DIpil Das

[caption id="attachment_89715" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

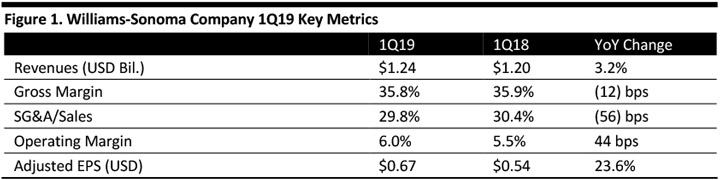

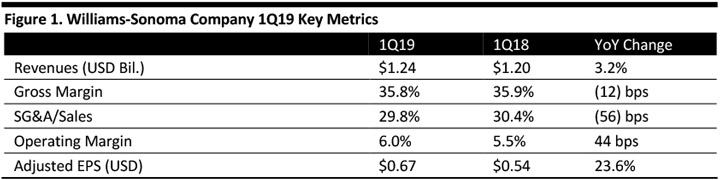

Williams-Sonoma reported 1Q19 revenues of $1.24 billion, up 3.2% year over year and slightly above the $1.21 billion consensus estimate.

Operating income was $74 million, an increase of 11.4% from $67 million in the year-ago quarter.

Gross margin was at 35.8%, slightly below the 35.9% reported in 1Q18.

Operating margin was 6.0%, an increase of 44 basis points from 5.5% in the year-ago quarter.

Adjusted EPS came in at $0.67, a rise of 23.6% from $0.54 in 1Q18.

Details from the Quarter

Management is positive about fiscal year 2019 and putting a focus on execution.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Williams-Sonoma reported 1Q19 revenues of $1.24 billion, up 3.2% year over year and slightly above the $1.21 billion consensus estimate.

Operating income was $74 million, an increase of 11.4% from $67 million in the year-ago quarter.

Gross margin was at 35.8%, slightly below the 35.9% reported in 1Q18.

Operating margin was 6.0%, an increase of 44 basis points from 5.5% in the year-ago quarter.

Adjusted EPS came in at $0.67, a rise of 23.6% from $0.54 in 1Q18.

Details from the Quarter

Management is positive about fiscal year 2019 and putting a focus on execution.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Williams-Sonoma reported 1Q19 revenues of $1.24 billion, up 3.2% year over year and slightly above the $1.21 billion consensus estimate.

Operating income was $74 million, an increase of 11.4% from $67 million in the year-ago quarter.

Gross margin was at 35.8%, slightly below the 35.9% reported in 1Q18.

Operating margin was 6.0%, an increase of 44 basis points from 5.5% in the year-ago quarter.

Adjusted EPS came in at $0.67, a rise of 23.6% from $0.54 in 1Q18.

Details from the Quarter

Management is positive about fiscal year 2019 and putting a focus on execution.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Williams-Sonoma reported 1Q19 revenues of $1.24 billion, up 3.2% year over year and slightly above the $1.21 billion consensus estimate.

Operating income was $74 million, an increase of 11.4% from $67 million in the year-ago quarter.

Gross margin was at 35.8%, slightly below the 35.9% reported in 1Q18.

Operating margin was 6.0%, an increase of 44 basis points from 5.5% in the year-ago quarter.

Adjusted EPS came in at $0.67, a rise of 23.6% from $0.54 in 1Q18.

Details from the Quarter

Management is positive about fiscal year 2019 and putting a focus on execution.

We are excited about our strong start to 2019 and the momentum we’re seeing from the execution of our growth and operational initiatives,” said Julie Whalen, EVP and CFO, on the analyst call.

Other details:- The company achieved revenue growth of 3.5%. Key growth drivers for revenues include West Elm, which delivered accelerated comps of 11.8% on top of 9.0% growth in comps last year, and Pottery Barn, which returned to a positive comp at 1.5%.

- In the first quarter, Williams-Sonoma reported a cash balance of $108 million, versus $290 million last year. The company invested $36 million in the business and returned more than $70 million to stockholders through dividend and share purchases.

- Due to the ongoing tariff war between the US and China, the company moved a substantial amount of its production out of China. It also offset the impact through cost renegotiations, selective price increases and cost reductions in other areas of business.

- The company’s Key Rewards loyalty program is one of its fastest-growing initiatives. Since its launch two years ago, total membership has grown to 5.5 million. Key Rewards members currently spend three times more on average than nonmembers, with twice the purchase frequency and three times more likelihood to shop across multiple brands.

- The company is planning to close a net 30 stores by the end of fiscal year 2019 and management will also review 250 stores coming up for lease renewal in the next three years.

- Williams-Sonoma crossed an important milestone this quarter, having been named to the Fortune 500 list of the largest companies in the US.

- Total net revenues: $5.67–5.84 billion.

- Comparable brand revenue growth: 2–5%.

- Non-GAAP operating margin: In line with FY18.

- Non-GAAP diluted EPS: $4.55–4.75.

- Non-GAAP income tax rate: 23–24%.

- Depreciation and amortization: $185–195 million.

- Total store count: 595 (net 30 store closures) by the end of FY19.

- Capital spending: $200–220 million.

- Return to shareholders: Quarterly cash dividend of $0.48 per share and incremental share buybacks under the company’s multi-year share repurchase authorization of approximately $678 million.

- Total net revenue growth of mid to high single digits.

- Non-GAAP operating income growth in-line with revenue growth, driving operating margin stability.

- ROIC above the industry average.