OC&C[/caption]

New Retail: Invented in China, now coming to the West

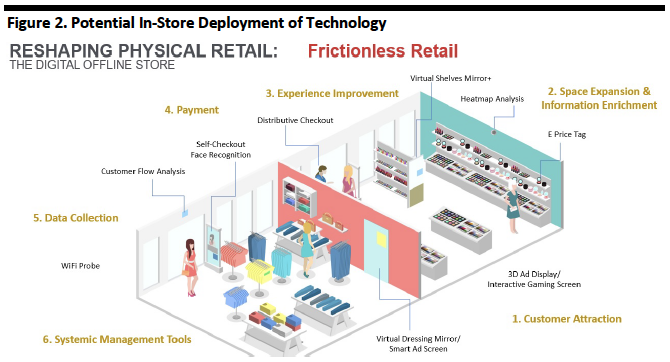

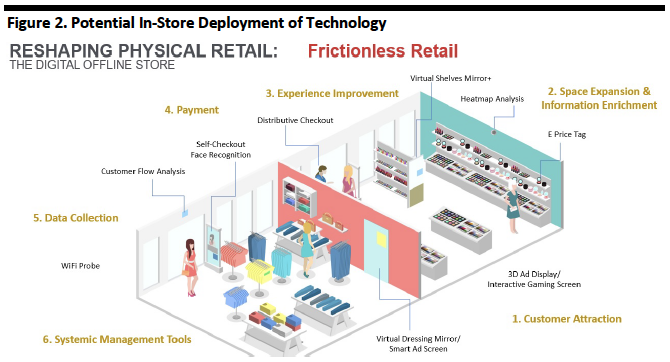

“New Retail” is a term coined by China’s Alibaba Group to describe the integration online retail with offline, and tying both to supply chain upstream and customer interaction (especially via social media and through digital payment capabilities) to create a seamless omnichannel shopping experience.

Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures – what we term an “Alibaba-fication” of online retailing.

We’re seeing more online retailers offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We’re also seeing further moves into permanent retail formats, with online data driving decisions about format, product range and location.

This is not about Amazon only: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations.

This is what we’ve seen so far:

Source: OC&C[/caption]

New Retail: Invented in China, now coming to the West

“New Retail” is a term coined by China’s Alibaba Group to describe the integration online retail with offline, and tying both to supply chain upstream and customer interaction (especially via social media and through digital payment capabilities) to create a seamless omnichannel shopping experience.

Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures – what we term an “Alibaba-fication” of online retailing.

We’re seeing more online retailers offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We’re also seeing further moves into permanent retail formats, with online data driving decisions about format, product range and location.

This is not about Amazon only: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations.

This is what we’ve seen so far:

Source: Coresight Research[/caption]

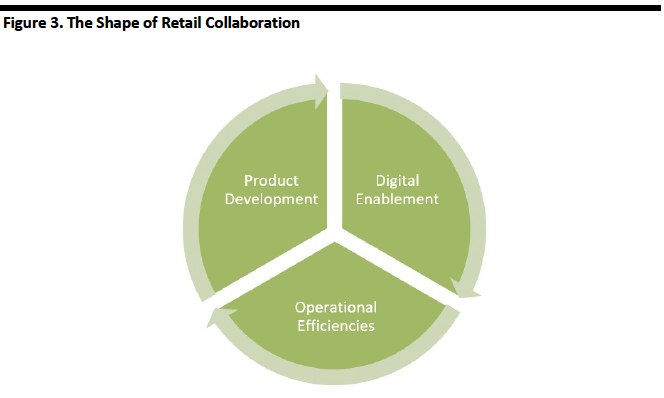

The future of retail is collaboration

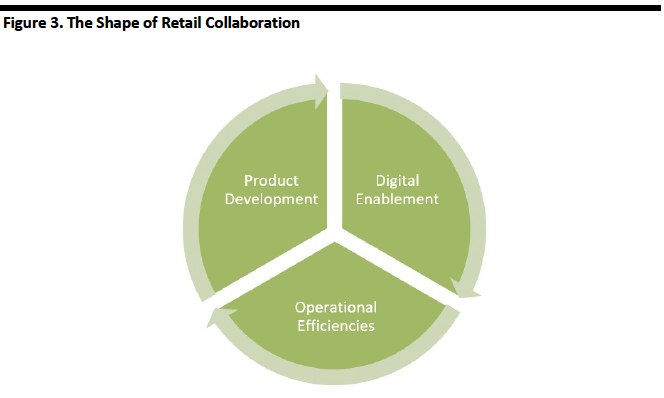

In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Brands and retailers will launch their own accelerators and funding programs, too, to gain exclusive first rights to innovations developed by emerging startups. We expect a flurry of activity around startups that can contribute to areas such as new product development in CPG and beauty; digital service improvements, with a strong emphasis on the point of customer interaction, including payments; and, operational efficiencies such as productivity and logistics.

What we’ve seen so far:

Source: Coresight Research[/caption]

The future of retail is collaboration

In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Brands and retailers will launch their own accelerators and funding programs, too, to gain exclusive first rights to innovations developed by emerging startups. We expect a flurry of activity around startups that can contribute to areas such as new product development in CPG and beauty; digital service improvements, with a strong emphasis on the point of customer interaction, including payments; and, operational efficiencies such as productivity and logistics.

What we’ve seen so far:

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO of eShopWorld, and Kelsey Groome, Managing Director of Traub.

Coresight Research CEO and Founder Deborah Weinswig speaking with Tommy Kelly, CEO of eShopWorld, and Kelsey Groome, Managing Director of Traub.Source: Coresight Research[/caption] One example is China’s Singles’ Day, which began as a festival of young Chinese people celebrating their pride in being single but has grown to become the world’s largest 24-hour online shopping event in terms of GMV. In 2018, Amazon Prime Day generated $4.2 billion in 36 hours. Alibaba’s Tmall generated $30.8 billion in just 24 hours during the 2018 Singles’ Day shopping festival, while JD.com reported US$23 billion in GMV. In fact, Singles’ Day, or 11.11 as the festival is also known, has grown to be so huge it can serve as a strategic entry point to the China market: There were 237 brands on Alibaba’s platform in 2018, up from 167 brands the year before. Over 40% of purchases on Singles’ Day were of international brands. The top sources of imported products were Australia, Germany, Japan, Korea and the US. Notable new entrants in 2018 included US sportswear retailer Footlocker and grocery chain Kroger, both of which participated via Alibaba’s Tmall. Purpose is emerging as retail’s North Star Everyone is talking about purpose – but what does it mean? Some 4% of millennials believe that successful business requires genuine purpose and 81% of 13-34 year olds reject the concept of conspicuous luxury. A paradigm shift in values is emerging, and that is influencing consumer behavior. As younger people become more mindful in pursuit of a more meaningful existence, they look for purpose-driven brands as well, and sustainability takes center stage. Shoppers increasingly expect brands to be environmentally friendly – and luxury is no exception. According to a Cotton Inc Supply Chain Insights report released in May, 2018, around half of consumers said they paid more to buy clothing made from natural fibers. In fact, luxury’s higher price tag means consumers expect more in terms of sustainability and social responsibility: In a survey of 966 luxury shoppers, Jean-Noël Kapferer from Northwestern University found 71.4% of respondents agree with the statement that luxury should be exemplary in terms of sustainability, while some 69.0% said they would be shocked if luxury brands weren’t sustainable given their price. High-end velocity Coresight Research Managing Director of Luxury and Fashion Marie Driscoll hosted a panel on high-end velocity, looking at the shape of new luxury and what luxury brands need to do to keep ahead of changing consumer perceptions. Digital is a given, and experiential has become non-negotiable. How can an industry that is often slow to adapt update its strategies – and do it quickly? Retail has been speeding up for a long time. Inditex ripped up the traditional rules of the supply chain in the 1990s when it cut product lead times from six months to five weeks. In 2009, Amazon introduced same-day delivery in the US. Ocado and its automated warehouse solutions will celebrate its 20th birthday next year. For retailers, good is no longer enough: Being great can lead to success, but being average can be punished hard. The good news is that retailers recognize change is needed: 75% believe they need to fundamentally change their business models to keep up with the pace of evolution in the industry. Winners are focusing on being the best at something that matters to customers and avoiding the pitfalls of trying to do everything, badly. High-velocity retailers no longer simply speed up traditional processes, but work out how to completely rewire elements of traditional retail to improve both speed and efficiency. They selectively deploy capital against priority areas and select partners that provide capability outside their heartlands. [caption id="attachment_87794" align="aligncenter" width="666"]

Source: OC&C[/caption]

New Retail: Invented in China, now coming to the West

“New Retail” is a term coined by China’s Alibaba Group to describe the integration online retail with offline, and tying both to supply chain upstream and customer interaction (especially via social media and through digital payment capabilities) to create a seamless omnichannel shopping experience.

Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures – what we term an “Alibaba-fication” of online retailing.

We’re seeing more online retailers offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We’re also seeing further moves into permanent retail formats, with online data driving decisions about format, product range and location.

This is not about Amazon only: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations.

This is what we’ve seen so far:

Source: OC&C[/caption]

New Retail: Invented in China, now coming to the West

“New Retail” is a term coined by China’s Alibaba Group to describe the integration online retail with offline, and tying both to supply chain upstream and customer interaction (especially via social media and through digital payment capabilities) to create a seamless omnichannel shopping experience.

Although “invented” in China (and certainly taking off there), New Retail’s concepts are catching on in the West as retailers see the benefits of data-driven online-to-offline offerings. The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures – what we term an “Alibaba-fication” of online retailing.

We’re seeing more online retailers offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We’re also seeing further moves into permanent retail formats, with online data driving decisions about format, product range and location.

This is not about Amazon only: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations.

This is what we’ve seen so far:

- Amazon opened more pop-up stores in the US and Europe. And, in the US, it opened more checkout-free Amazon Go convenience stores and a new banner called 4-star, which sells nongrocery products rated four or more stars by online customers.

- Amazon brought in a new element of “real-world” experiences for its annual Prime Day.

- Groupe Casino’s online banner Cdiscount opened a product showroom in the group’s new “Le 4 Casino” concept store in Paris.

- Zalando opened a new beauty store in Berlin.

Source: Coresight Research[/caption]

The future of retail is collaboration

In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Brands and retailers will launch their own accelerators and funding programs, too, to gain exclusive first rights to innovations developed by emerging startups. We expect a flurry of activity around startups that can contribute to areas such as new product development in CPG and beauty; digital service improvements, with a strong emphasis on the point of customer interaction, including payments; and, operational efficiencies such as productivity and logistics.

What we’ve seen so far:

Source: Coresight Research[/caption]

The future of retail is collaboration

In increasing numbers, established brands and retailers are working with startups to provide the expertise in digitalization they need to compete with online-native rivals. Though we expect to see further acquisitions, we also expect more legacy firms to seek partnerships and vendor agreements with nascent digital enablers.

Brands and retailers will launch their own accelerators and funding programs, too, to gain exclusive first rights to innovations developed by emerging startups. We expect a flurry of activity around startups that can contribute to areas such as new product development in CPG and beauty; digital service improvements, with a strong emphasis on the point of customer interaction, including payments; and, operational efficiencies such as productivity and logistics.

What we’ve seen so far:

- JD.com announced the launch of a global accelerator program to support startups focusing on AI.

- Farfetch announced the launch of Dream Assembly, a fashion and retail-tech focused incubator.

- LVMH announced the launch of La Maison des Startups accelerator program at Station F startup campus in Paris.

- Beiersdorf launched a beauty accelerator program based in Seoul.

- Ulta Beauty announced a strategic partnership with Iterate, a technology solutions company and an innovation workflow platform that provides access to startups.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]