Source: Company reports/FGRT

Fiscal 3Q17 Results

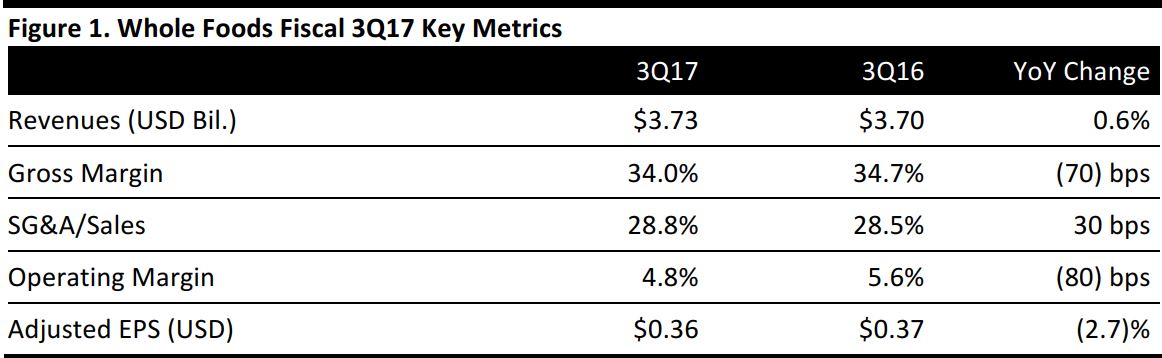

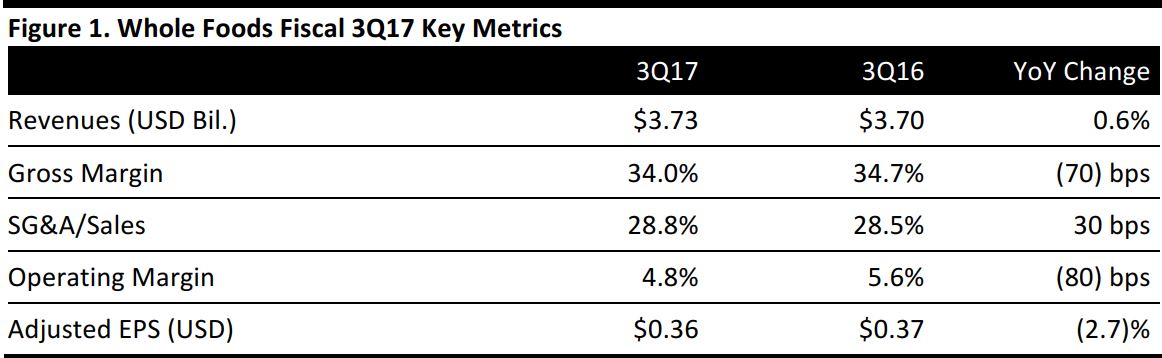

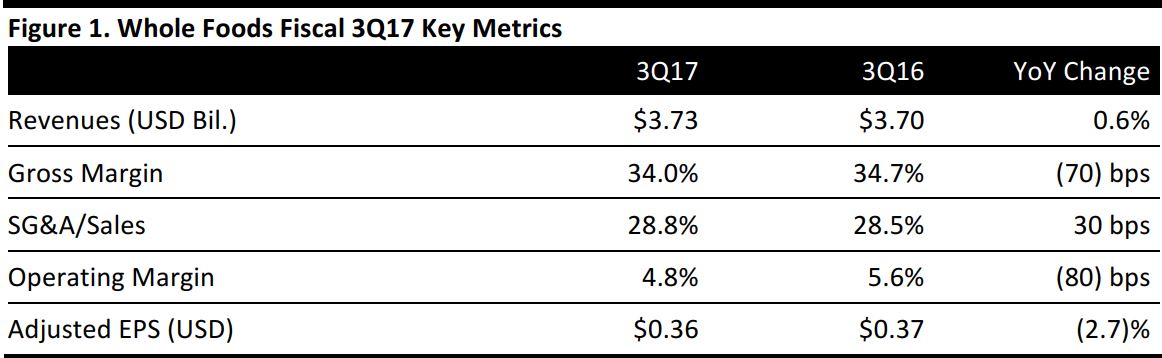

Whole Foods reported fiscal 3Q17 adjusted EPS of $0.36, ahead of the $0.33 consensus estimate but down 2.7% year over year. Total revenues were $3.73 billion, in line with the consensus estimate and up 0.6% from the year-ago quarter.

Whole Foods’ same-store sales decreased by 1.9% from the year-ago quarter, compared with a projected drop of 2.2%. The period marked the eighth straight quarter of comp declines, which have been driven by tougher competition from traditional grocers and big-box retailers that have expanded their organic offerings. Kroger and Walmart, for example, have aggressively expanded their organic offerings, often at lower prices.

While same-store sales declined in the period, the drop was less severe than expected and not as steep as in the previous quarter. Management also said that same-store sales had turned positive during the first three weeks of the current quarter.

In the third quarter, Whole Foods opened six stores, including one relocated store. The company currently has more than 465 stores in the US, Canada and the UK. The company did not host an investor call because of the pending acquisition by Amazon.

Whole Foods agreed to be acquired by Amazon in June for $42 a share (with the deal valued at $13.7 billion), and said it expects to close the deal during the second half of this year. John Mackey, Cofounder and CEO, will remain CEO after the deal closes, and the chain will continue to operate under the Whole Foods brand. During a town hall meeting with Whole Foods employees last month, Mackey said that he thinks Amazon can help the company’s efforts to cut costs and introduce a loyalty program.

FY17 Outlook

The company is not updating its outlook for the rest of the year, citing the pending takeover by Amazon. Previously, Whole Foods expected FY17 EPS of $1.30 or greater, compared with $1.55 in FY16; consensus calls for full-year EPS of $1.31. The company had projected a comp decline of about 2.5% versus the consensus estimate of a 2.3% decline.