Source: Company reports

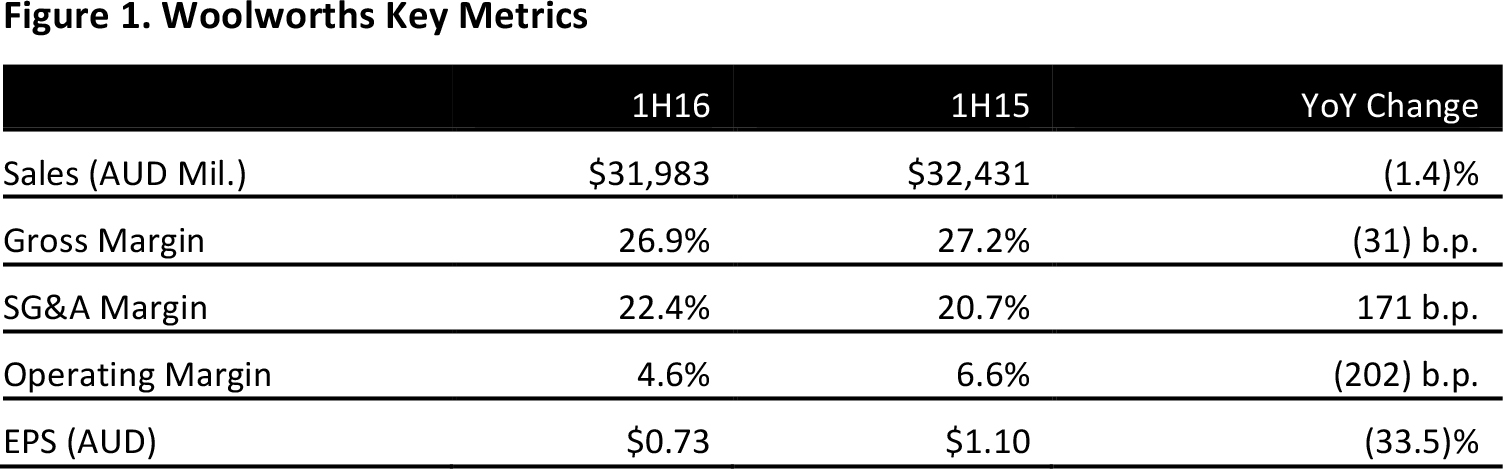

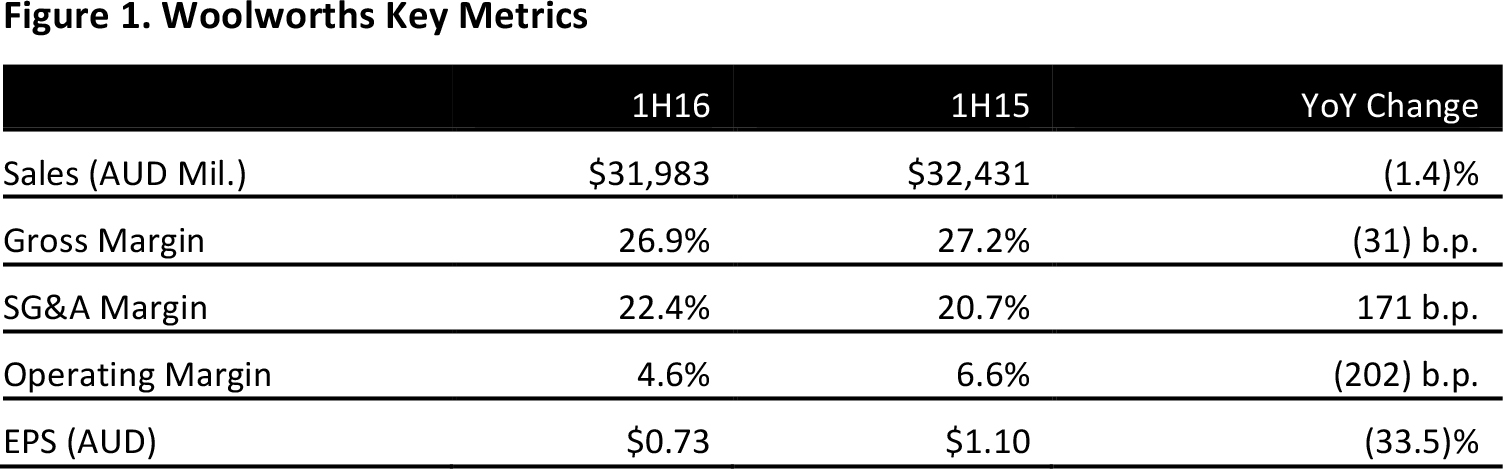

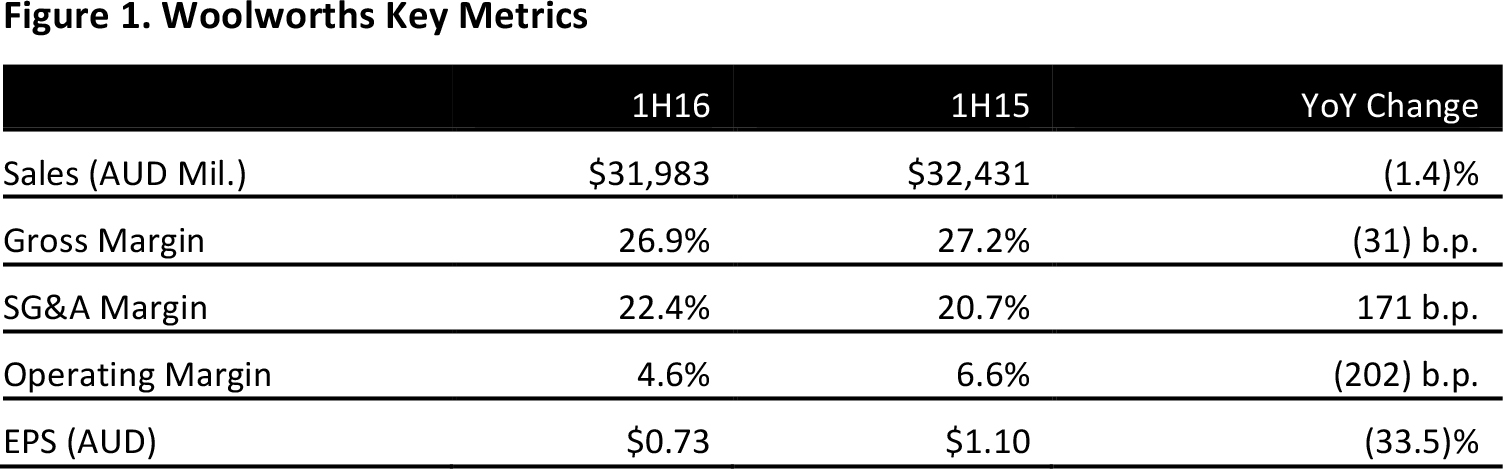

Australia-based retailer Woolworths reported a 1H16 revenue decline of 1.4%, to A$32.0 billion, in line with the consensus estimate. The decrease was mainly due to the negative impact of automotive fuel sales. Group sales excluding fuel were up 1.2%, to A$29.5 billion. The implementation of a lower-prices strategy across the company’s Australian supermarkets slowed performance by negatively impacting comps, which were (0.8)% for the Australian food and liquor segment.

The company reported a decrease of 31.6% in EBIT, to A$1,456.6 million, below the consensus estimate of A$1,512.4 million. Net profit before significant items declined by 33.1%, to A$925.8 million, which was below consensus of A$948.1 million. The decline was mainly the result of subdued sales growth, primarily in Australian supermarkets.

After significant items, the company reported a net loss of A$972.7 million, a decline of 176% year over year. Significant items in 1H16 were related to the impairment of assets and stores and other costs linked to the company’s decision to exit the home improvement business (announced on January 18, 2016). This net loss was versus the consensus estimate for GAAP net profit of A$941.35 million.

Adjusted EPS for 1H16 was down 33.5% year over year, to A$0.73 before significant items, below the consensus estimate of A$0.76. GAAP EPS, after significant items, was A$(0.77).

Management commented that the results reflected the significant changes the company is going through to rebuild its business. Changes include a stronger focus on its Australian supermarket operations, with a considerable investment in price, service and customer experience.

Sales by Division

Australian food, liquor and petrol sales were down 2.5%, to A$24.9 billion. Petrol sales decreased by 23.8%, to A$2.5 billion, due to falling fuel prices and changes in the Woolworths-Caltex alliance, which saw sales from 131 Caltex sites no longer recognized by Woolworths.

Australian food and liquor sales in 1H16 increased by 0.7%, to A$22.3 billion. However, comps declined by 0.8% due to a 2.1% reduction in average prices as the company implemented its lower-prices strategy across its Australian supermarkets.

New Zealand supermarkets’ 1H16 sales increased by 4.0% in local currency, to NZ$3.2 billion (an increase of 3.8% in reporting currency, to A$2.9 billion). Comps increased by 2.0% as customers reacted positively to lower prices.

General merchandise sales decreased by 3.9% to A$2.3 billion in 1H16. Comps decreased by 4.5%. Lower tablet sales and a decline in DVD sales affected comps, despite strong performance in toys and apparel.

Home improvement sales were up 16.2% in 1H16, to A$1,148 million, driven by the performance of the company’s Masters retail operation. Since the company had announced its exit from home improvement in January, these sales were largely driven by clearance activity.

Woolworths also operates a hotels division, which saw a revenue increase of 2.6%, to A$802 million, during the period, driven by strong food-service sales.

Outlook

For 2H16, Woolworths does not expect significant improvements in comps in Australian supermarkets, as the market is likely to remain competitive and price deflation is set to continue.