albert Chan

Williams-Sonoma, Inc.

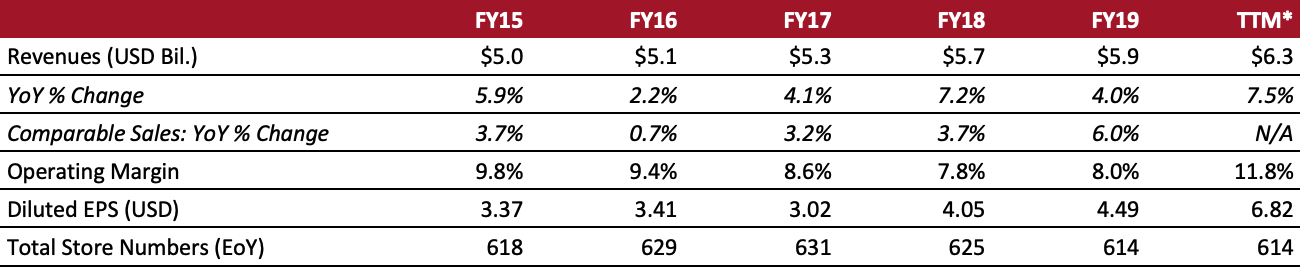

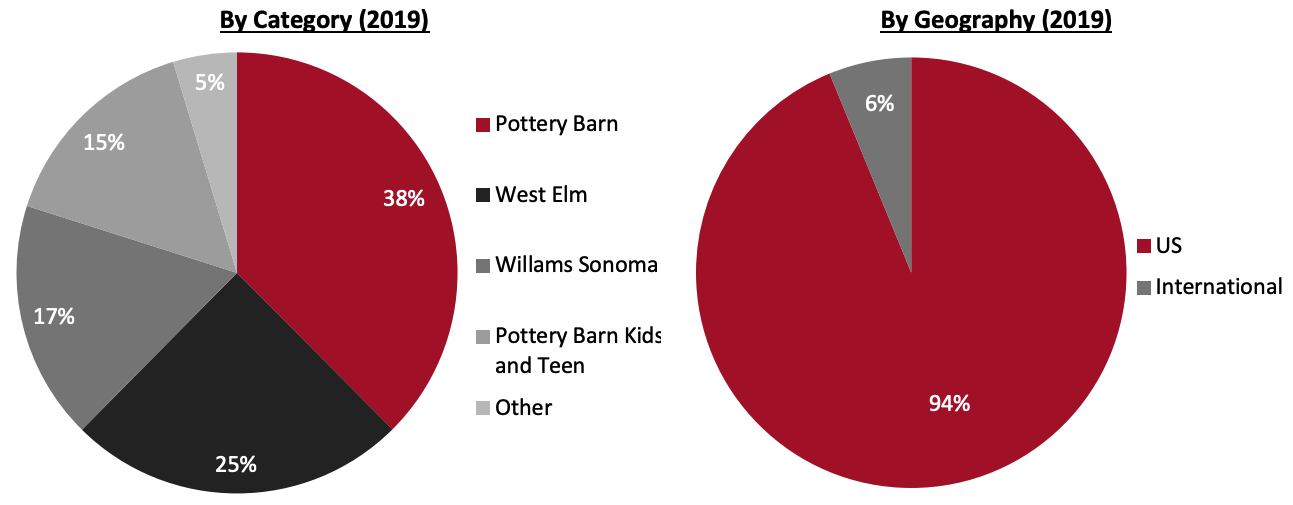

Sector: Home and home improvement Countries of operation: Australia, Canada, the UK and the US (including Puerto Rico) Key product categories: Bathware, kitchenware, entertainment products, furniture, home furnishings and decorative accessories, and outdoor Annual Metrics [caption id="attachment_126737" align="aligncenter" width="720"] Fiscal year ends on January 31 of the following calendar year

Fiscal year ends on January 31 of the following calendar year*Trailing 12 months ended November 1[/caption] Summary Williams-Sonoma is a US-based multichannel specialty retailer of home and kitchenware products that operates stores in Australia, Canada, Puerto Rico, the US and the UK. The company was incorporated in 1973 and is headquartered in San Francisco, California. It operates in two segments: e-commerce and retail. The company includes multiple banners including Mark and Graham, Outward, Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Rejuvenation, West Elm and Williams Sonoma. The Williams Sonoma banner offers a range of products for cooking, dining and entertaining, including cookbooks and cookware, cutlery, electronics, furniture, outdoor, tabletop and bar products. Company Analysis Coresight Research insight: Williams-Sonoma’s significant investments in its e-commerce platform over the past few years have given it a major competitive advantage in the current market landscape, comparing favorably with many of its rivals. The company is well equipped to weather the ongoing challenges in the store environment amid the Covid-19 pandemic. Williams-Sonoma’s e-commerce penetration grew from 57% of total sales in its fourth quarter of fiscal 2019 to 70% in its first quarter of fiscal 2020, 76% in its second quarter and 70% in its third quarter. As e-commerce continues to gain traction, the company plans to rationalize its brick-and-mortar presence. Williams-Sonoma has a long-term plan of operating with “fewer, better and more profitable stores.” In its third quarter fiscal 2020 earnings call on November 19, 2020, the company announced its long-term financial targets of revenue growth in the mid-to-high single-digit range. It also targets operating margin expansion and an above-industry average return on invested capital.

| Tailwinds | Headwinds |

|

|

- Brand experimentation and innovation, for a best-in-class approach to multichannel retail experiences

- Operational excellence across the enterprise, from quality products and sourcing to efficient manufacturing and supply chain

- Culture and corporate social responsibility, from commitments to foster women in leadership and embrace diversity, to a healthy impact on the community and environment

- Accelerating digital growth and a fundamental shift in its channel mix

- A marketing strategy focusing on content and building customer relationships

- Increasing profitability and bolstering its longer-term earnings outlook

Company Developments

Company Developments

| Date | Development |

| January 25, 2021 | Denim wear label Wrangler launches its first-ever home collection in partnership with Williams-Sonoma subsidiary banner Pottery Barn Teen. |

| October 8, 2020 | Williams-Sonoma announces plans to improve its holiday shopping experience. The retailer is organizing dedicated queues for online order pickups, waitlist apps and private shopping appointments outside normal store operating hours for customers looking to avoid crowds. |

| September 29, 2020 | Williams-Sonoma launches new collaborations with cooking collective Ghetto Gastro and kitchen design and manufacturing company Crux. |

| September 24, 2020 | Williams-Sonoma unveils a collection with premier textile purveyor The House of Scalamandré. |

- Laura J. Alber—CEO, President and Director

- Julie P. Whalen—Executive Vice President and CFO

- Dean A. Miller—Executive Vice President and COO

Source: Company reports/S&P Capital IQ