Web Developers

On Monday, October 15, Sears Holdings filed for Chapter 11 bankruptcy protection in the US Bankruptcy Court for the Southern District of New York. The company intends to reorganize around a smaller network of profitable stores, with 142 closures slated as part of the restructuring. However, there doubts linger over the long-term prospects for Sears Holdings and many commentators expect the company to be liquidated at some point in the near future.

Sears Holding’s revenues have been falling fast, but the company still turned over a substantial $16.7 billion in the year ended February 3, 2018, with the Sears banner accounting for $11.1 billion of that total. On a trailing 12-month basis, group revenue fell by $14.3 billion in the period ended August 4, 2018, according to S&P Capital IQ.

So, if Sears Holdings falls, which retailers will gain? In this report, we offer a number of data points that help answer that question.

Sears Holdings operates Kmart as well as its eponymous chain, but our analysis here focuses only on the Sears department store chain: it excludes Kmart as well as Sears Hometown and Sears Outlet stores, which are independent of Sears Holdings.

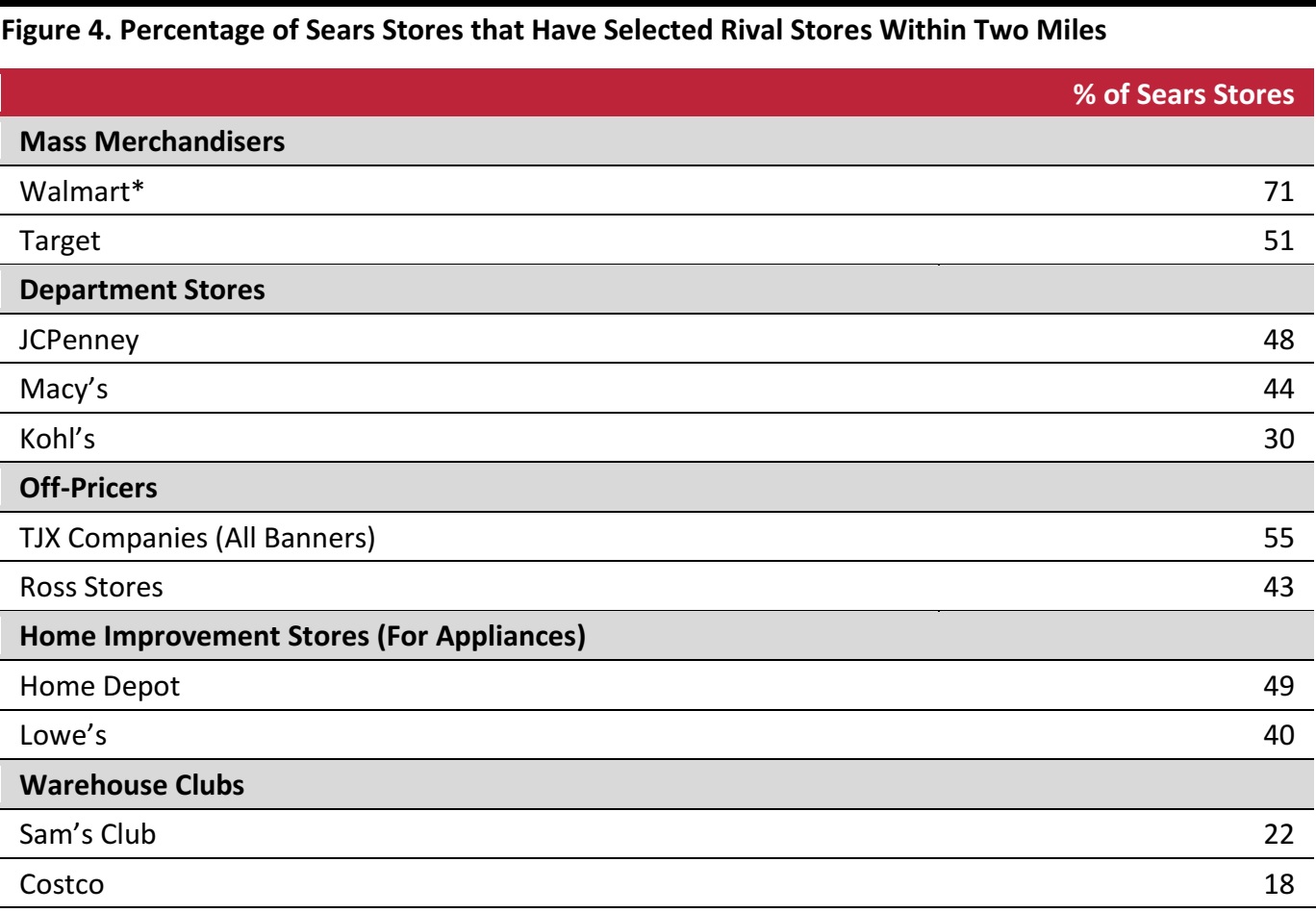

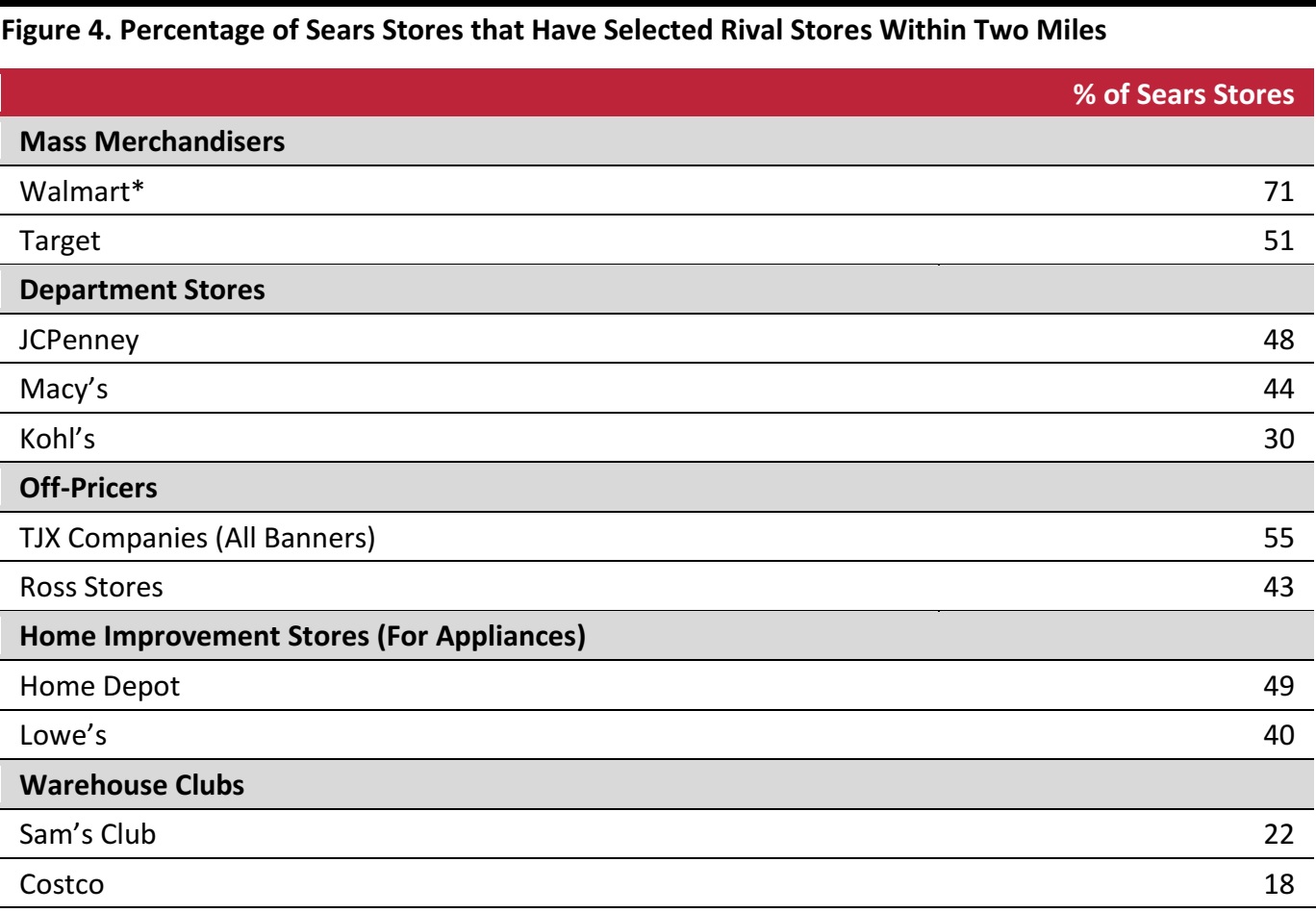

We show the merchandise sales mix of Sears department stores for the year ended February 3, 2018 below.

Source: Company reports

Apparel Shopper Data Suggest Potential for Walmart and JCPenney to Capture Sales

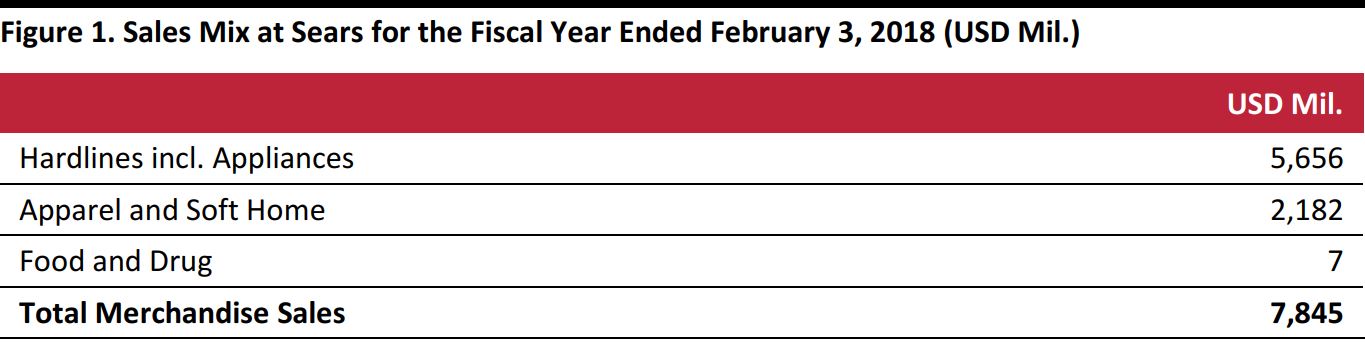

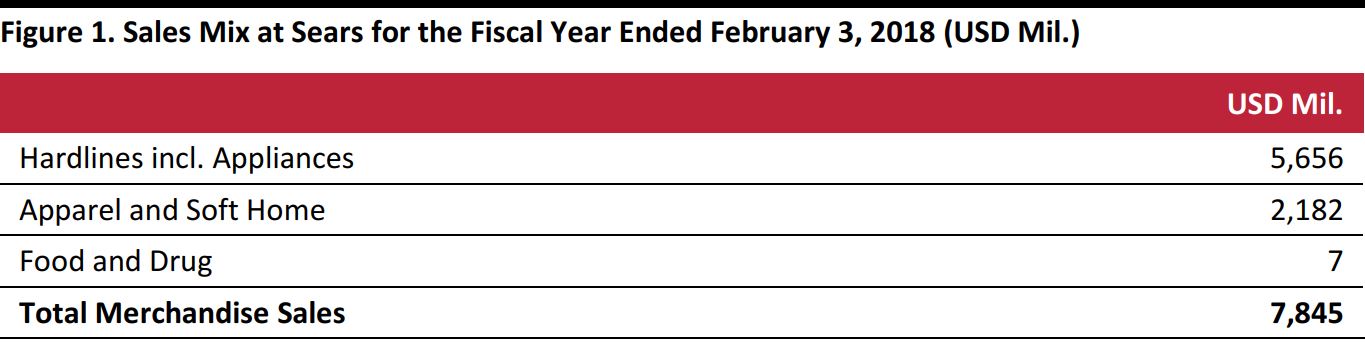

Coresight Research’s shopper data show that Sears has the oldest average apparel shopper of all the major department stores and that its average apparel shopper’s income is slightly above the average for all apparel shoppers. As shown below, Kohl’s and Costco are the major retailers whose average customer profiles are most similar to Sears’, while those of JCPenney and Macy’s are also close. The off-pricers, such as T.J. Maxx, attract a notably younger average shopper. Costco’s proposition differs significantly from that of Sears, and we would expect this to limit its gains in apparel—though it could capture some appliance sales.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, surveyed in January 2018 Bubble size represents shopper numbers. Note that average age excludes shoppers under age 18, who were not surveyed. Source: Coresight Research

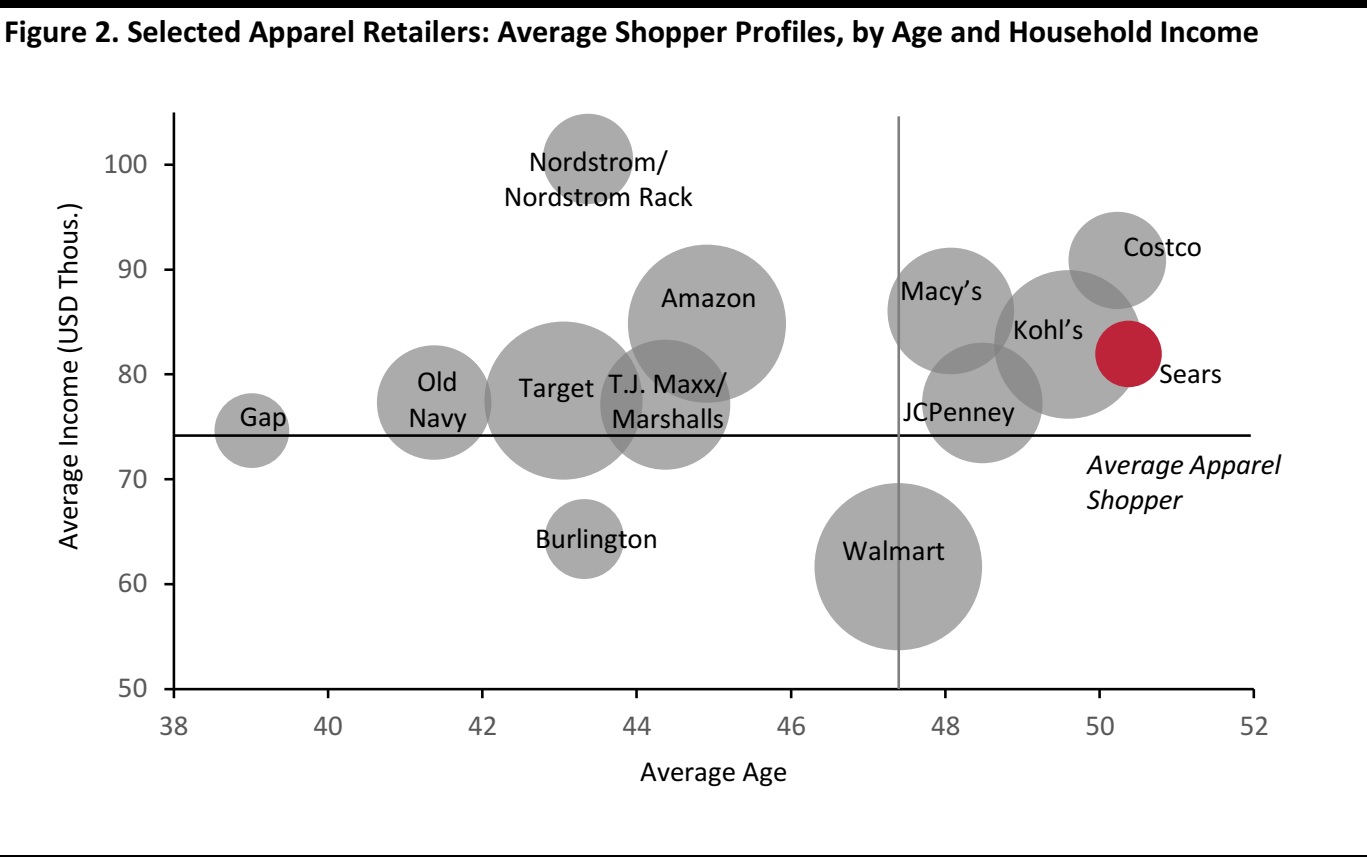

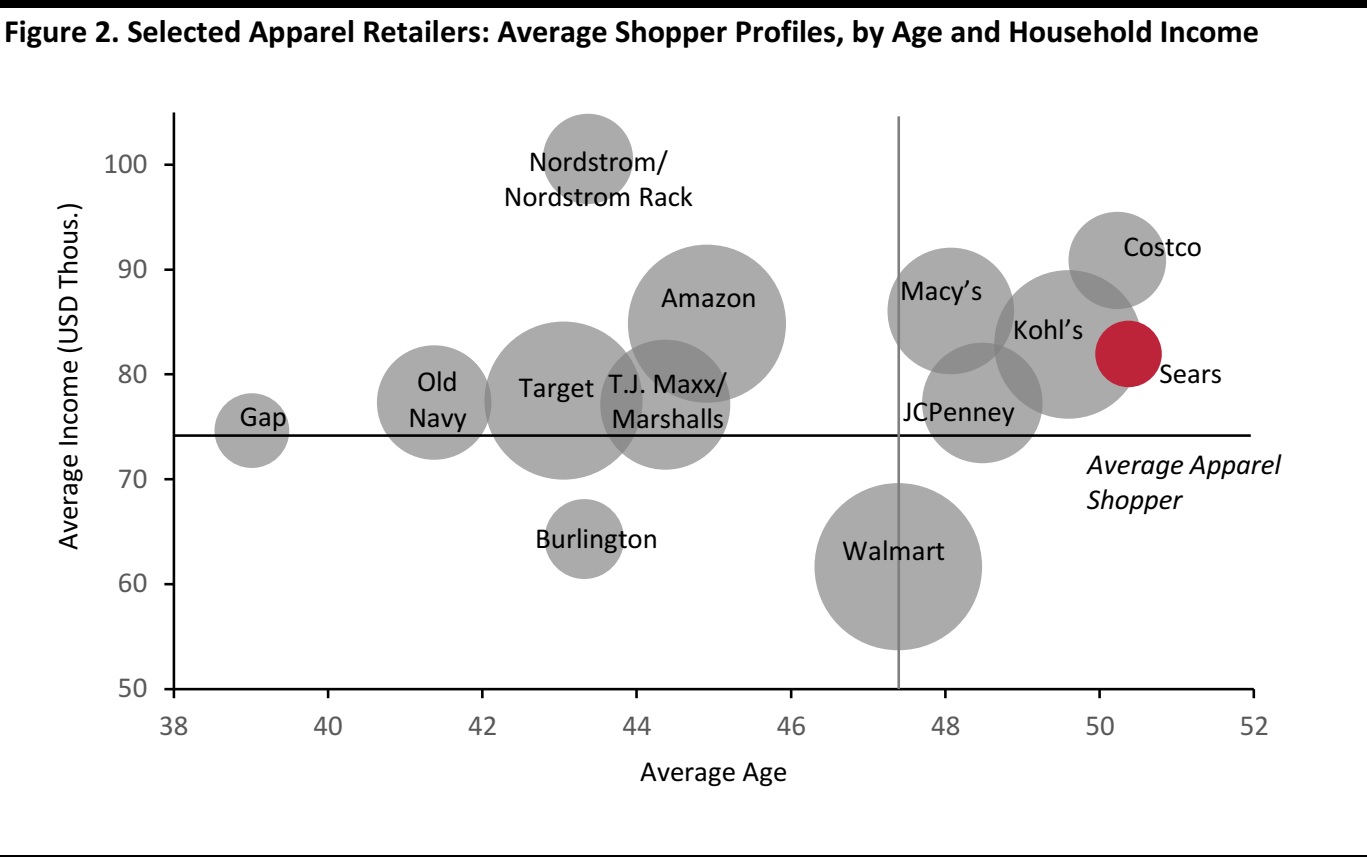

Cross-shopping data add further depth to our analysis in the apparel category. We looked at which other stores Sears apparel shoppers also shop for apparel, and found that Walmart, JCPenney and Target top the list. Walmart’s prominence is unsurprising, as it is the most-shopped retailer among all apparel shoppers. Second-position JCPenney overindexes very strongly among Sears apparel shoppers, while it is only the seventh-most-shopped apparel retailer among the total population. Macy’s ranks higher as a cross-shopping destination among Sears shoppers than among the total population, too. This reflects the fact that department store shoppers are effectively a subset of apparel shoppers that browse and buy at a number of department store retailers.

Base: Internet users ages 18+ who have bought clothing or footwear from Sears in the past 12 months, surveyed in January 2018 Source: Coresight Research

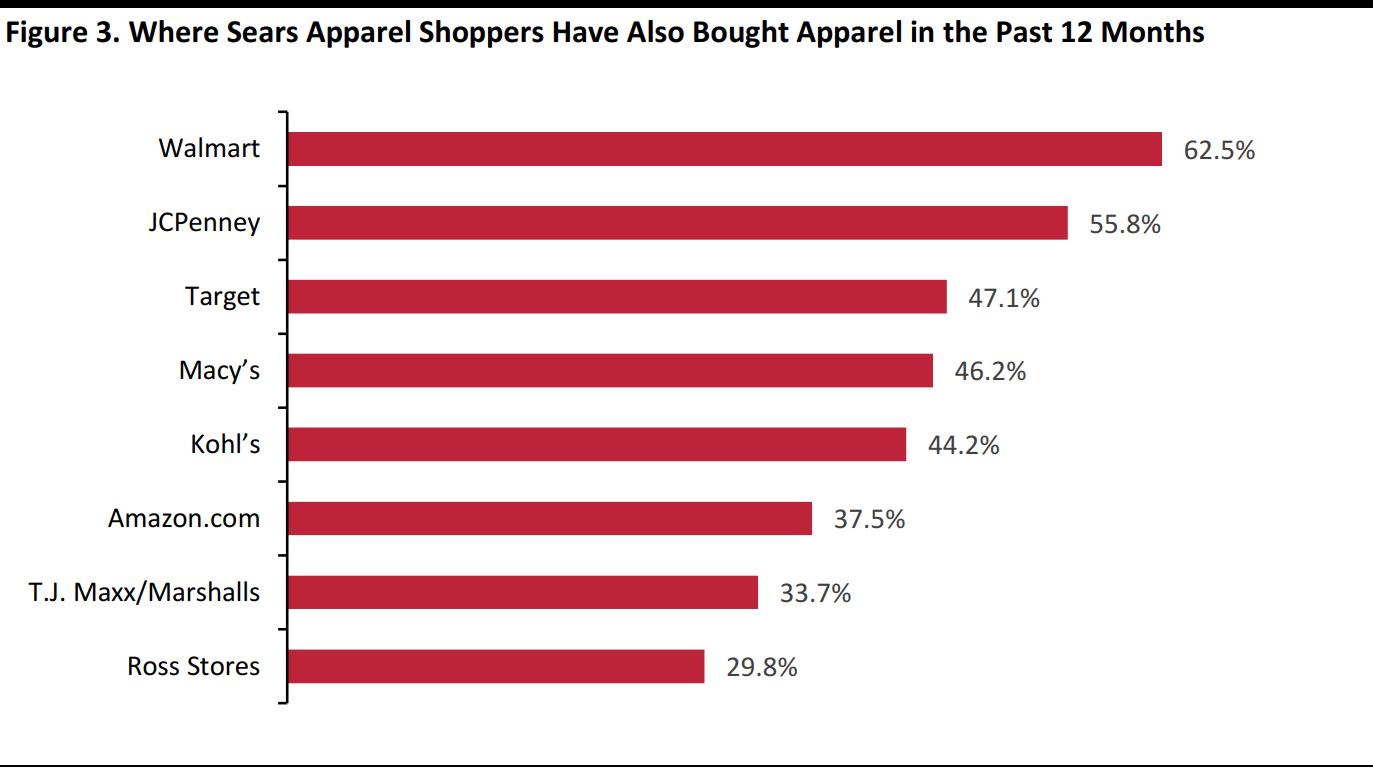

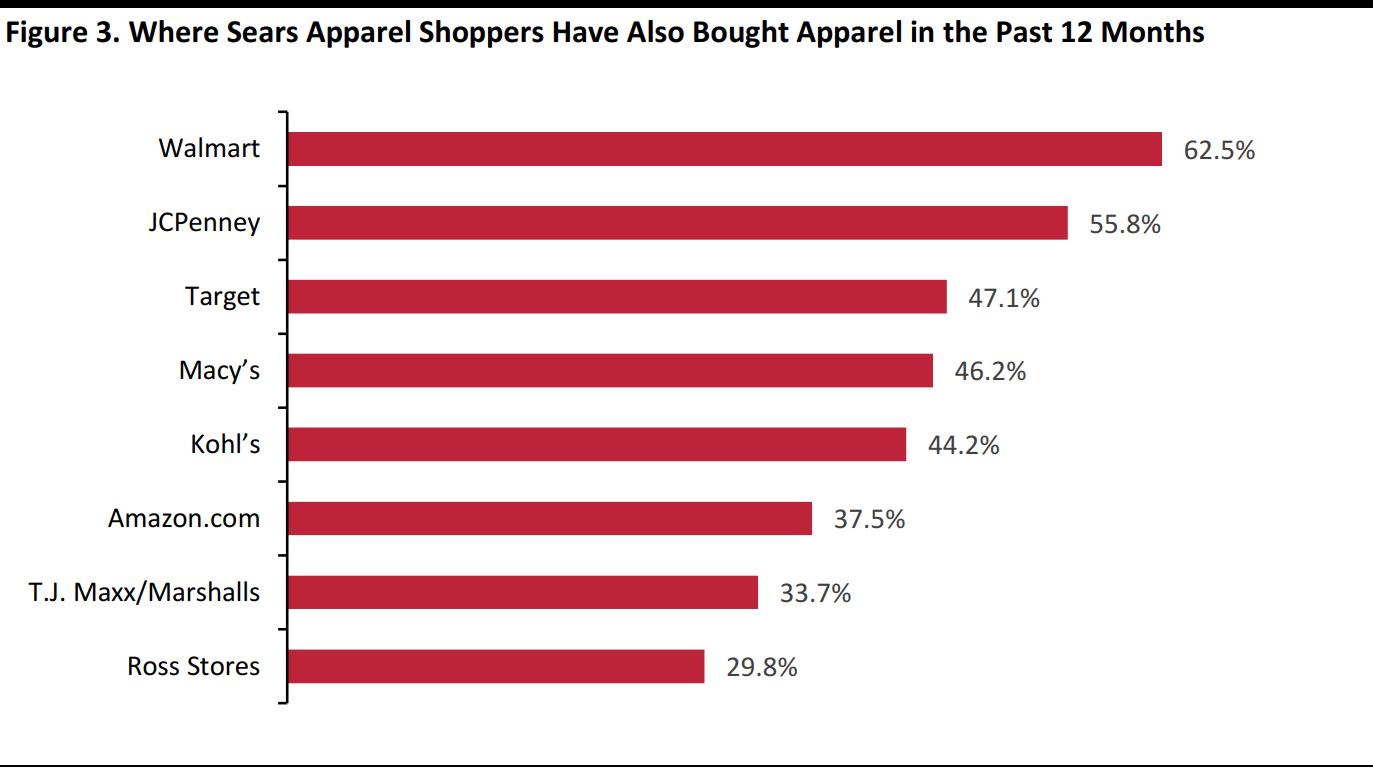

Store Proximity Data Further Suggest that Walmart, Target and JCPenney Are Well Placed to Pick Up Sears Shoppers

Coresight Research’s store proximity data show a roughly similar picture, with Walmart registering the highest rates of geographical proximity to Sears stores. Among the department stores, JCPenney leads—and this retailer’s push into appliances since 2016 should bolster its gains should Sears close down. Kohl’s locations overlap with Sears locations to a much lesser degree than other major department stores, as many Kohl’s stores are located away from malls, where other department stores tend to be based. In terms of home-appliance retailers, Home Depot is close to more Sears stores than is Lowe’s, though both retailers see substantial overlap. By contrast, Sam’s Club and Costco see relatively low geographical proximity to Sears stores. The Sears banner operated 506 stores as of August 4, 2018 (latest reported).