Introduction

In this brief report, we look at key demographic characteristics of shoppers at America’s biggest apparel retailers. Based on a Coresight Research consumer survey, we consider the age and affluence of shoppers at major clothing and footwear retailers. This report forms part of our How the US Shops series of reports, each of which is based on proprietary consumer research.

The data in this report come from an online survey undertaken in January 2018 of 1,564 US adults who had bought clothing or footwear in the past 12 months. All survey figures in this report represent the percentage of respondents selecting the respective option.

Where America Shops for Apparel

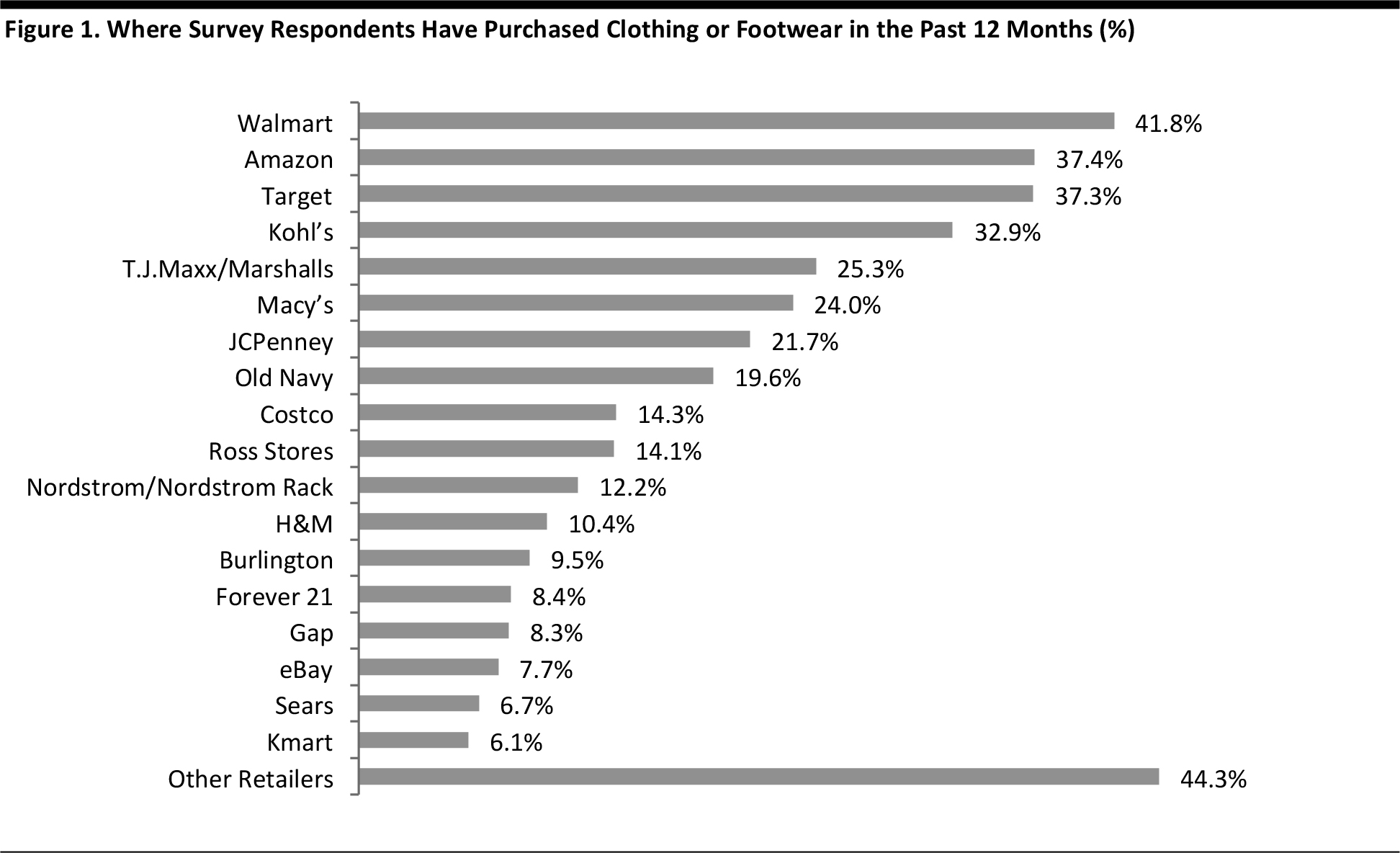

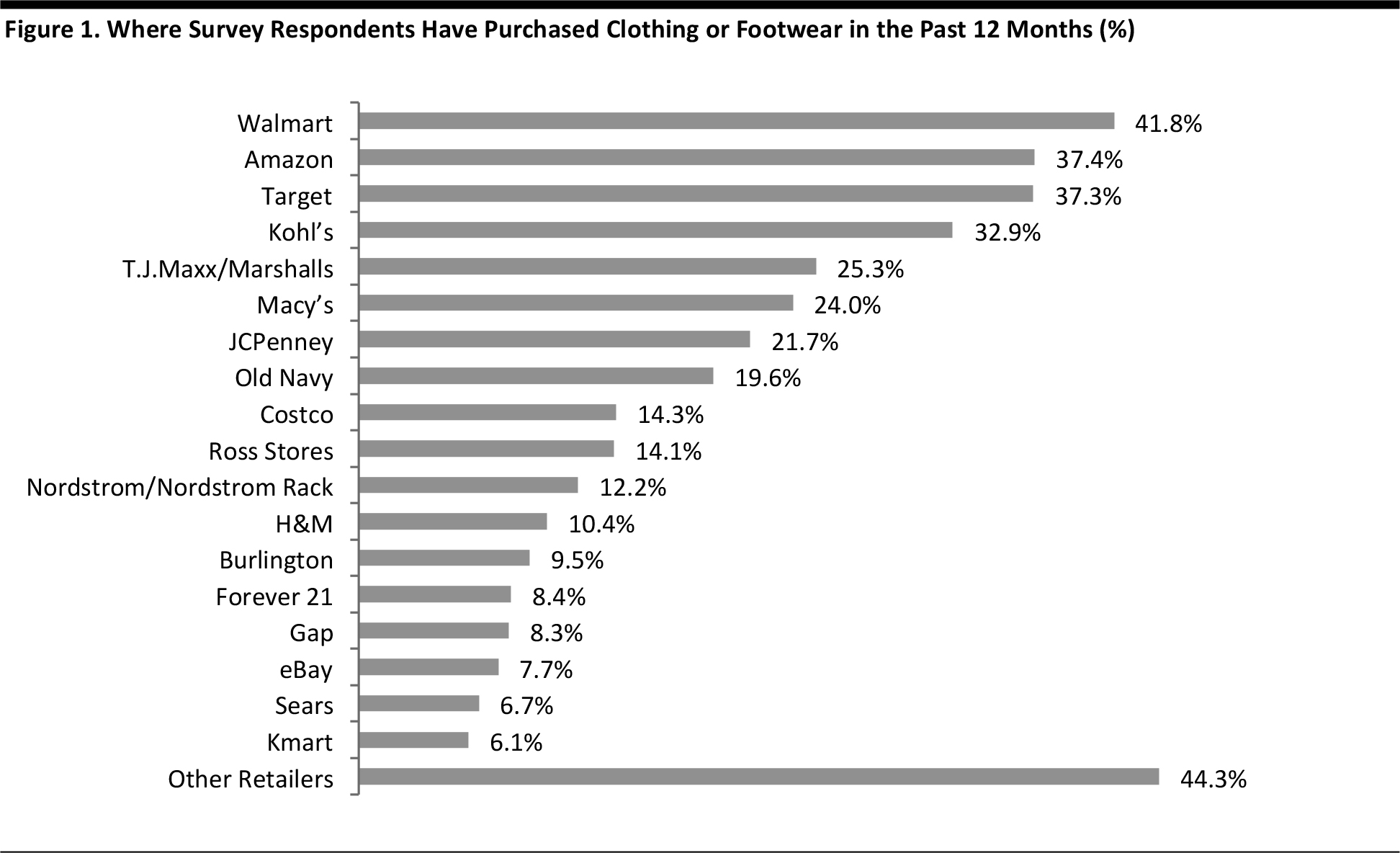

We begin with a ranking of America’s top retailers, by number of shoppers. Walmart, Amazon and Target lead this ranking, with major department stores and T.J.Maxx/Marshalls comprising a second tier.

We discuss Amazon’s position in the apparel market in more detail in our report

Deep Dive: Amazon Apparel—US Survey Reveals What Shoppers Buy, Which Retailers They Have Switched from and Their Attitudes Toward Amazon as a Fashion Retailer

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to select any options from the list provided.

Source: Coresight Research

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to select any options from the list provided.

Source: Coresight Research

Shopper Profiles by Age and Affluence

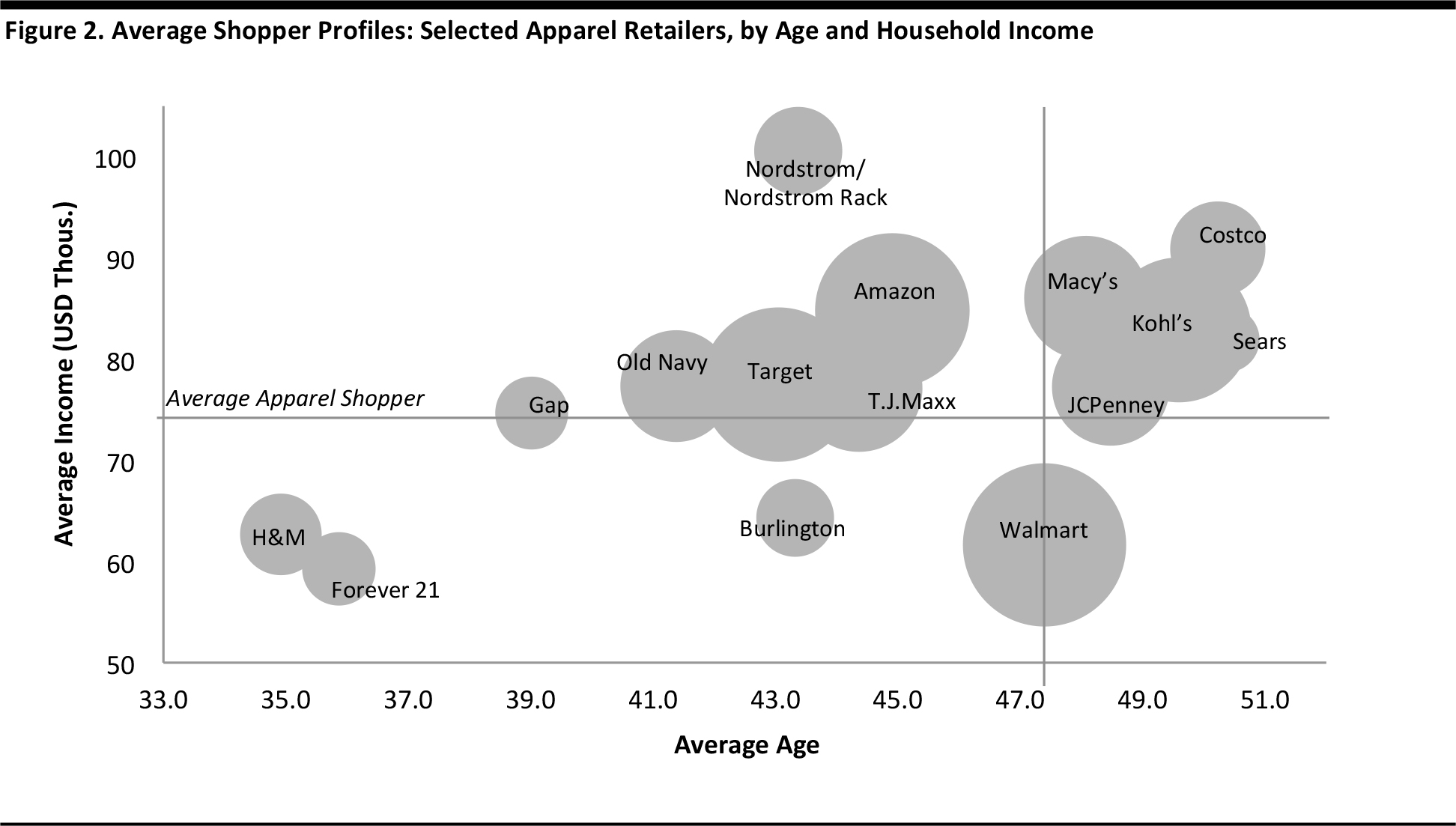

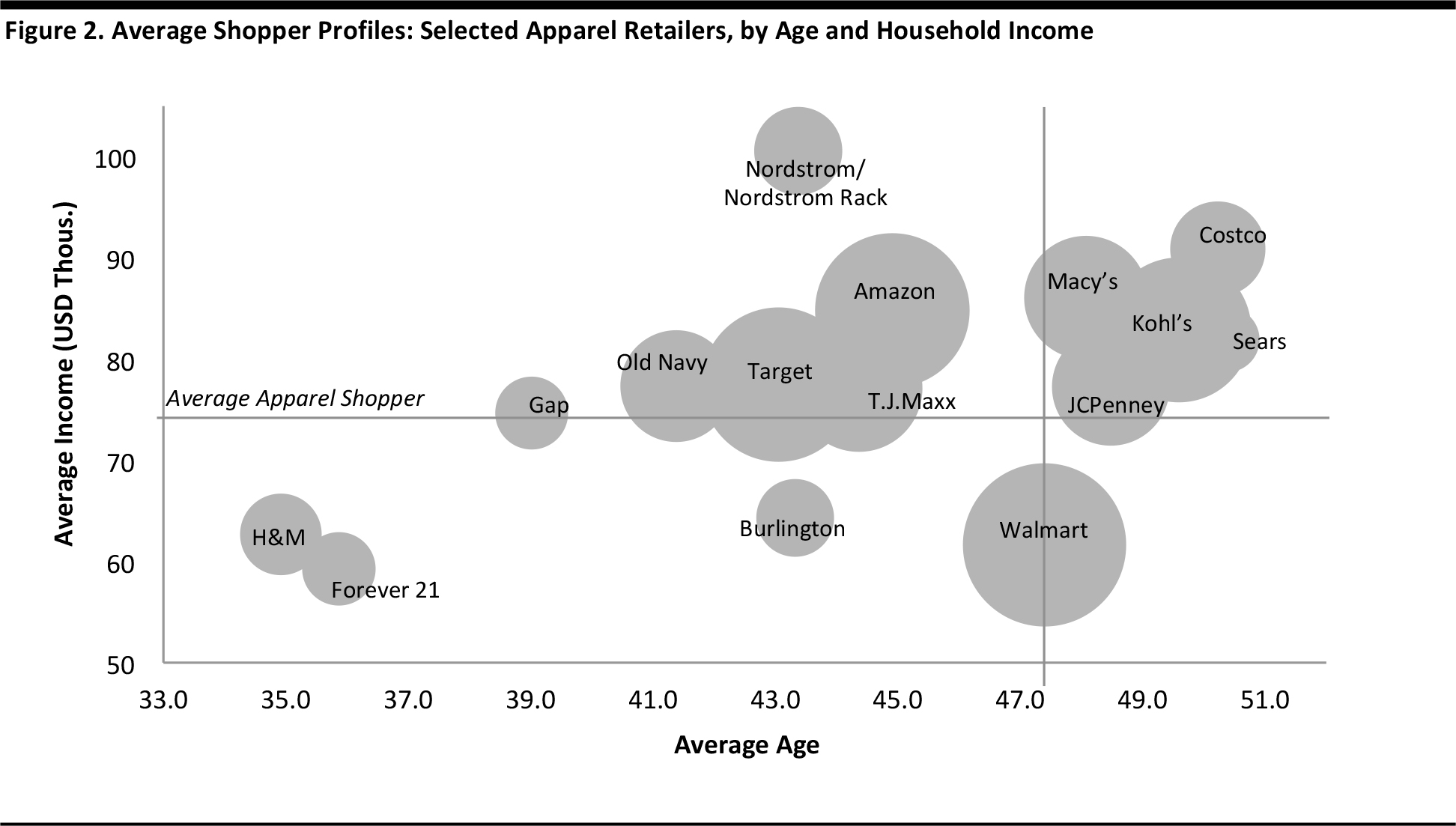

The following chart presents the average age and household income of shoppers at each of the top apparel retailers, with bubble size representing their scale.

- The average department store shopper is slightly older and more affluent than the average apparel shopper. Of the major department stores, Macy’s attracts a slightly younger average shopper; as we show later, Macy’s appeal is more even across age groups than that of rivals such as Kohl’s.

- Costco attracts an older, more affluent shopper, and we found a similar picture for the grocery category in our recent counterpart to this report, Who Shops Where for Groceries—A Look at US Grocery Store Demographics.

- Target attracts shoppers that are typically younger than the average shopper. We have previously noted Target’s popularity among millennials for groceries and beauty products. Target’s shoppers are very close to the average in terms of income and, as we show later, this is due to the retailer’s consistent appeal across all income groups.

- Walmart’s average apparel shopper is significantly less affluent than the average. More suprisingly, so is H&M’s average shopper, as its younger shoppers have not reached their peak earnings.

- The relative youth of Gap’s average shopper may surprise some readers. Its shoppers are dominated by those aged under 45.

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

T.J.Maxx Wins Younger Shoppers

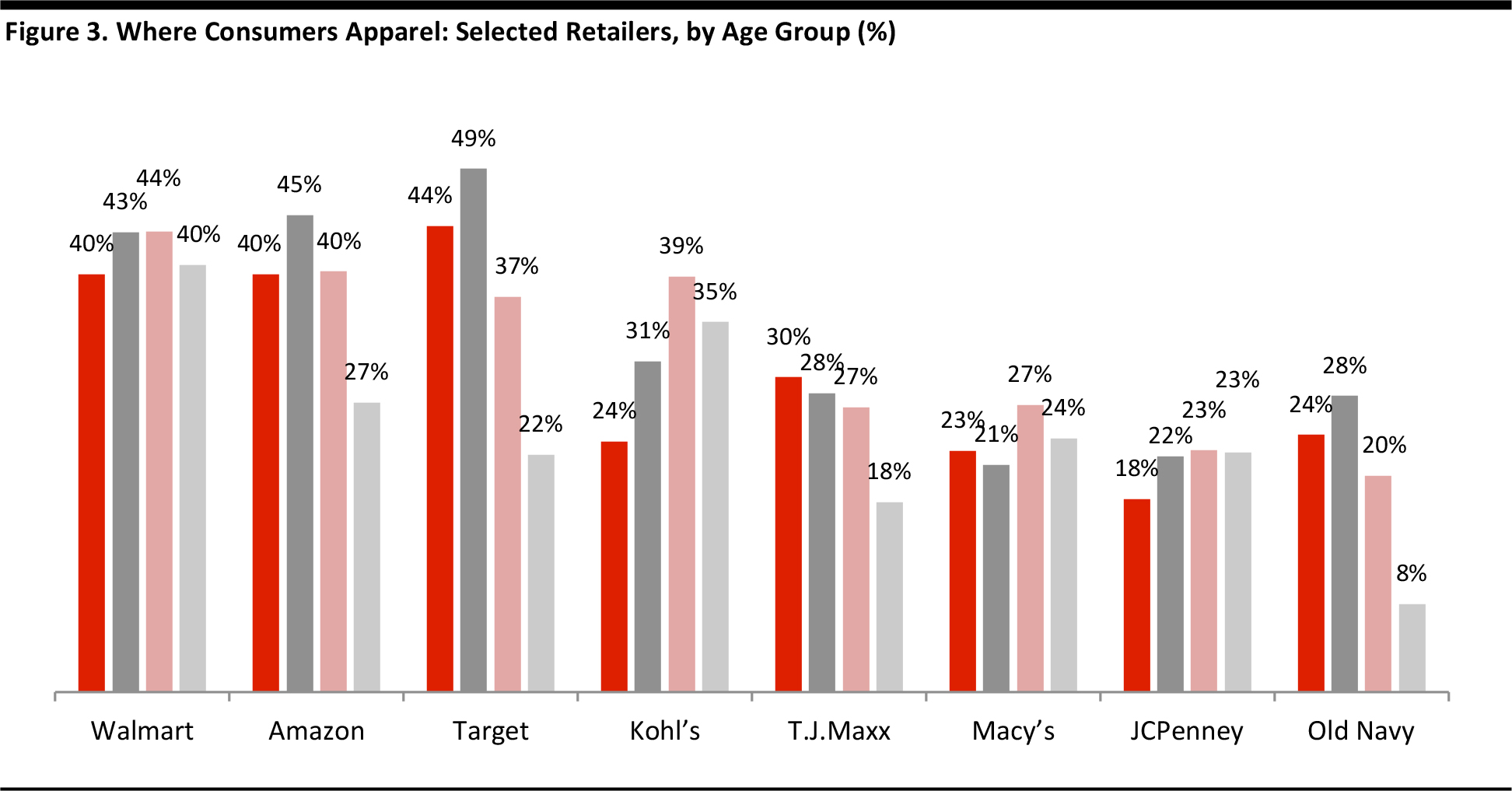

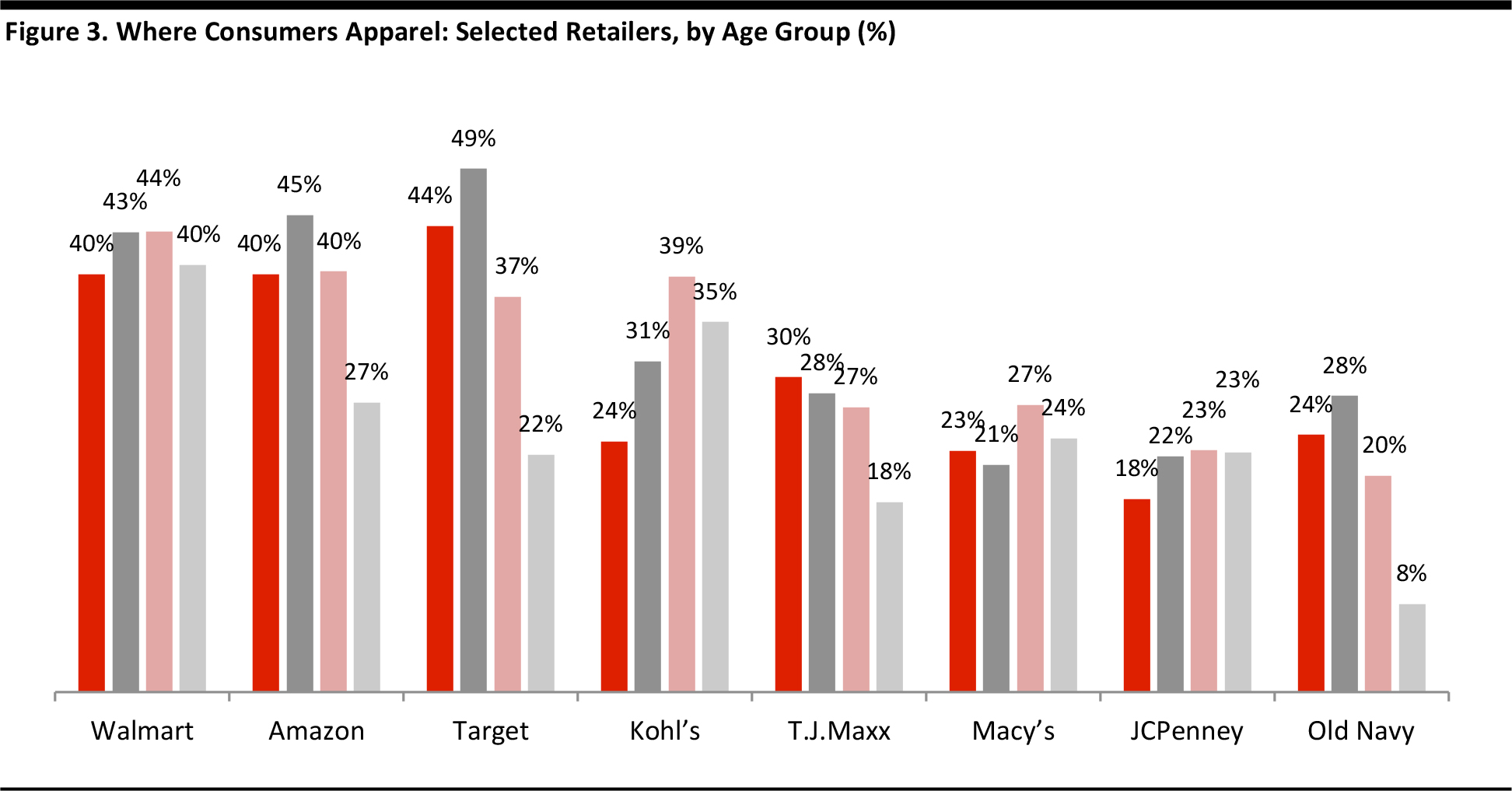

Among the very top tier of clothing retailers, those aged under 45 flock to Amazon, Target and T.J.Maxx.

- Target’s popularity tails off rapidly beyond the 30–44 age group.

- T.J.Maxx is the only one of the major retailers charted to see the highest shopper penetration among the 18–29 age group.

- Walmart sees relatively even penetration for apparel across all age groups.

- The major department stores tend to see the highest penetration rates among middle-aged shoppers (those ages 45–60).

- Of the department stores charted below, Kohl’s sees the greatest differences by age, with 18–29-year-olds considerably less likely than 45–60-year-olds to buy apparel from the retailer. Macy’s sees much more consistent appeal among the age groups.

T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

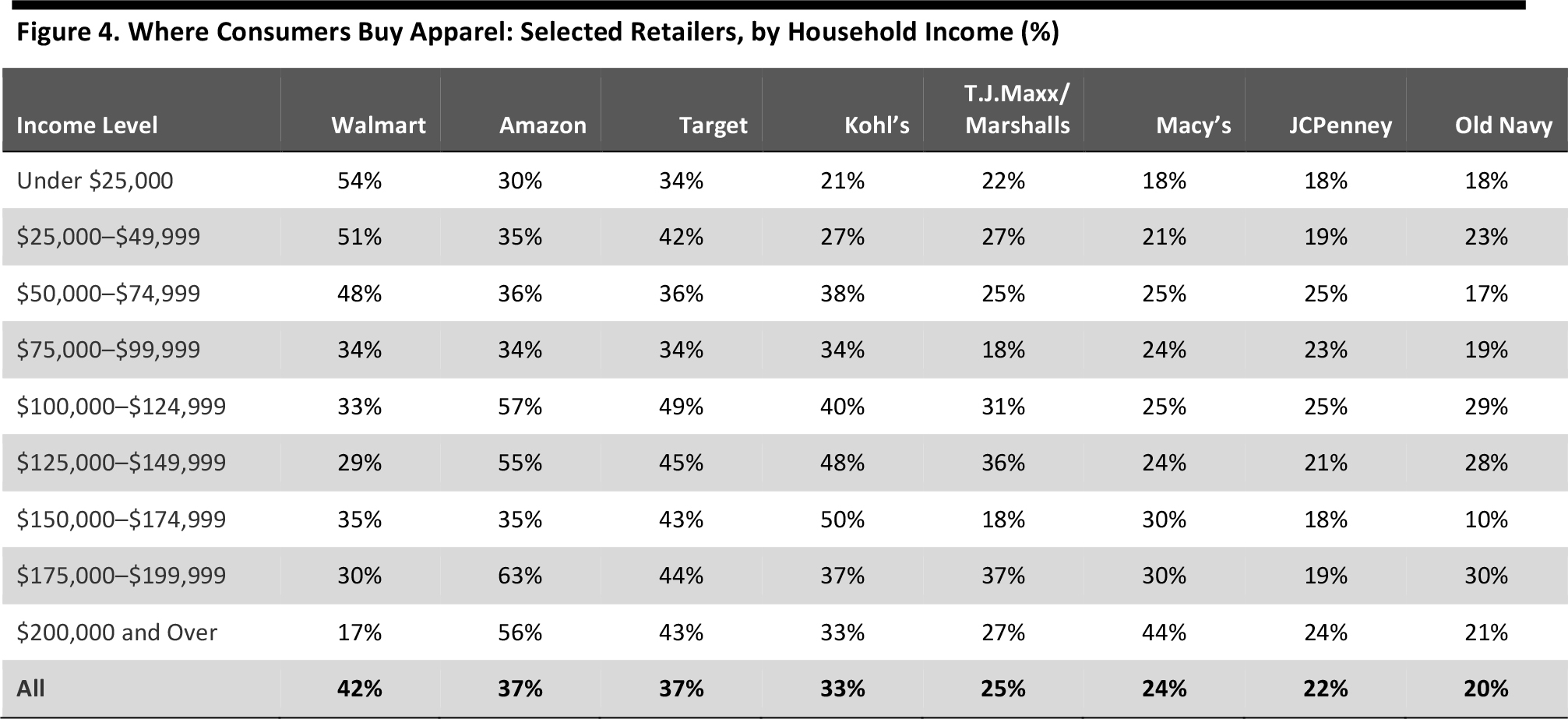

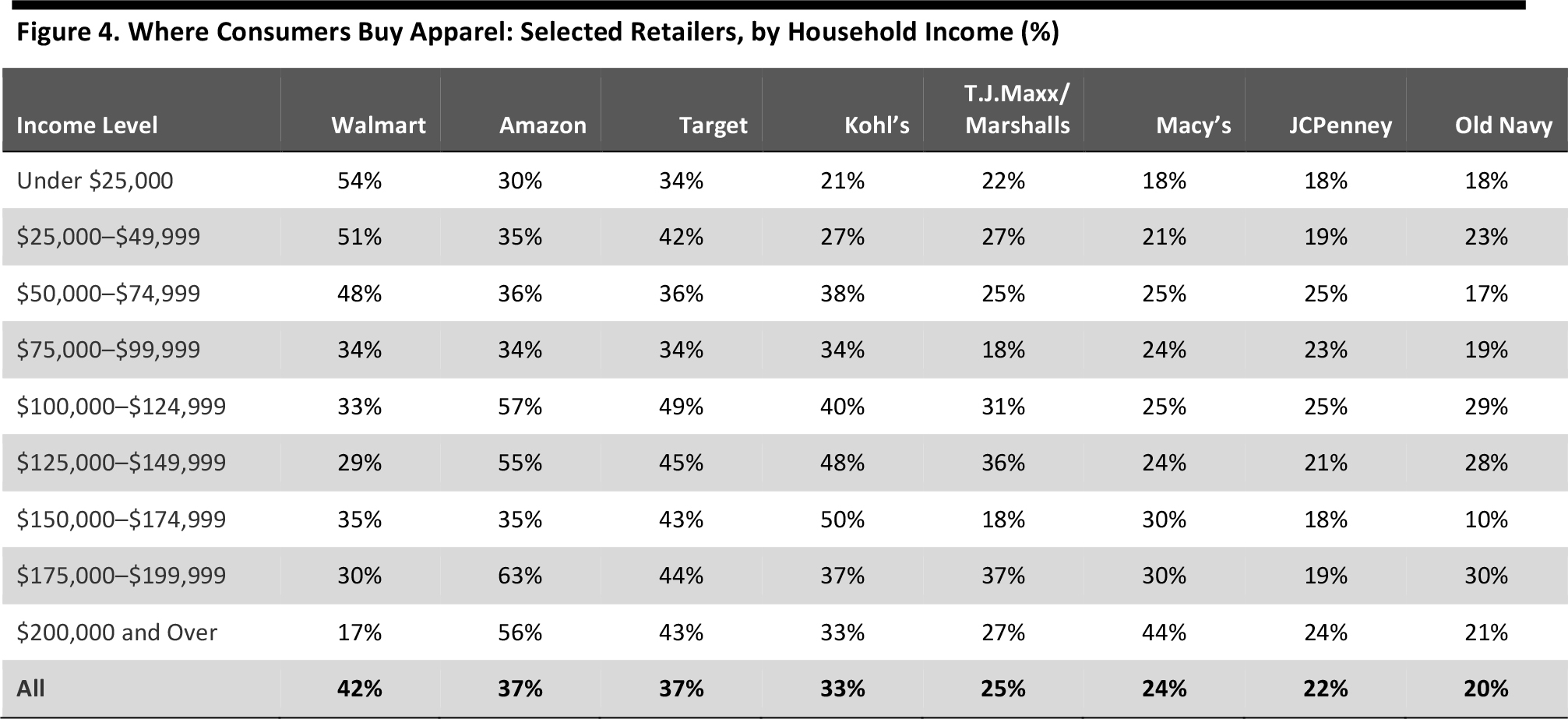

�Target and T.J.Maxx Register Consistent Appeal Across Income Groups

- Target registers relatively consistent appeal across income bands. For example, 42% of those with an oncome of $25,000–$49,999 and 43% of those with an income of $150,000–$174,999 buy clothing or footwear from Target.

- T.J.Maxx sees high penetration rates among middle and higher earners, peaking among those with incomes of $100,000 to $199,999—although it registers strong appeal across all income bands.

- The tendency to shop at Macy’s increases as household income rises, but the popularity of Kohl’s tails off among the highest earners.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

Key Takeaways

- Unlike some rivals such as Walmart, Target and T.J.Maxx show strong appeal to younger shoppers and attract shoppers across all income groups.

- H&M’s shoppers are less affluent: their average household income is approximately the same as that of Walmart apparel shoppers.

- The average department store shopper is slightly older and more affluent than the average apparel shopper. Department stores must work to combat any aging of their shopper base in order to maintain their leading market positions.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to select any options from the list provided.

Source: Coresight Research

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to select any options from the list provided.

Source: Coresight Research Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

T.J.Maxx includes Marshalls.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months.

Source: Coresight Research