DIpil Das

Our Who Shops Where reports profile US consumers who shop for selected categories at major retailers. In this report, we look at the demographics of beauty, grooming and personal care shoppers.

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

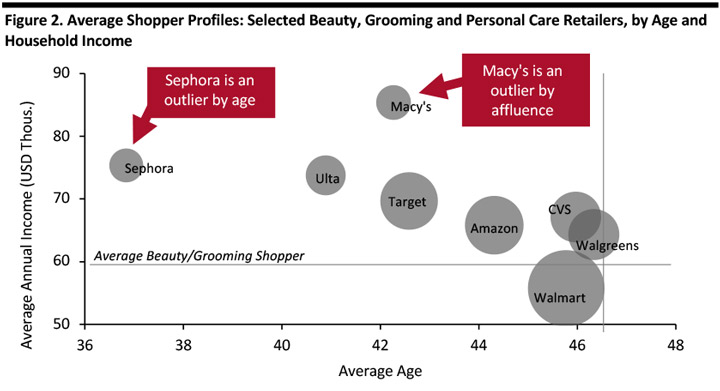

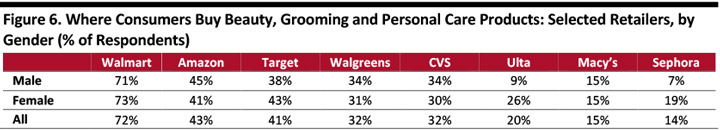

Source: Coresight Research [/caption] The following chart presents the average age and household income of shoppers at each of the top beauty, grooming and personal care retailers, with bubble size representing their scale. Bubble size reflects number of shoppers.

Bubble size reflects number of shoppers.

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research [/caption] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research. [/caption] [caption id="attachment_89223" align="aligncenter" width="720"] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research [/caption] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research [/caption] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research [/caption]

Where the US Shops for Beauty, Grooming and Personal Care Products

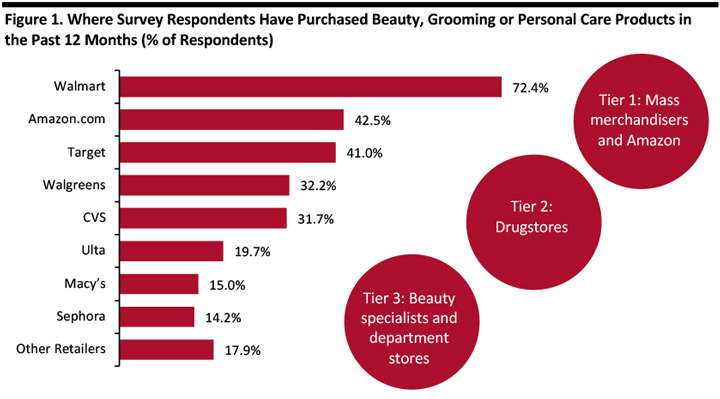

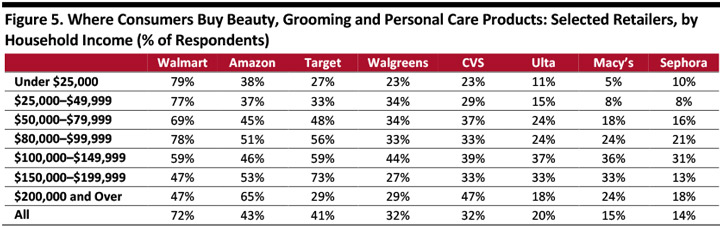

We begin with a ranking of America’s top retailers of beauty, grooming and personal care products, ranked by the proportion of respondents who had purchased from them in the past 12 months. Among the very biggest retailers, we see three tiers: first, broad-appeal, mass-market retailers; second, major drugstore chains; third, beauty specialists and Macy’s. [caption id="attachment_89220" align="aligncenter" width="720"] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019 Source: Coresight Research [/caption] The following chart presents the average age and household income of shoppers at each of the top beauty, grooming and personal care retailers, with bubble size representing their scale.

- Amazon, the major drugstores and Walmart attract shoppers that are close to the average, by age and income, although Amazon shoppers tend to be slightly younger.

- Among the value-focused generalist retailers (Walmart, Amazon and Target), Target sees the youngest average shopper.

- Macy’s sees a substantially more affluent average shopper than any of the other retailers in the chart.

- By age, Sephora is the outlier. It attracts a shopper that is, on average, significantly younger than even Ulta, a major rival.

Bubble size reflects number of shoppers.

Bubble size reflects number of shoppers. Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Source: Coresight Research [/caption]

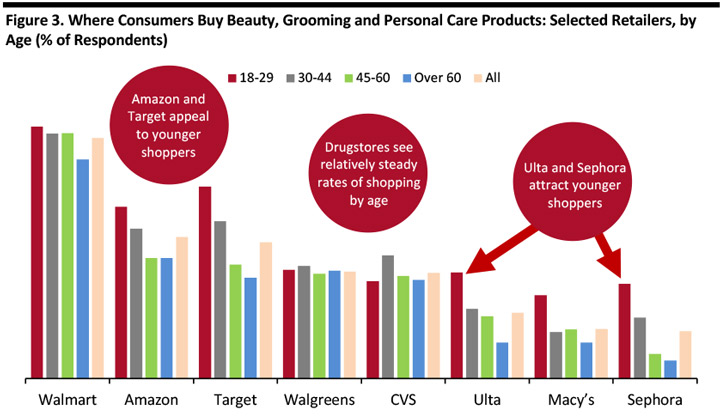

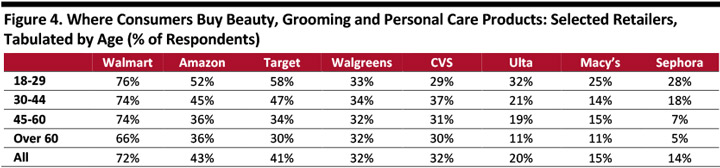

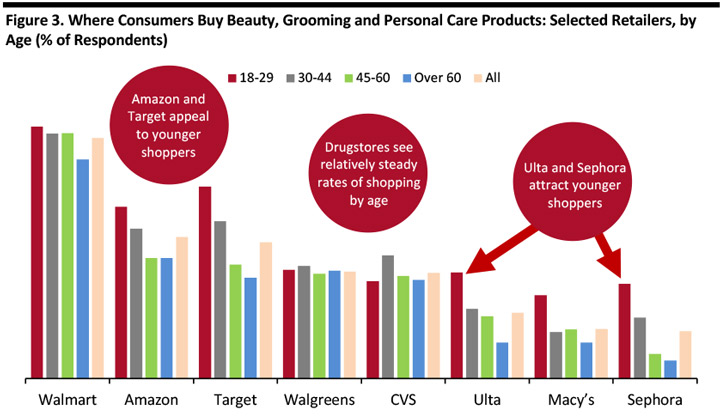

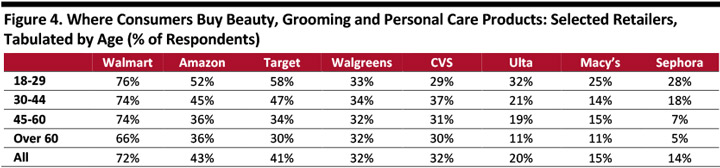

By Age: Amazon and Target Appeal to Younger Consumers

Walmart, Walgreens and CVS each see relatively even rates of shopping across the age groups — while Amazon and Target each see a strong peak among the youngest age group. Ulta, Macy’s and Sephora also enjoy relatively strong appeal among younger consumers. [caption id="attachment_89222" align="aligncenter" width="720"] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019 Source: Coresight Research. [/caption] [caption id="attachment_89223" align="aligncenter" width="720"]

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019 Source: Coresight Research [/caption]

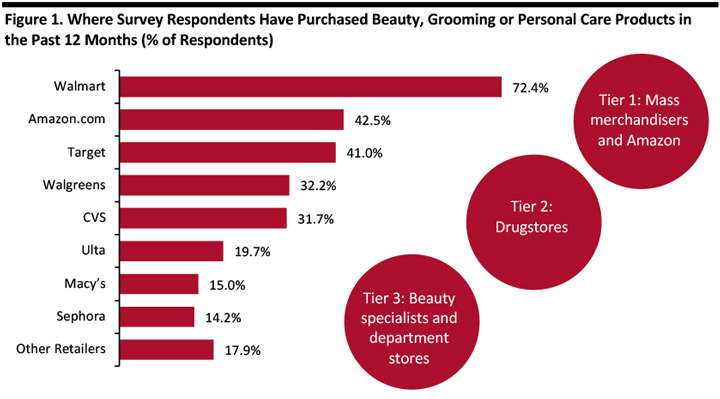

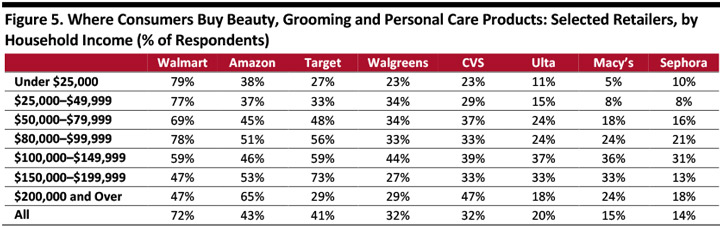

By Income: Amazon and Target Enjoy Strong Appeal Among Affluent Shoppers

- Shopping at Amazon for beauty, grooming and personal care products tends to increase with income. Target sees a roughly similar trend, with the very highest income group proving to be one exception.

- Ulta and Sephora each see shopping rates peak among those with an income of $100,000–$149,999. This income peak is arguably more impressive for Sephora, given it has an unusually young average shopper.

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019 Source: Coresight Research [/caption]

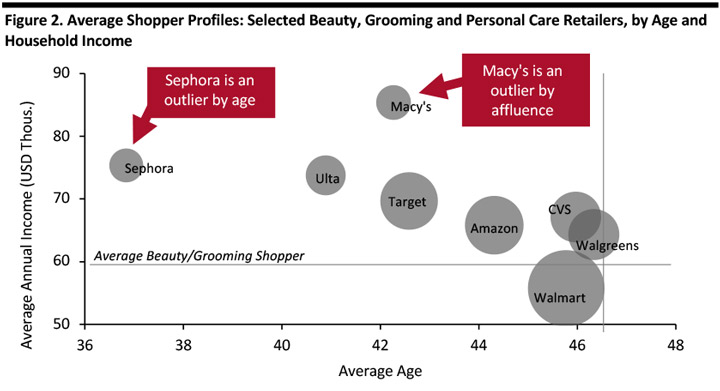

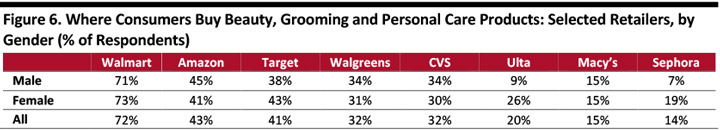

By Gender: Amazon Appeals to Male Shoppers

Male shoppers overindex slightly at Amazon and female shoppers overindex at Target. Unsurprisingly, female shoppers take a strong lead at beauty specialists Ulta and Sephora. [caption id="attachment_89225" align="aligncenter" width="720"] Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019

Base: 649 US Internet users ages 18+ who have purchased beauty, grooming or personal care products in the past 12 months, surveyed in February 2019 Source: Coresight Research [/caption]