DIpil Das

Where the US Shops for Groceries

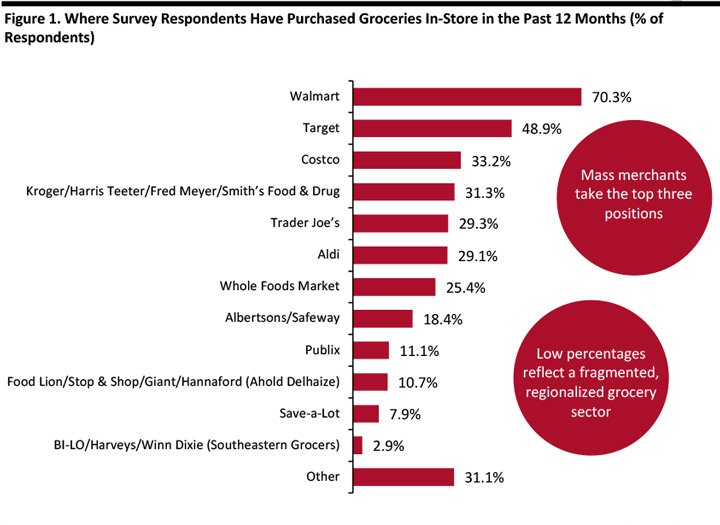

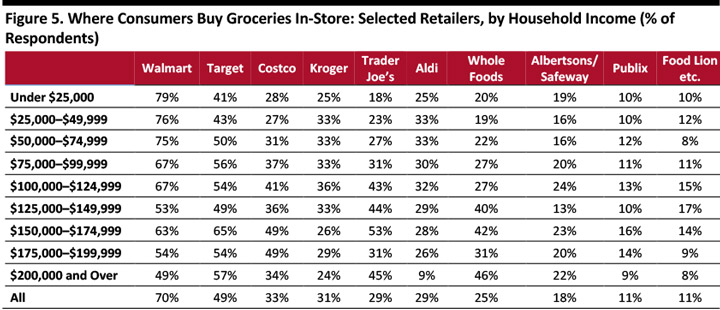

The US grocery market is fragmented and regionalized, and sees strong positions held by nonspecialist retailers such as Walmart, Target and Costco. These mass merchants were the top three retailers from which respondents said they had bought groceries in the past 12 months. Two discount formats — Trader Joe’s and Aldi — are also among the most-shopped grocery retailers. Traditional supermarket retailers are represented by Kroger, Albertsons, Publix and Ahold Delhaize’s various banners. [caption id="attachment_89230" align="aligncenter" width="720"] Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019

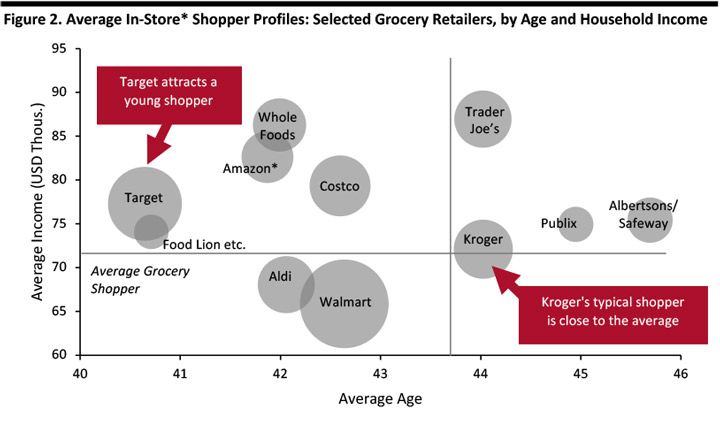

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption] The following chart presents the average age and household income of shoppers at each of the top grocery retailers, with bubble size representing their scale.

- By age and affluence, Kroger’s typical shopper is very close to that of the average grocery shopper.

- Target attracts a younger shopper: As we show later, shopping at mass merchandisers for groceries tends to decline with age.

- Supermarket retailers tend to attract an older average shopper.

- In the discount segment, typical shoppers at Aldi and Trader Joe’s are very different from each other, with Trader Joe’s customers among the most affluent in the sector.

- For comparison, we include Amazon shoppers (online) in the chart below (the only data point not representing in-store shoppers). They show a very similar age/affluence profile to Whole Foods Market shoppers (in-store).

*Amazon is for online shoppers

*Amazon is for online shoppers Bubble size reflects number of shoppers

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019

Source: Coresight Research [/caption]

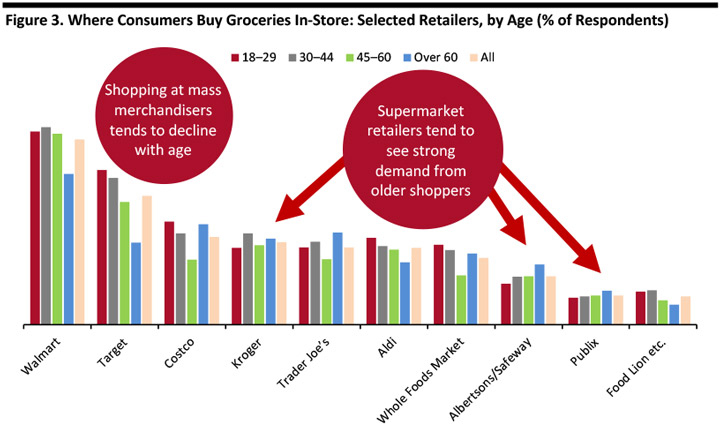

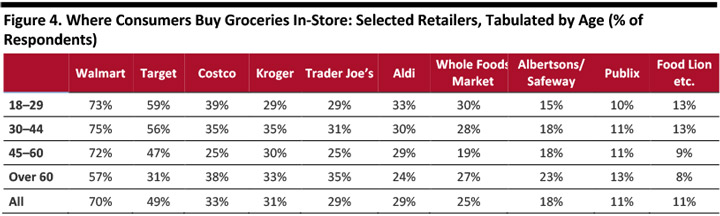

By Age: Mass Merchandisers Attract Younger Consumers

Mass merchandisers Walmart and Target attract a younger shopper, with demand peaking among those aged under 45. Target sees a more pronounced skew to younger shoppers than Walmart. A number of supermarket retailers see higher rates of shopping among older consumers, though Kroger sees a more even distribution than rivals such as Albertsons and Publix. [caption id="attachment_89232" align="aligncenter" width="720"] Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption] [caption id="attachment_89207" align="aligncenter" width="720"]

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption]

By Income: Target Appeals Across Incomes

Shopping at Walmart tends to decline as income goes up. However, Target sees strong shopper numbers across the income bands, peaking in the $150,000–$174,999 income band. Costco and Trader Joe’s see a similar income peak to Target. [caption id="attachment_89208" align="aligncenter" width="720"] Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019

Base: 1,803 US Internet users ages 18+ who have purchased groceries in-store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption]