Wish

Sector: E-commerce

Region of operation: Global, with a focus on the US

Key product categories: Accessories, apparel and footwear

Annual Metrics

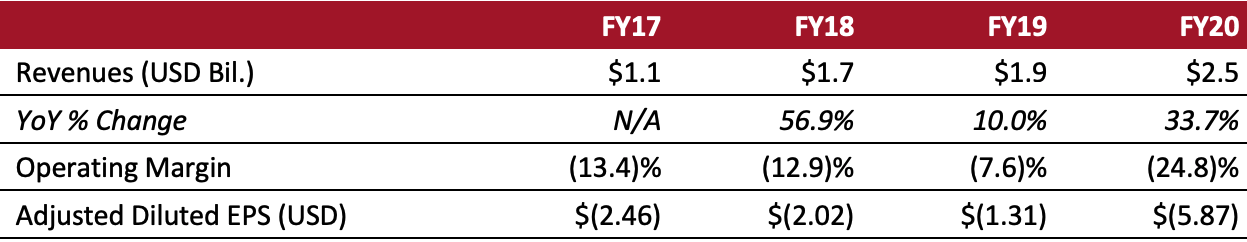

[caption id="attachment_126472" align="aligncenter" width="580"]

Fiscal year ends on December 31

Fiscal year ends on December 31[/caption]

Summary

Founded in 2010, Wish is an e-commerce platform that focuses on providing an affordable and entertaining mobile shopping experience to consumers around the world. The company is based in San Francisco and has offices in Amsterdam, Shanghai and Toronto. The marketplace features a variety of discounted goods, ranging from cheap apparel and homeware to electronics and toys. In 2020, over 90% of merchants on Wish were based in China, according to research firm Marketplace. However, the company continues to expand its merchant base around the world—since 2019, the number of merchants on Wish in the US has grown by approximately 268%, according to the company.

According to Wish, over 90% of user activity and purchases occur on its mobile app. Wish leverages big data to offer a highly personalized shopping experience—over 70% of sales on its platform do not involve a search query and instead come solely through browsing. Its parent company, ContextLogic, filed for an initial public offering on Nasdaq in November 2020 and began trading in December.

Company Analysis

Coresight Research insight: Wish focuses on giving global customers access to the widest selection of affordable goods by working directly with suppliers. Amid a tough economic context where consumers may be price sensitive, we expect Wish to benefit from both its discount prices and its mobile-first, highly personalized commerce model. The Coresight Research US Consumer Tracker regularly finds that a substantial share of US consumers (i.e., over one-quarter) expect to retain the habit of shopping more online and less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see only partial retention of sales in the online channel.

| Tailwinds |

Headwinds |

- Amid a still-tough economic context, low prices and discount formats may remain structural winners.

- The company’s visual and engaging product presentation, which is similar to a social media feed, results in enhanced user engagement.

- The pandemic has resulted in increasing acceptance of online shopping among consumers, boosting the company’s sales and traffic amid the pandemic.

|

- Heightened competition from other e-commerce marketplaces present a challenge to Wish.

- Wish finds it difficult to maintain quality control, as it provides products from third-party sellers.

- The company does not have strong logistics to support its sales, so customer experience may be affected.

|

Strategy

In its prospectus issued in November 2020, Wish outlined the following key focus areas to achieve long-term growth:

1. Increase product supply and seller base

- Partner with other merchant platforms, such as PayPal, ShipStation and PlentyMarkets, to acquire additional merchants outside of China, expand geographic reach and diversify their seller base.

- Empower merchants with tools, services and ongoing education to enable them to promote their products in a variety of ways both on and off the Wish platform.

- Expand the Wish Local program, where brick-and-mortar stores upload their in-store inventory on Wish for local pickup or delivery. As of November 2020, 50,000 stores around the world are involved in this initiative.

2. Innovate and extend the platform

- Diversify product categories and services, including consumer-packaged goods and in-person services, primarily offered through Wish Local merchants.

- Continue to experiment with and optimize first-party sales, including private-label strategy.

- Expand advertising partners across end markets, such as financial services, subscription and travel.

3. Grow its consumer base

- Continue to offer attractive discounts and value to engage with consumers.

- Invest in consumer support and logistics infrastructure to enable fast deliveries and localization of the platform.

Company Development

| Date |

Development |

| March 21, 20201 |

Wish shares begin trading on the International Quotation System of the Mexican Stock Exchange. |

| February 8, 2021 |

Wish partners with nonprofit organization Black Girls CODE to support more women of color to study science, technology, engineering and mathematics. |

| December 16, 2020 |

Wish’s initial public offering (IPO) of 46,000,000 shares of its Class A common stock begins trading on the Nasdaq Global Select Market under the symbol “WISH.” |

| November 20, 2020 |

Wish’s parent company, ContextLogic, an initial public offering, aiming to raise $1.1 billion. |

| October 27, 2020 |

Wish opens its marketplace to CedCommerce merchants—Cedcommerce, which specializes in e-commerce solutions, has been helping customers sell and expand their business to a wide variety of platforms. |

| September 23, 2020 |

Wish launches a $2 million fund to support black-owned businesses. |

| May 27, 2020 |

Wish reaches a strategic cooperation agreement with LianLian Pay, a Chinese company offering payment solutions, who become Wish’s official payment service provider. |

| August 1, 2019 |

Wish raises $300 million in a confirmed Series H round led by equity firm General Atlantic. |

Management Team

- Peter Szulczewski—Co-founder, CEO and Chairperson

- Rajat Bahri—CFO

- Thomas Chuang—Vice President of Operations

- Brett Just—Chief Accounting Officer

Source: Company reports

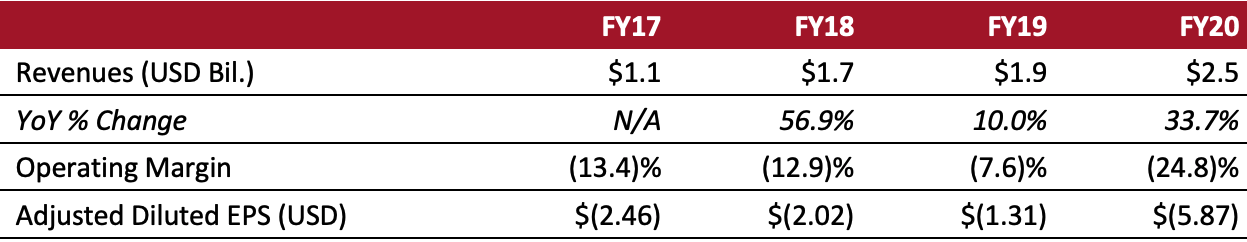

Fiscal year ends on December 31[/caption]

Summary

Founded in 2010, Wish is an e-commerce platform that focuses on providing an affordable and entertaining mobile shopping experience to consumers around the world. The company is based in San Francisco and has offices in Amsterdam, Shanghai and Toronto. The marketplace features a variety of discounted goods, ranging from cheap apparel and homeware to electronics and toys. In 2020, over 90% of merchants on Wish were based in China, according to research firm Marketplace. However, the company continues to expand its merchant base around the world—since 2019, the number of merchants on Wish in the US has grown by approximately 268%, according to the company.

According to Wish, over 90% of user activity and purchases occur on its mobile app. Wish leverages big data to offer a highly personalized shopping experience—over 70% of sales on its platform do not involve a search query and instead come solely through browsing. Its parent company, ContextLogic, filed for an initial public offering on Nasdaq in November 2020 and began trading in December.

Company Analysis

Coresight Research insight: Wish focuses on giving global customers access to the widest selection of affordable goods by working directly with suppliers. Amid a tough economic context where consumers may be price sensitive, we expect Wish to benefit from both its discount prices and its mobile-first, highly personalized commerce model. The Coresight Research US Consumer Tracker regularly finds that a substantial share of US consumers (i.e., over one-quarter) expect to retain the habit of shopping more online and less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see only partial retention of sales in the online channel.

Fiscal year ends on December 31[/caption]

Summary

Founded in 2010, Wish is an e-commerce platform that focuses on providing an affordable and entertaining mobile shopping experience to consumers around the world. The company is based in San Francisco and has offices in Amsterdam, Shanghai and Toronto. The marketplace features a variety of discounted goods, ranging from cheap apparel and homeware to electronics and toys. In 2020, over 90% of merchants on Wish were based in China, according to research firm Marketplace. However, the company continues to expand its merchant base around the world—since 2019, the number of merchants on Wish in the US has grown by approximately 268%, according to the company.

According to Wish, over 90% of user activity and purchases occur on its mobile app. Wish leverages big data to offer a highly personalized shopping experience—over 70% of sales on its platform do not involve a search query and instead come solely through browsing. Its parent company, ContextLogic, filed for an initial public offering on Nasdaq in November 2020 and began trading in December.

Company Analysis

Coresight Research insight: Wish focuses on giving global customers access to the widest selection of affordable goods by working directly with suppliers. Amid a tough economic context where consumers may be price sensitive, we expect Wish to benefit from both its discount prices and its mobile-first, highly personalized commerce model. The Coresight Research US Consumer Tracker regularly finds that a substantial share of US consumers (i.e., over one-quarter) expect to retain the habit of shopping more online and less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see only partial retention of sales in the online channel.