albert Chan

[caption id="attachment_95451" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

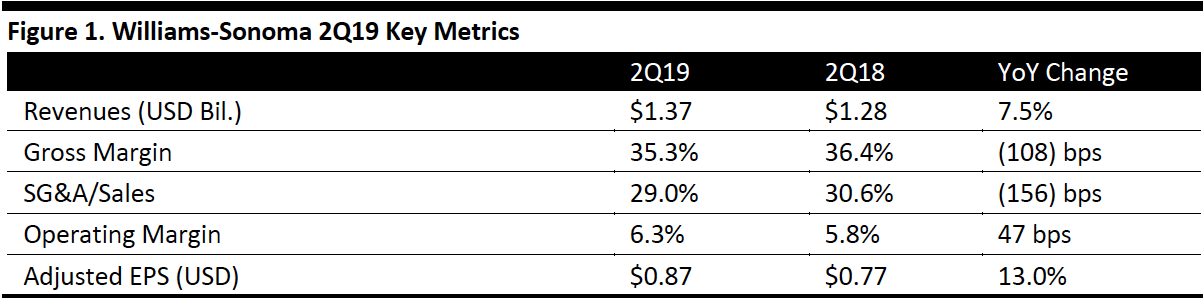

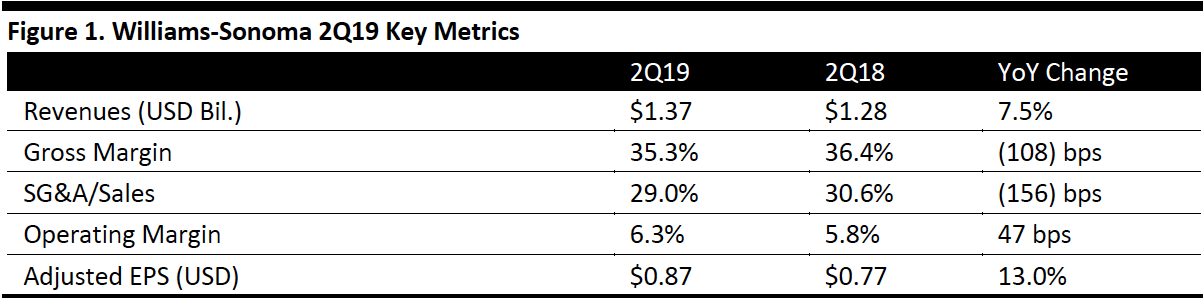

Williams-Sonoma reported fiscal 2Q19 revenues of $1.37 billion, up 7.5% year over year, beating the consensus estimate of $1.31 billion. Adjusted EPS was $0.87, up 13.0% year over year and ahead of the consensus estimate of $0.83.

Comparable sales accelerated 6.5% compared with the consensus estimate of a 3.3% increase, and up from the year-ago period of 4.6% growth. By brand, Pottery Barn comparable sales were up 4.2% compared to 2.0% last year and versus the 1.0% consensus. West Elm comparable sales were up 17.5% compared with 9.5% last year and the consensus estimate of 9.3%. Williams-Sonoma comparable sales were down (1.1)% compared to 1.6% in the year-ago period and versus the consensus estimate of flat growth. Pottery Barn Kids and Teen comparable sales were up 3.7%, compared with 5.7% growth last year.

On the earnings call, Williams-Sonoma CEO Laura Alber said “West Elm is the first pillar of the company’s growth strategy and its biggest growth opportunity.” According to management, newly opened West Elm stores are performing above expectations and the company is on track to double the brand’s revenue.

In Pottery Barn, the digital experience has led to “friction-free shopping,” increased traffic and product engagement. Management reiterated its plan to reposition Pottery Barn with a diversified product offering and supported by the launch of Pottery Barn Apartment and Marketplace. Pottery Barn’s kids and teen segment delivered its highest two-year comps in four years and there was significant growth across back-to-school offerings, including backpacks, eco-friendly food storage products and dormitory furnishings.

Management noted Williams-Sonoma brand results were disappointing as strength in its full-price business and new introductions were not enough to overcome clearance volume and misses in tabletop.

On the call, management announced Williams-Sonoma’s plans to expand into India in early 2020, and to expand its wholesale networks in New Zealand and Ireland in the second half of this year.

Management also said its cross-brand loyalty program, The Key, has been an important driver of customer engagement and revenue growth. The company added one million new members over the past three months, bringing total membership to 6.4 million. Approximately 70% of loyalty member sales come from multi-brand shoppers, which helps drive cross-brand sales.

Recent Developments

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Williams-Sonoma reported fiscal 2Q19 revenues of $1.37 billion, up 7.5% year over year, beating the consensus estimate of $1.31 billion. Adjusted EPS was $0.87, up 13.0% year over year and ahead of the consensus estimate of $0.83.

Comparable sales accelerated 6.5% compared with the consensus estimate of a 3.3% increase, and up from the year-ago period of 4.6% growth. By brand, Pottery Barn comparable sales were up 4.2% compared to 2.0% last year and versus the 1.0% consensus. West Elm comparable sales were up 17.5% compared with 9.5% last year and the consensus estimate of 9.3%. Williams-Sonoma comparable sales were down (1.1)% compared to 1.6% in the year-ago period and versus the consensus estimate of flat growth. Pottery Barn Kids and Teen comparable sales were up 3.7%, compared with 5.7% growth last year.

On the earnings call, Williams-Sonoma CEO Laura Alber said “West Elm is the first pillar of the company’s growth strategy and its biggest growth opportunity.” According to management, newly opened West Elm stores are performing above expectations and the company is on track to double the brand’s revenue.

In Pottery Barn, the digital experience has led to “friction-free shopping,” increased traffic and product engagement. Management reiterated its plan to reposition Pottery Barn with a diversified product offering and supported by the launch of Pottery Barn Apartment and Marketplace. Pottery Barn’s kids and teen segment delivered its highest two-year comps in four years and there was significant growth across back-to-school offerings, including backpacks, eco-friendly food storage products and dormitory furnishings.

Management noted Williams-Sonoma brand results were disappointing as strength in its full-price business and new introductions were not enough to overcome clearance volume and misses in tabletop.

On the call, management announced Williams-Sonoma’s plans to expand into India in early 2020, and to expand its wholesale networks in New Zealand and Ireland in the second half of this year.

Management also said its cross-brand loyalty program, The Key, has been an important driver of customer engagement and revenue growth. The company added one million new members over the past three months, bringing total membership to 6.4 million. Approximately 70% of loyalty member sales come from multi-brand shoppers, which helps drive cross-brand sales.

Recent Developments

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Williams-Sonoma reported fiscal 2Q19 revenues of $1.37 billion, up 7.5% year over year, beating the consensus estimate of $1.31 billion. Adjusted EPS was $0.87, up 13.0% year over year and ahead of the consensus estimate of $0.83.

Comparable sales accelerated 6.5% compared with the consensus estimate of a 3.3% increase, and up from the year-ago period of 4.6% growth. By brand, Pottery Barn comparable sales were up 4.2% compared to 2.0% last year and versus the 1.0% consensus. West Elm comparable sales were up 17.5% compared with 9.5% last year and the consensus estimate of 9.3%. Williams-Sonoma comparable sales were down (1.1)% compared to 1.6% in the year-ago period and versus the consensus estimate of flat growth. Pottery Barn Kids and Teen comparable sales were up 3.7%, compared with 5.7% growth last year.

On the earnings call, Williams-Sonoma CEO Laura Alber said “West Elm is the first pillar of the company’s growth strategy and its biggest growth opportunity.” According to management, newly opened West Elm stores are performing above expectations and the company is on track to double the brand’s revenue.

In Pottery Barn, the digital experience has led to “friction-free shopping,” increased traffic and product engagement. Management reiterated its plan to reposition Pottery Barn with a diversified product offering and supported by the launch of Pottery Barn Apartment and Marketplace. Pottery Barn’s kids and teen segment delivered its highest two-year comps in four years and there was significant growth across back-to-school offerings, including backpacks, eco-friendly food storage products and dormitory furnishings.

Management noted Williams-Sonoma brand results were disappointing as strength in its full-price business and new introductions were not enough to overcome clearance volume and misses in tabletop.

On the call, management announced Williams-Sonoma’s plans to expand into India in early 2020, and to expand its wholesale networks in New Zealand and Ireland in the second half of this year.

Management also said its cross-brand loyalty program, The Key, has been an important driver of customer engagement and revenue growth. The company added one million new members over the past three months, bringing total membership to 6.4 million. Approximately 70% of loyalty member sales come from multi-brand shoppers, which helps drive cross-brand sales.

Recent Developments

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Williams-Sonoma reported fiscal 2Q19 revenues of $1.37 billion, up 7.5% year over year, beating the consensus estimate of $1.31 billion. Adjusted EPS was $0.87, up 13.0% year over year and ahead of the consensus estimate of $0.83.

Comparable sales accelerated 6.5% compared with the consensus estimate of a 3.3% increase, and up from the year-ago period of 4.6% growth. By brand, Pottery Barn comparable sales were up 4.2% compared to 2.0% last year and versus the 1.0% consensus. West Elm comparable sales were up 17.5% compared with 9.5% last year and the consensus estimate of 9.3%. Williams-Sonoma comparable sales were down (1.1)% compared to 1.6% in the year-ago period and versus the consensus estimate of flat growth. Pottery Barn Kids and Teen comparable sales were up 3.7%, compared with 5.7% growth last year.

On the earnings call, Williams-Sonoma CEO Laura Alber said “West Elm is the first pillar of the company’s growth strategy and its biggest growth opportunity.” According to management, newly opened West Elm stores are performing above expectations and the company is on track to double the brand’s revenue.

In Pottery Barn, the digital experience has led to “friction-free shopping,” increased traffic and product engagement. Management reiterated its plan to reposition Pottery Barn with a diversified product offering and supported by the launch of Pottery Barn Apartment and Marketplace. Pottery Barn’s kids and teen segment delivered its highest two-year comps in four years and there was significant growth across back-to-school offerings, including backpacks, eco-friendly food storage products and dormitory furnishings.

Management noted Williams-Sonoma brand results were disappointing as strength in its full-price business and new introductions were not enough to overcome clearance volume and misses in tabletop.

On the call, management announced Williams-Sonoma’s plans to expand into India in early 2020, and to expand its wholesale networks in New Zealand and Ireland in the second half of this year.

Management also said its cross-brand loyalty program, The Key, has been an important driver of customer engagement and revenue growth. The company added one million new members over the past three months, bringing total membership to 6.4 million. Approximately 70% of loyalty member sales come from multi-brand shoppers, which helps drive cross-brand sales.

Recent Developments

- On June 13, Pottery Barn Kids launched a home décor collection in partnership with Mojang and Microsoft’s Minecraft videogame. This range includes more than 30 products that use Minecraft’s adventurous virtual world imagery in a collection of bedding, gear, home furnishings and décor.

- In 2Q19, Williams-Sonoma opened a West Elm Coast distribution center (DC) in Fontana, California. The company expects the DC to be fully operational by September 2019, and facilitate faster delivery and reduce operating costs on the West Coast.

- On May 30, Williams-Sonoma announced a partnership with the Chase Center, which is home to the San Francisco-based Golden State Warriors, to be the official furniture and home design partner. Under this partnership, Williams-Sonoma will furnish multiple areas including courtside lounges, bar spaces, club suites and corporate offices at the Chase Center.