DIpil Das

Introduction: Retailers Need To Look to Alternate Sources of Profitability

For years, the retail industry has been challenged to keep up with rapidly changing consumer expectations. Prior to the Covid-19 pandemic, retailers were already struggling with profitability. Covid-19 has accelerated consumer trends, such as online shopping, and increased competition, exposing brands that have failed to innovate in the fast-paced retail environment. As retailers search for cost-saving initiatives, we explore an often-untapped yet substantial resource for increasing profitability: not-for-resale goods and services (NFR). NFR expenses—across areas such as marketing, real estate, IT, professional services, and distribution and logistics—typically equate to about 20% of a company’s revenue, according to benchmarks and data from LogicSource, so time spent and/or financial investment in evaluating these expenses can produce a hefty return on investment. In this report, we analyze proprietary survey data to reveal the impact the Covid-19 pandemic has had on retailer’s profitability, their current and forward-looking strategies to fight declining profits. We dive into the findings from a July 2020 survey of 220 executives at North American retail and CPG companies. As well as the Covid-19 impact, we asked respondents about their familiarity with, awareness of, and openness to examining NFR expenses. We will highlight the key opportunity areas and typical organizational barriers and challenges that retailers face when evaluating these expenses.Retailers Are Facing a Profitability Crisis: Survey Insights

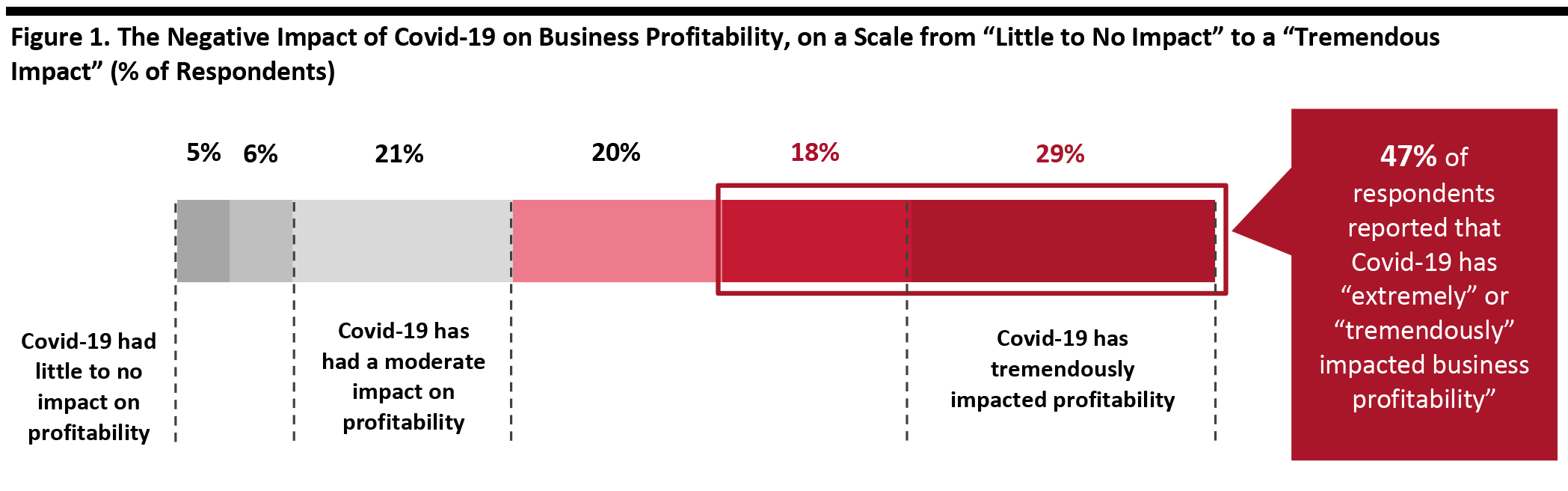

Amid the Covid-19 crisis, retail companies are laser-focused on profitability. As of August 26, 2020, US retail has seen 28 bankruptcies year-to-date (of which 23 were filed after lockdowns began)—the highest number of retail bankruptcies in a decade. Our survey of retail and CPG executives provides details on the extent of the struggles:- 100% of respondents had experienced at least some negative impact to their organization’s profitability; not a single organization surveyed reported that they were unaffected by Covid-19.

- Some 88% of respondents stated that Covid-19 has had at least a “moderately” negative impact on the profitability of their business.

- 47% stated that Covid-19 has been at least “extremely” impactful on profitability.

Total may not sum to 100% due to rounding

Total may not sum to 100% due to rounding Base: 220 retail and CPG executives

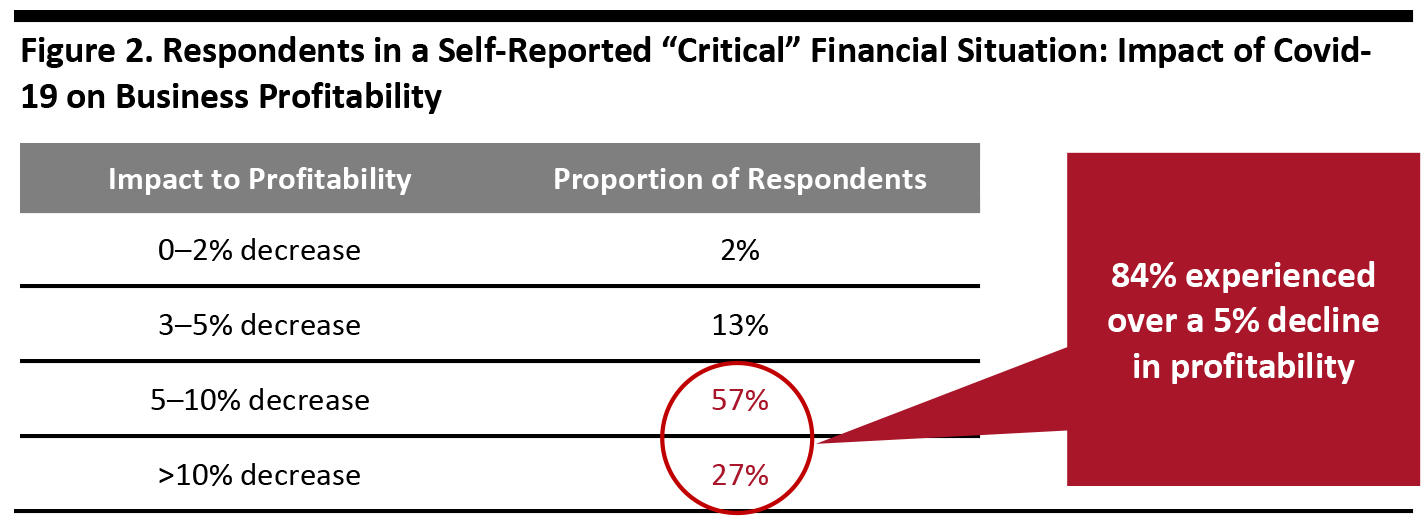

Source: Coresight Research [/caption] When asked about how critical their financial situation is, 51% of respondents said more than “moderately critical” and 11% stated that their business may not survive. Of the retailers that reported that their financial situation is more than moderately critical:

- Some 39% said that “a mix of both increased costs and decreased revenues” was the primary driver of their financial situation.

- 29% said only “increased costs” was the primary reason.

- Another 31% said only “decreased revenues” was the primary driver.

- 1% were unsure of the primary driver behind their moderately critical financial situation.

Total does not sum to 100 because 1% of respondents replied “Not sure”

Total does not sum to 100 because 1% of respondents replied “Not sure” Base: 115 respondents that rated their financial situation a five or higher on a scale of one (“not at all critical”) to seven (“extremely critical”)

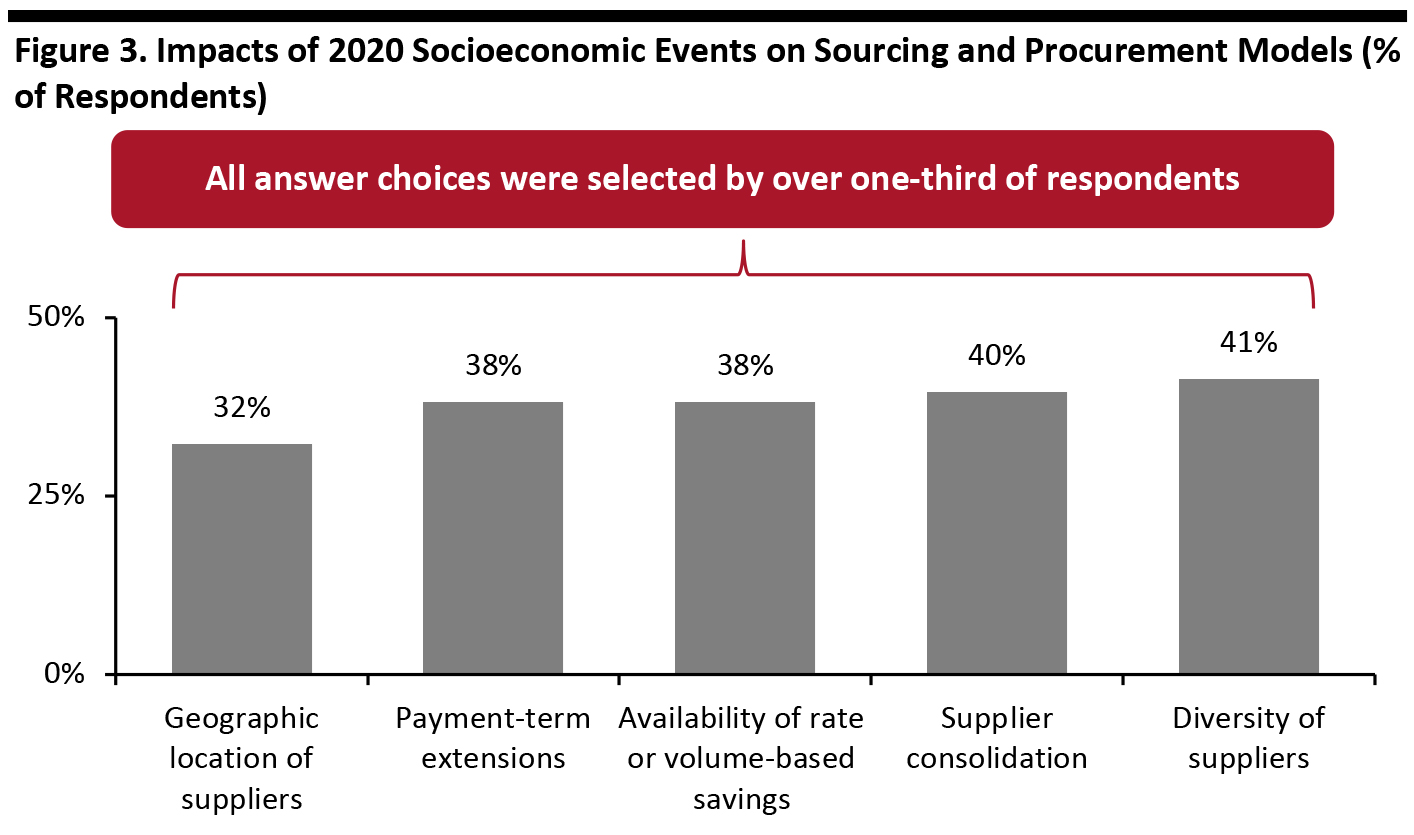

Source: Coresight Research [/caption] Top Negative Drivers Impacting Profitability Our survey respondents reported myriad impacts on their retail and CPG businesses that are directly attributed to Covid-19. Of the options we provided, the following impacts were each cited by around 40% of our survey respondents:

- Issues with suppliers

- Increased costs due to increased investment in PPE (personal protective equipment)

- Substantially decreased revenues

- The shutdown of their business for a period of time

Base: 220 retail and CPG executives

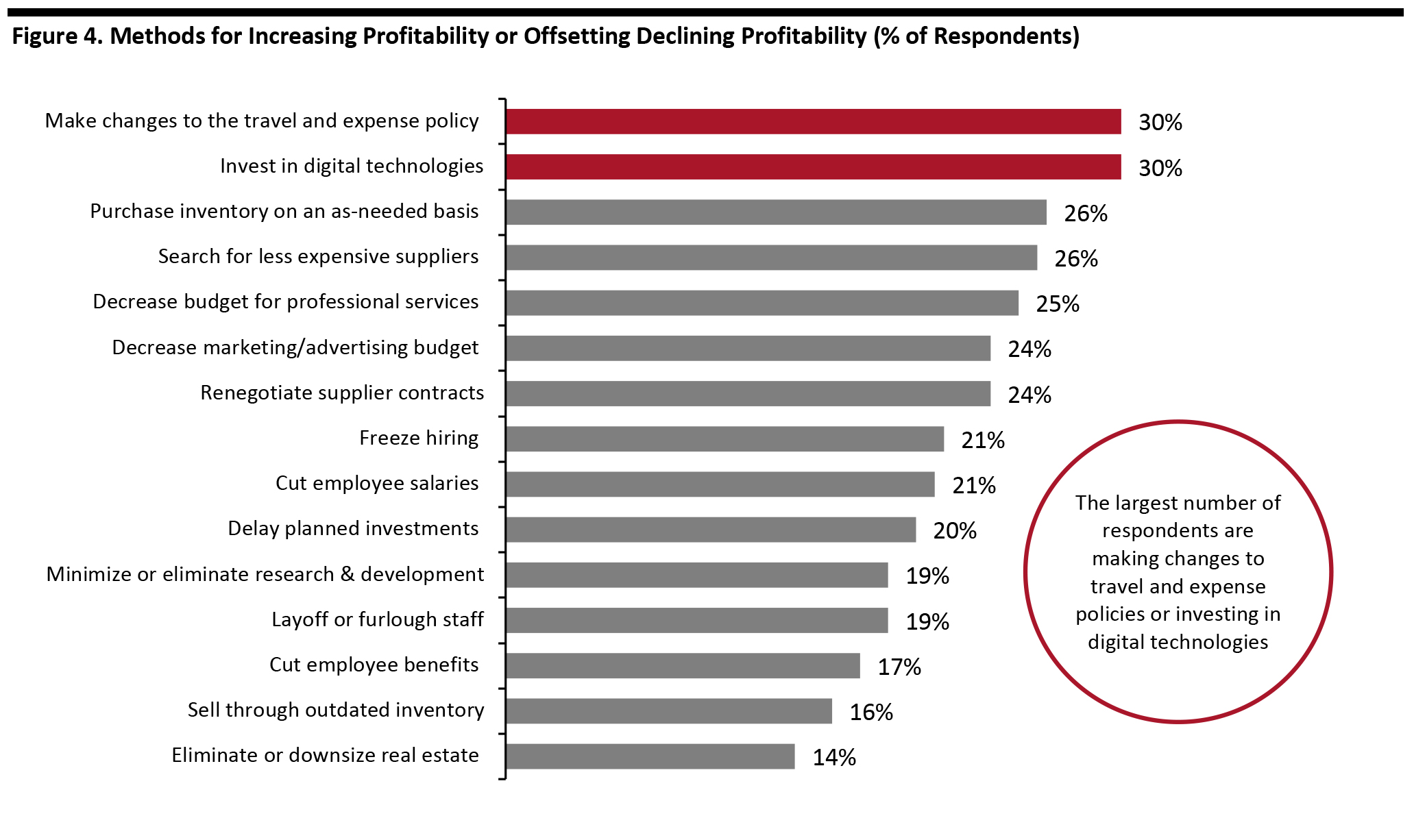

Base: 220 retail and CPG executives Source: Coresight Research [/caption] Retailers Are Taking Steps To Offset Declining Profitability Some retail companies have already turned to cutting costs not related to goods or services for sale. We asked our respondents to report the current steps they are taking to offset declining profitability and found that retail and CPG companies are focusing on internal and indirect costs.

- The largest proportion of respondents (30%) stated that they are making changes to their travel and expenses policies.

- Around one-quarter of respondents each reported that they are purchasing inventory on an as-needed basis, searching for less expensive suppliers, decreasing their budget for vendors and contractors, decreasing their marketing and advertising budget and renegotiating supplier contracts. Suppliers, contractors and travel budgets are extremely costly for businesses.

- Fewer than 20% of respondents are turning to options such as staff furloughs and layoffs, cutting benefits or selling through current inventory. Cutting expenses related to employees, while lucrative, poses a risk of souring employee morale or hurting the organization’s reputation.

- Almost one-third of retail and CPG organizations said they were planning to invest in digital technology.

- Another 27% of respondents stated that they are investing in supply chain & logistics.

- 21% are investing in the IT department and 20% are investing in a more diverse organization.

Base: 220 retail and CPG executives

Base: 220 retail and CPG executives Source: Coresight Research [/caption]

NFR: An Often-Overlooked Route to Boosting Profit Margins

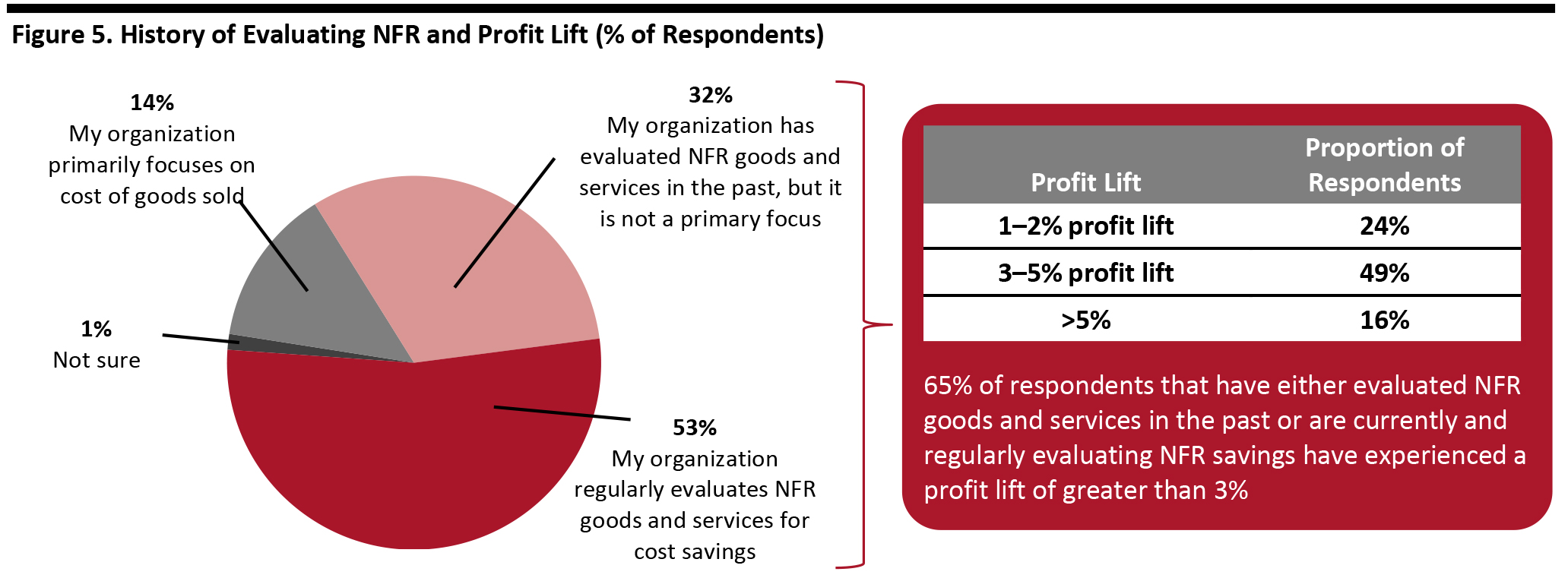

When retailers look to drastically cut expenses, the obvious answer is to reduce expenses related to goods and services for sale. However, NFR goods and services are often overlooked and can represent a substantial opportunity for retailers, particularly during these unprecedented times. In particular, NFR represents an opportunity for organizations to avoid cost-cutting measures that negatively impact their company culture or employee engagement. So, what exactly is NFR? NFR refers to all goods and services purchased by an organization outside of the merchandise it sells to its customers. In retail, this is spending and organization costs associated with marketing, real estate, facilities, IT, professional services, packaging and distribution/logistics. According to benchmarks and data from LogicSource, NFR typically equates to about 20% of a company’s revenue, so the time spent on, and/or financial investment into, evaluating these expenses can produce a hefty return on investment. NFR cost reductions can improve an organization’s financial situation in the short term, as well as provide a long-term solution for improving operational efficiency, managing suppliers, evaluating technology and avoiding layoffs and furloughs. For retailers that evaluate NFR goods and services for cost savings, the majority report a significant impact on profit lift. Despite this, NFR expenditures are not always a priority focus area:- Some 53% of those surveyed agreed that their organization “regularly evaluates NFR goods and services for cost savings.”

- 32% stated that their organization “has evaluated NFR in the past, but it is not the primary focus.”

Base for History of Evaluating: 220 retail and CPG executives

Base for History of Evaluating: 220 retail and CPG executives Base for Profit Lift: 187 respondents that selected either “My organization has evaluated NFR goods and services in the past, but it is not a primary focus” or “My organization regularly evaluates NFR goods and services for cost savings.”

Source: Coresight Research [/caption] These data confirm that focusing on NFR expenses can directly translate to increases in profit. Retail and CPG companies that reported that evaluating NFR is “not the primary focus” were less likely than those regularly evaluating NFR to report a profit increase of greater than 5%—suggesting that the more time that is invested in evaluating these expenses, the greater the reward. Despite the data proving that retailers have evaluated NFR in the past, and that retail leadership is aware of and familiar with NFR goods and services, still 66% of respondents agreed that “there is a lot more [their] organization could be doing to cut costs associated with NFR goods and services.”

Three Opportunities To Capitalize On Cutting NFR Expenses

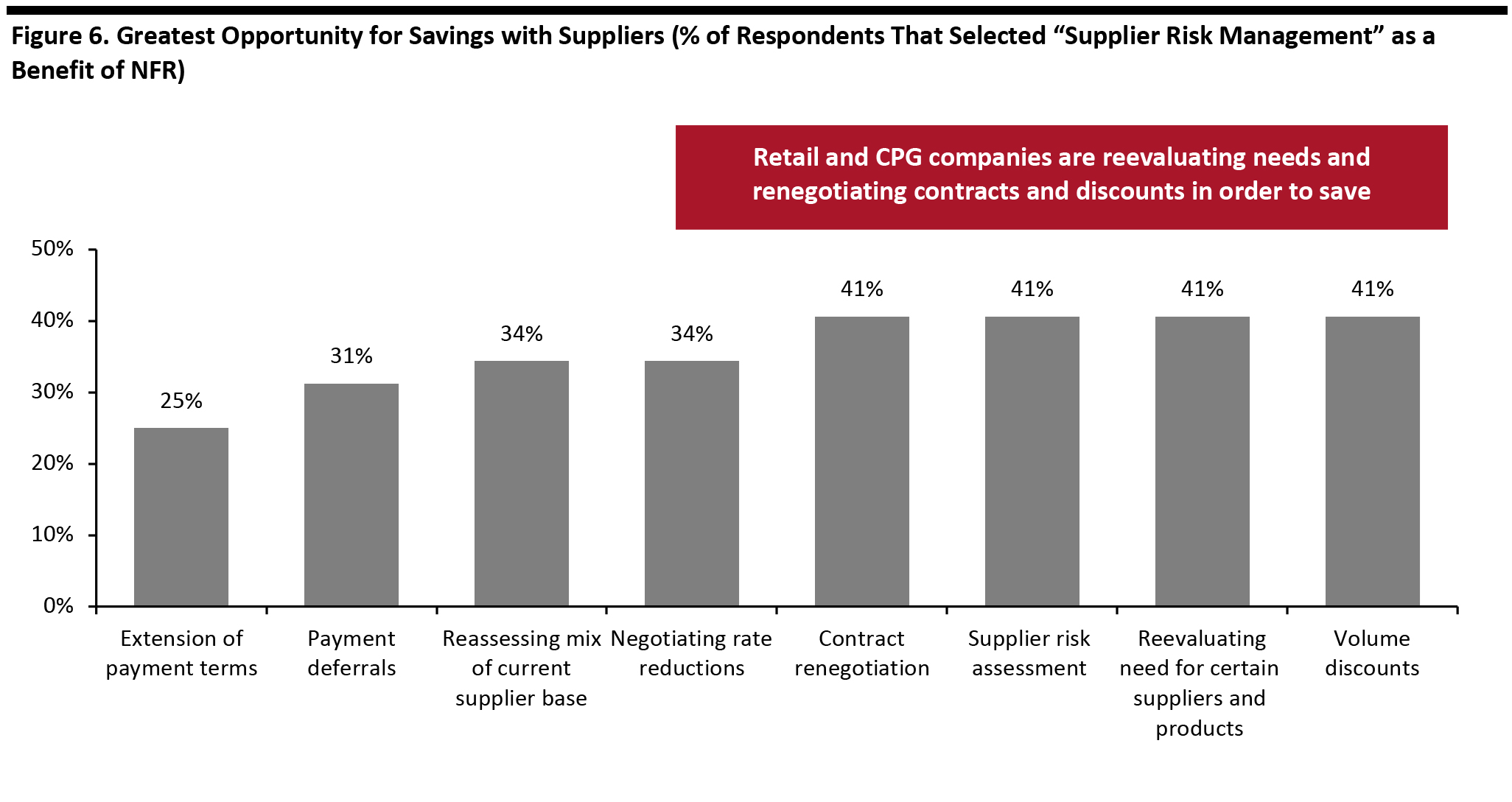

For CPG and retail firms seeking to achieve NFR-related profit boosts, we outline three opportunity areas for cost savings. Opportunity 1: Reevaluate Supplier Relationships Supply-chain management—and specifically procurement—represents one of the largest potential opportunities for retailers to capitalize on the power of evaluating NFR expenses. In response to the chaotic environment caused by Covid-19, retail and CPG organizations should renegotiate contracts and reevaluate their supplier network. When asked specifically what actions were taken in 2020 to reduce NFR costs, the largest proportion of respondents (47%) reported that their organizations are managing their suppliers. When asked to report on the greatest opportunity for savings with suppliers, our respondents selected volume discounts, reevaluating the need for certain suppliers and products, supplier risk assessment and contract renegotiation. However, as shown in Figure 6, there is a wide array of opportunity for savings through managing supplier risk. A common theme is that renegotiating terms or contracts can provide substantial opportunity for savings. Suppliers are also experiencing a stressful situation and may be more willing to negotiate. [caption id="attachment_116232" align="aligncenter" width="700"] Base: 32 respondents that selected “supplier risk management” as one of the greatest potential benefits of NFR

Base: 32 respondents that selected “supplier risk management” as one of the greatest potential benefits of NFR Source: Coresight Research [/caption] Opportunity 2: Streamline Internal Processes and Operations Improving operational efficiency, reducing demand and eliminating waste opens the door for sustained cost reductions throughout the organization without turning to broad-based restructuring and layoffs. Retail executives can unlock significant cost reductions through:

- Reducing and standardizing usage and inventories of consumables—for example, by reducing expenses related to maintenance and repair (such as supplies and janitorial items) and rationalizing SKUs across paper and corrugate expenditures.

- Eliminating waste internally and with suppliers—for example, by ensuring rate compliance for small parcel spend and improving processes internally to eliminate supplier upcharges, such as rush fees and emergency callouts.

- Optimizing or outsourcing internal teams and processes—for example, outsourcing facility maintenance operations, consolidating providers of contingent labor and automating administrative processes.

Retailers Recognize the Substantial Opportunity but Acknowledge That Barriers Exist

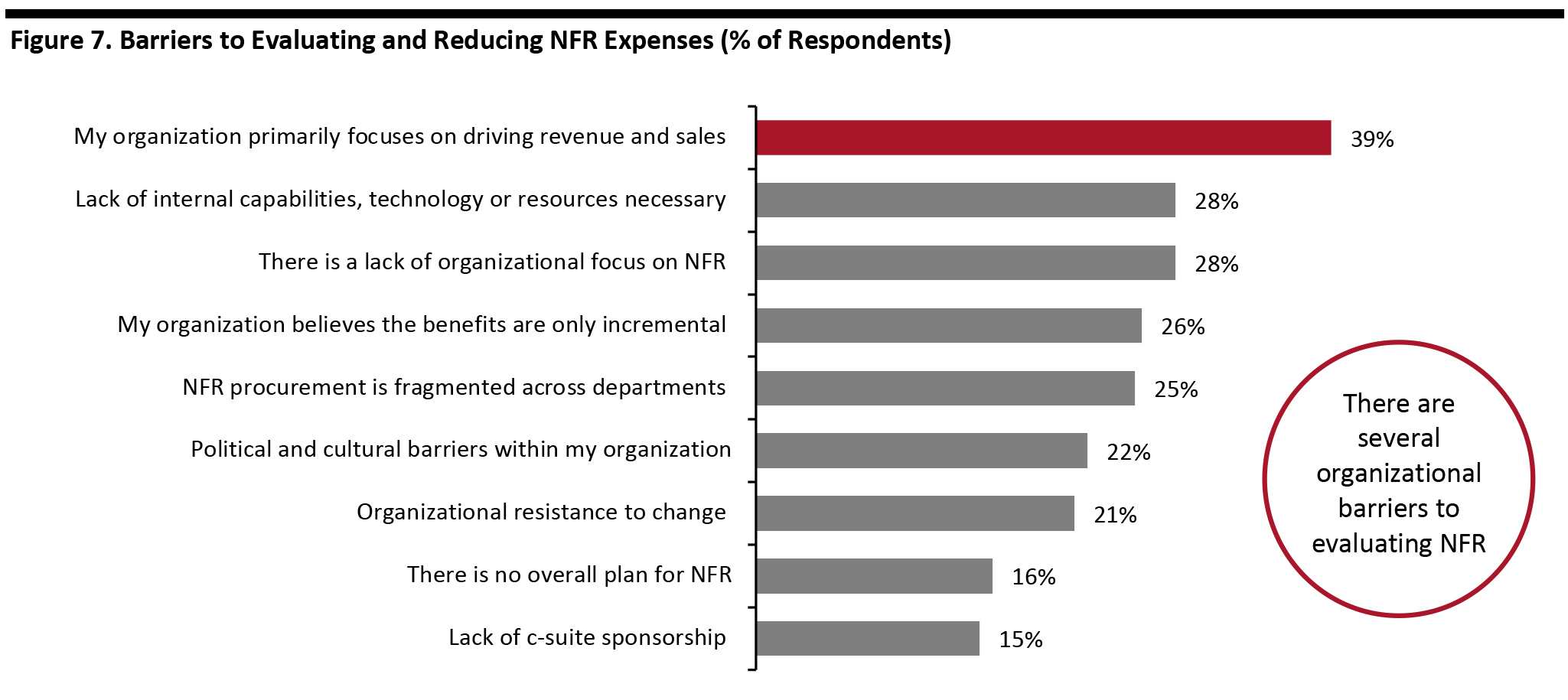

Although 45% of retailers we surveyed admitted that they are either not evaluating NFR expenses or that this is not a main focus, 72% agreed that NFR goods and services represent a “substantial opportunity” for cost savings. Retailers are not able to harness the benefits of NFR savings due to certain barriers standing in their way. The number-one barrier reported by 39% of retailers and CPG companies is that their “organization primarily focuses on driving revenue and sales.” Other barriers include a lack of organizational focus on NFR, a lack of internal capabilities, technology or resources, or the organization believes that the benefits are only incremental. Figure 9 shows all of the barriers mentioned by retailers in our survey. In summation, NFR is put on the backburner because it is not prioritized within the organization; there isn’t a strong belief or understanding of the benefits; the organization is scattered and fragmented; or they just simply do not have the time and/or resources. [caption id="attachment_116233" align="aligncenter" width="700"] Base: 220 Retail and CPG Executives

Base: 220 Retail and CPG Executives Source: Coresight Research [/caption] It can also be difficult for organizations to know where to start or which departments hold the largest potential for cost savings, generally. When asked which departments were the most important for leadership to optimize, 71% of our respondents said finance, 68% said marketing and 66% said IT. When asked which aspects of NFR cost savings would be the most challenging to reduce, at least 50% of retailers selected each of the following: finance, sourcing and procurement, distribution and logistics, and packaging. However, similar to the question about optimizing departments, responses to cutting departments were equally varied, and all selections were chosen by over 40% of our respondents. This once again indicates that that the importance of departments varies according to each individual company. When asked why particular areas of the business were challenging to cut, the majority of retail and CPG businesses responded, “The amount of money spent in this area is necessary and cannot be reduced.” See Figure 10 for the top five reasons our respondents gave for why certain NFR expenses are more challenging to reduce than others. [caption id="attachment_116234" align="aligncenter" width="700"]

Base: 220 Retail and CPG executives

Base: 220 Retail and CPG executives Source: Coresight Research [/caption] Sources of untapped profitability will be unique from business to business, and all organizations will face barriers and challenges when attempting to unearth these not-so-obvious but potentially considerable cost savings; however, there are options to get started.

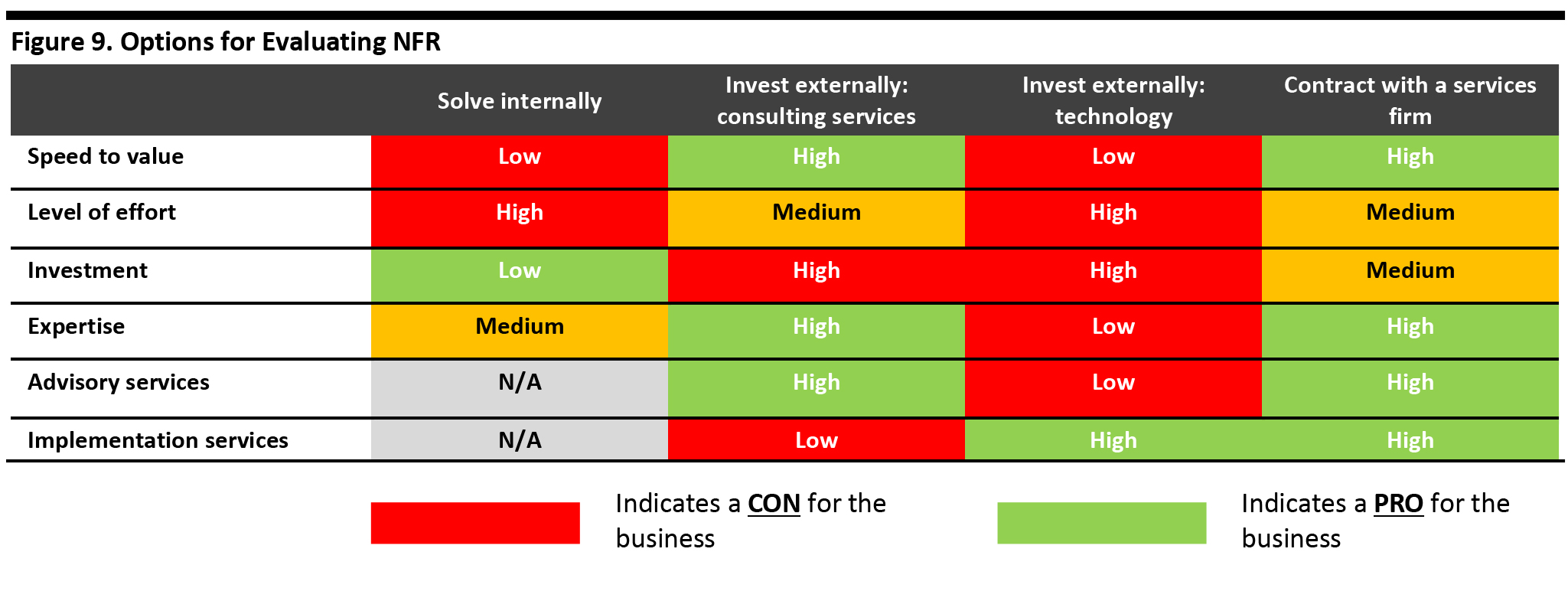

Evaluating NFR: Where To Start and How To Get the Value

While retail and CPG executives understand the payoffs from NFR and acknowledge that barriers exist, many are not sure where to start or how to find a solution. We have outlined three ways in which retail and CPG organizations can evaluate NFR:- Solve internally—Build a team internally to primarily focus on evaluating NFR.

- Invest externally—Hire consulting services to conduct a thorough analysis and then complete execution internally or invest in a new technology to increase efficiency.

- Contract with a services firm—Hire a services firm to conduct both analysis and execution.

Source: Coresight Research[/caption]

Each method for evaluating NFR has both positives and negatives, and each retail organization will have to analyze which of these methods suites their unique needs. An organization that has a clear understanding of NFR and has resources with capacity to dedicate to this analysis may want to keep operations internal. However, an organization that does not have the expertise to conduct this analysis and has the ability to invest in other options may want to consider contracting a consulting or services firm. Consulting firms and services firms provide expertise and a quick turnaround for a higher price than internal analysis.

Source: Coresight Research[/caption]

Each method for evaluating NFR has both positives and negatives, and each retail organization will have to analyze which of these methods suites their unique needs. An organization that has a clear understanding of NFR and has resources with capacity to dedicate to this analysis may want to keep operations internal. However, an organization that does not have the expertise to conduct this analysis and has the ability to invest in other options may want to consider contracting a consulting or services firm. Consulting firms and services firms provide expertise and a quick turnaround for a higher price than internal analysis.

Conclusion: NFR Savings Represent a Substantial Opportunity To Increase Profitability for Retailers

Our research proves that NFR can deliver significant profit gains with focus and a clear strategy. There are opportunities for NFR savings in almost every area of a retailer or CPG’s business, but the challenge is in driving effective change management to realize the associated value. It is important, especially in times of crisis, that retailers prioritize NFR and have a focused strategy for how to approach this analysis. There are three primary avenues for evaluating NFR expenses and driving profit improvement opportunities:- Reevaluating supplier partnerships can result in substantial savings through sourcing events, contract renegotiations, rate changes, adjustments to payment terms and evaluation of overall needs.

- Improving efficiency within the organization can include anything from restructuring and outsourcing non-core business functions to automating manual processes. Internal opportunities abound, but finding and valuing them is key.

- Incremental unit cost reductions at scale can result in large savings. Small adjustments to packaging and supplies items, and elimination of over-ordering and waste in general services and consumables can produce substantial profit gains.