Nitheesh NH

Our Who Shops Where reports profile US consumers who shop for selected categories at major retailers. In this report, we look at the demographics of apparel shoppers.

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

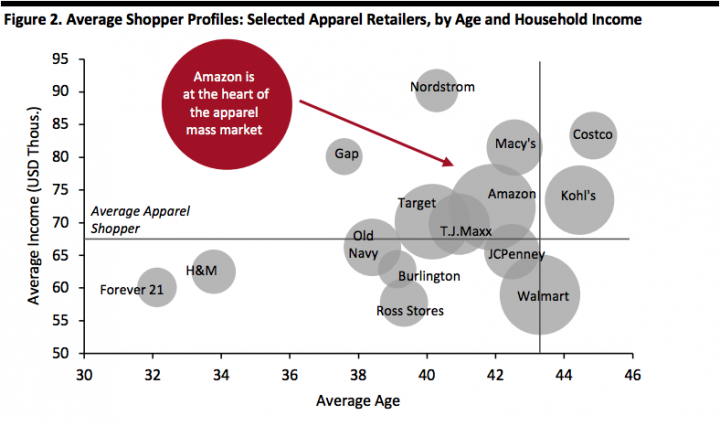

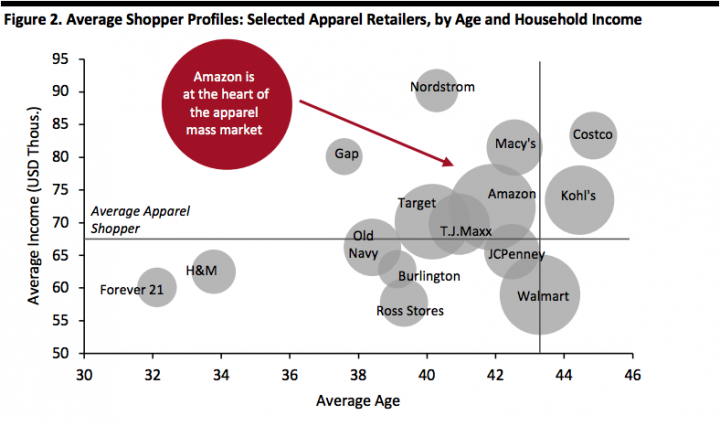

Source: Coresight Research[/caption] The following chart presents the average age and household income of shoppers at each of the top apparel retailers, with bubble size representing scale. Bubble size reflects number of shoppers. T.J. Maxx includes Marshalls; Nordstrom includes Nordstrom Rack.

Bubble size reflects number of shoppers. T.J. Maxx includes Marshalls; Nordstrom includes Nordstrom Rack.

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January-February 2019

Source: Coresight Research[/caption] Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Source: Coresight Research[/caption] [caption id="attachment_89143" align="aligncenter" width="720"] Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Source: Coresight Research[/caption] Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Source: Coresight Research[/caption]

Where the US Shops for Apparel

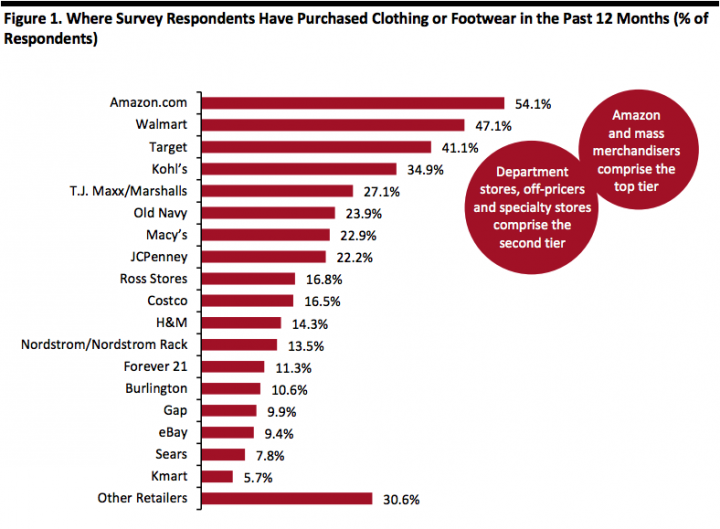

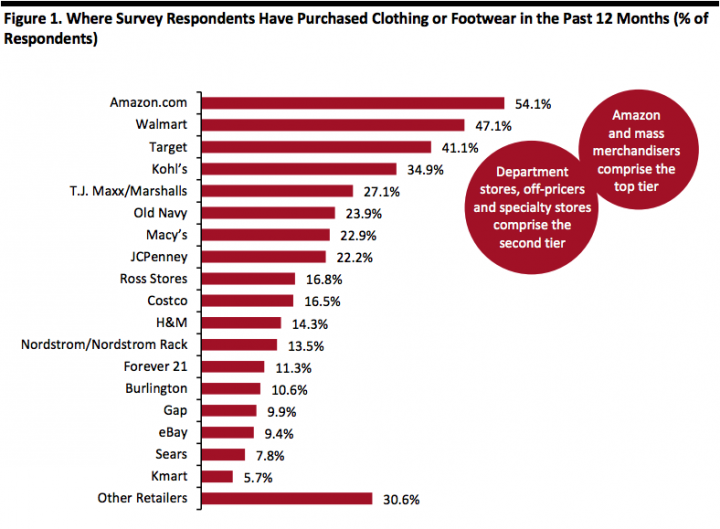

We begin with a ranking of the top retailers of clothing and footwear in the US, ranked by the proportion of respondents who had purchased from them in the past 12 months. Amazon, Walmart and Target lead this ranking, with major department stores, off-pricers and specialty retailers comprising a second tier. Amazon jumped from second to first place in 2019. For more details, see our separate report on Amazon apparel. [caption id="attachment_89140" align="aligncenter" width="720"] Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019Source: Coresight Research[/caption] The following chart presents the average age and household income of shoppers at each of the top apparel retailers, with bubble size representing scale.

- By age and income, Amazon’s typical apparel shopper is very close to the average for all apparel shoppers — a finding which should alarm major rivals: Buying clothing and footwear on Amazon is no longer the habit of a niche group of shoppers.

- Kohl’s has the oldest average shopper of the three top department stores (which includes Macy’s and JCPenney).

- Target and T.J. Maxx attract a similar shopper, which is slightly younger than average with a close-to-average income. As we show later, Target holds solid appeal across income groups.

- All three off-pricers (Ross Stores, Burlington and T.J. Maxx) attract younger-than-average shoppers.

- While H&M attracts a less-affluent shopper, this is probably a function of appealing primarily to younger consumers.

- Gap’s average customer is surprisingly young, while its above-average income could be a result of Gap’s loss of appeal among mass market shoppers, some of whom may have peeled away to rivals including fast fashion stores and online retailers.

Bubble size reflects number of shoppers. T.J. Maxx includes Marshalls; Nordstrom includes Nordstrom Rack.

Bubble size reflects number of shoppers. T.J. Maxx includes Marshalls; Nordstrom includes Nordstrom Rack.Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January-February 2019

Source: Coresight Research[/caption]

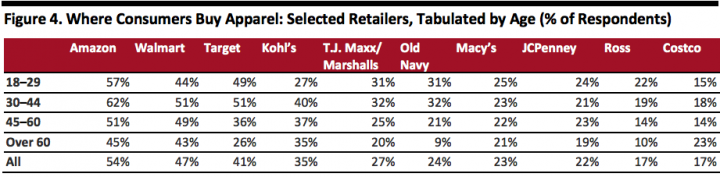

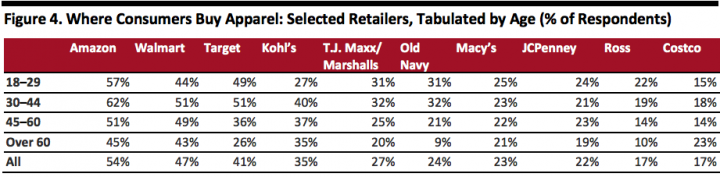

By Age: Mass Merchandisers and Off-Pricers Attract Millennials

Shopping at Amazon, Walmart and Target peaks among those aged under 45 — broadly, millennials. In addition, Target sees a strong representation of 18–29-year-old shoppers, as do off-pricers T.J. Maxx and Ross Stores. Of the three department stores in the chart below, Kohl’s sees the greatest differences by age, with 18–29-year-olds much less likely than their older peers to buy apparel from the retailer. Macy’s and JCPenney see more consistent appeal across the age groups. [caption id="attachment_89142" align="aligncenter" width="720"] Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019Source: Coresight Research[/caption] [caption id="attachment_89143" align="aligncenter" width="720"]

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019Source: Coresight Research[/caption]

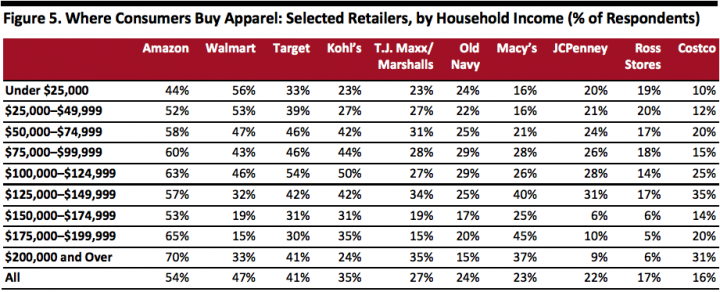

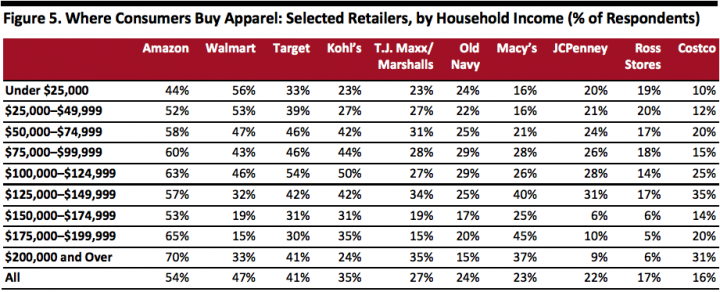

By Income: Amazon and Target Enjoy Broad Appeal

- Amazon sees strong shopper numbers across income groups, with the penetration rate troughing among the lowest income band.

- Target also registers solid appeal across income bands, peaking at 54% of those with household incomes of $100,000–124,999 buying apparel from the retailer.

- Shopping at T.J. Maxx peaks among those with incomes of $125,000–$149,999, one band higher than for Target.

- Shopping for apparel at Macy’s tends to increase as household income rises, but the popularity of Kohl’s tails off above the $100,000–$124,999 income range.

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019

Base: 1,628 US Internet users ages 18+ who have purchased clothing or footwear in the past 12 months, surveyed January–February 2019Source: Coresight Research[/caption]