DIpil Das

Introduction

The US grocery market is highly fragmented, with the scale and type of competition varying by region. The sector is known for fierce competition among major players and although the overall industry is growing at a slow pace, the online grocery market is booming. One common factor across the many regional grocery markets is the presence of discount stores and warehouse clubs. In this report, we review how these two types of retailers are competing. In warehouse clubs, we cover Costco, BJ's, and Sam's Club and in discount stores, we discuss dollar stores Dollar General and Dollar Tree, hard discounters such as Aldi and Lidl as well as Big Lots.

Market Landscape

As we discussed in our recent Who Shops Where for Groceries report, Costco and Aldi feature in the list of top 10 companies from which US consumers have purchased groceries in-store over the 12 month period ended April 2019. While Costco ranked third in the survey, Aldi ranked sixth.

Costco continues to be the leader in the warehouse clubs sector, but its competitors Sam’s Club and BJ’s are stepping up to make up ground. Driven by improved performance in fresh food and private label goods, among other factors, Sam’s Club has recorded comparable sales growth in the last 12 consecutive quarters. BJ’s, which went public last year following a seven-year stint under private ownership, raised its annual membership fee after registering its best-ever membership renewal rate. All three companies have invested in enhancing omnichannel capabilities.

In the case of discount stores, they are opening more stores and extending their reach across the country. Dollar General, for example, focuses on rural areas while Dollar Tree and Family Dollar focus on urban and suburban areas with millennials being a key target market. Dollar stores are expanding their portfolios to include more fresh produce, healthy foods and beverages

Grocery Outlet Holding, which has been growing its store base at a CAGR of 10.1% since 2015, plans to open 32 stores in 2019 and has a long-term target of opening up to 4,800 stores. The company went public with a June IPO, raising an estimated $346 million.

German hard discounters Aldi and Lidl are carving their own niche in the US market much like they did in Europe. According to a Bain study in collaboration with research firm ROIRocket involving 17,400 consumers, around 30% of consumers who shop at traditional grocery stores and mass merchandizers also frequent Aldi and Lidl stores. Aldi is currently the eighth largest grocery retailer in the US in terms of estimated 2018 revenues, according to Euromonitor.

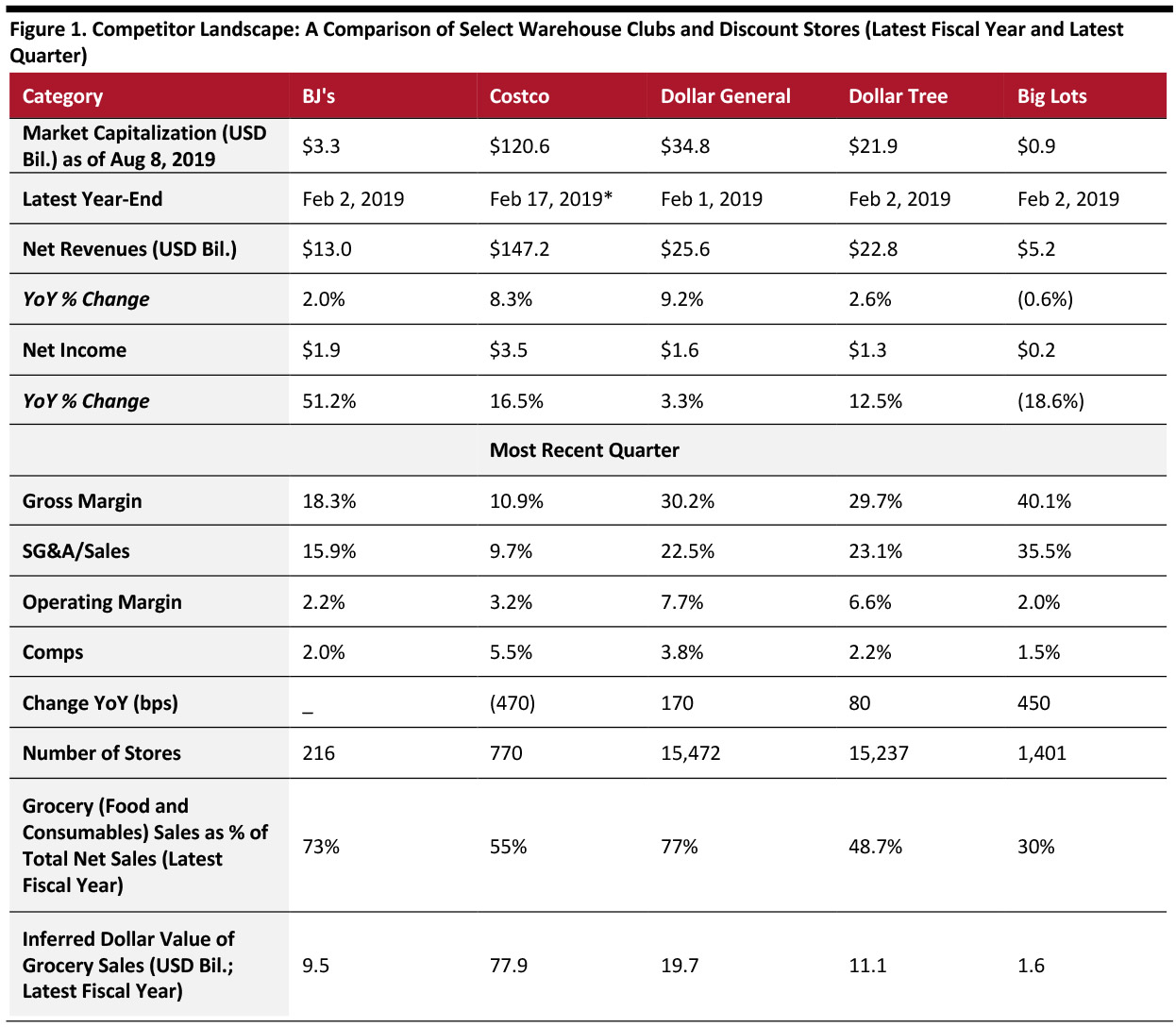

Below, we provide a snapshot of various metrics of some of the key retailers we discuss in this report.

[caption id="attachment_94600" align="aligncenter" width="700"] *Costco’s full-year results have been taken on a trailing 12 months basis for the period ending February 17, 2019 so as to keep period of comparison consistent. Costco’s latest fiscal year ended on September 2, 2018.

*Costco’s full-year results have been taken on a trailing 12 months basis for the period ending February 17, 2019 so as to keep period of comparison consistent. Costco’s latest fiscal year ended on September 2, 2018. Note:Grocery segment includes different items for different companies that includes food, consumables, edible grocery, non-edible grocery, vegetables, soups, tobacco products, sundries, perishables, health and beauty products.

Source: Company reports/Coresight Research [/caption]

Warehouse Clubs and Discount Stores Step up Focus on E-Commerce and Omnichannel Capabilities

Warehouse clubs were slow to adopt e-commerce initially, but have recently stepped up activity considerably.

Costco entered into a partnership with Instacart in October 2017 to provide a same-day delivery service for perishables and two-day delivery for household products and shelf-stable groceries. Sales from e-commerce comprised about 5% of total sales (i.e., nearly $7 billion) in FY18.

According to the company, it currently offers same-day grocery delivery to its members within a 20-minute drive radius in 99% of its US locations, while two-day delivery is available across the continental US.

Through its website samsclub.com, Sam’s Club today offers a broad range of merchandise, including some products not available in clubs. Along with direct-to-home delivery, Sam’s Club provides delivery service at Sam’s Club outlets as well through its “Club Pickup” initiative. Among its omnichannel capabilities, the warehouse club also offers a mobile checkout and payment service called “Scan & Go” which enables members to skip the checkout line.

BJ’s Wholesale Club introduced its buy online pick up in club (BOPIC) service in all its 213 stores in April 2016, and in May 2017 hired a chief digital officer for the first time to strengthen its e-commerce capabilities. In October 2017, BJ’s introduced a new mobile application with an add-to-card feature which enables customers to digitally select and save coupons directly to the BJ’s membership card. Coupons are then automatically applied to in-club purchases with no additional steps required from members, making it easier to use coupons while also driving users to the app.

Among discount stores, Big Lots initiated a buy online pickup in store (BOPIS) pilot program in June this year and intends to complete a full roll out to its stores by the close of summer. The company has also recently invested in enhancing its e-commerce platform through improvements to create more intuitive navigation, add functionality and speed checout.

Aldi, after forging a partnership with Instacart in 2017 for online grocery delivery, announced it was expanding the service to cover 35 states in September 2018.

Dollar stores such as Dollar General and Dollar Tree have e-commerce websites but have disclosed very little about their online operations.

Although both types of companies are investing in e-commerce and omni-channel capabilities, warehouse clubs overall are ahead of discount stores.

Discount Stores Have the Advantage of Greater Reach

One of the key advantages discount stores have over warehouse clubs is their wide reach.

Within the dollar store category alone, there are more than 30,000 stores across the US – more than the combined networks of Walmart and McDonald’s. According to the Institute of Local Self-Reliance (ILSR), the number of dollar stores in the country in 2011 was 20,000 – showing their numbers have grown over 50% in just eight years.

Dollar General, whose primary target market consists of households that earn less than $35,000, estimates that close to three-quarters of the population in the US reside within five miles of one of its stores.

According to Coresight Research estimates, the combined grocery (food and consumables) sales that Dollar General and Dollar Tree generated in their latest fiscal year (ended in February 2019) was around $30 billion.

Among warehouse clubs, Costco has the greatest reach, yet pales in comparison to discount stores. Costco has expanded in wealthier areas on the coasts but is more prevalent in western states. Sam’s Club is mainly located in rural and suburban America. BJ’s clubs, on the other hand, are concentrated on the east coast.

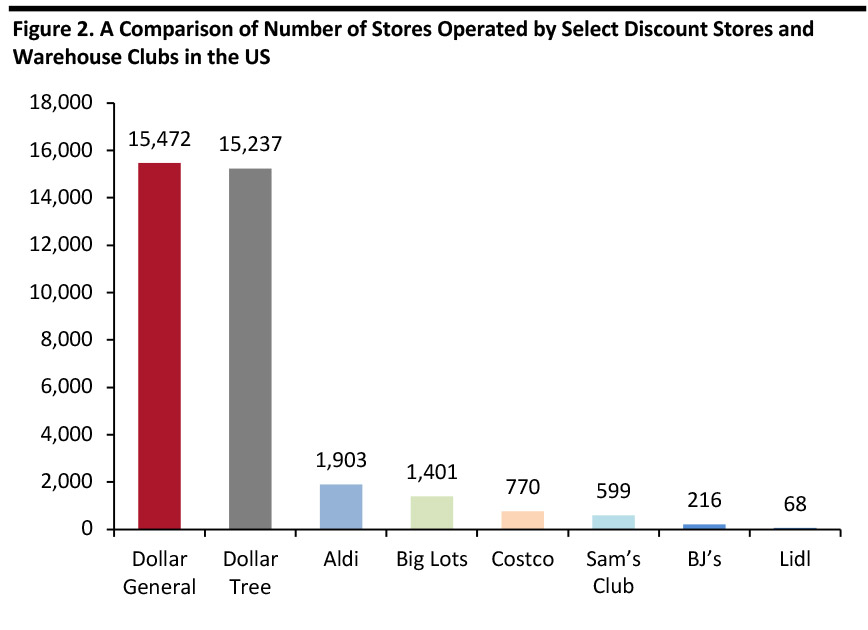

The figure below indicates the number of stores that select retailers operate in the US.

[caption id="attachment_94592" align="aligncenter" width="700"] Note: Store count for all retailers except Aldi and Lidl are as of end of latest fiscal year. Store count for Aldi and Lidl are as per current number of stores listed on their respective US websites.

Note: Store count for all retailers except Aldi and Lidl are as of end of latest fiscal year. Store count for Aldi and Lidl are as per current number of stores listed on their respective US websites. Source: Company reports and websites [/caption]

Discount Stores are Focusing on Expanding Store Networks

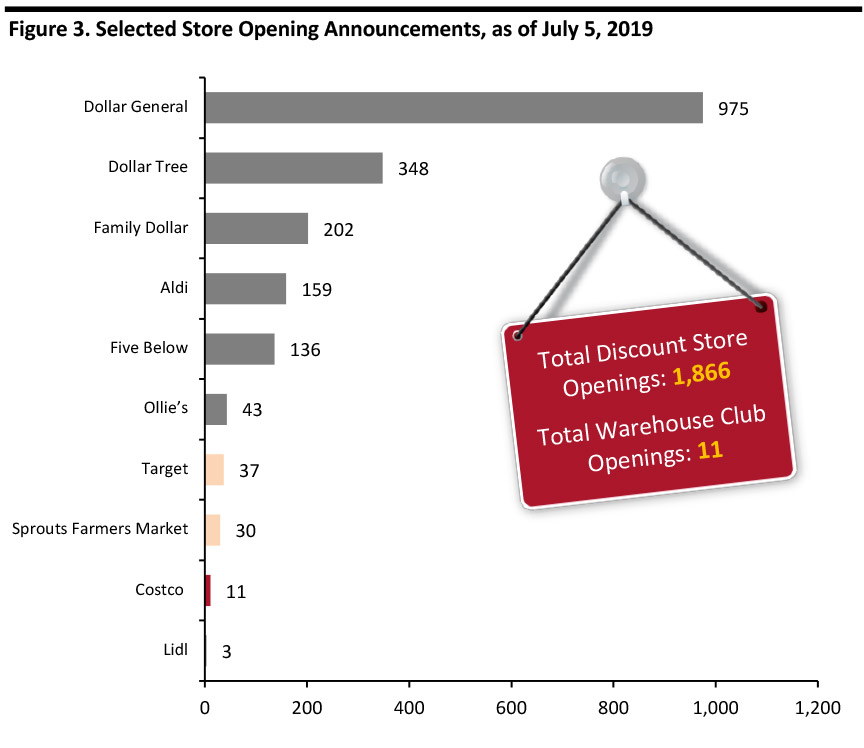

While the US retail environment continues to experience a narrative of widespread store closures, discount stores have been bucking the trend with store opening announcements greatly outnumbering store closure announcements in 2019. By July 5, 2019, US retailers had announced 7,062 store closures and 3,022 store openings.

In terms of retailers announcing the most store openings this year, Dollar General and Dollar Tree (inclusive of Family Dollar) occupied the number one and two positions while Aldi, Five Below and Ollie’s also featured prominently. On the other hand, only Family Dollar, which is expected to close around 359 stores, reported a significant number of planned closures for the year. Store opening announcements by retailers highlighted in this report are illustrated below.

[caption id="attachment_94593" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Among warehouse clubs, even though Costco, for example, plans to open around 12 stores this year, the scale is not as significant as that of the discount stores.

European Hard Discounters Aldi and Lidl are Making a Significant Impact

Aldi has been operating in the US for decades and currently has an ambitious expansion plan to operate 2,500 stores by 2022, which would make it the third-largest US grocer in terms of store count, behind Walmart and Kroger. It is aiming to build a monthly customer base of 100 million by the end of 2022. Being part of a private company, Aldi US does not release sales figures, but according to a statement in August 2018 from Aldi US CEO Jason Hart, the company’s US sales doubled in the preceding five years while the goal for the next five years is to double its sales once more.

Lidl opened its first US store in 2017. Its first year was underwhelming relative to its stated target to open 100 stores within the first year of operation: The total was 53. In November 2018, Lidl announced its acquisition of 27 Best Market stores in New York and New Jersey in a move to strengthen its presence in the market. The retailer now expects to hit the 100 store mark by the end of 2020.

While Lidl initially entered the US market with stores that were larger than its traditional stores, more recently it has changed strategy in favor of smaller stores in more densely populated areas.

Warehouse Clubs and Discount Stores are Optimizing Product Portfolio

In the environment of ever-changing consumer preference and behavior, we found that warehouse clubs are increasing focus on product portfolio optimization, and so are discount stores.

To better customize product portfolio to map to changing customer needs, BJ’s has been working to enhance its grocery assortment. BJ’s currently offers a wider range of fresh food and non-bulk items than most competitors. Fresh food accounts for 27% of the company’s sales, compared to 16% at Costco. The company’s focus on fresh food has helped it draw more customers, including millennials, and this, especially among members, indirectly leads to increased purchases in other categories. In its latest quarter ended on February 2, 2019, comparable sales in the edible grocery segment grew by 3%, while non-edible grocery and perishable segment comps grew 2%.

Costco, too, has increased its focus on its fresh food portfolio and in July 2018 entered into a partnership with Zest Labs to increase the longevity of fresh food.

Dollar General is enlarging its assortment of food products and gaining market share as it continues to face profit-margin pressure. The company is expected to spend $50 million in 2019 on two key programs: “DG Fresh,” which is a multiphase strategic initiative to distribute perishable goods to about 300 stores and “Fast Track,” an effort to improve in-store productivity and convenience to customers. The company introduced its “Better For You” initiative in 2018 under which it offered healthier food options in over 2,500 stores and plans to expand this coverage to around 6,000 stores by the end of 2019.

In August 2018, Aldi announced a significant product expansion plan whereby 20% of items will be new compared to the previous year, with a focus on fresh, organic and easy-to-prepare food products.

Warehouse Clubs Face Greater Pressure on Margins

By the very nature of their business model, warehouse clubs are vulnerable when it comes to pressure on margins as profits come from membership fees more than product sales. If membership growth is insubstantial, pressure on margins will get worse. Costco, however, is known to have comparatively stable margins and earlier this year stated that pricing pressure on its grocery segment had decreased.

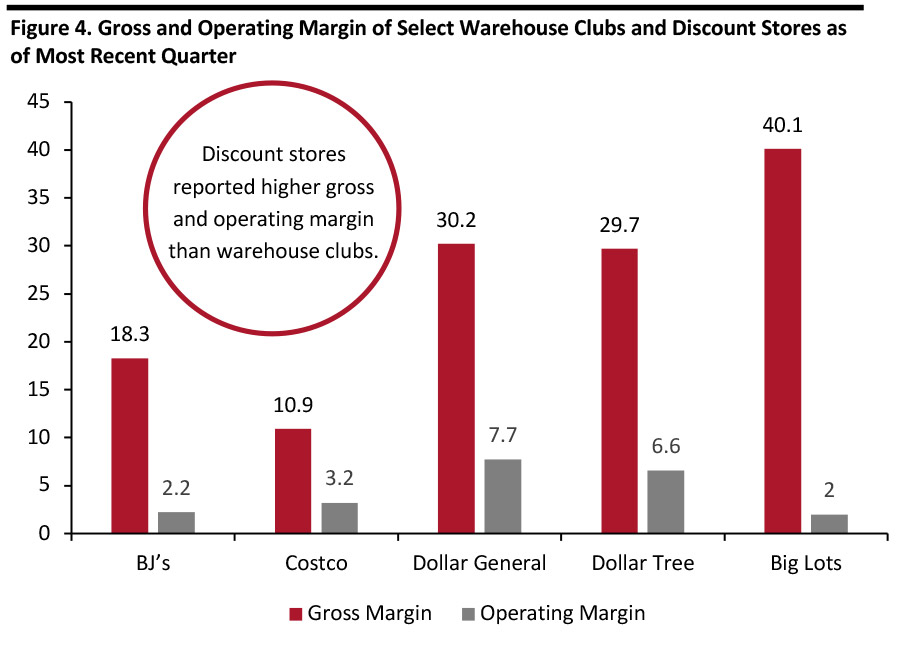

In terms of gross margin and operating margin, warehouse clubs are operating well below the discount stores, as shown below.

[caption id="attachment_94601" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

BJ’s revenues, between its fiscal 2013 and fiscal 2017, grew by just 1.2% to $12.5 billion and is expected to reach $13 billion by the end of fiscal year 2020. While growth has been slow, the company also has a heavy debt burden which weighs on margins.

Discount stores, on the other hand, fare a little better although they experience pressure on margins as well. Until recently, most Dollar General did not offer fresh food or perishable items, which have lower margins and shorter shelf life. However, the company is now trying to grow this business as it seeks to drive more frequent store visits.

Ohio-based discount store chain Big Lots is continuing to feel the heat of intense price competition in its food category: The company’s net sales from the food category in the year ended February 2, 2019, was $783 million, a 4.3% decline over the prior year. The category represented 14.9% of total sales in FY19, compared to 15.5% in FY18. In the consumables category, the company reported net sales of $799 million, a 2.9% decline over the previous year, and as a percentage of net sales, declined to 15.3% in FY19 compared to 15.6% in FY18.

Who is Winning?

Although both warehouse clubs and discount stores compete in the grocery segment, given that they operate under different business models, a fair comparison is challenging.

However, based on the metrics shown below, discount stores currently hold the edge over warehouse clubs in terms of overall impact in the sector.

[caption id="attachment_94595" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Conclusion

The US grocery sector continues to be highly competitive. Warehouse clubs, with their recent impetus and investment in e-commerce and omnichannel capabilities, have managed to equip themselves to stay. Discount formats are spreading across the nation to make themselves accessible to a majority of the US population.

Both discount stores and warehouse clubs will continue to reinvent themselves to better serve their respective consumer bases and compete more effectively against mass merchandisers – and Amazon – as the battle for supremacy in the grocery segment wages on.