What’s the Story?

The wholesale business model has typically been particularly prevalent in department stores and other multibrand stores. However, wholesale distribution is being disrupted by new models of selling and distribution.

In this report, we consider three influencing factors in the shift away from traditional selling models, and the advantages and disadvantages of the wholesale model versus the direct-to-consumer (DTC) model from a multibrand retailer’s perspective, with a focus on the US. We discuss major announcements within the space and analyze the implications of reduced reliance on the wholesale model in US department store retail.

Why It Matters

The way that the department stores are working with brands and sourcing brands is changing. This is one of the most important issues affecting department stores today, because department stores have typically relied on top brand associations through wholesale agreements to attract consumers. Furthermore, in the past, department stores were assured brand inventory through wholesale agreements.

As wholesale agreements between brand and department stores change, the department store will need to adjust its operating model, both to better represent the brands in its portfolio and to adjust for the inventory it carries in its stores.

A Shift in Selling Models: Three Influencing Factors

A shift is occurring in the retail industry supply chain in how brands and retailers are partnering and selling their products from business to business and from business to consumer. Traditionally, major brands have worked with retailers through wholesale models, selling their products at a specified cost, which the retailer then marks up, and sells to consumers. Today, brands are increasingly selling directly to consumers through their own channels.

We are seeing the shift in traditional selling models being driven by three interconnected factors, which we detail below.

1. Increasing Digital Sales

Over the past year, nearly all brands and retailers have seen digital sales rise significantly. In the US department store sector, digital sales grew from 24%–33% of total sales in fiscal 2019 to 44%–55% in fiscal 2020 at Kohl’s, Macy’s and Nordstrom.

2. Brands’ Exit from Wholesale To Sell Through Own Channels

Brands distributing through third-party retailers book those revenues at wholesale prices rather than retail prices and the markup is captured by the retailer; for apparel retail, this markup may be twice the wholesale cost (i.e., a 50% gross margin for the retailer). Brands selling through their own channels therefore generate greater revenues (booked at retail selling prices) and profits. However, this involves a tradeoff, because it removes the security of a retail partner.

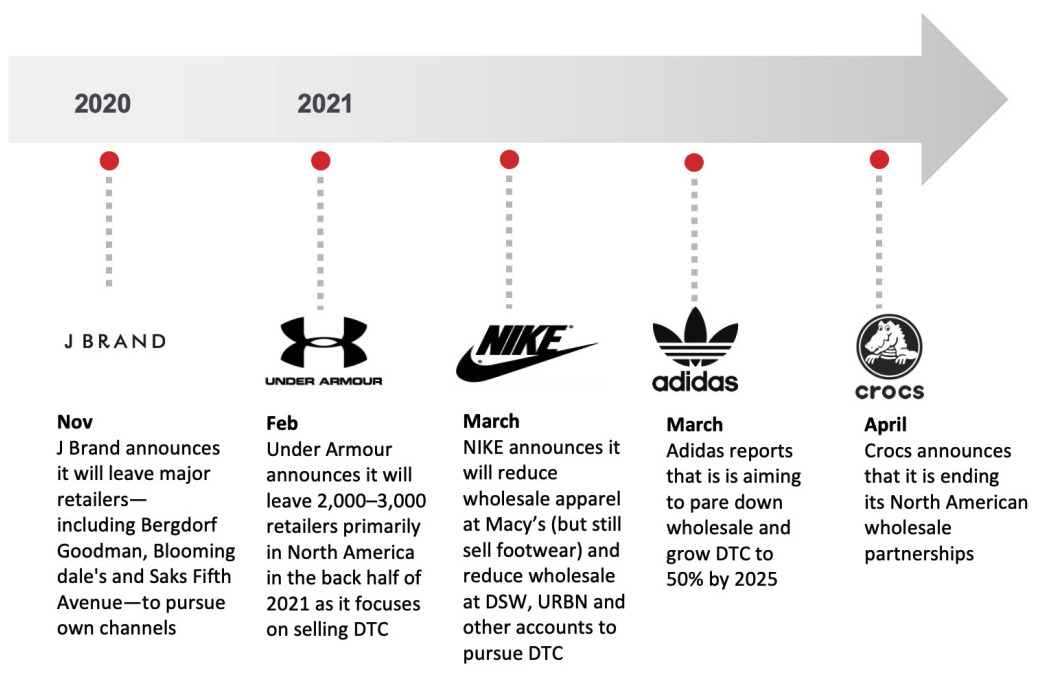

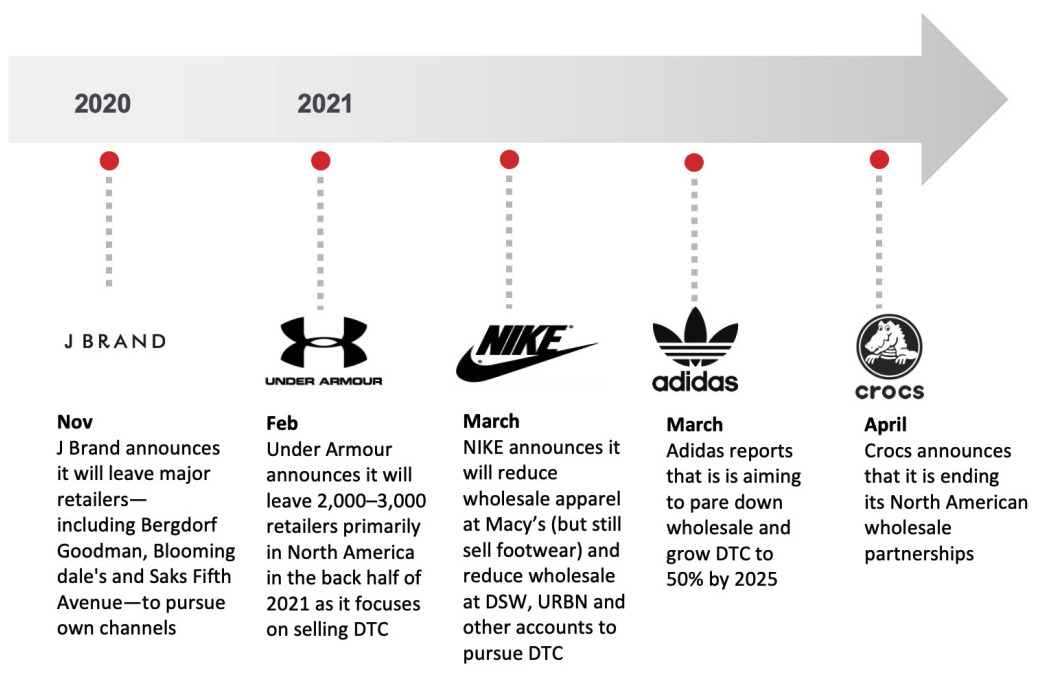

Over the past year, major brands have announced plans to exit from “undifferentiated retail brand partnerships” to pursue their own DTC relationships, which may impact major department stores and multibrand retailers (see Figure 2). Two notable characteristics of the major brands that are exiting wholesale channels are that they are well-established, highly recognized brands and/or that they have a large consumer following on digital channels.

Figure 2. Recent Wholesale Reductions by Selected Brands

[caption id="attachment_129668" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

3. Rapidly Shifting Consumer Trends

Selling direct to consumers can enable brands to respond to consumer trends more quickly. This includes both digitally native vertical brands (DNVBs)—which are brands that are born online and sell and ship their own product—and DTC brands that sell to consumers directly through their own channels but may also sell their products to retail partners for distribution.

One advantage of selling through DTC and DNVB models is agility, meaning that if a style is not trending, the brand may replace the style on its website with a more popular option. The wholesale model does not allow for this agility. With the Covid-19 pandemic having caused volatility in consumer demand, the ability to adapt quickly to market trends has become even more important.

DTC vs. Wholesale: A Retailer’s Perspective

Some retailers, such as Hudson’s Bay and Nordstrom, are facilitating a DTC model with brands in which the brands own and hold the inventory and the department stores enter into revenue-sharing arrangements. We highlight the advantages and disadvantages of the wholesale model versus DTC for the retailer in Figure 3.

Figure 3. Advantages and Disadvantages of Wholesale Selling vs. DTC from a Retailer’s Perspective

| Wholesale |

DTC |

| Advantages |

- Guaranteed inventory at reduced costs due to bulk purchasing: Retailers obtain inventory at agreed-to wholesale prices and mark the prices up at agreed upon rates.

- Brands become part of retailer’s portfolio and image: Multibrand retailers rely on top and trending brands to attract consumers to shop their store.

- Access to a brand’s customer base: Multibrand retailers gain access to a brand’s customer base through their association, which may help to generate sales in other categories and brands.

- Increased touchpoints with customers: Retailers manage the fulfillment and returns process, acting as the face of the brand.

- Efficient marketing: Multibrand retailers can launch promotions to a wide audience.

|

- Minimizes risk: The department store retailer does not have to predict and forecast demand. Brands hold the inventory and ship on demand. The customer orders products directly from brands as ordered.

- Adds ability to respond to trends more quickly: Through DTC, brands can introduce new products faster than the wholesale channel because it has more direct control of inventory and allocation.

- Saves costs and reduces supply chain pressure: Brands fulfill the orders, including order processing, shipping and returns.

|

| Disadvantages |

- Responsible for unsold inventory: The retailer is financially responsible for unsold inventory.

- Risk of damage by brand association: The retailer is the brand owner; if the brand image is tarnished, this can hurt the retailer.

|

- Less control over customer support: Brands provide all shipping and logistics support, meaning that the retailer loses the opportunity to interact with customers.

- Less control over customer data: DTC gives brands direct access to detailed customer data about demographics, geographies, preferences and purchasing power.

- Loss of opportunity to build customer loyalty: As consumers can develop a relationship with the brand directly, they may not have a reason to shop through the retailer.

|

Source: Coresight Research

DTC vs. Wholesale: An Analysis of Major US Department Stores

Department stores and multibrand retailers’ identities are closely linked to the brands they offers its customers: Customers shop at retailers that have the brands and styles that they like at the price points they seek—ranging from value to luxury. National brands can be a traffic driver, particularly for trending fashion brands across the apparel, luxury, handbags and sportswear categories.

Below, we look at the three major department stores in the US—Kohl’s, Macy’s and Nordstrom—and the sales penetration of wholesale/national, private-label and partner or shared brands from fiscal 2020.

- The wholesale model comprised 44% of sales across the three department stores (note that this is understated as Macy’s reported only its top 10 national brands). Private label accounted for 18% of sales, and partner or shared brands contributed 4%.

- Based on the retailers’ portfolio projections for the future, it is estimated that by 2023, wholesale will comprise 50% of sales across the three retailers, with increases at Kohl’s and Macy’s and decreases at Nordstrom. Private label will increase to 25%, with increases at Macy’s and Nordstrom and decreases at Kohl’s. Partner or shared brands will increase to a combined 14% of sales at Macy’s and Nordstrom.

Figure 4. Kohl’s, Macy’s and Nordstrom: Selling Model Details

[wpdatatable id=1090]

Source: Company reports

Kohl’s: Bucks Industry Trend by Aggressively Increasing National Brand and Retail Partnerships

At Kohl’s, an off-mall retailer, sales penetration of national brands increased from 50% in fiscal 2010 to 66% in fiscal 2020, totaling $10.5 billion. At a presentation at the Bank of America Securities and Retail Conference in March 2021, Kohl’s reported that its top three national brands are NIKE, Adidas and Under Armour. Kohl’s also sells Champion and Columbia.

The department store has aggressively been adding brands and retail partnerships to its portfolio. This provides evidence that wholesale arrangements remain attractive for many brands and retailers.

- In April 2021, Kohl’s announced a partnership with Tommy Hilfiger to launch in 600 stores and an expanded assortment online in the fall of 2021. The assortment will include men’s sportswear styles and classic styles.

- In March 2021, Kohl’s announced it would introduce Calvin Klein underwear, intimates and loungewear in more than 600 stores and online in the fall of 2021.

- In February 2021, Kohl’s announced a partnership with Eddie Bauer to launch in stores and online in the Fall of 2021, to sell size-inclusive women’s, men’s and kid’s apparel

- In October 2020, Kohl’s announced that it would sell Cole Haan footwear in select stores and online from spring 2021.

- In March 2020, Kohl’s announced a partnership with Land’s End to offer the brand’s entire assortment of women’s, men’s, kids and home merchandise on Kohls.com, directly fulfilled and shipped by Lands’ End, as well as offering seasonal goods for the family (including outerwear in fall/winter and swimwear in spring/summer) in 150 stores from fall 2020.

- In a non-wholesale arrangement, in December 2020, Kohl’s announced a partnership with Sephora to bring 200 “Sephora at Kohl’s” locations to Kohl’s in the fall of 2021, with 850 locations planned by 2023. Sephora will also launch on Kohls.com.

Kohl’s has six private-label brands and five exclusive brands in its private portfolio, which totaled $5.4 billion in sales in fiscal 2020, comprising 34% of the company’s total sales. Most recently, Kohl’s introduced a private-label sustainable athleisure brand for men and women in March 2021.

The company has also been focusing on emerging and smaller brands through Curated by Kohl’s and the Wellness Market:

- Curated by Kohl’s is an in-store and online market of emerging brands that rotate quarterly, with new products spanning apparel, accessories and home. Kohl’s partnered with Facebook on brand curation, identifying and engaging with brands that have built a strong online community on social media. Management said that many of the brands are digitally native brands, so it is another avenue to introduce Kohl’s customers to emerging brands and a fresh assortment on a continual basis.

- The Wellness Market is a curated selection of products spanning home, beauty, personal wellness, baby and pet care, with an emphasis on products that offer clean, natural or sustainable attributes. Management reported on its third-quarter 2020 earnings call in November 2020 that the company is leveraging the marketplace to test new products and categories and “see how they come to life.” Under the umbrella of wellness, the Wellness Market is a way for the company to gain consumer insights and experiment with product offerings.

Macy’s: Focusing on Top 10 Brands While Increasing Private Label to 25% of Sales

At its Investor Day in February 2020, Macy’s reported that its top 10 national brands comprised 25% of total sales. Management added that the company has numerous vendors that are not in its top 10 list that are incredibly important to its customer offerings. Macy’s has relationships with vendor partners and is able to buy the best and exclusive products due to its scale, according to management. The company shares analytics and insights about its mutual customers with its vendor partners. Macy’s and its partners have jointly agreed upon contribution margin plans and clear and measurable results.

While Macy’s does not provide further insight into the overall sales penetration of its total wholesale or national brands, during JP Morgan’s virtual conference on April 14, 2021, management highlighted select national brands that performed well. According to the company, Levi’s was a standout denim brand; Polo was trending across men’s and women’s; and in shoe categories, Birkenstock, Steve Madden and Kors were trending brands.

Beginning in fiscal 2019, Macy’s has made a concerted push into its “vendor direct” program, through which the company offers brands online that own the inventory themselves and ship directly to consumers. At the company’s Investor Day in 2020, Macy’s management reported that it added over 1 million SKUs and 1,000 vendors to its vendor direct program (a 59% increase). Management said that the vendor direct program provides its customers significantly more selections and provides its merchants with demand insights and trends. On its earnings call for the fourth quarter of fiscal 2020, held in February 2021, Macy’s reported that its vendor direct program is key to its plans to grow its digital business to $10 billion, with vendor direct accounting for approximately 20% of digital sales. However, management reported that one inconvenience of the program is that once a customer orders from vendor direct versus owned inventory, the shipments can be split; Macy’s is continuing to monitor this to ensure that customer expectations are matched across both experiences.

Macy’s has 32 private brands, which accounted for 20% of its business in fiscal 2020—totaling an estimated $3.6 billion—management reported at the Morgan Stanley Consumer Conference Presentation on December 1, 2020. At its Investor Day in February 2020, Macy’s reported plans to grow its four best-performing private brands— Alfani, Charter Club, INC and Style & Co—to $1 billion each by 2025. The company plans to grow its private-label business to 25% of its overall business.

Nordstrom: Reducing Wholesale To Expand into New Retail Partnerships and Doubling Private-Label Sales by 2025

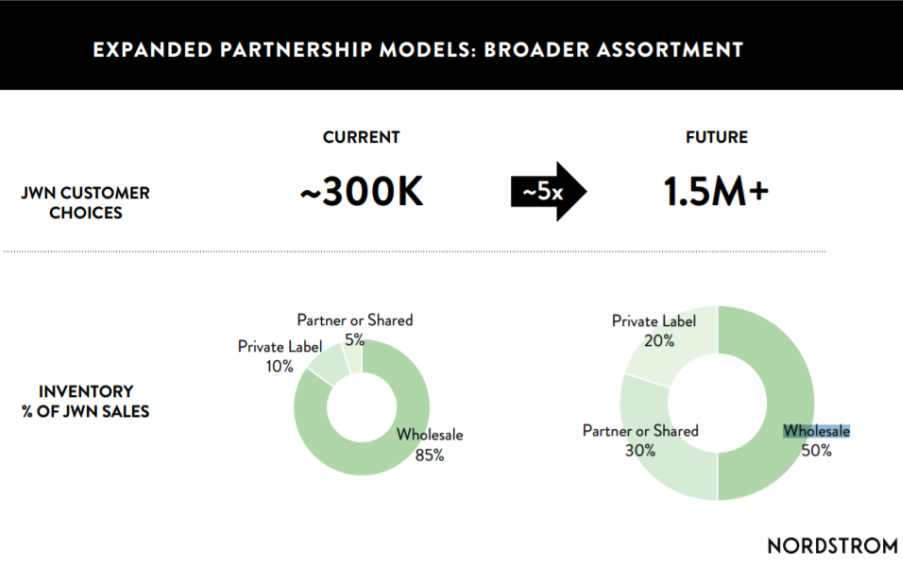

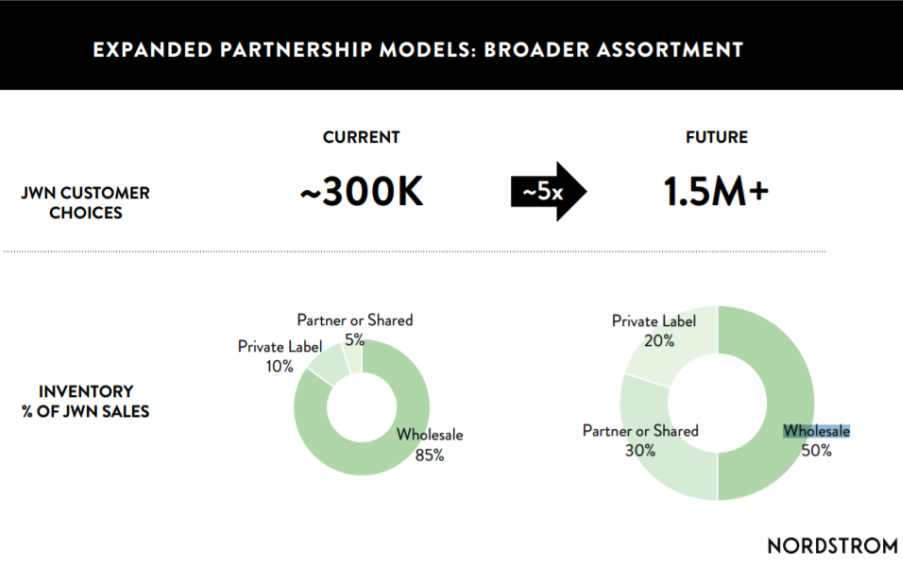

Nordstrom reported at its Investor Day in February 2021 that it intends to reduce its current wholesale business from 85% to 50% in the future, increase private labels from 10% to 20% and increase its partner or shared model from 10% of current sales to 20% of sales, as shown in the image below.

[caption id="attachment_129670" align="aligncenter" width="700"]

Source: Nordstrom

Source: Nordstrom[/caption]

Management said that extending beyond its traditional wholesale model allows Nordstrom to increase its selection while sharing risk and benefits with its partners. It also gives the retailer additional agility and flexibility to adapt to emerging preferences and trends. Nordstrom reported that it operates five primary partnership models:

- Private label and traditional wholesale, where the company owns the inventory

The company’s private-label business is called Nordstrom Product Group, with products offered at both Nordstrom and Nordstrom Rack. Management reported that it added designers to support its private-label group, help its labels to remain compelling and improve its speed to market. Nordstrom customers who buy private labels spend five times more than its average customer, make three times more trips per year and make significantly fewer merchandise returns, according to the company.

- Drop shipping and concession, where the vendor owns the inventory

Nordstrom stated that it has had great success with drop shipping: During its anniversary sale in 2020, over 25% of sales on Nordstrom.com were fulfilled via drop ship.

The company uses the concession model primarily with luxury brands, which gives the brands direct control of the merchandise offering while gaining access to Nordstrom’s customers. The benefit for Nordstrom is that it allows them to enhance the assortment in each location that has a concession arrangement.

- Revenue sharing, where the ownership of inventory is shared

Management said it sees significant opportunities for revenue sharing, through which the retailer can share both the risk and the benefits with brands. Nordstrom plans to expand its selection from approximately 300,000 customer choices today to over 1.5 million choices.

The Shift to DTC: Three Implications for US Department Stores

1. National Brands’ Exit from Wholesale at Department Stores Will Cause Portfolio Erosion

National brands are big sellers, giving consumers a reason to shop at department stores and multibrand retailers. The effect of losing a major brand can impact a department store’s overall sales. For example, NIKE’s announcement in March 2021 that it was leaving “undifferentiated retail partners” may affect the overall consumer shopping basket at Macy’s. When consumers have more than one brand that they shop for at a single destination, this helps to support traffic. The opposite is also true: If more than one brand leaves the department store or retailer that a consumer shops, this can influence shopping behavior. The exit of a major brand can impact other brands that sell through the same retailer, in the same way that other tenants may lose out on sales when a mall loses its anchor store.

We have seen an initial wave of brands exiting wholesale, particularly in the activewear space. Adidas, NIKE and Under Armour have all announced exits from major wholesale arrangements. We see this trend continuing as brands invest in their own channels. For example, on April 5, 2021, Chip Bergh, CEO at Levi’s, reported via CNBC that the company is aggressively pursuing its DTC business, seeking to grow DTC this year to 60% of revenues, up from 40% in 2020. While Levi’s has not announced plans to end its wholesale relationships, this highlights another retailer that is focusing on growing its own retail channels.

If wholesale partnerships decline, department stores will need to reassess their offerings and channels.

2. Hybrid Operating Models Are the Future

We see a mix of new operating models as representing the wave of the future, with department stores becoming less reliant on wholesale channels and initiating new partnership arrangements. We are already beginning to see this. Brands are becoming more self-reliant on their own channels of distribution, both online and offline. We see new, creative models emerging where smaller brands are seeking to leverage department stores and multibrand retailers as a launchpad to grow their business. In the future, we expect department stores to move toward showcasing smaller brands and becoming a discovery zone for emerging DTC brands. Portfolios will include wholesale relationships with selected major national brands alongside new arrangements with emerging brands.

Neighborhood Goods is a new kind of department store that is working with DTC brands in its physical locations. Launched in 2017 in the US, the retailer operates three small stores (10,000–25,000 square feet) and works with 50–60 DTC brands on a rotating basis in its stores. The stores are localized, meaning that its brands are in all three stores but at different mixes depending on the local market. Brands pay a fee for being in the store, and the company receives a revenue share on its sales. It is a win-win for the brand, as having brand space and exposure is more cost efficient than opening up a pop-up store.

3. Risk of Wholesale Disruption at the Three Major US Department Stores

The three major US department stores are taking different approaches to their brand portfolios and brand diversification, which we discuss below. In the near term, we see Kohl’s as being best positioned for growth with a diversified portfolio and Macy’s at most at risk from the shift to new operating models.

Kohl’s

Kohl’s is well positioned for growth through the diversification of its retail partnerships, having launched six major partnerships over the past year. Due to the diversity of brands in its portfolio and the addition of new brands, Kohl’s is reducing its risk should a major brand exit the relationship.

Kohl’s is building out its private-label brand portfolio and launched a sustainable athleisure brand for men and women in March 2021. The company is also growing its emerging brands; the department store launched Curated by Kohl’s to test DNVBs on a rotating basis and launched the Wellness Market to test new categories and brands.

Macy’s

Macy’s is the most at risk out of the three department stores for two reasons. First, the company reported its top 10 national brands accounted for 25% of its sales, which is high-risk should one or more brands decide to exit the wholesale arrangement. Secondly, in apparel as an example, six top brands span both men’s and women’s categories, so the exit of a top brand would impact multiple categories.

On the positive side, Macy’s reported that 20% of its digital sales in fiscal 2020 were from its vendor direct program, which is important part of the company’s strategy to grow its digital business to $10 billion by 2023.

Nordstrom

Nordstrom has initiated its own transition to a new operating model. With over 54% of its sales derived from digital sales in fiscal 2020, the department store is aggressively pursuing other alternatives to wholesale. Nordstrom is expanding partnerships and other retail agreements and is planning to grow its DTC business to $4.5 billion. This is a smart strategic move because Nordstrom is a fashion-first retailer; it will allow the department store to offer of-the-moment trends online while still maintaining a strong core of wholesale partnerships (50% of its trusted brand partners).

The company also plans to increase its online product inventory to five times what it currently offers today. Thus, the offerings online will be an endless aisle of products from brands that are not available in the stores in many cases—a forward-looking strategy.

What We Think

As digital sales are rising, retailers and brands alike are changing how they do business to accommodate consumers’ changing demand. This is causing a shift in the arrangements that department stores had with the major brands in their portfolio; previously, they had agreements where they purchased inventory at the onset of the season at prearranged costs; these relationships are changing because brands are realizing that it is more profitable to sell through their own channels directly to consumers. The speed of DTC is also accelerating the shift, as the channel is faster and more agile than wholesale.

We project that department stores will reduce their reliance on wholesale in future, and more creative selling models will emerge through which smaller brands will leverage department stores as a platform to grow their businesses. We see department stores leveraging DTC and DNVBs to partner on revenue-sharing opportunities through dropshipping and concessions. We expect the model will benefit smaller and emerging brands in particular that may not have had been afforded exposure previously.

We expect department stores to move toward showcasing smaller brands and becoming a discovery zone for emerging DTC brands while also maintaining a wholesale relationship with selected major national brands.

Source: Company reports[/caption]

3. Rapidly Shifting Consumer Trends

Selling direct to consumers can enable brands to respond to consumer trends more quickly. This includes both digitally native vertical brands (DNVBs)—which are brands that are born online and sell and ship their own product—and DTC brands that sell to consumers directly through their own channels but may also sell their products to retail partners for distribution.

One advantage of selling through DTC and DNVB models is agility, meaning that if a style is not trending, the brand may replace the style on its website with a more popular option. The wholesale model does not allow for this agility. With the Covid-19 pandemic having caused volatility in consumer demand, the ability to adapt quickly to market trends has become even more important.

Source: Company reports[/caption]

3. Rapidly Shifting Consumer Trends

Selling direct to consumers can enable brands to respond to consumer trends more quickly. This includes both digitally native vertical brands (DNVBs)—which are brands that are born online and sell and ship their own product—and DTC brands that sell to consumers directly through their own channels but may also sell their products to retail partners for distribution.

One advantage of selling through DTC and DNVB models is agility, meaning that if a style is not trending, the brand may replace the style on its website with a more popular option. The wholesale model does not allow for this agility. With the Covid-19 pandemic having caused volatility in consumer demand, the ability to adapt quickly to market trends has become even more important.

Source: Nordstrom[/caption]

Management said that extending beyond its traditional wholesale model allows Nordstrom to increase its selection while sharing risk and benefits with its partners. It also gives the retailer additional agility and flexibility to adapt to emerging preferences and trends. Nordstrom reported that it operates five primary partnership models:

Source: Nordstrom[/caption]

Management said that extending beyond its traditional wholesale model allows Nordstrom to increase its selection while sharing risk and benefits with its partners. It also gives the retailer additional agility and flexibility to adapt to emerging preferences and trends. Nordstrom reported that it operates five primary partnership models: