albert Chan

[caption id="attachment_81389" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

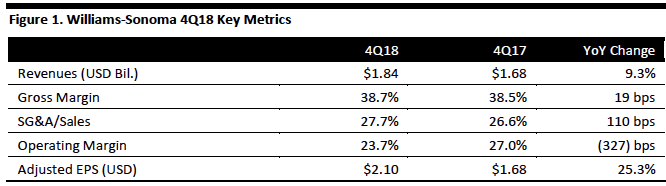

4Q18 Results

Williams-Sonoma reported 4Q18 revenues of $1.84 billion, up 9.3%.

Comps increased 2.4%, in line with consensus, driven by West Elm, whose comps increased 11.1%. Management commented that 4Q18 comps were below expectations due to a softer gift business in the quarter.

E-commerce revenue growth accelerated to 14.3%, accounting for 54.6% of total revenue.

Adjusted EPS was $2.10, up 25.3% and ahead of the $1.96 consensus estimate. GAAP EPS was $1.93, up 70.4% year over year, and including charges of $0.08 per share for outward-related items, $0.02 per share in employment-related expense, $0.01 per share for tax legislation, and $0.06 per share in impairment and early termination charges.

During the quarter, the company opened eight stores and closed 16, ending the quarter with 625 stores.

FY18 Results

FY18 revenues were $5.67 billion, up 7.2%.

Comps increased 3.7%, down from 3.2% the prior year.

E-commerce revenues were $3.1 billion, up 10.9% and comprising 54.3% of total revenues.

Adjusted EPS was $3.61, up 23.7%. GAAP EPS was $4.05, compared with $3.02 the prior year.

FY18 revenue breakdown:

Source: Company reports/Coresight Research[/caption]

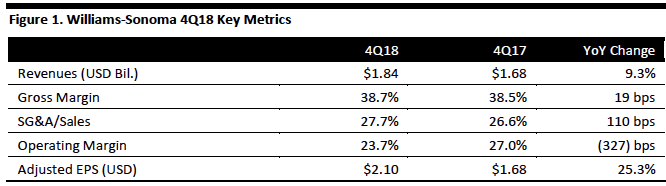

4Q18 Results

Williams-Sonoma reported 4Q18 revenues of $1.84 billion, up 9.3%.

Comps increased 2.4%, in line with consensus, driven by West Elm, whose comps increased 11.1%. Management commented that 4Q18 comps were below expectations due to a softer gift business in the quarter.

E-commerce revenue growth accelerated to 14.3%, accounting for 54.6% of total revenue.

Adjusted EPS was $2.10, up 25.3% and ahead of the $1.96 consensus estimate. GAAP EPS was $1.93, up 70.4% year over year, and including charges of $0.08 per share for outward-related items, $0.02 per share in employment-related expense, $0.01 per share for tax legislation, and $0.06 per share in impairment and early termination charges.

During the quarter, the company opened eight stores and closed 16, ending the quarter with 625 stores.

FY18 Results

FY18 revenues were $5.67 billion, up 7.2%.

Comps increased 3.7%, down from 3.2% the prior year.

E-commerce revenues were $3.1 billion, up 10.9% and comprising 54.3% of total revenues.

Adjusted EPS was $3.61, up 23.7%. GAAP EPS was $4.05, compared with $3.02 the prior year.

FY18 revenue breakdown:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Williams-Sonoma reported 4Q18 revenues of $1.84 billion, up 9.3%.

Comps increased 2.4%, in line with consensus, driven by West Elm, whose comps increased 11.1%. Management commented that 4Q18 comps were below expectations due to a softer gift business in the quarter.

E-commerce revenue growth accelerated to 14.3%, accounting for 54.6% of total revenue.

Adjusted EPS was $2.10, up 25.3% and ahead of the $1.96 consensus estimate. GAAP EPS was $1.93, up 70.4% year over year, and including charges of $0.08 per share for outward-related items, $0.02 per share in employment-related expense, $0.01 per share for tax legislation, and $0.06 per share in impairment and early termination charges.

During the quarter, the company opened eight stores and closed 16, ending the quarter with 625 stores.

FY18 Results

FY18 revenues were $5.67 billion, up 7.2%.

Comps increased 3.7%, down from 3.2% the prior year.

E-commerce revenues were $3.1 billion, up 10.9% and comprising 54.3% of total revenues.

Adjusted EPS was $3.61, up 23.7%. GAAP EPS was $4.05, compared with $3.02 the prior year.

FY18 revenue breakdown:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Williams-Sonoma reported 4Q18 revenues of $1.84 billion, up 9.3%.

Comps increased 2.4%, in line with consensus, driven by West Elm, whose comps increased 11.1%. Management commented that 4Q18 comps were below expectations due to a softer gift business in the quarter.

E-commerce revenue growth accelerated to 14.3%, accounting for 54.6% of total revenue.

Adjusted EPS was $2.10, up 25.3% and ahead of the $1.96 consensus estimate. GAAP EPS was $1.93, up 70.4% year over year, and including charges of $0.08 per share for outward-related items, $0.02 per share in employment-related expense, $0.01 per share for tax legislation, and $0.06 per share in impairment and early termination charges.

During the quarter, the company opened eight stores and closed 16, ending the quarter with 625 stores.

FY18 Results

FY18 revenues were $5.67 billion, up 7.2%.

Comps increased 3.7%, down from 3.2% the prior year.

E-commerce revenues were $3.1 billion, up 10.9% and comprising 54.3% of total revenues.

Adjusted EPS was $3.61, up 23.7%. GAAP EPS was $4.05, compared with $3.02 the prior year.

FY18 revenue breakdown:

- Pottery Barn revenues were $2.2 billion (comprising 38.4% of total revenues), up 5.4% from the prior year.

- West Elm revenues were $1.3 billion (comprising 22.8% of total revenues), up 16.1% from the prior year.

- Williams-Sonoma revenues were $1.1 billion (comprising 18.6% of total revenues) , up 3.3% from the prior year.

- Pottery Barn Kids and Teen revenues were $896 million (comprising 15.8% of total revenues), up 5.4% from the prior year.

- Other revenues were $250 million (comprising 4.4% of total revenues), up 9.2% from the prior year.

- Pottery Barn reported a (0.4)% comp decrease, down from 4.1% in the year-ago quarter.

- West Elm reported a 11.1% comp increase, down from 12.3% in the year-ago quarter. Growth was driven by strong e-commerce performance and continued strength in the core furniture business.

- Williams-Sonoma reported a 0.1% comp increase, down from 4.3% in the year-ago quarter. Comps dipped largely due to a reduction in promotional activity as the company reduced inventories and continued to refine the balance between top-line growth and profitability for the brand. Emerging brands Rejuvenation and Mark and Graham continue to scale with double-digit growth and increasing profitability.

- Pottery Barn Kids and Teen reported a 1.6% comp increase, up from 1.4% in the year-ago quarter. The business substantially improved from last year, and the baby business continues to gain momentum, up 15% and attracting new customers at the entry point to the brand and to Registry creations

- Revenues of $5.67-5.84 billion, up 0-3%.

- Comps to increase 2-5%.

- Adjusted EPS of $4.50-4.70 (up 1-5%), above the $4.44 consensus estimate.

- Net 30 store closures for a total count of 595 by the end of the year.

- Capital spending of $200-220 million.

- Total net revenue growth in the mid-to-high single digits.

- Adjusted operating income growth in line with revenue growth, in the mid- to high-single digits.

- Stable (flat) operating margins.

- Above-industry average return on invested capital (ROIC).