Source: Company reports/FGRT

2Q17 Results

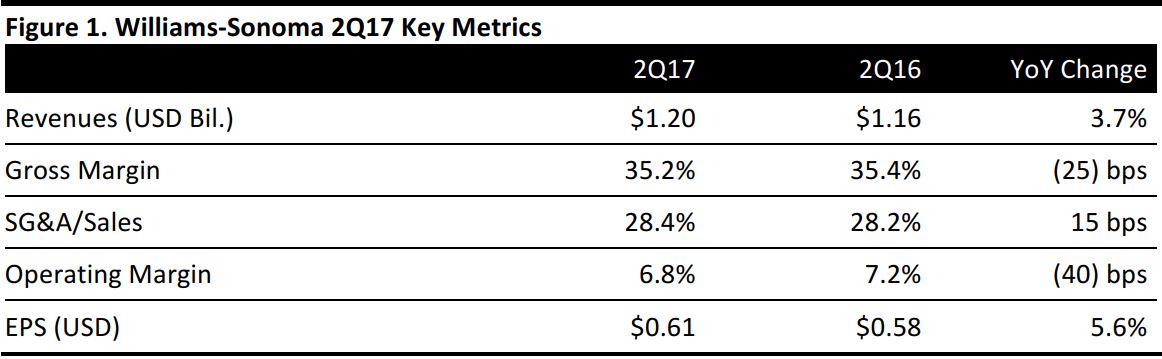

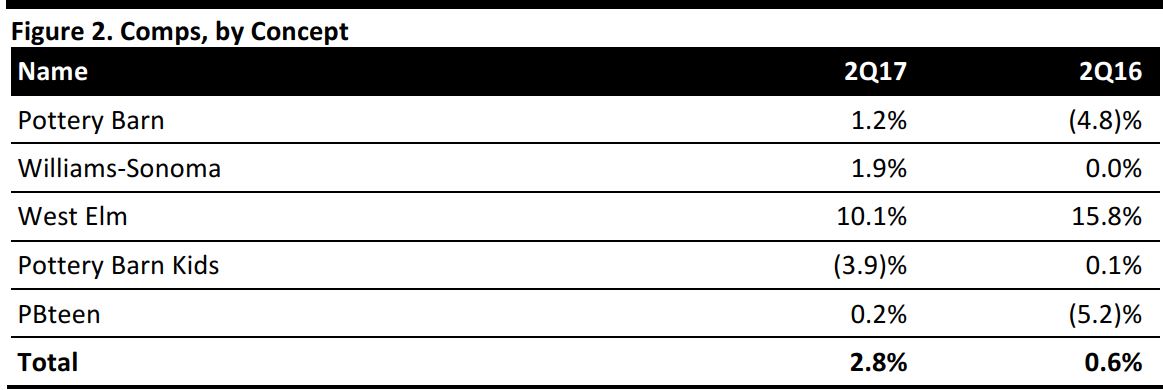

Williams-Sonoma reported 2Q17 revenues of $1.20 billion, up 3.7% year over year and in line with the consensus estimate.

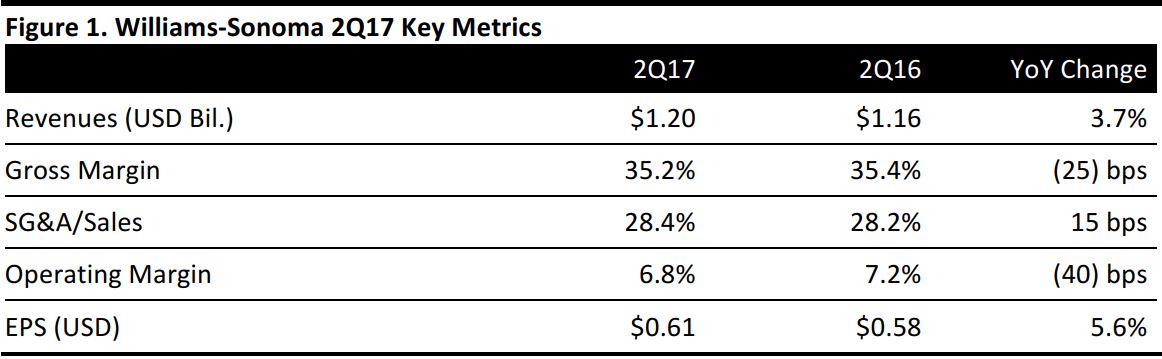

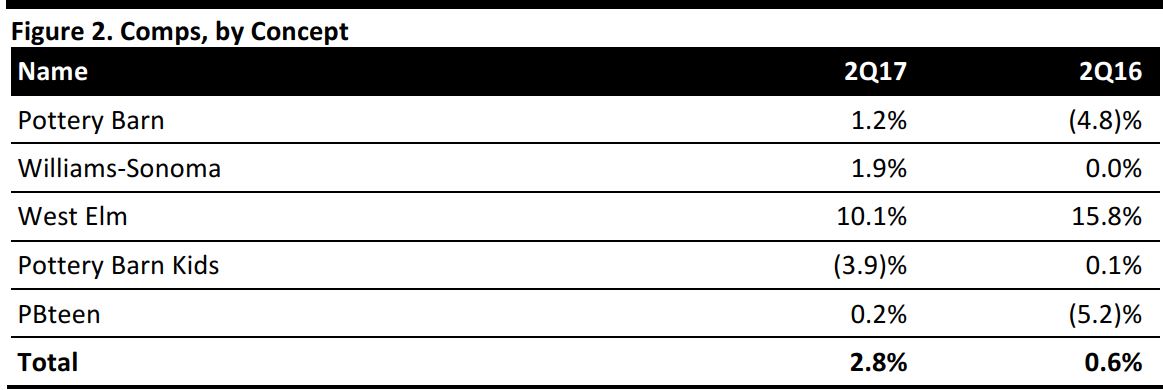

Comps increased by 2.8%, slightly ahead of the 2.7% consensus estimate and up from 0.6% in the year-ago quarter.

EPS was $0.61, up from $0.58 in the year-ago quarter and beating the consensus estimate by two cents.

Management commented that its actions to deliver value, quality and customer service are driving improved topline performance. The team plans to build further upon these initiatives to increase differentiation and drive profitable growth.

Details from the Quarter

Source: Company reports

Source: Company reports

- E-commerce revenues were $631 million in the quarter, up 5.2% and amounting to 52.5% of total company net revenues, up from 51.7% in the year-ago period.

- Inventories were $1.073 billion at the end of the quarter, up 11.4% from $963 million at the end of 2Q16, largely owing to inventory in transit and not yet received at distribution centers. The biggest drivers of inventory growth were associated with higher-growth brands, particularly West Elm.

- The company ended the quarter with a total of 635 stores, following nine openings and two closings during the quarter.

- Total store selling square footage was 4.00 million, up from 3.89 million in the year- ago quarter.

Outlook

Management reiterated its guidance for the year:

- Net revenues of $5.17–$5.27 billion (versus consensus of $5.22 billion)

- Comp growth of 1%–3%

- Adjusted EPS of $3.45–$3.65 (versus consensus of $3.56)

- An ending store count of 633 (including 24 openings and 20 closings), versus 629 at the end of 2016

The company offered the following guidance for 3Q17:

- Net revenues of $1.27–$1.31 billion (versus consensus of $1.28 billion)

- Comp growth of 2%–5% (versus consensus of 2.7%)

- EPS of $0.80–$0.87 (versus consensus of $0.82)

Source: Company reports

Source: Company reports