Web Developers

The Coresight Research team attended World Retail Congress 2018 in Madrid this week. Here are our top takeaways from the third and final day of the conference:

Third-Generation Retail and the Unification Driven by Platform Firms

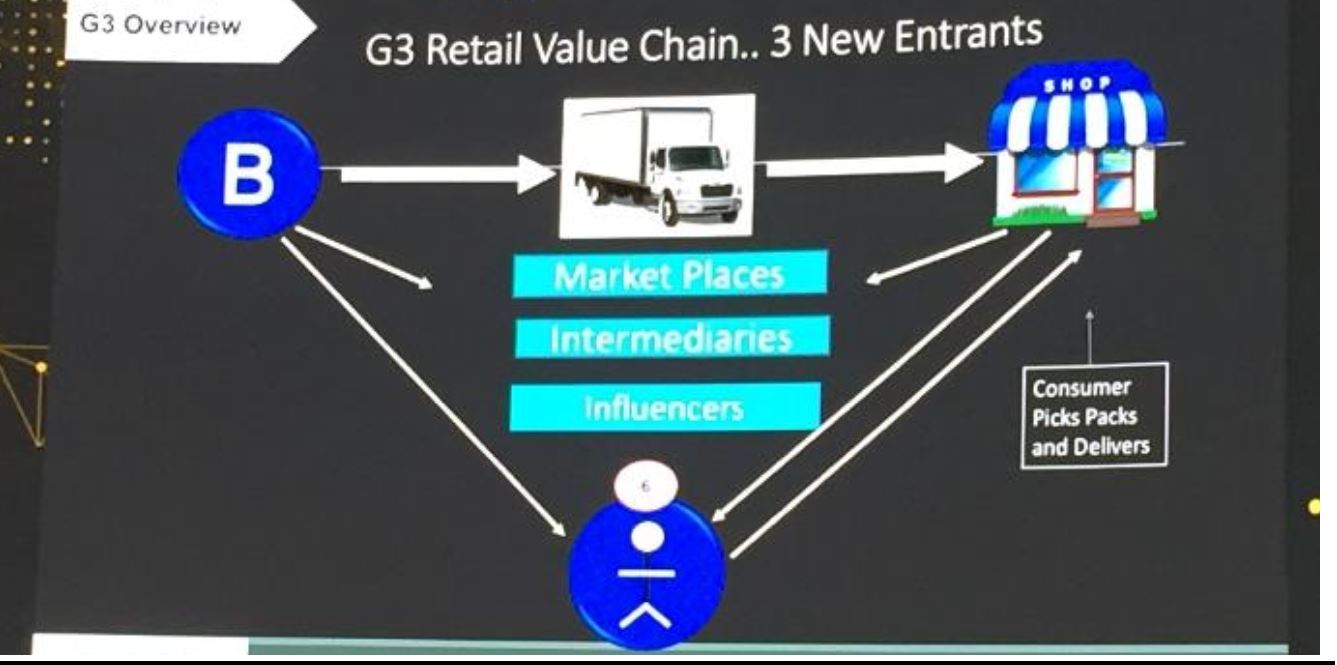

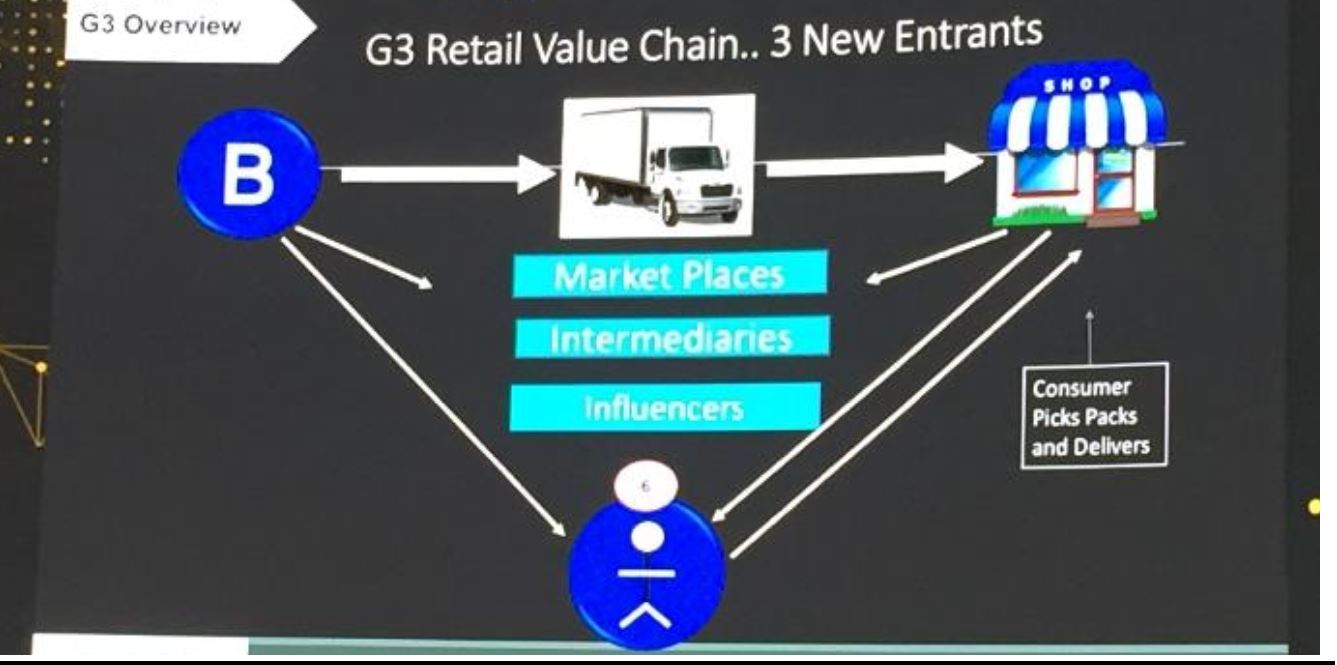

The “intergeneration rotation” in retail is creating a third generation characterized by “retail as a service,” according to Dan O’Connor, Founder and CEO of RetailNet Group and Fellow at the Advanced Leadership Initiative at Harvard University, who spoke on the third day of the conference. O’Connor noted that third-generation retail is characterized by the prominence of marketplace and intermediary firms such as Alibaba, Amazon, WeChat, Facebook, Snapchat, Delivery Hero and Google, as well as by social media influencers. This new structure of retail is changing the supply chain by shifting where consumers go for information and how they connect with products and recommendations. O’Connor pointed to Alibaba as the single best creator of a unified marketplace model, citing its presence in adjacent and complementary sectors such as payments and cloud technology. Other takeaways from O’Connor’s presentation include:- Firms such as Alibaba are driving the unification of the third-generation retail landscape, as they consolidate various types of retail and retail-adjacent services. This unification is also seen in mobile apps from firms such as Tencent, which is replacing stand-alone apps with Mini Programs embedded in its WeChat app.

- Retail is moving from store-based retailers with technology to tech firms with some stores.

- We are seeing the emergence of retail as a service, spanning automation, platform services and intermediary service providers. Tech giants such as Alibaba are driving this by collaborating with brick-and-mortar store brands.

Slide from Dan O’Connor’s presentation on third-generation retail at World Retail Congress 2018 Source: Coresight Research

Social Media as the New Storefront

Facebook’s Global Head of Retail and E-Commerce Strategy, Martin Barthel, said that there are three themes in a social-media-focused digitalization process:- The first is personalization, and Barthel said that Facebook can help retailers personalize advertisements and product recommendations using machine learning, Facebook’s analysis of its users’ purchase intent signals and data inputs from retailers. Barthel said that 80% of Gen Zers and millennials expect mobile advertisements to be personalized.

- Second, Facebook thinks it can help physical stores level the data playing field with e-commerce by enabling them to target shoppers by location, and track who is coming into their stores and who is buying.

- Third, Barthel sees merchandising becoming more immersive, with huge consumer demand for video: he cited one survey that found that 70% of consumers would rather watch a video than read text when they need to learn about a product or brand. Barthel pointed to Instagram as one channel that retailers can use to share branded video content. He also noted that augmented reality will bring “augmented commerce” to shoppers in the coming years.

Source: Coresight Research

Source: Coresight Research