Source: Company reports

4Q15 RESULTS

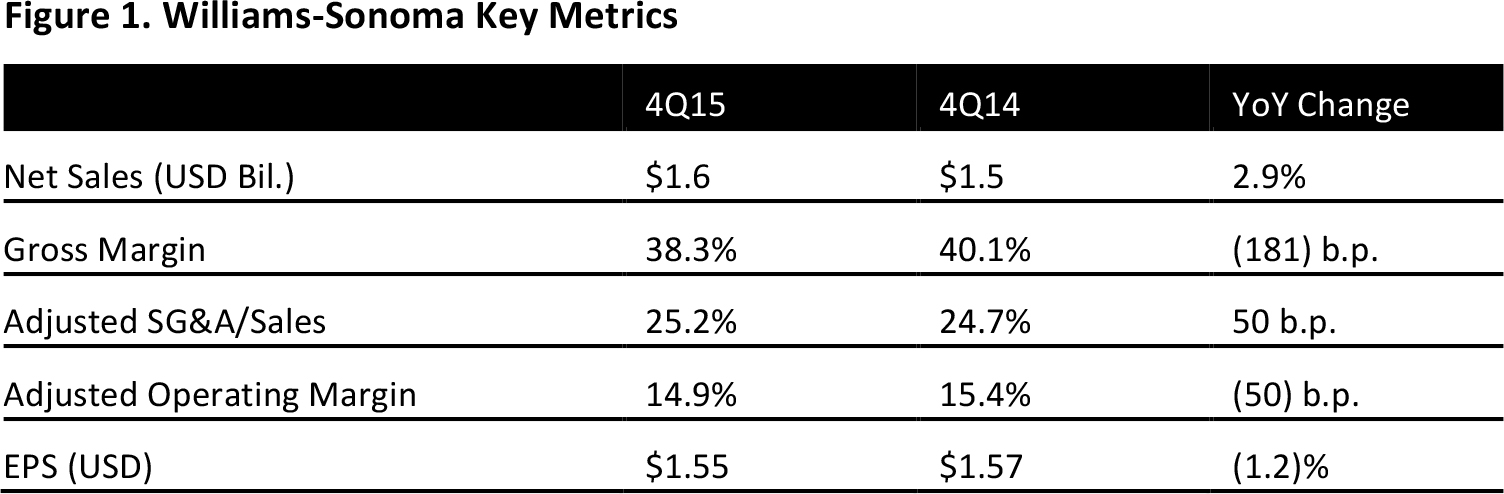

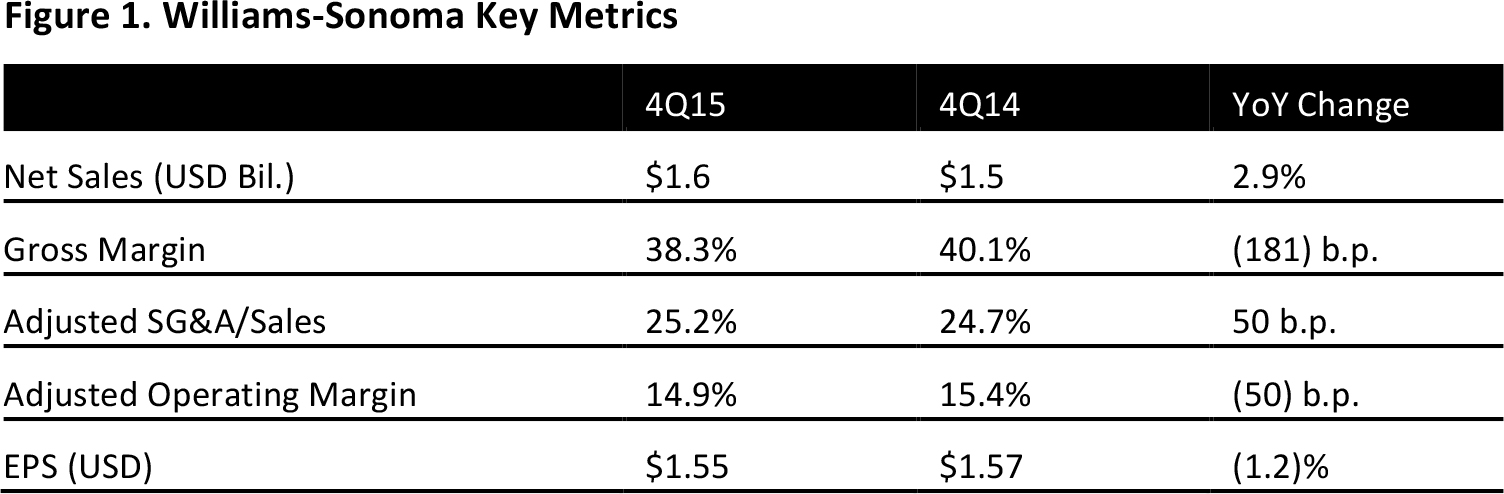

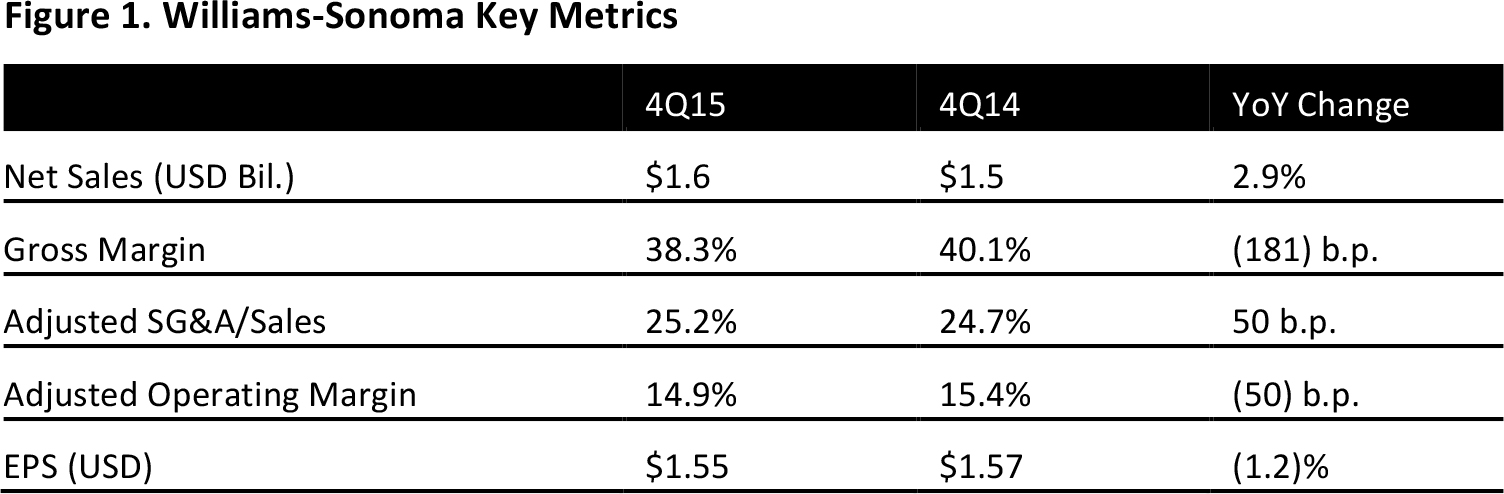

Williams-Sonoma’s 4Q15 net sales were $1.6 billion, up 2.9% year over year but slightly below the consensus estimate. Retail sales grew by 2.9% year over year, to $794 million, and e-commerce sales increased by 2.9% year over year, to $792 million.

Retail comps increased by 0.8%, which was below the consensus of 3.6%. Growth was driven by a 12.8% increase at West Elm and a 0.9% increase at Williams-Sonoma. Comp gains were partially offset by a 2.0% decrease at Pottery Barn, which was below the consensus estimate of 2.4%. Pottery Barn Kids saw a 0.1% gain, which missed consensus of 3.1% growth.

The gross margin decreased by 181 basis points year over year, to 38.3%, owing to lower merchandise margins, shipping and fulfillment-related costs, and lower margins associated with higher franchise sales. Excluding onetime events, the adjusted SG&A-to-sales ratio increased by 50 basis points, to 25.2%.

EPS was $1.55, compared to the consensus estimate of $1.58.

During the fourth quarter, the company opened four stores and ended the quarter with 618 stores versus 601 at the end of the year-ago quarter.

2015 RESULTS

Net sales in 2015 increased by 5.9%, to $5.0 billion. Retail sales grew by 5.4% year over year, to $2.5 billion, and e-commerce sales grew by 6.4% year over year, to $2.5 billion.

Retail comps increased by 3.7% for the year, following an increase of 7.1% in 2014. The same-store sales increase was driven by West Elm comp growth of 14.8%. West Elm sales increased by 22.7% year over year, to $821 million.

EPS was $3.37 compared to $3.24 in 2014.

GUIDANCE

For 2016, the company expects sales growth in the low-to-mid-single digits based on 3%–6% comp growth, or revenue of $5.2–$5.3 billion, slightly below the consensus estimate.

The company also expects 4%–8% EPS growth, which would result in EPS of $3.50–$3.65, below the consensus estimate of $3.75.

For the first quarter, the company expects net sales of $1.1 billion, slightly below the consensus estimate, based on a 3%–6% increase in comps.

First-quarter EPS is expected to be $0.48–$0.52, below the consensus estimate of $0.55.