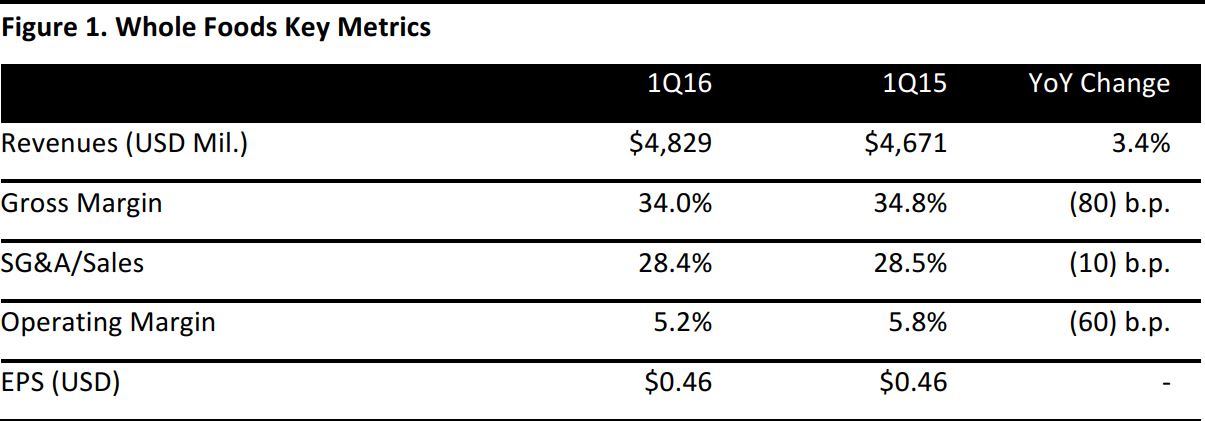

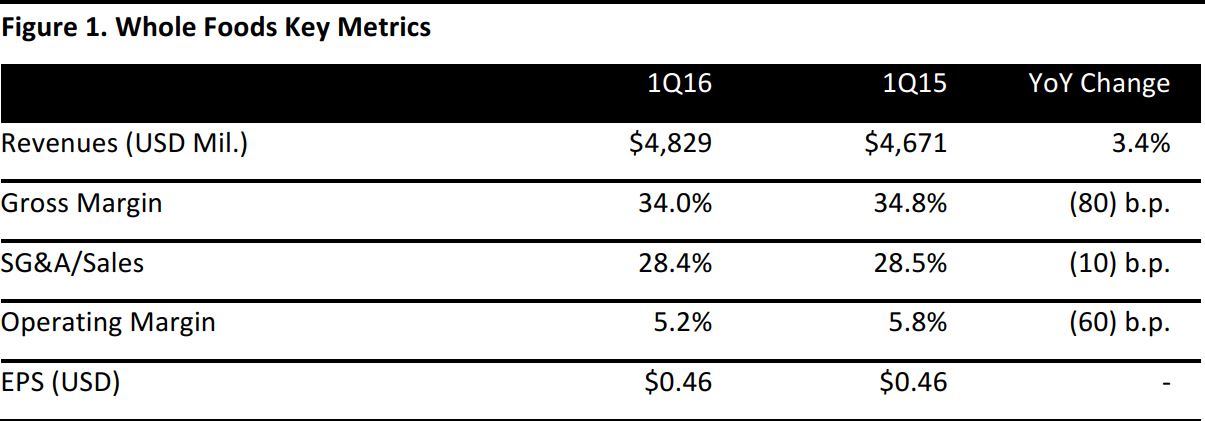

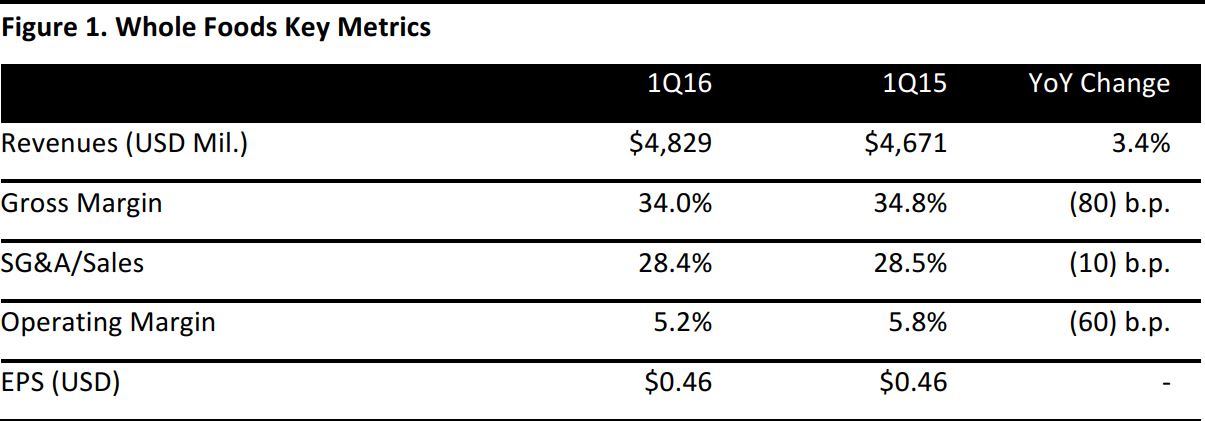

Source: Company reports

Whole Foods reported 1Q16 EPS of $0.46 versus the consensus estimate of $0.40.

Total revenue was $4.83 billion, an increase of 3.4% over the prior year period, versus expectations of $4.81 billion. Comps declined by 1.8%, versus consensus of a 2.1% decline. The decrease was driven by a 0.2% decline in basket and a 1.6% decline in transactions.

Comps for the first three weeks of 2Q16 declined by 2.8%, following a modest deceleration in trends over the first quarter.

Management provided guidance for the fiscal year. EPS is expected to be $1.53 or greater, in line with consensus of $1.53. Sales growth is expected to be 3%–5%, driven in part by the addition of 30 new stores, including three 365 by Whole Foods Market stores and comps of (2)% to 0%. Square footage growth is expected to be at least 7%. The company sees potential for 1,200 Whole Foods stores in the US, with the new 365 format expanding the growth opportunity beyond that. EBITDA margins are expected to be approximately 8.5% and capex is expected to be 5% of sales.

Results are highly dependent on comps, which have been particularly difficult to predict, given the competitive landscape. Management is hopeful comps will improve over the course of the year as comparisons get easier and sales-building initiatives gain traction. However, there could be some offsetting impact from a ramp-up in price investments and promotions throughout the year.