A Significant Mark Left on US Retail

Toys“R”Us first filed for bankruptcy protection in September 2017, and June 29, 2018 marked its final day in business in its home market.

The toy retailer operated 881 stores in the US as of October 28, 2017, according to company reports. Most of these were big-box formats with an average store gross size of 32,500 square feet, according to market research firm eMarketer. Given these numbers, we estimate the closure of the Toys“R”Us retail chain has left 28.6 million square feet of retail space vacant in the US commercial property market.

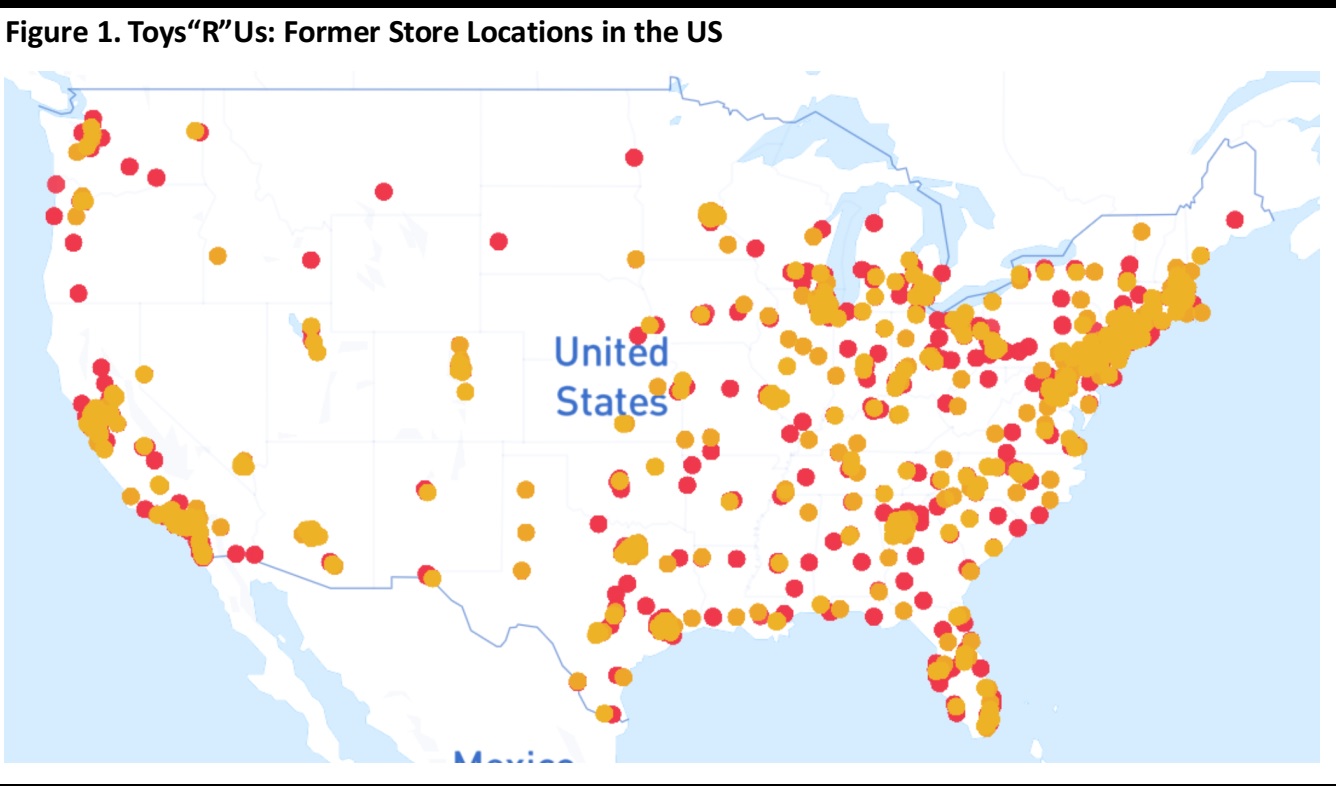

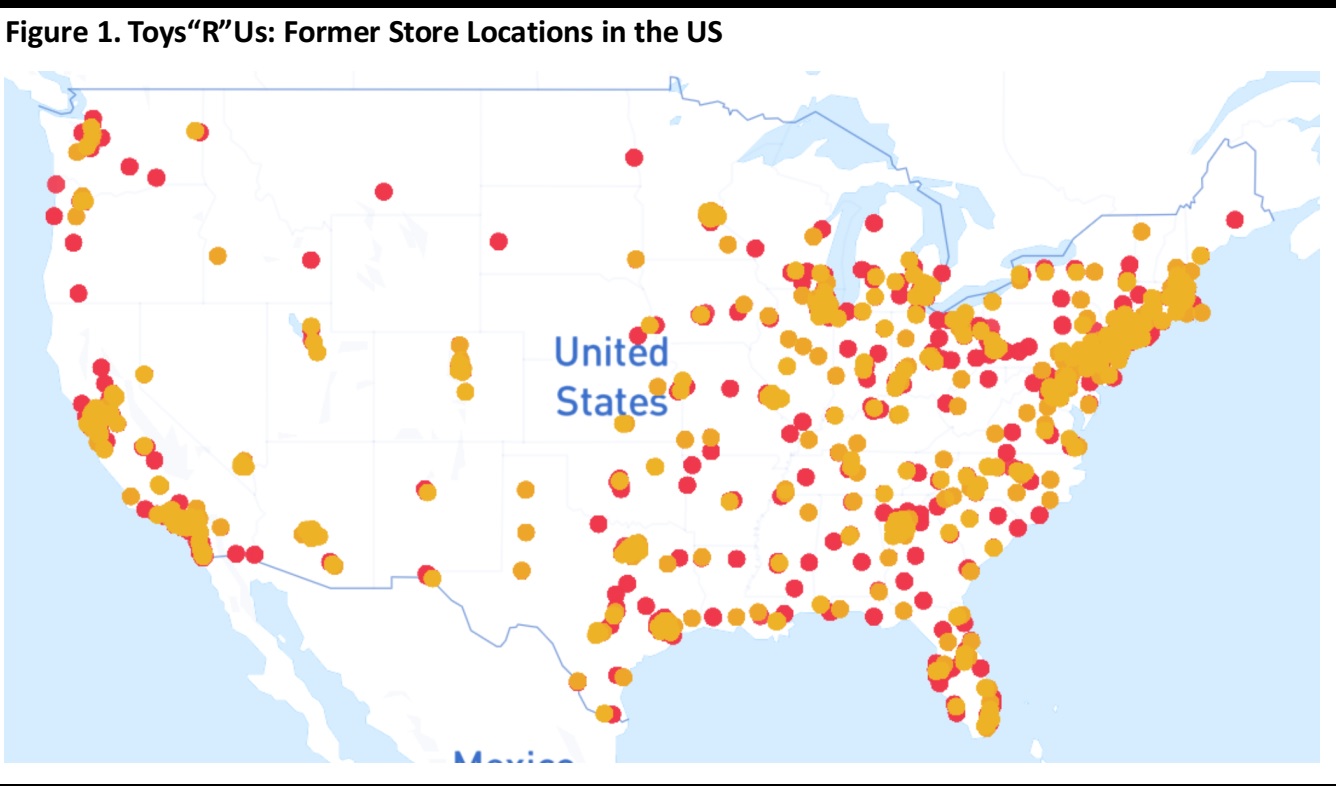

Red dots represent Toys“R”Us stores; yellow dots represent Babies“R”Us stores.

Source: Thinknum

Red dots represent Toys“R”Us stores; yellow dots represent Babies“R”Us stores.

Source: Thinknum

The impact of the toy retailer’s closure on US retail is significant, even in absolute store numbers. In our

Weekly Store Openings and Closures Tracker 2018 #27, we reported that Toys“R”Us topped the list of retailers in terms of store closures announced year to date, representing 21% of total store closures in the US.

Which Retailers Will Be Taking Over the Toys“R”Us Stores?

Earlier this month, The Wall Street Journal reported that some of the vacant Toys“R”Us retail space would be taken over by furniture retailers Big Lots and Scandinavian Design, arts and craft retailer Hobby Lobby, off-price retailer Burlington and off-price department stores TJ Maxx and Marshalls (both owned by TJX Companies).

Toys“R”Us stores were either owned directly by the retailer, or leased back to Toys“R”Us Property Co., a separate entity created by the retailer. Other stores were owned by real estate investment trusts (REITs), including Kimco Realty, Brixmor and DDR. Respective company reports by these firms have given us further indications of the retail names likely to take over the Toys“R”Us vacancies.

Kimco Realty

On its 1Q18 earnings call, Kimco Realty CEO Conor C. Flynn said that the toy retailer’s former locations were already seeing significant demand from other retailers in categories including off-price, health and wellness, specialty grocery, home improvement, furniture, arts and crafts and entertainment. Moreover, the REIT noted the growing demand for former Toys“R”Us spaces from other entities such as co-working facilities, hospitality groups and medical facilities.

The green circle in Figure 2 shows the retail brands that are expanding their store presence in the space owned by Kimco Realty, replacing the retracting retailers shown in the blue circle, which include Toys“R”Us. Among the names in the green circle, we can see Dollar General, TJ Maxx and Burlington, together with organic grocery retailer Sprouts Farmers Market, foodservice retailers such as KFC and Chipotle and healthcare service provider GoHealth Urgent Care.

Source: Kimco Realty

DDR

On DDR’s 1Q18 earnings call, President and CEO David R. Lukes stated that the challenges the Toys“R”Us bankruptcy were generating for DDR would be partially mitigated by renting part of these spaces to smaller shops, which indicates that vacant Toys“R”Us stores would likely be partitioned off and occupied by smaller retailers. For example, Dollar General’s average store gross size is 9,100 square feet, according to eMarketer, less than one-third the gross size of an average Toys“R”Us store.

Lukes went on to say that the vacancy of big-box retail spaces resulting from Toys“R”Us closures also represented an opportunity to undertake economically attractive redevelopment projects, as it would allow DDR to recapture control of space and parking fields.

Key Takeaways

The closure of the Toys“R”Us store chain leaves a significant mark on US retail. The total number of stores closed represents 21% of total store closure announcements in the US market year to date. The retailer, which used to operate big-box stores, has left behind substantial vacant space in the US commercial property market.

This space is likely to be partitioned off and taken over by retailers that operate smaller store formats and even by nonretail businesses such as co-working facilities, hospitality groups and medical facilities. Retailers that are likely to take on the vacant space include discount retailers such as Dollar General, organic grocery retailers, foodservice retailers and even healthcare providers.

Red dots represent Toys“R”Us stores; yellow dots represent Babies“R”Us stores.

Source: Thinknum

Red dots represent Toys“R”Us stores; yellow dots represent Babies“R”Us stores.

Source: Thinknum