Nitheesh NH

Woolworths

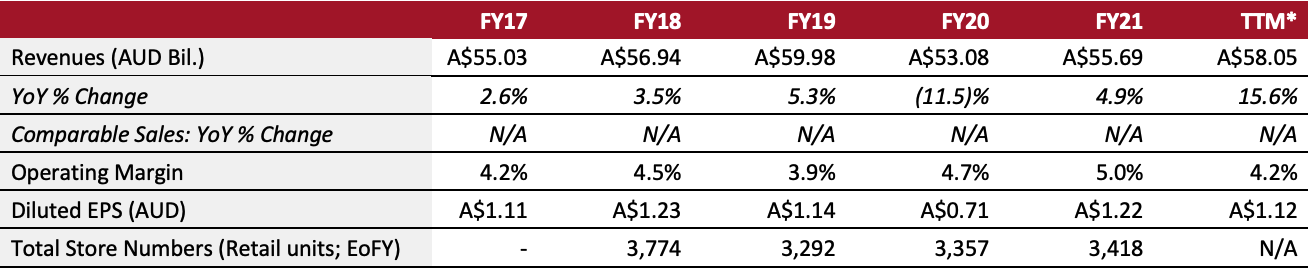

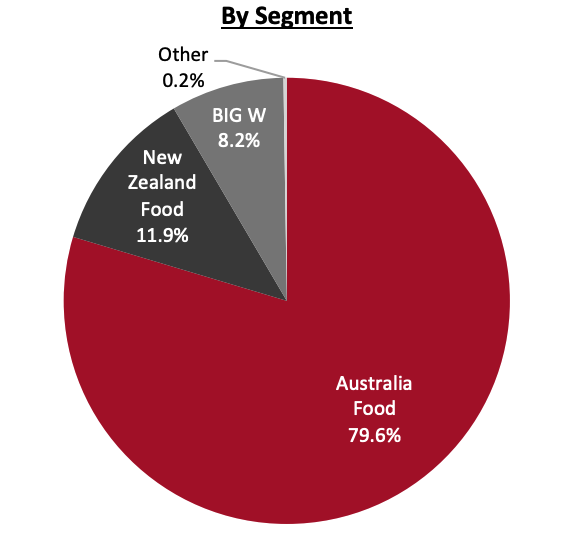

Sector: Food, drug and mass retailers Countries of operation: Australia and New Zealand Key product categories: Grocery and general merchandise Annual Metrics [caption id="attachment_148829" align="aligncenter" width="700"] Fiscal year 2021 ended June 27, 2021

Fiscal year 2021 ended June 27, 2021*Trailing 12 months ended January 2, 2022[/caption] Summary Founded in 1924 and headquartered in Sydney, Australia, Woolworths operates supermarkets, discount department stores and B2B food services. The company sells its products and services under the banners BIG W, Countdown, Metro Food, WooliesX and Woolworths. In June 2021, the company spun off its drinks and hotel business, Endeavour Group, which included 251 Dan Murphy’s liquor supermarket stores, 1,392 BWS liquor stores and 339 hotels. As of February 23, 2022, Woolworths operates 1,446 stores in Australia and New Zealand. Company Analysis Coresight Research insight: Woolworths is a market leader in Australia’s grocery and food retail sector. After the demerger of its liquor retailing and hospitality operations in 2021, the company has essentially become a pure-play food retailer. The company’s food businesses have been relatively resilient during the pandemic, as they were allowed to operate as essential services despite the restrictions. Stronger demand from pantry and kitchen stocking will continue to benefit the food segments, but we also note that supply chain disruptions and additional Covid-related costs would partially offset those gains. We anticipate the competition to intensify in the online channel, particularly between the Coles-Ocado and Woolworth-Takeoff partnerships. Additionally, the aggressive expansion of grocery discounter Aldi will alter and further segment the grocery sector and increase competitive pressure. Nevertheless, we believe Woolworths has a strong competitive advantage stemming from its leading market share, resulting in low cost of doing business, a vast store network and high bargaining power. We expect these attributes to enable Woolworths to maintain its market share and protect its operating margins.

| Tailwinds | Headwinds |

|

|

- The company continues to make good progress on its holistic diversity and inclusion agenda, with a key focus on reconciliation, cultural inclusion, gender diversity and LGBTQ+ inclusion.

- To continue to meet rapidly increasing demand, the company announced plans for its first automated fulfillment center to be built in Auburn, which is set to open in 2024. The facility will be built in partnership with automation provider Knapp and help the company’s personal shoppers to pick and dispatch up to 50,000 home deliveries per week in Western Sydney, and better serve the company’s growing online grocery needs.

- Woolworths aims to offer localized food offerings for every community and provide the right products to its customers in the right stores.

- In June 2021, the company successfully demerged Endeavour Group; Woolworths and Endeavour Group continue to work together to retain benefits, including the infrastructure built by Woolworths across its core competencies.

- In April 2021 Woolworths strengthened its partnership with advanced analytics provider Quantium by increasing its shareholding from 47% to 75%. This partnership also created Q-Retail Business to bring together the best data science and advanced analytics and retail capabilities.

- Woolworths has rolled out a number of initiatives to stores and distribution centers to help protect customers and teams. This includes enabling Government QR code check‑in for all states and territories, the promotion of the Sonder app to support team members’ mental wellbeing, in‑store Health Ambassadors, and the use of face shields and additional cleaning procedures across stores in high‑risk areas.

Company Developments

Company Developments

| Date | Development |

| June 3, 2022 | Woolworths announces that it will stop selling reusable plastic bags at its more than 1,000 supermarket by June 2023. |

| May 12, 2022 | Woolworths launches Australia’s first in-store vertical farm at Park Sydney Village, in partnership with agricultural technology company InvertiGro. |

| April 4, 2022 | Woolworths announces the opening of Heathwood Distribution Center in the city of Brisbane, Queensland, which will service 280 Queensland and northern New South Wales stores. |

| February 7, 2022 | Woolworths rolls out a new brand identity to better symbolize its evolution and what its collective brands stand for. |

| November 17, 2021 | Woolworths announces that it has removed single-use plastic products from sale nationwide to eliminate approximately 2.1 million kilograms of plastic annually. |

| October 13, 2021 | Woolworths appoints Annette Karantoni as Chief Supply Chain Officer and Managing Director of Primary Connect, the supply chain arm of Woolworths. |

| September 28, 2021 | Woolworths launches Everyday Market platform on Woolworths.com.au for customers nationwide. Everyday Market is an online marketplace that complements the existing grocery range of the main website with a focus on the household appliances, toy, pet care, health and beauty categories. |

| August 23, 2021 | Woolworths partners with Uber Eats to roll out same-hour grocery delivery nationwide. |

| June 2, 2021 | Woolworths spins out its internal payments division into a separate payment solutions entity called Wpay. |

| May 27, 2021 | Woolworths launches HealthyLife, an online business providing customers with health and wellness advice, experiences, services and products. |

- Gordon Cairns—Chairman

- Brad Banducci—CEO

- Stephen Harrison—CFO

Source: Company reports/S&P Capital IQ