DIpil Das

Introduction

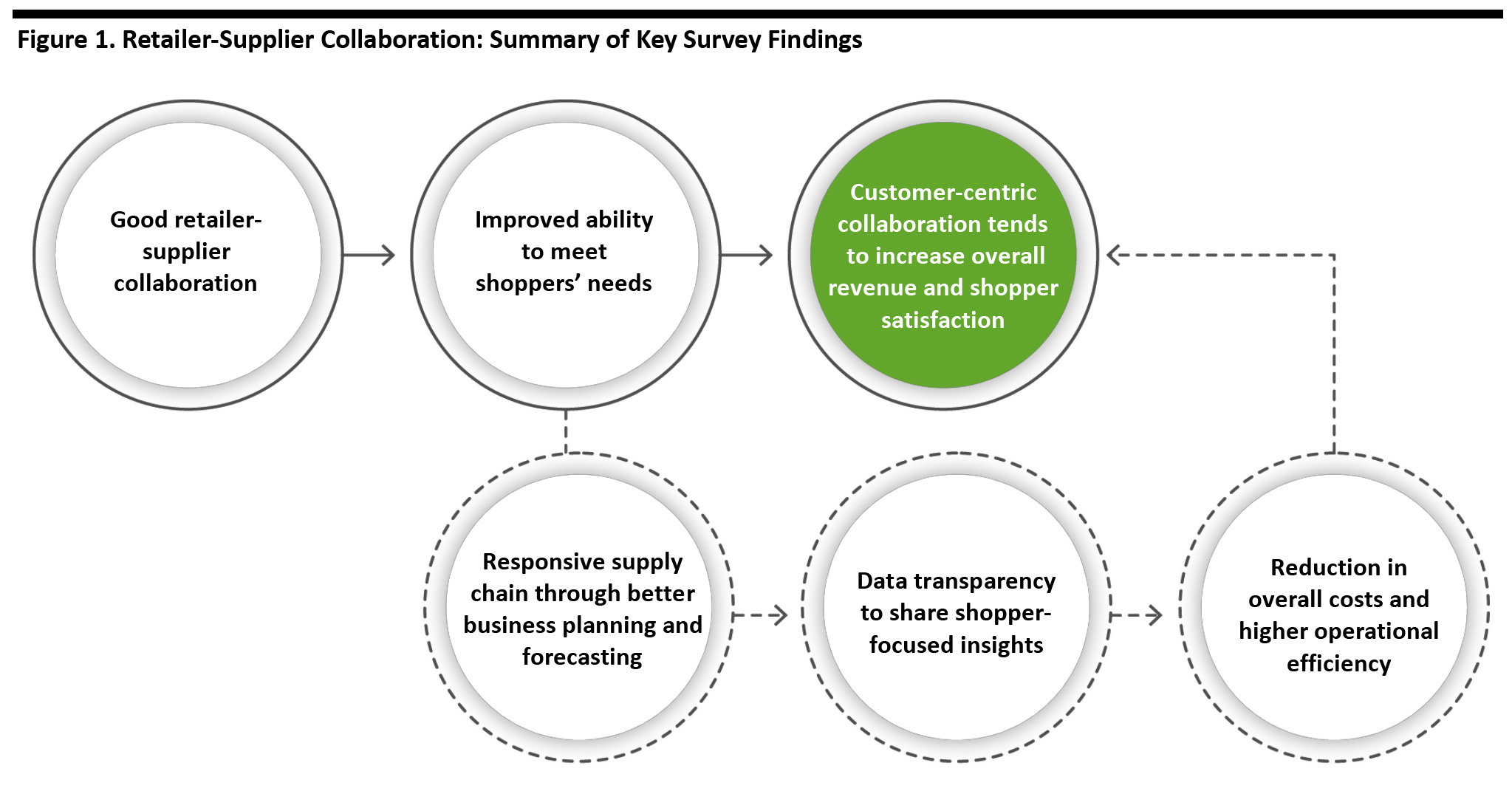

Amid changing market conditions such as fast-developing e-commerce and discount channels, retailers are under unprecedented pressure to fulfill customer needs, forecast category demand, manage supply-chain processes and generate growth. In grocery and adjacent sectors, it has become more important than ever for retailers to adapt quickly to changing consumer behavior and market trends. Retailers can overcome these challenges through effective shopper-centric collaboration with their suppliers. Customer centricity positively impacts sales by driving repeat business, which in turn, builds loyalty and increases profitability. Successful collaboration can help to fulfill customer needs, reduce out-of-stocks and yield leaner and more profitable supply chains by eliminating unnecessary costs. However, collaboration also has its challenges. To successfully collaborate, retailers and suppliers need to understand and respect each other’s requirements. The path to mutual understanding begins with having shared goals and a single version of the truth when collaborating for growth. In this report, sponsored by Precima, a Nielsen company, we analyze the findings of a March 2020 Coresight Research survey of 210 global retailers and suppliers of grocery products/consumer packaged goods (CPG)—105 respondents from each group—in France, Germany, the UK and the US. We asked respondents about mutually important criteria for growth, challenges and best practices for successful collaboration. The study shows the advantages of collaboration between retailers and suppliers, the shortfalls in their existing relationship, and the role of customer-centric collaboration in improving their levels of satisfaction in key success criteria.Retailers and Suppliers See the Benefits of Collaboration—Customer-Centricity Can Enhance These Benefits

[caption id="attachment_110551" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Retailers and suppliers see the ability to meet the needs of shoppers as the top advantage of collaboration—and fully 70% of retailers and 58% of suppliers cited responsiveness to consumer and market trends as key criteria for successful collaboration.

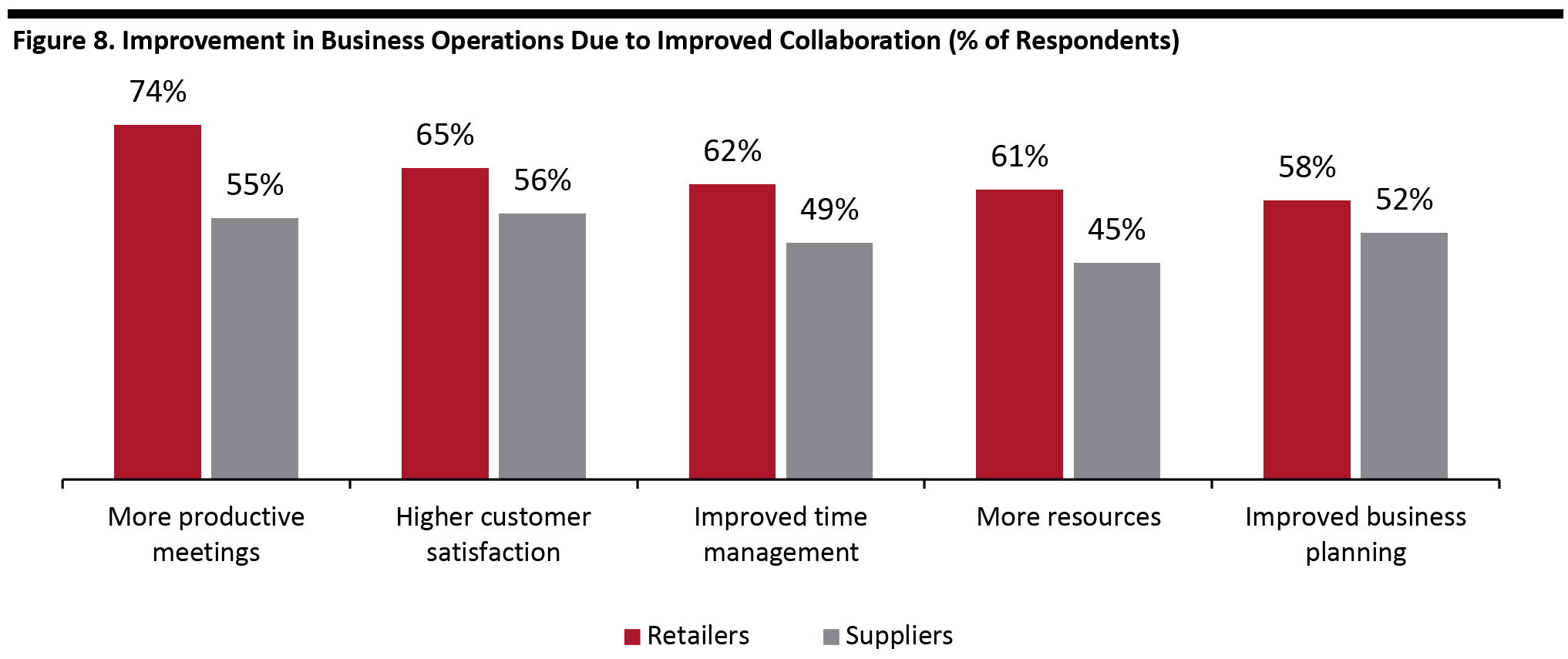

Over the past two years, a large majority of retailers and suppliers said that their collaboration has improved. Retailers generally reported higher levels of gains from such improvements than suppliers: Two-thirds of retailers stated that improved collaboration has led to increased customer satisfaction; and almost six in 10 say it has led to improved business planning.

Greater collaboration regarding shopper-centric data could take these gains to even higher levels, and retailers and suppliers should explore data-sharing opportunities and channels, including cloud-based platforms. When faced with ingrained resistance to sharing data outside of the firm, retail category managers can adopt an incremental approach to test and learn from data-sharing practices, and so build an evidence-backed case for a broader data-sharing strategy.

Source: Coresight Research[/caption]

Retailers and suppliers see the ability to meet the needs of shoppers as the top advantage of collaboration—and fully 70% of retailers and 58% of suppliers cited responsiveness to consumer and market trends as key criteria for successful collaboration.

Over the past two years, a large majority of retailers and suppliers said that their collaboration has improved. Retailers generally reported higher levels of gains from such improvements than suppliers: Two-thirds of retailers stated that improved collaboration has led to increased customer satisfaction; and almost six in 10 say it has led to improved business planning.

Greater collaboration regarding shopper-centric data could take these gains to even higher levels, and retailers and suppliers should explore data-sharing opportunities and channels, including cloud-based platforms. When faced with ingrained resistance to sharing data outside of the firm, retail category managers can adopt an incremental approach to test and learn from data-sharing practices, and so build an evidence-backed case for a broader data-sharing strategy.

Lack of Trust and Communication Translates to Challenges When Collaborating

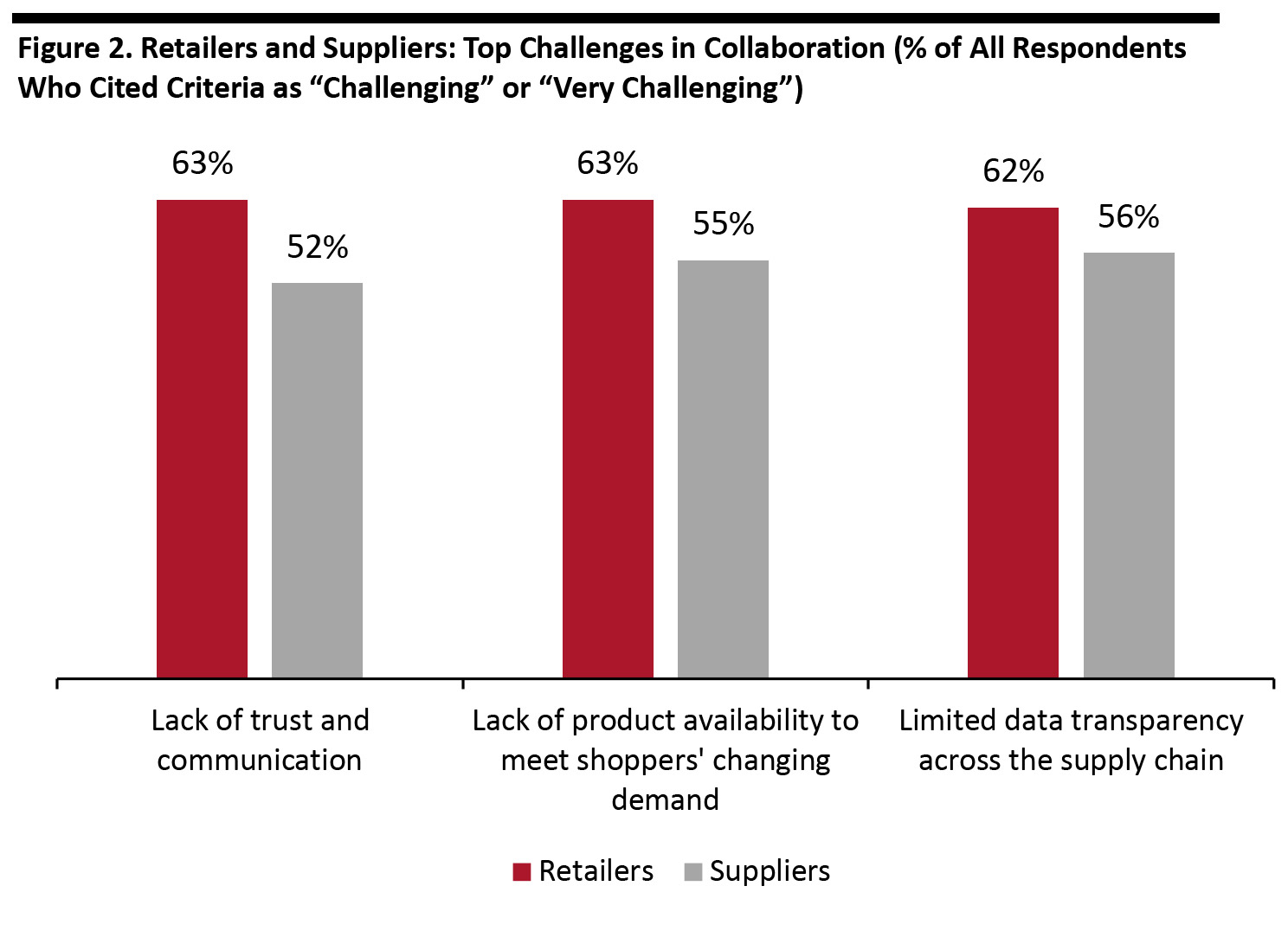

Challenges in collaboration between retailers and suppliers primarily arise due to poor communication and mistrust. Our survey saw 63% of all retailers and 52% of suppliers cite lack of trust and communication as “challenging” or “very challenging” when collaborating. Persistent trust issues keep retailers and suppliers from sharing granular insights with each other, leaving the supply chains far from being demand-driven. In fact, 63% of retailers and 55% of suppliers consider a lack of product availability to meet shoppers’ changing demand to be “challenging” or “very challenging.” [caption id="attachment_110552" align="aligncenter" width="700"] Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: What are the main challenges in your collaboration with retailers/suppliers?

Source: Coresight Research [/caption]

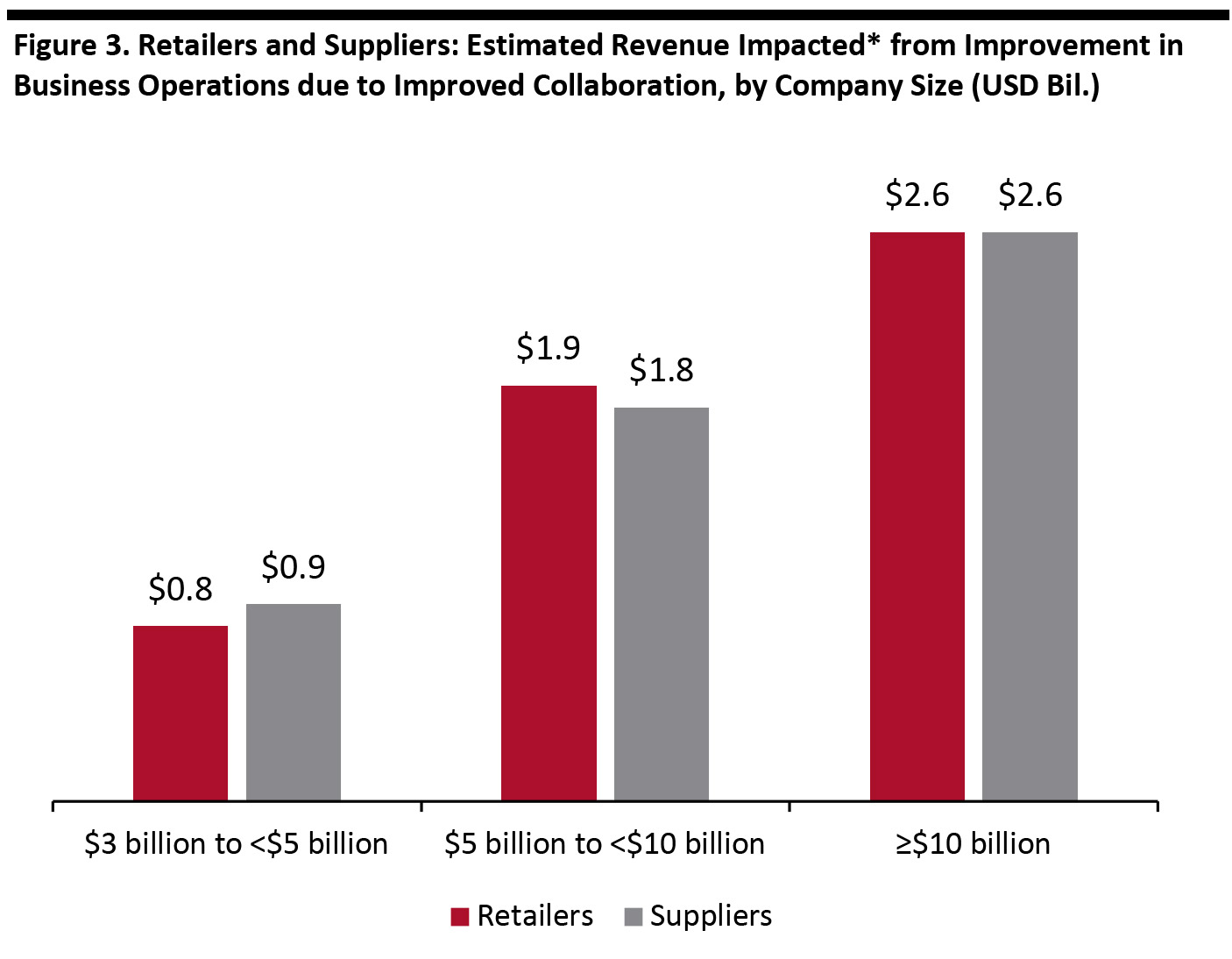

Retailer-Supplier Collaboration Has a Direct Impact on Overall Company Revenue

Over the past two years, retailers and suppliers have gained efficiencies in business operations through improved collaboration, which has a direct impact on their overall revenue. We asked both retailers and suppliers about the impact of improved collaboration on their revenues. Using the responses, we estimated the average revenue per retailer and per supplier that is positively impacted by improved collaboration. Based on the responses and our analysis, we found that retailers and suppliers who cited improved collaboration indicated that improved business operations impact around one-fifth of their total revenue. [caption id="attachment_110553" align="aligncenter" width="700"] *Note: Impacted revenue is the overall revenue of a company that is influenced by improved business operations as a result of better collaboration.

*Note: Impacted revenue is the overall revenue of a company that is influenced by improved business operations as a result of better collaboration. Base: Estimates are based on responses from 89 grocery/drug retailers and 97 CPG suppliers who stated their collaboration had improved over the past two years.

Source: Coresight Research [/caption]

Retailer-Supplier Collaboration Improves Customer Experience

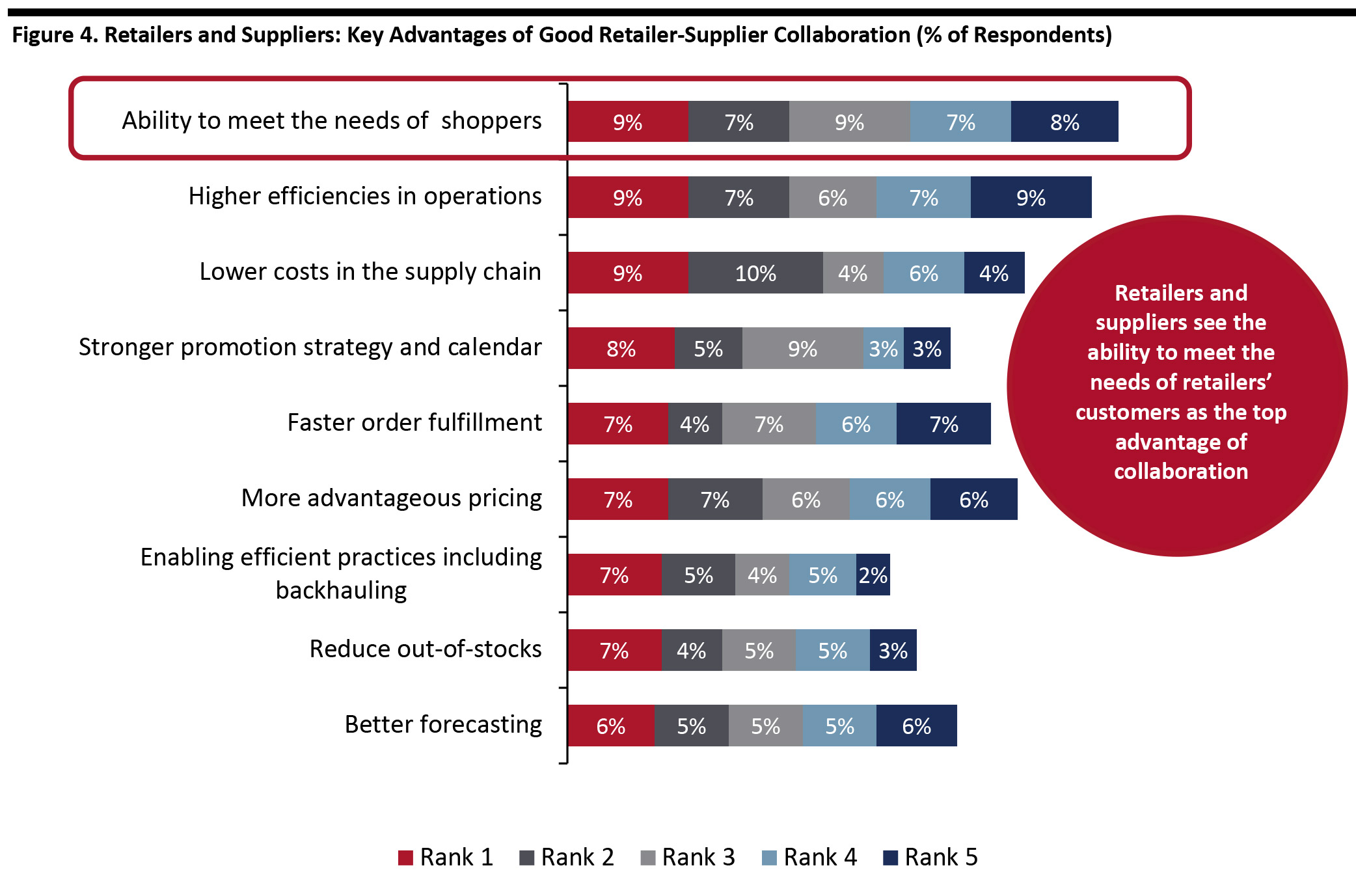

Improved customer service emerged as the top advantage of good retailer-supplier collaboration, with 39% of respondents citing it as a key advantage. With increased competition from numerous channels and the growing prevalence of omnichannel shopping, both retailers and suppliers understand the importance of delivering optimal customer experience. Retailers’ transparency on parameters such as in-store metrics, promotional campaigns and shopper loyalty can lead to analytics-driven demand forecasting that keeps customers at the center. Higher efficiencies in operations surfaced as the second-best advantage of a good retailer-supplier collaboration, according to 37% of all respondents. This complements our finding above, as improved collaboration between retailers and suppliers—from as early as the first mile—is expected to increase operational efficiency. In addition, 33% of respondents cited lower costs in supply chains as the key advantage of good retailer-supplier collaboration. [caption id="attachment_110554" align="aligncenter" width="700"] Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: What are the advantages of good retailer-supplier collaboration? Please select and rank up to five, with “rank 1” representing the most important.

Source: Coresight Research [/caption]

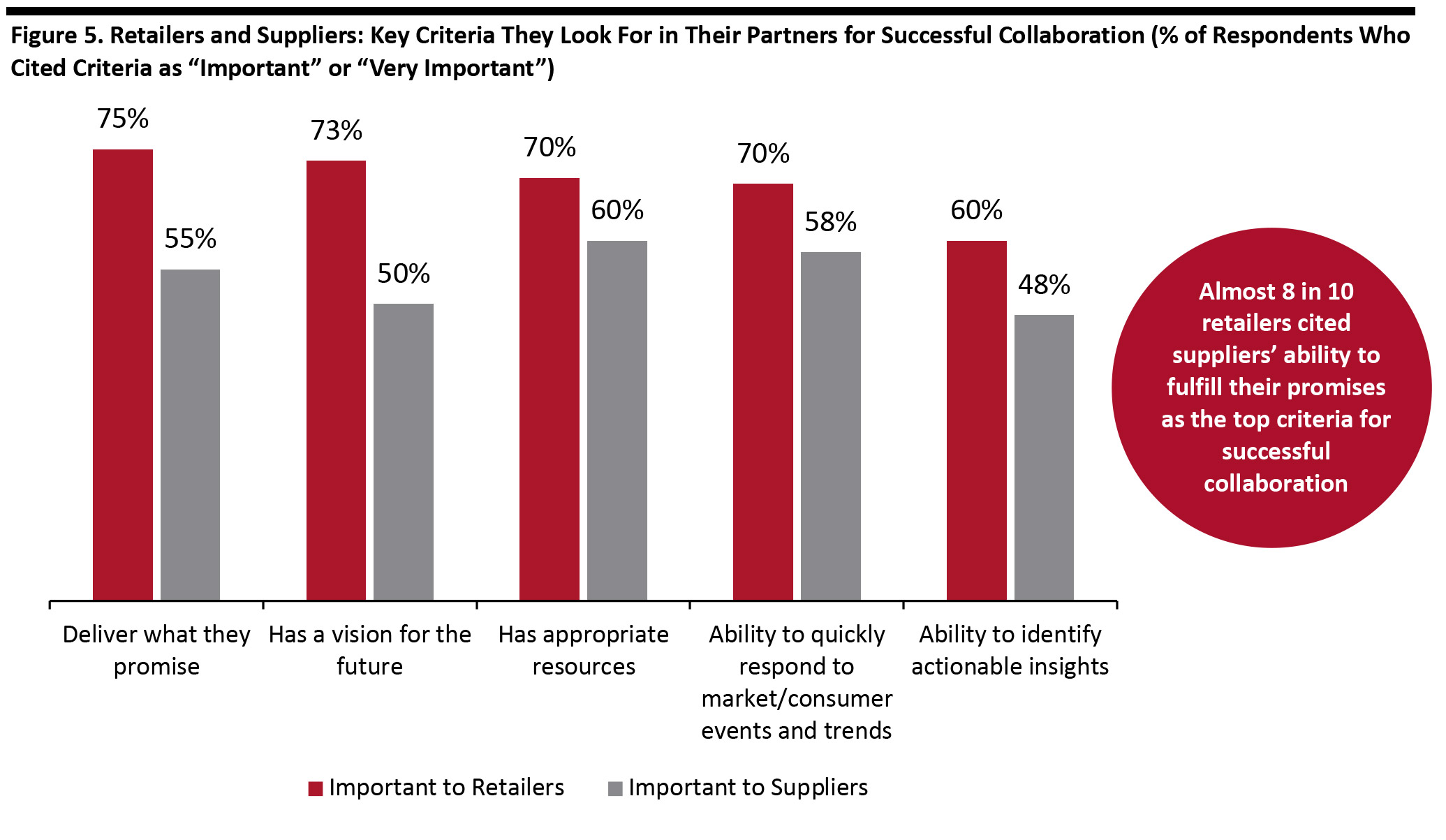

Key Criteria for Retailer-Supplier Collaboration: Reliability, Credibility and Trust

The collaboration between retailers and suppliers depends on mutual contribution. While both retailers and suppliers understand the importance of sharing shopper-focused insights such as promotional analytics and loyalty data, the partnership must follow a strategic and defined path to ensure success from their collaboration. We asked respondents to rate criteria they look for in their supplier/retailer partners in order of importance. The majority of surveyed retailers (75%) cited their suppliers’ ability to fulfill their promises as “important” or “very important” for successful collaboration, making delivery on promises the top criteria for this group. The most important criteria for suppliers when collaborating with retailers was having appropriate resources, with 60% of surveyed suppliers citing this criterion as “important” or “very important.” SIx in 10 retailers and almost five in 10 suppliers cited their partner’s ability to identify actionable insights as “important” or “very important.” The importance of having appropriate resources to mine data and its interpretation is even more important to both retailers (70%) and suppliers (60%). [caption id="attachment_110555" align="aligncenter" width="700"] Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: What are the key criteria for success in your collaboration with retailers/suppliers?

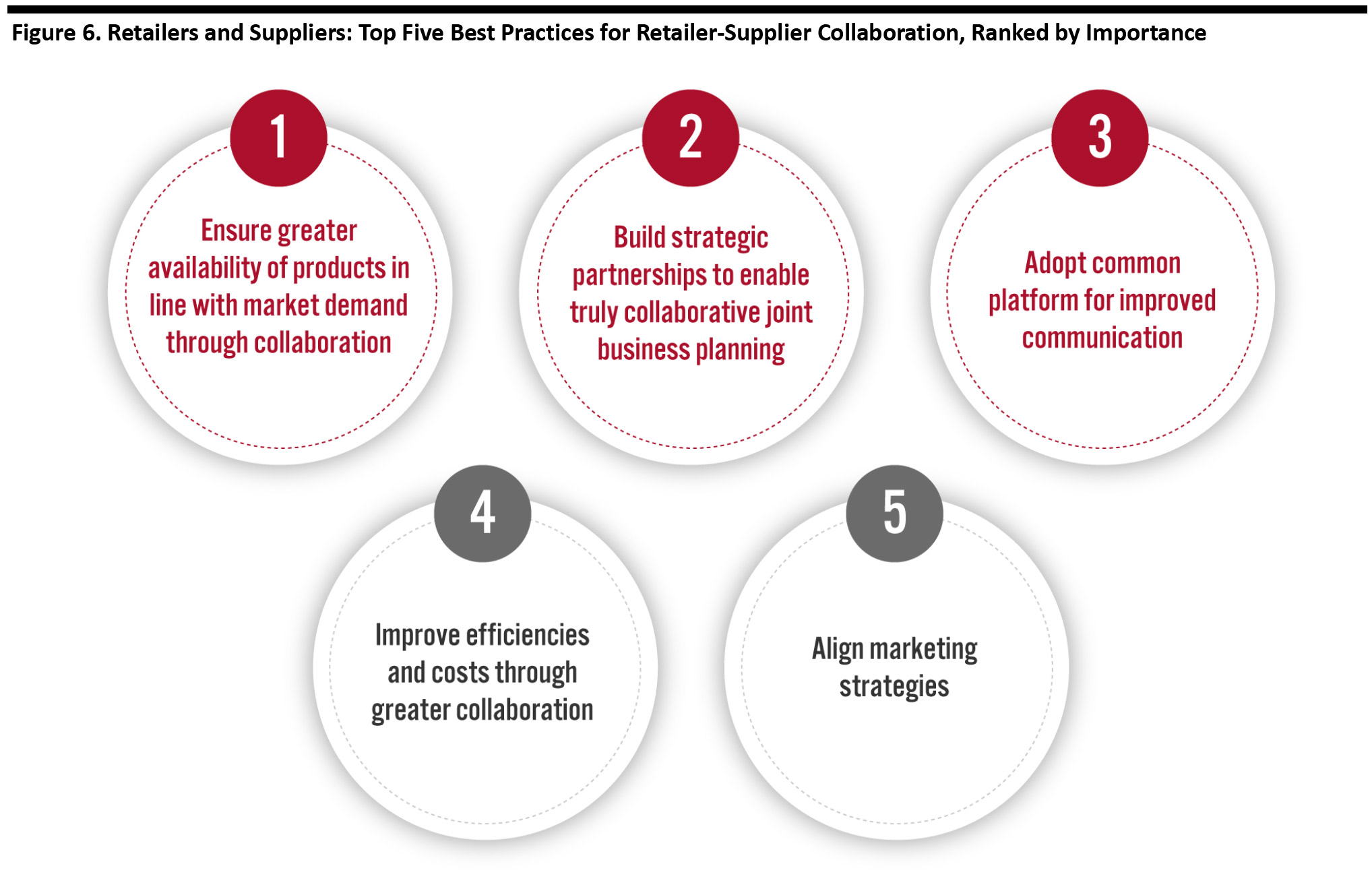

Source: Coresight Research [/caption] Furthermore, for successful collaboration, both retailers and suppliers recognize the importance of their partner’s ability to respond to changing market trends and consumer behavior. In fact, 70% of the retailers and 58% of the suppliers cited responsiveness to consumer and market trends as “important” or “very important.” In addition, to achieve the number-one goal of better meeting customers’ needs, retailers and suppliers should consider increasing data transparency by collecting and sharing data beyond basic aggregated sales and inventory data. For example, the next logical step would be to share item, basket and anonymized customer data; this will allow retailers and suppliers to collaboratively develop insights that address customer needs and, in turn, drive growth and increase customer satisfaction. We asked retailers and suppliers about the best practices for collaborating with each other, and found the following:

- In line with our observation above, some 38% of respondents cited ensuring higher availability of products in line with market demand as a best practice for successful collaboration.

- Building strategic partnerships to enable collaborative and joint business planning closely followed as the second-most important best practice for collaboration, identified by 35% of all respondents.

Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: Respondents were asked to rank in order of importance best practices for collaboration, with “rank 1” as most important.

Source: Coresight Research [/caption]

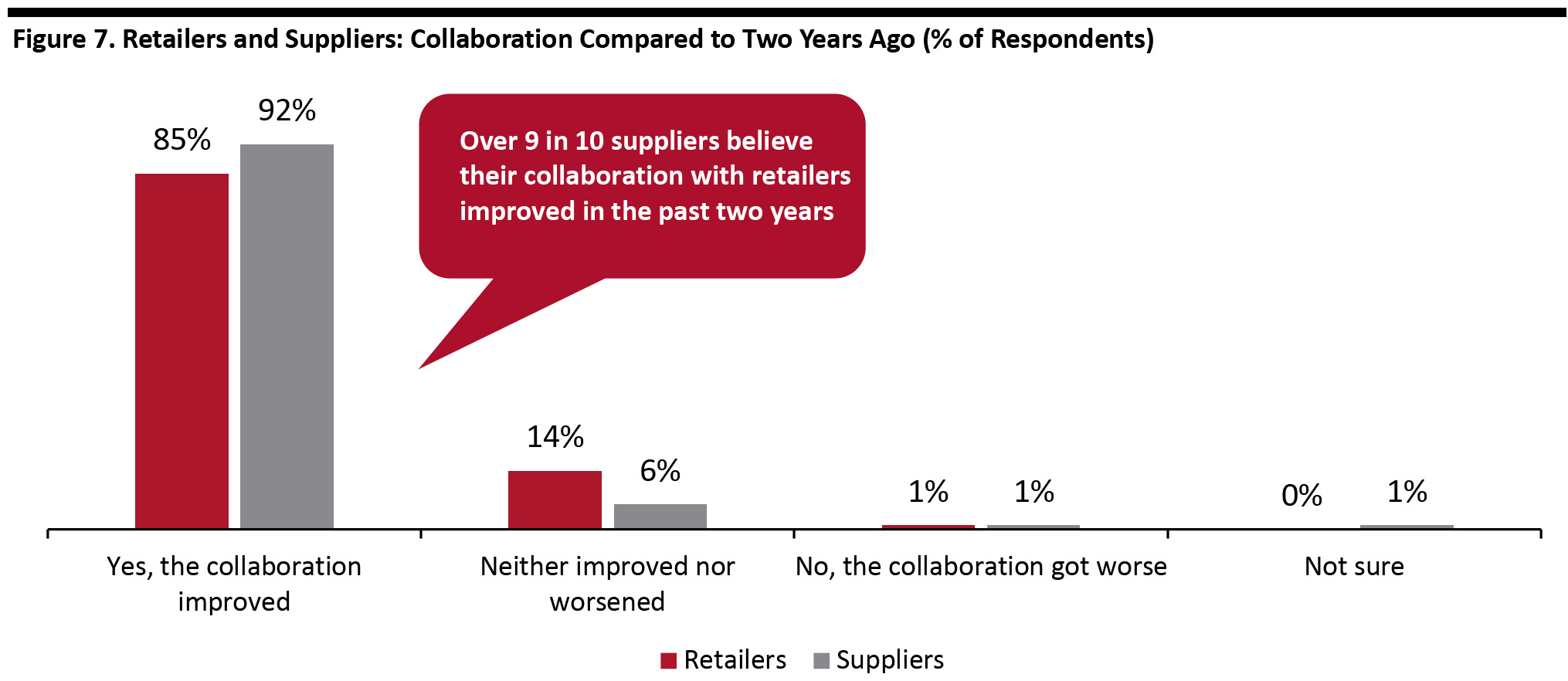

Retailer-Supplier Collaboration Has Improved

Collaboration between retailers and their suppliers has been evolving for many years. Retailers and suppliers are increasingly collaborating across multiple business segments, such as supply chain processes and merchandising, and thus improving their relationships. When we asked retailers and suppliers whether their collaboration has improved in the past two years, an overwhelming proportion of respondents from both categories reported positively:- 85% of retailers said that their collaboration has improved with their suppliers over the past two years.

- 92% of suppliers said that their collaboration has improved with retailers over the past two years.

Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: Has the collaboration with your suppliers/retailers improved in the past two years?

Source: Coresight Research [/caption] Although retailers and suppliers both agree that their collaboration is better today than two years ago, the consequential improvement in their business operations is skewed toward retailers. We asked respondents who said their collaboration had improved about its impact on their business operations:

- 75% of retailers had more productive meetings with their suppliers due to improved collaboration, while just 55% suppliers experienced more productive meetings.

- Of the retailers who reported improvements, the lowest proportion experienced improvement in their business planning due to better collaboration.

Base: 89 grocery/drug retailers and 97 CPG suppliers who stated their collaboration had improved over the past two years.

Base: 89 grocery/drug retailers and 97 CPG suppliers who stated their collaboration had improved over the past two years. Survey question summary: Which of the following aspects of your business operations improved as a result of your improved collaboration with your suppliers/retailers?

Source: Coresight Research [/caption]

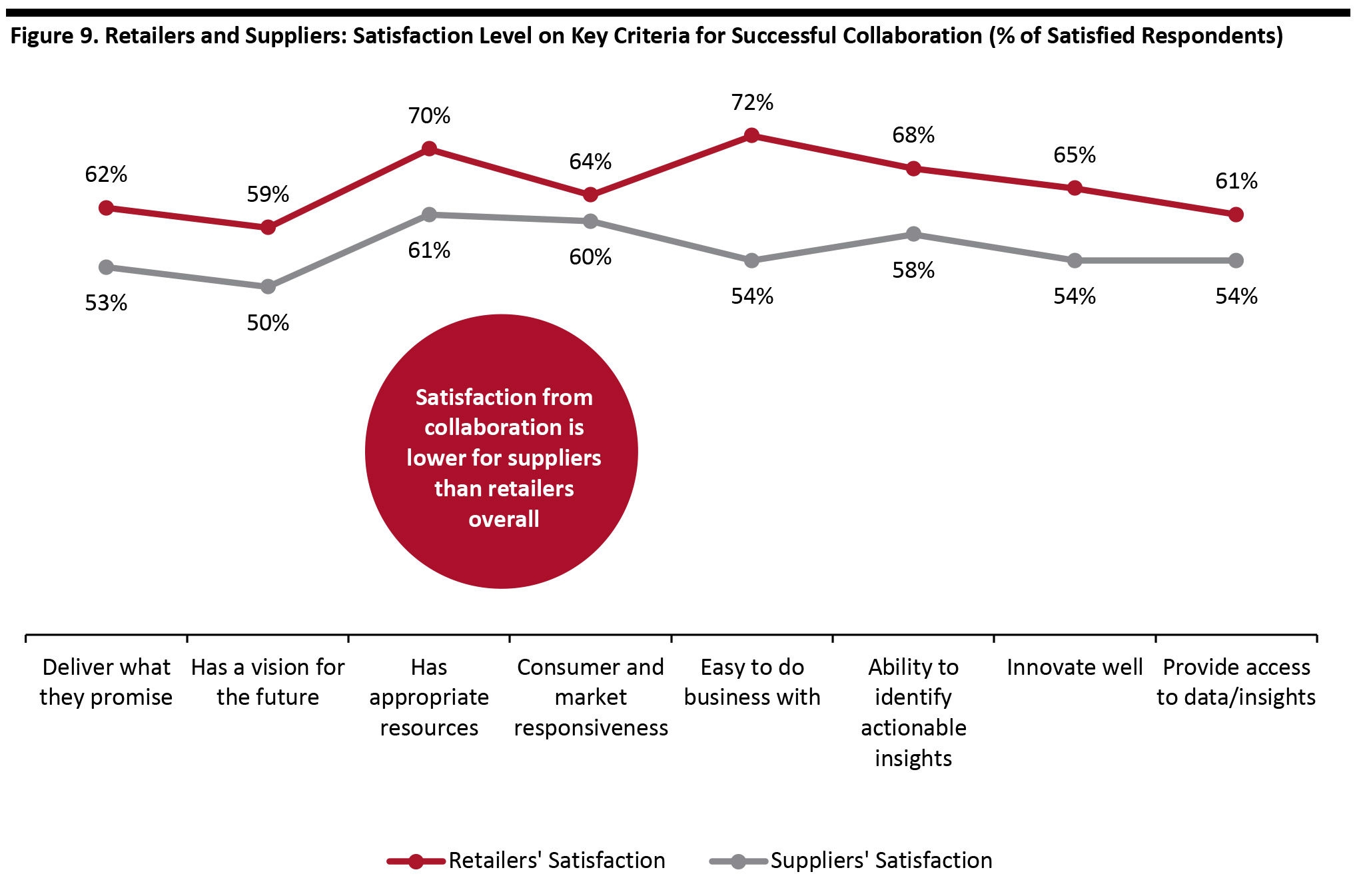

Tapping Collaboration to Fullest Potential Can Increase Overall Satisfaction

In order to improve satisfaction from collaboration, retailers and suppliers must outline their expectations, establish performance metrics and build trust. Our survey data suggests that neither retailers nor suppliers are fully satisfied with their current collaboration. However, retailers’ satisfaction regarding collaboration is higher than suppliers’ overall (as shown in Figure 9). In the context of data sharing, over half of the suppliers surveyed were satisfied with access to data and insights when collaborating with retailers. Retailers showed a higher level of satisfaction regarding this criterion, with around six in 10 reporting that they are satisfied with access to data and insights from suppliers. [caption id="attachment_110559" align="aligncenter" width="700"] Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question summary: How satisfied are you with your relationship with your suppliers/retailers based on key criteria for successful collaboration identified earlier?

Source: Coresight Research [/caption]

Retailer-Supplier Collaboration: Opportunities and the Path Forward

Our survey results underscore two primary opportunities in retailer-supplier collaboration:- Improvement in customer-centric data collaboration:Survey responses suggest that building responsive supply chains and servicing customer demand quickly are priorities for both retailers and suppliers. Both retailers and suppliers could leverage predictive analytics coupled with improved data sharing to meet these priorities, which would translate to a more customer-centric business overall.

- Result-oriented collaboration:Retailer-supplier collaboration has significantly improved over the last two years, but our survey findings indicate that retailers and suppliers have not been able to capitalize on their improved collaboration. A more result-oriented collaboration that is embedded into business decision-making processes can bring about substantial changes to business operations.

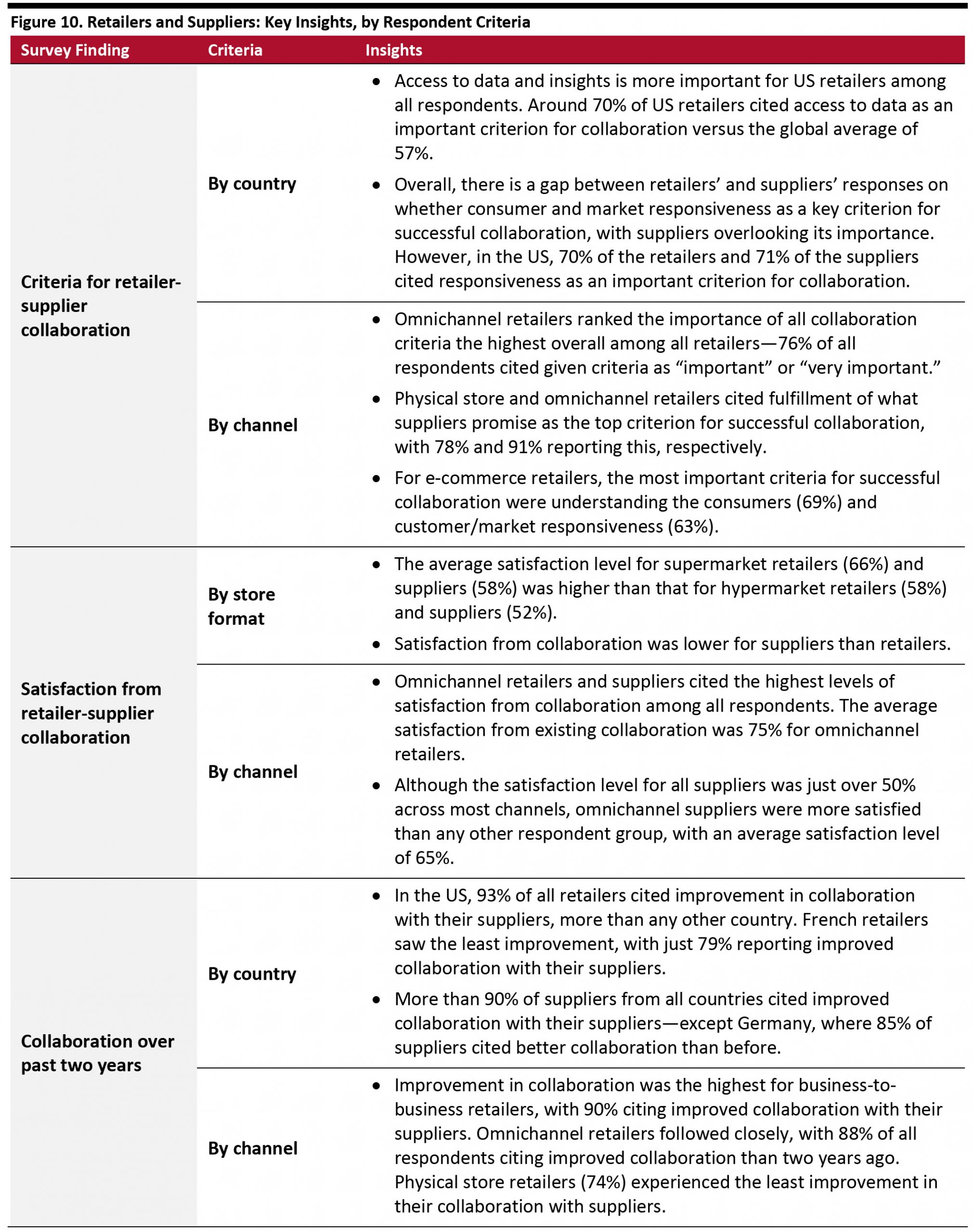

Retailer-Supplier Collaboration: Key Insights across Respondent Groups

In this section, we break down our data to analyze key survey results across different respondent groups. We identify growth opportunities on which retailers and suppliers can collaborate:- By focusing on collaboration beyond supply chain and fulfillment, brick-and-mortar retailers can look to achieve customer-focused growth.

- Omnichannel and e-commerce retail represents an “open door” for customer-led collaboration. Those who embrace customer-led partnerships the quickest will be able to capitalize on this growth opportunity.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Key Insights

Retailers and suppliers who cited improved collaboration indicated that improved business operations directly influence around one-fifth of their overall revenue. Improved customer service emerged as a key advantage of good retailer-supplier collaboration, according to 39% of respondents. The majority of surveyed retailers (85%) and suppliers (92%) agree that their collaboration is better today than two years ago, but the consequential improvement in their business operations is skewed toward retailers. Sharing customer and store-level data can increase the overall benefits of collaboration for both retailers and suppliers, especially their ability to forecast demand and market shifts. In turn, this will allow both retailers and suppliers to increase their responsiveness to customers and market trends.What Is Next for Category Management?

While this study shows the importance of collaboration and the opportunity that data transparency has to unlock growth, the obvious next question is, “What does this mean for the future of category management?” We look forward to addressing this question in greater depth in future research.Taking Retailer-Supplier Collaboration to The Next Level

Precima, a Nielsen company, enables retailers to align their strategies with their suppliers through its Supplier Collaboration solution—a cloud-based platform, containing data and insights that allow you to speak the same language, view common facts, and jointly act on valuable insights to fuel ongoing results. According to Precima—based on the company’s experience with its clients—retailers and suppliers have seen 2–3% growth in overall sales when they have achieved full transparency in data sharing, including sales, inventory, basket and customer data. This is because they can easily and efficiently mine data and embed their insights into decision-making processes. Precima’s solution offering can help retailers and their supplier partners to address the existing shortfalls in the market. The following are the key benefits of Precima’s Supplier Collaboration platform:- Transparency: The centralized data platform allows retailers and suppliers to share a common view of data, in turn, increasing transparency.

- Communication: Precima’s solution allows retailers to improve communication with their suppliers, which increases the likelihood of a long-term strategic partnership.

- Result Oriented: Retailers can identify actions that can improve operational efficiency of existing resources.

- Fast Deployment: Precima assigns a dedicated support team to its clients overseeing setup, deployment, training and ongoing support.

- Ease of Usage: Precima’s cloud-based software-as-a-service (SaaS) portal is highly configurable and can be configured based on the need of its clients.

Methodology

This study is based on the analysis of data from an online survey of 210 grocery/FMCG/CPG manufacturers/suppliers and retailers. The survey selected respondents selected based on the following criteria:- Based in France, Germany, the UK and the US, with around 50 respondents per country.

- Position focus on brick-and-mortar, e-commerce and business-to-business retail.

- Employed in companies with an annual turnover equal to or exceeding $3 billion in the most recent fiscal year.

- Holding senior positions (owners, C-suite, VP/EVP, directors, senior managers).

- Responsible for operations management, merchandising, customer insights and analytics, logistics and supply chain, product sourcing, sales and marketing.

- Holding roles with significant strategic decision-making responsibilities.