Introduction

Where do Americans shop for groceries, and how do those shopping trends differ by characteristics such as age and affluence? In this brief report, we provide answers to those questions. We look at the characteristics of shoppers at major grocery retailers, with a focus on age, affluence and membership of Amazon’s Prime service. This report forms part of our

How the US Shops series of reports, each of which is based on proprietary consumer research.

The data in this report come from a proprietary online survey of 1,813 US adults who had bought groceries in-store in the past 12 months, undertaken in March 2018. All survey figures in this report represent the percentage of respondents selecting the respective option.

For data on grocery e-commerce, see our forthcoming report

US Online Grocery Consumer Survey: Amazon Is the Most-Shopped Retailer, but Not Yet a Full-Order Grocery Destination.

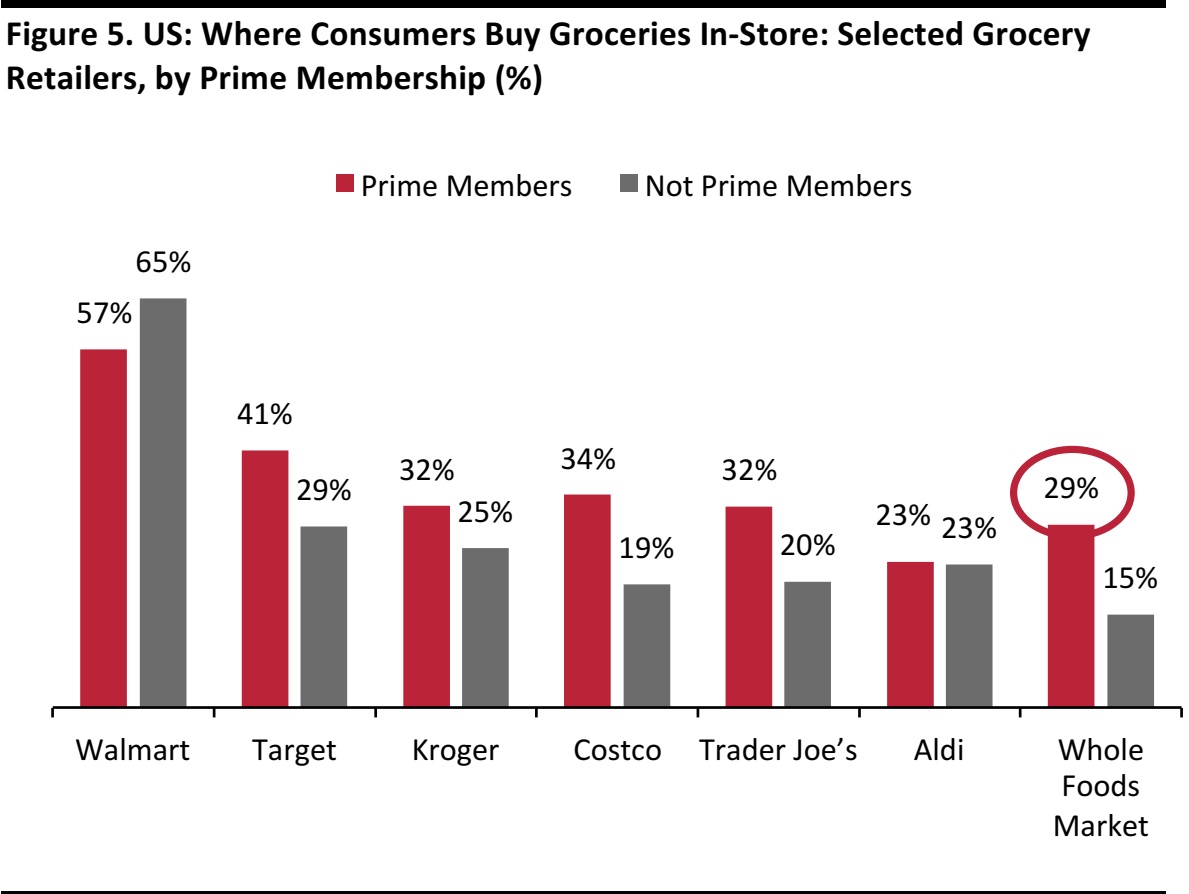

Where America Shops for Groceries

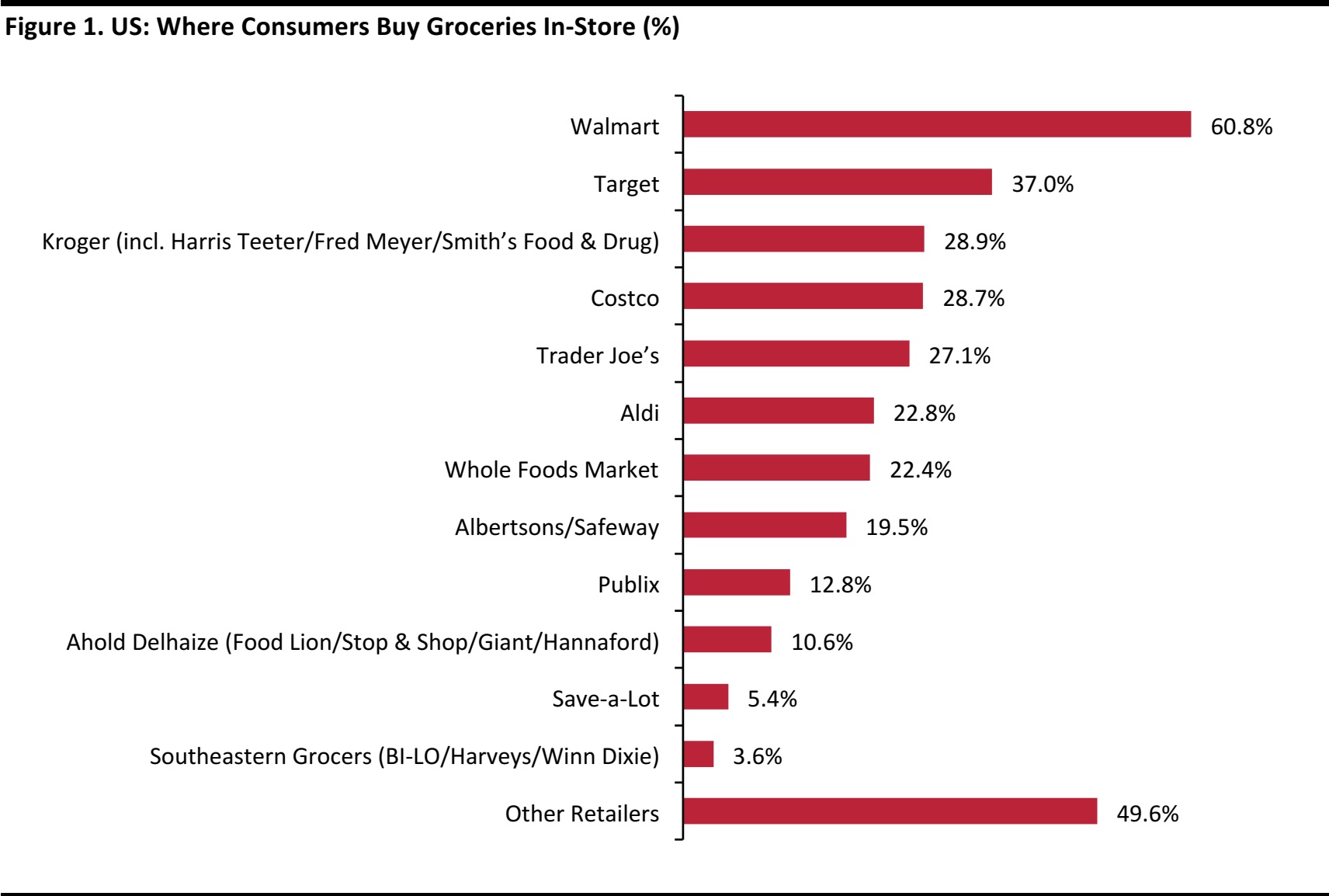

Unsurprisingly, Walmart dominates the ranking of grocery retailers, with almost 61% of survey respondents saying they had bought groceries there in the past 12 months. Other nonspecialist retailers Target and Costco also take leading positions, and this reflects the fragmented nature of the US grocery market: a large number of supermarket chains are regional operators, and even Kroger, the leading supermarket retailer, does not have national coverage.

This fragmentation also means that chains with a more specialized positioning, such as Trader Joe’s and Whole Foods Market, rank relatively high simply because of their broad geographical coverage. And the long tail of regional grocery chains results in a large number of respondents selecting “other retailers” in surveys such as ours.

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months.

Source: Coresight Research

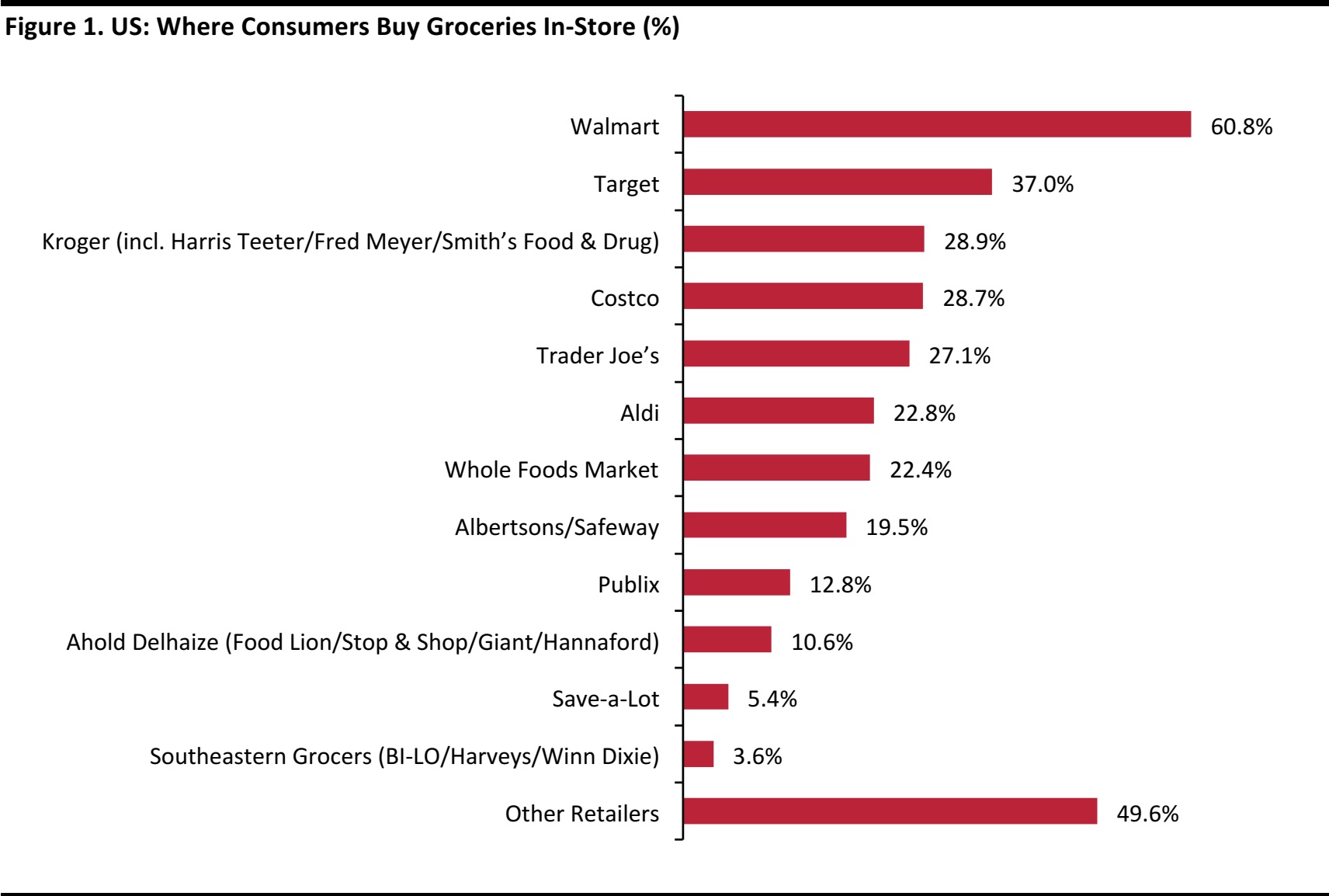

Shopper Profiles by Age and Affluence

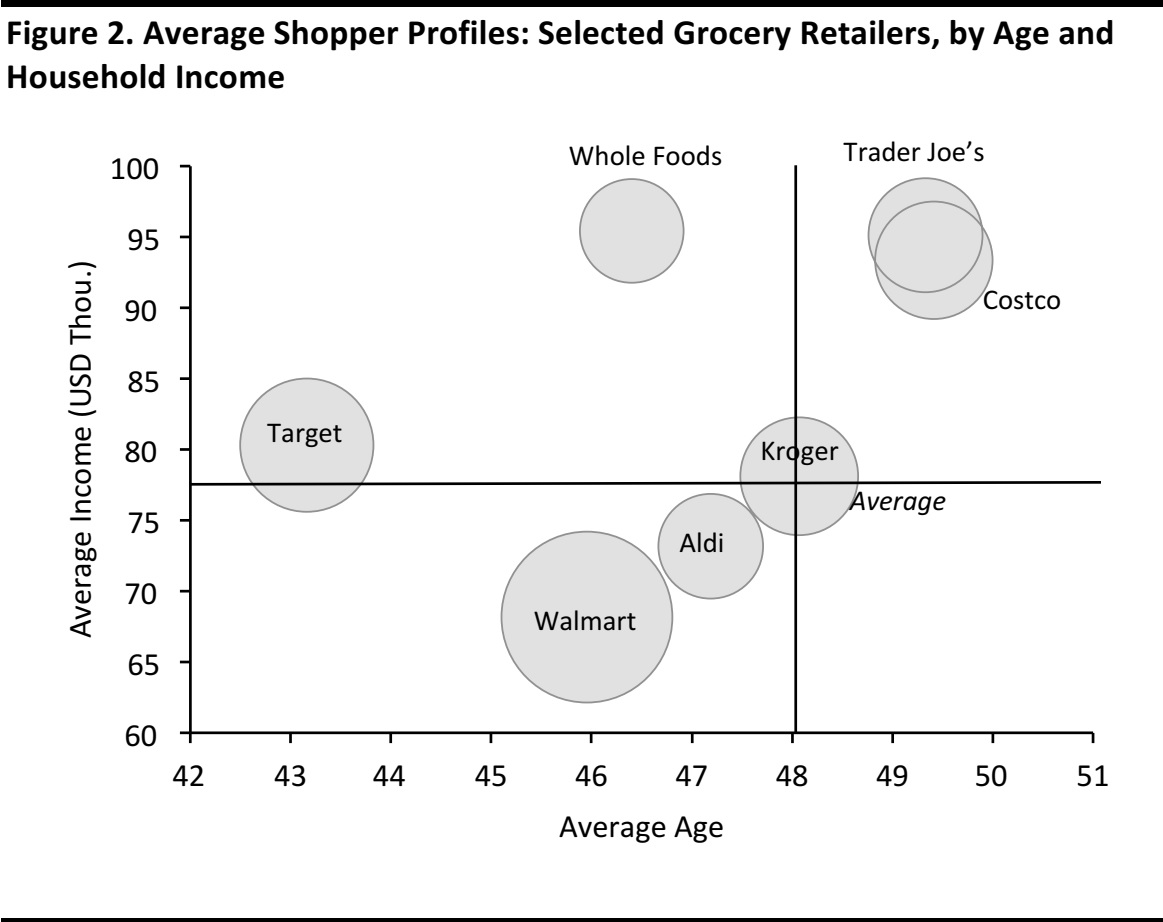

The following chart presents the average age and household income of shoppers at each of the top grocery retailers, with bubble size representing their scale.

- Kroger’s average shopper is almost identical to the overall average grocery shopper in terms of age and affluence. Aldi is very close to the overall average, as well. Aldi’s proximity to Kroger and Walmart on these metrics could alarm these retailers, given the discounter’s aggressive expansion: in June 2017, Aldi announced that it was aiming to open 900 new stores by the end of 2022.

- Target is highly differentiated by age, attracting a notably younger grocery shopper: its average grocery shopper is aged 43, versus 48 for all grocery shoppers and 46 at Walmart. We see an over representation of young shoppers at Target in other categories, too: we have previously noted Target’s popularity among millennial beauty shoppers.

- Costco, Trader Joe’s and Whole Foods attract shoppers that are significantly more affluent than the overall average grocery shopper.

Bubble size represents shopper numbers.

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months.

Source: Coresight Research

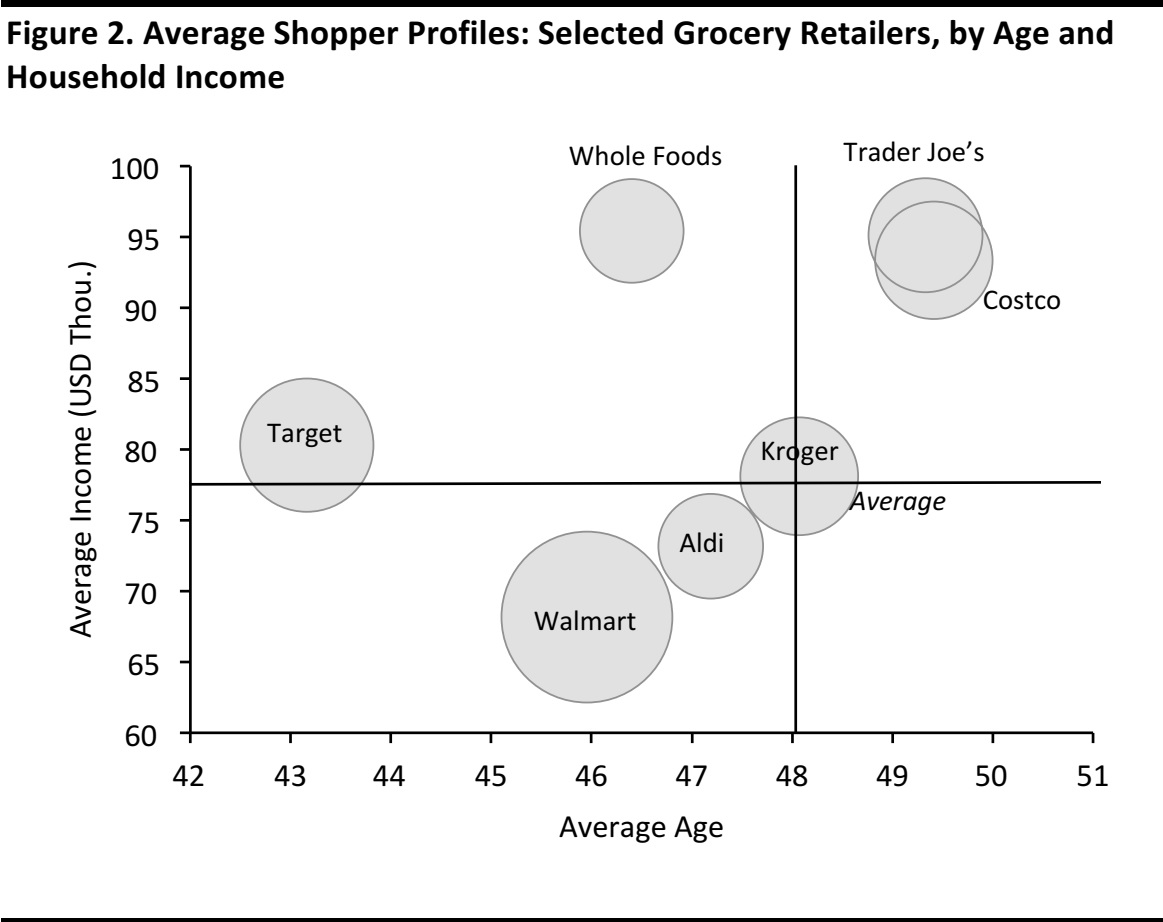

Mass Merchandisers Attract Younger Shoppers

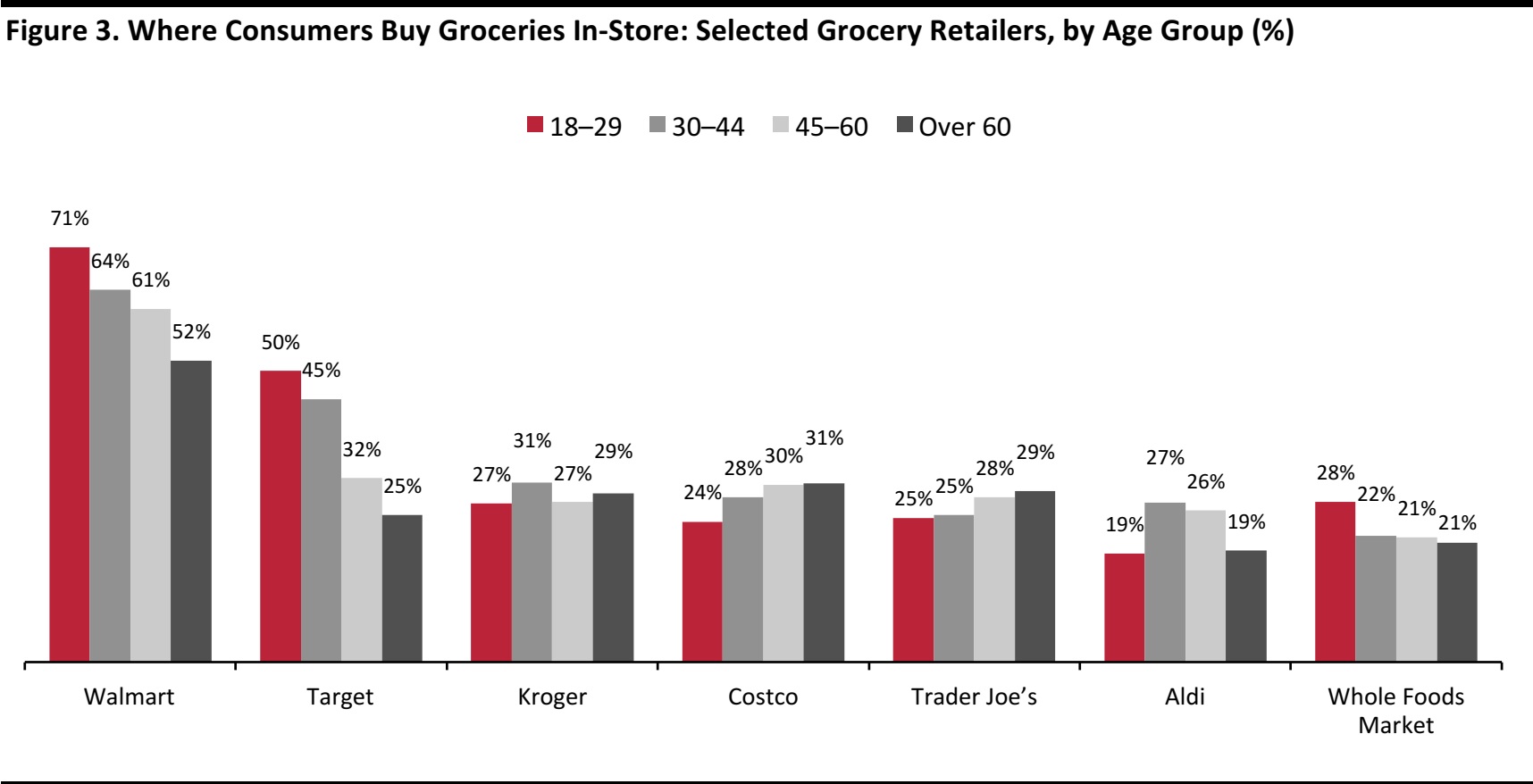

Younger shoppers flock in disproportionate numbers to mass merchandisers Walmart and Target for their groceries. For example, 18–29-year-olds are twice as likely as those over 60 to buy groceries from Target stores, as shown in the chart below. We have

previously noted that millennials tend to be frugal grocery shoppers, and this budget consciousness should remind us that millennials are more diverse than the typical stereotype of a healthy-living, ethical consumer suggests.

A number of supermarket retailers such as Trader Joe’s (charted) and Albertsons/Safeway and Publix (not charted) see a skew toward older shoppers, as does Costco.

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months.

Source: Coresight Research

Costco Attracts More Affluent Shoppers

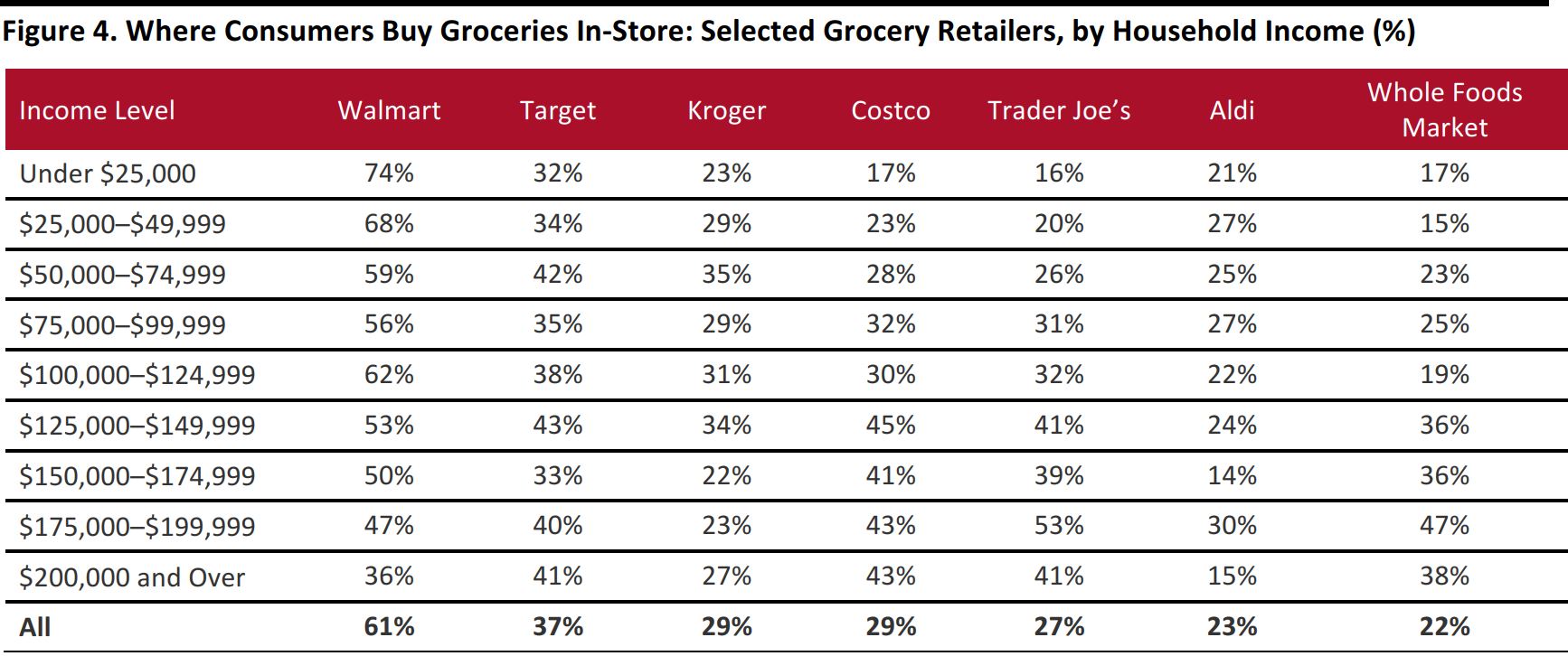

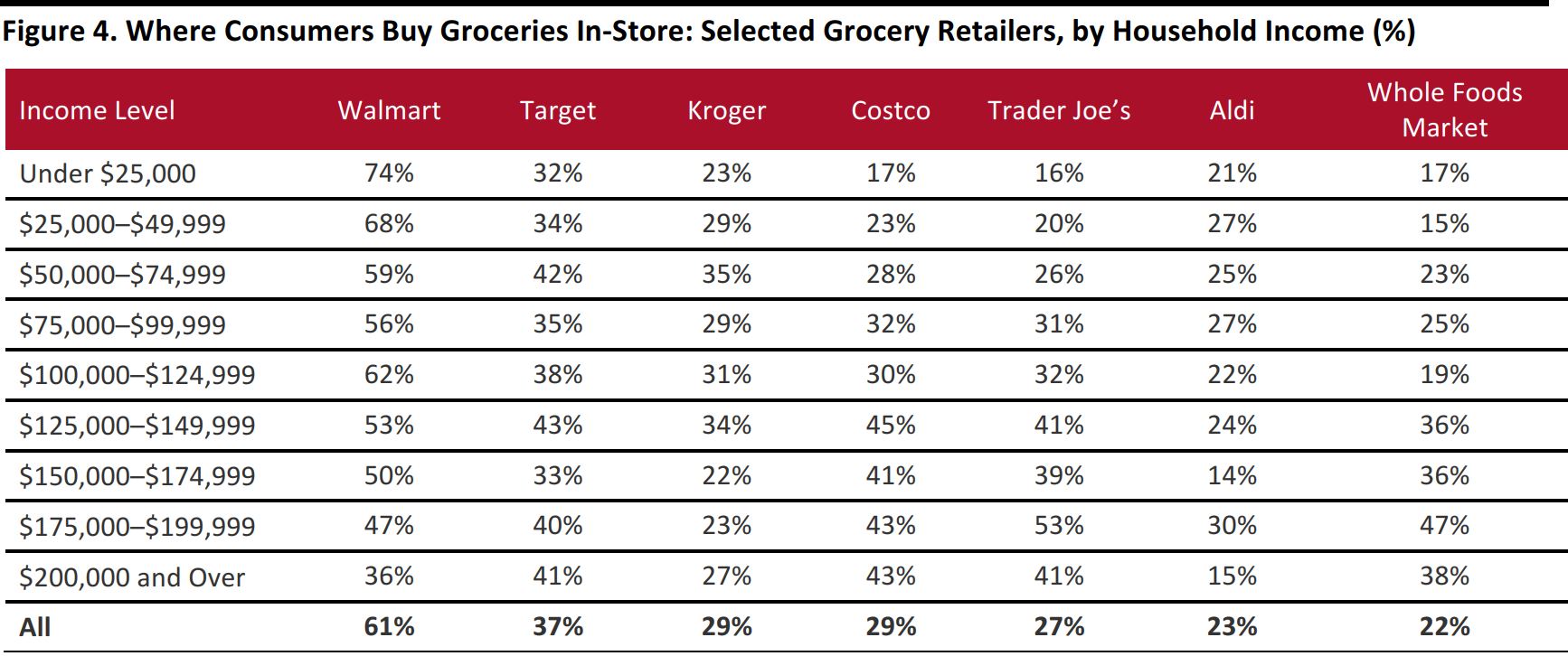

Among these leading retailers, Walmart sees by far the greatest variation in shopping levels by income: some 74% of those with an income of less than $25,000 buy groceries from Walmart, compared to 36% of those with an income of $200,000 or more. Target and Kroger see more consistent levels of shopping across the income scale, although penetration tends to increase as household income rises. Costco sees a skew toward more affluent households.

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months.

Source: Coresight Research

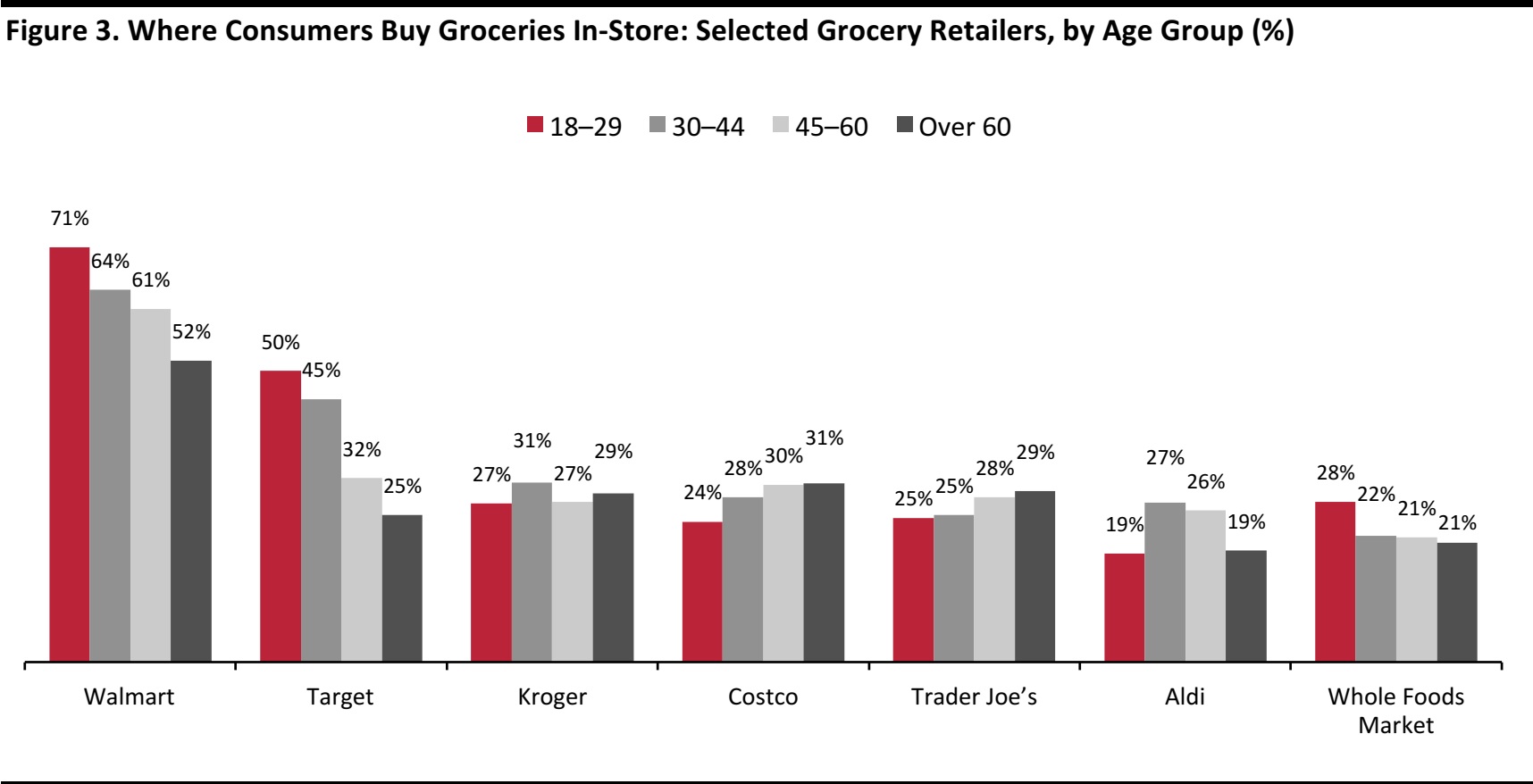

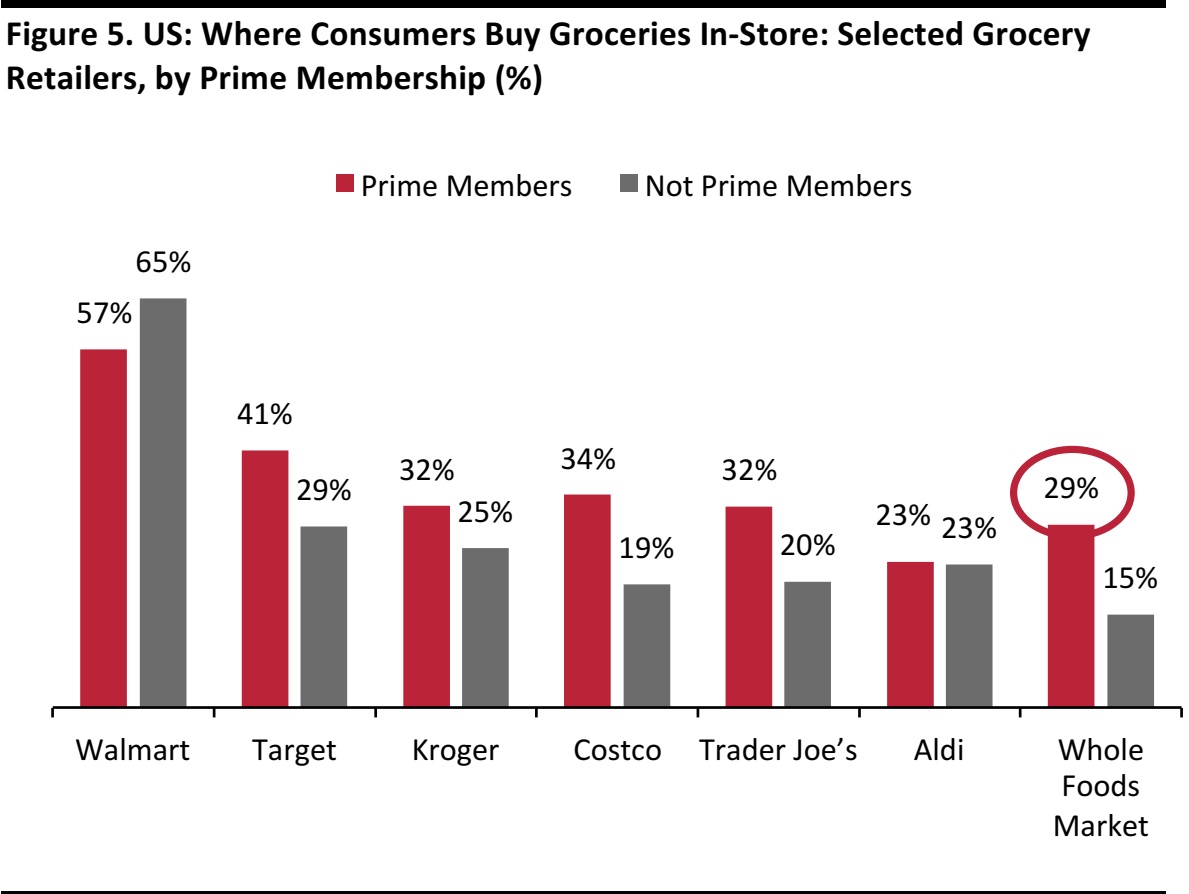

Prime Members Almost Twice As Likely to Shop at Whole Foods

Why did Amazon acquire Whole Foods Market? One reason could be that Amazon Prime members turn to the store for their grocery shopping in disproportionate numbers. In fact, Prime members are almost twice as likely to buy groceries from Whole Foods than those without Prime membership are, and almost one in three Prime members have shopped at Whole Foods in the past year.

The crossover between Prime members and Whole Foods shoppers is likely due to their characteristic of being more affluent: our survey confirmed that Prime membership rates tend to increase in step with household income, and we have already noted the relative affluence of Whole Foods shoppers.

Prime members are notably more prominent than nonmembers among grocery shoppers at Target, and this is a trend we also saw among apparel shoppers at Target, as we discussed in

our recent report on Amazon apparel.

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months.

Source: Coresight Research

Key Takeaways

- By age and affluence, the average shopper at Aldi is very similar to that at Walmart and Kroger, and this suggests that Aldi’s expansion could pose a particular threat to these two retailers.

- The much-sought-after millennial shopper is more than just the typical stereotype of a healthy-living, ethical shopper: young consumers tend to be frugal grocery shoppers and they turn largely to mass merchandisers for groceries.

- Nevertheless, Walmart and Target see some key differences: Target attracts significantly younger shoppers, Target sees more consistent shopper penetration across income groups and Amazon Prime members over index at Target but under index at Walmart.

- Amazon Prime members already over index strongly among shoppers at Whole Foods Market, and this is likely a reflection of their characteristic of having a higher income level.