Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

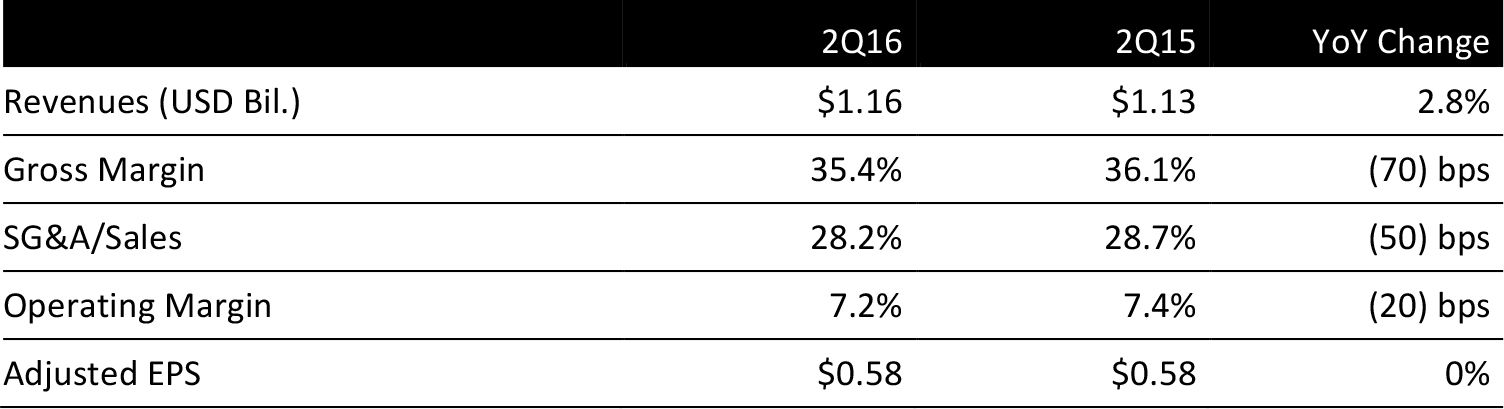

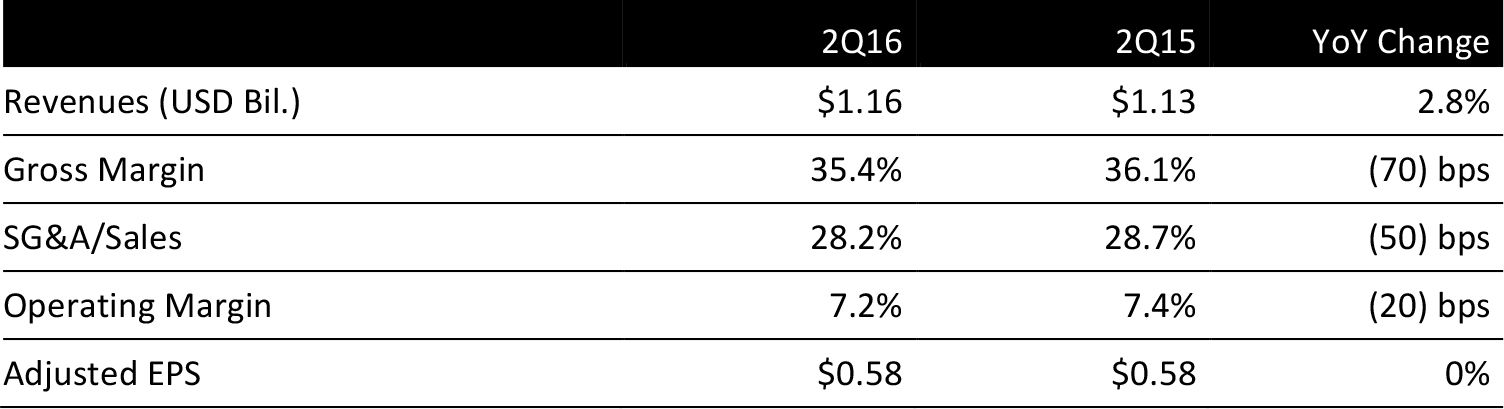

Williams-Sonoma reported 2Q16 revenues of $1.16 billion, up 2.8% year over year and slightly below the consensus estimate. E-commerce sales grew by 5.2% year over year, to $600 million, and retail sales grew by 0.4% year over year, to $559 million. E-commerce sales were 51.7% of total company sales versus 50.6% in 2Q15.

Retail comps increased by 0.6%, which was below the consensus of 2.8%. Growth was driven by a 15.8% increase at West Elm and a 0.1% increase at Pottery Barn Kids. Comp gains were partially offset by a 4.8% decrease at Pottery Barn and a 5.2% decline at Pottery Barn Teen. The Williams-Sonoma brand was flat year over year.

Merchandise inventories were $963 million, down 6.6% year over year versus 2.8% sales growth.

EPS was $0.58, flat year over year and in line with the consensus estimate.

Management noted the overall retail environment has “softened” and sales were impacted by a more cautious consumer. As a result, the company has lowered its outlook for the remainder of the year.

2016 Outlook

For the third quarter, the company expects EPS of $0.75–$0.85 versus the consensus of $0.81. That is based on revenue of $1.24–$1.29 billion and comp growth of 0%–4%. The consensus calls for revenue of $1.28 and comps of 3.7%.

Management lowered its full-year guidance for EPS of $3.35–$3.55 compared to prior guidance of $3.50–$3.65 and slightly below the consensus of $3.57. That is based on expected revenue growth of 2%–5%, which implies sales of $5.08–$5.23 billion versus the consensus of $5.22 billion.

Comps are expected to increase in the 1%–4% range versus prior guidance of 3%–6% and consensus estimate of 3.9%.

Gross margin is expected to improve in the second half of the year, as a new distribution center and secondary warehousing costs become less of a headwind.

Williams-Sonoma expects to end the fiscal year with 626 stores versus 618 at the end of FY 2015.

�