Source: Company reports

3Q16 RESULTS

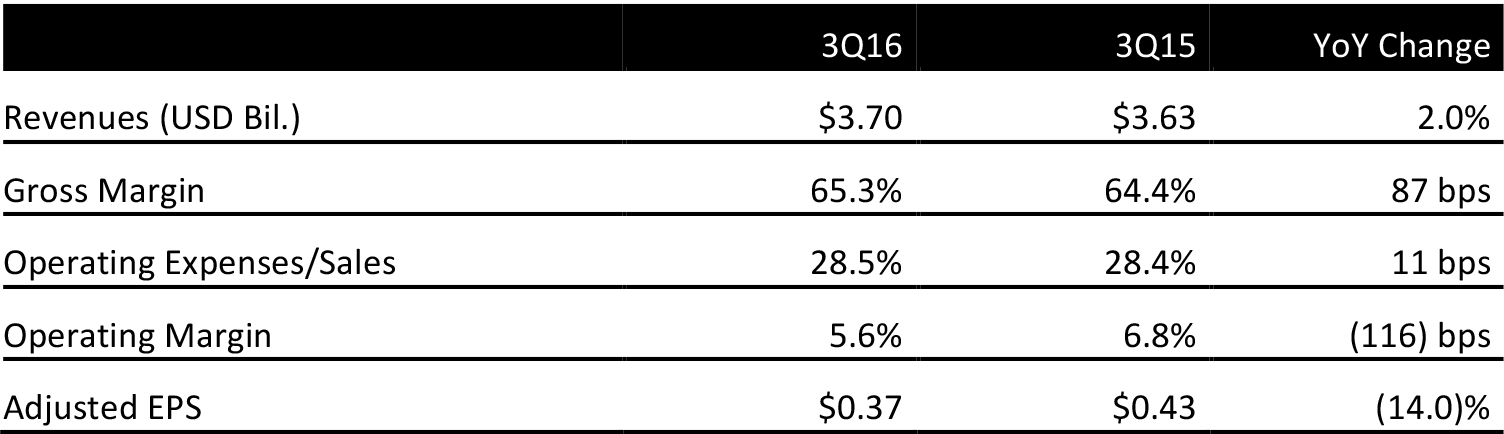

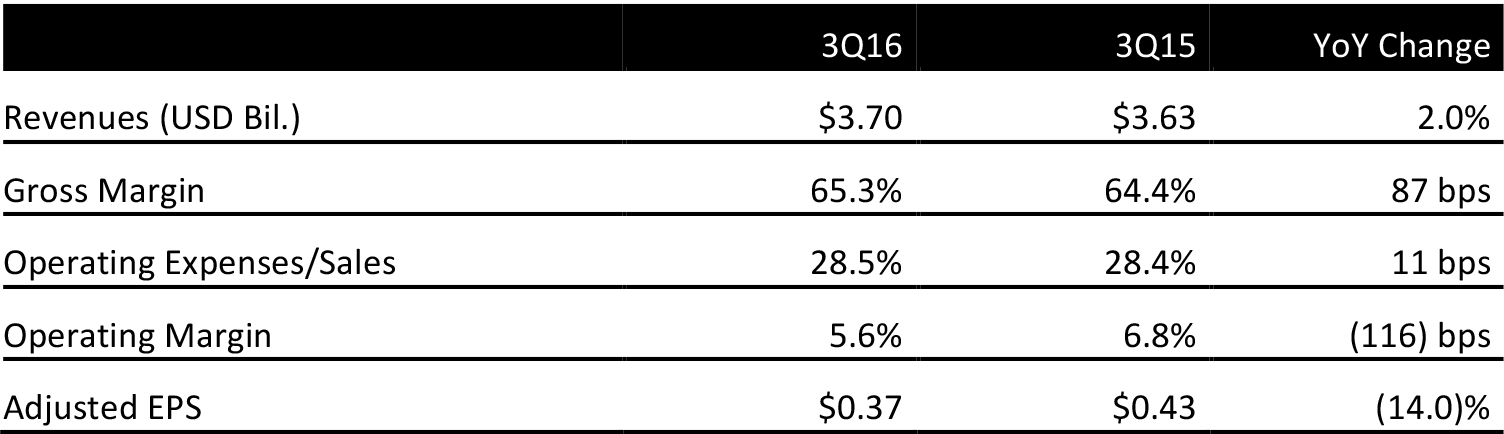

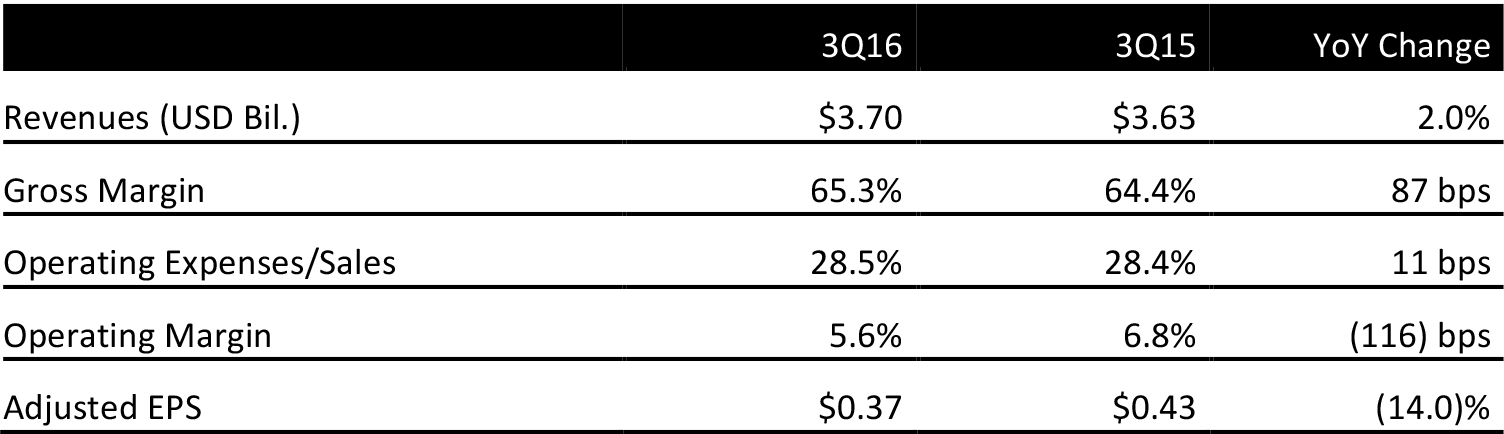

Whole Foods Market reported fiscal 3Q16 revenues of $3.7 billion, up 2% year over year and roughly in line with the consensus estimate.

Comparable store sales decreased by 2.6% in the quarter and transactions were down 2.7%. The company’s average price per item decreased in the period, although average items per basket increased.

SG&A increased by 11 basis points, to 28.5% of sales. During the quarter, the company produced $189 million in cash flow from operations.

In the quarter, Whole Foods opened 12 new stores, including its first 365 by Whole Foods Market, which it says is designed around affordability and convenience and is supported by enhanced digital experiences.

Reported adjusted EPS was $0.37, which was in line with the consensus estimate but represented a 14% decrease from EPS of $0.43 in the year-ago quarter.

2016 OUTLOOK

Whole Foods expects sales growth of approximately 2% in 4Q16 and EPS of $0.23–$0.24, if comparable store sales are in line with the 2.4% year-to-date decrease and healthcare costs continue.

The company expects some ongoing offsetting impact from its value strategy and disinflation. Whole Foods expects to open five new stores by the end of 4Q16. In its 2Q16 report, the company predicted same store sales of (2)% and sales growth of up to 3%.