albert Chan

What’s the Story?

In light of the pandemic-led shift to e-commerce and savings accrued by US shoppers amid extended periods of lockdown, the holiday season presents a significant opportunity for brands and retailers to capture online sales this year. In addition, ongoing supply chain disruptions and shipping worries are pushing retailers and their customers to start the holiday season now.

To arm brands and retailers with the knowledge of how and where to reach US shoppers and thus maximize sales this holiday season, we present findings from the Coresight Research x January Digital 2021 US Holiday Insights Survey. We asked respondents how they plan to shop in the 2021 holiday season, what categories they will likely buy, what matters most to them when choosing where to shop and how they discover products. Trends uncovered will enable brands and retailers to generate data-driven marketing strategies to effectively gain share of wallet during this critical year-end opportunity.

We present findings across the physical in-store shopping channel and e-commerce, which comprises online orders for home delivery, as well as BOPIS (buy online, pick up in store) and curbside pickup.

This report is brought to you in partnership with strategic consulting and media firm January Digital.

Why It Matters

Last year, holiday-season retail sales (calendar fourth quarter) in the US totaled $1.1 trillion, according to our analysis of US Census Bureau data, up 9.2% year over year—the highest annual growth since 2010—and comprising 28% of total US retail sales in 2020. The online channel accounted for 20% of holiday sales, with e-commerce sales having increased by around 27% year over year, according to the US Census Bureau. The high penetration and growth underscores the importance of digital initiatives in 2021 and beyond.

This year, holiday sales will be supported by excess consumer savings due to extended periods of lockdown, a decreasing unemployment rate and any lasting impacts of government stimulus payments. However, supply chain issues and labor shortages may offset short-lived gains for US retailers. According to Salesforce’s Q2 Shopping Index, US retailers will face incremental costs of $223 billion in goods sold this coming holiday season due to significant year-over-year cost increases for freight, manufacturing and labor. Salesforce also estimates that labor shortages will see retailers spend $47 billion in additional wages for store associates in November and December 2021, compared to the year-ago period.

Unless brands and retailers know how to reach and appeal to customers, they will not be able to capture the huge sales opportunity while simultaneously managing increased supply chain pressures and labor costs. Understanding shoppers’ expectations for the 2021 holiday season will also shed light on consumers behaviors heading into 2022.

Where, What and How Will US Consumers Shop for Holiday 2021?: Coresight Research x January Digital Analysis

1. Where Will Consumers Shop This Holiday Season?E-Commerce Set To Dominate Holiday Spending—Even Among Unexpected Demographics

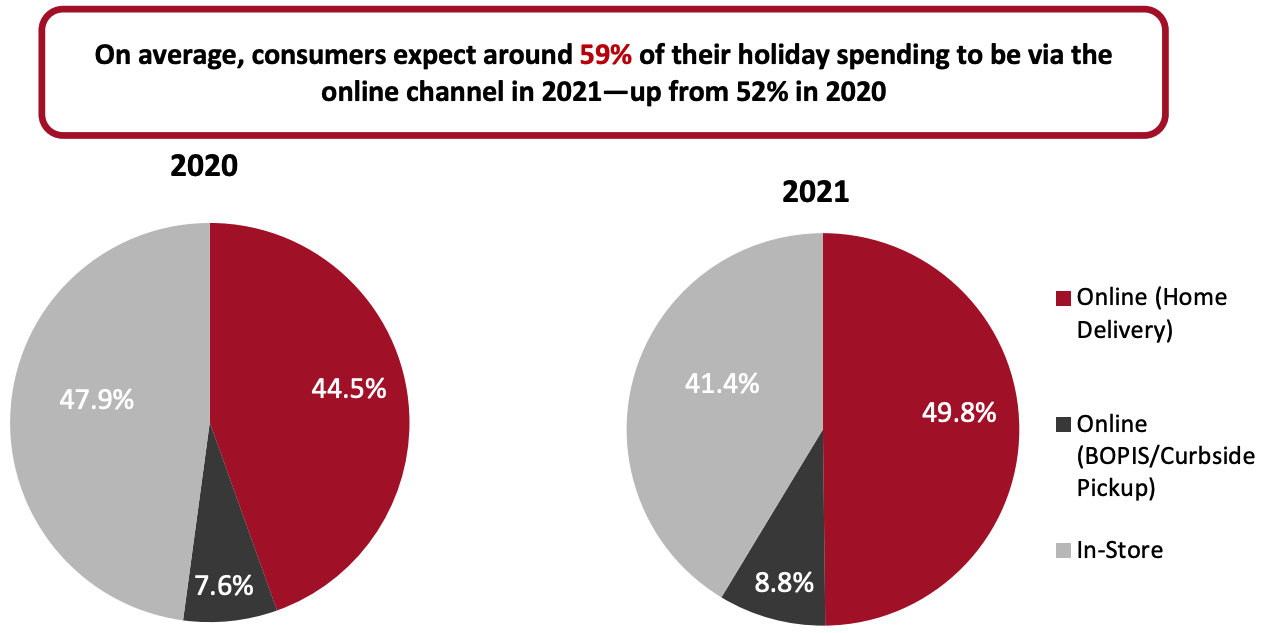

On average, US consumers expect around 59% of their holiday spending to be via the online channel in 2021—up from 52% in 2020 and taking share from the physical retail channel, according to the Coresight Research x January Digital 2021 US Holiday Insights Survey (see Figure 1). Holiday shoppers reported that they expect to spend more online during the 2021 holiday season than they did last year: 37% of consumers expect to spend more on online orders for home delivery, and 17% said they will spend more on BOPIS/curbside-pickup orders.

Across US retail, online sales comprised 20% of total sales in the 2020 holiday quarter—much lower than the online share of 2020 holiday shopping reported by respondents in our survey. Similarly, for holiday 2021, we do not expect e-commerce to capture anywhere near 50% of total retail sales. A key reason for the disparity is that our survey focused on spending specifically for holiday (such as gift giving) and so implicitly excludes everyday shopping that would constitute a large part of total retail sales. In particular, grocery, which has a very low e-commerce penetration rate, accounts for a substantial proportion of day-to-day retail sales, depressing e-commerce’s share of total retail sales. However, we see the rise of online grocery and a surge in Covid-19 cases (leading consumers to be wary of visiting public places, such as stores) as factors that could drive an increase in online shopping through the 2021 holiday season compared to last year.

The data charted in Figure 1 are the averages of respondents’ self-reported splits of holiday shopping by channel.

Figure 1. US Consumers’ Retail Spending Expectations for Holiday 2020 and Holiday 2021, Breakdown by Channel (% of Respondents)

[caption id="attachment_134639" align="aligncenter" width="700"] Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Base: 1,000 US consumers that intend to shop for the 2021 holiday seasonSource: January Digital/Coresight Research[/caption]

The slight increase in the share of BOPIS/curbside pickup—from 7.6% in 2020 to 8.8% in 2021—was driven by shoppers aged 45–60. We expect that consumers will continue to desire the ease and convenience that store-based fulfillment of online services provides. BOPIS/curbside-pickup offers benefits for retailers too, creating opportunity for extra in-store purchases when shoppers pick up orders at retailers’ physical stores, while also enabling them to reduce fulfillment costs. Target, for example, said that fulfilling an order by Drive Up or Order Pickup is 90% cheaper than shipping from a warehouse.

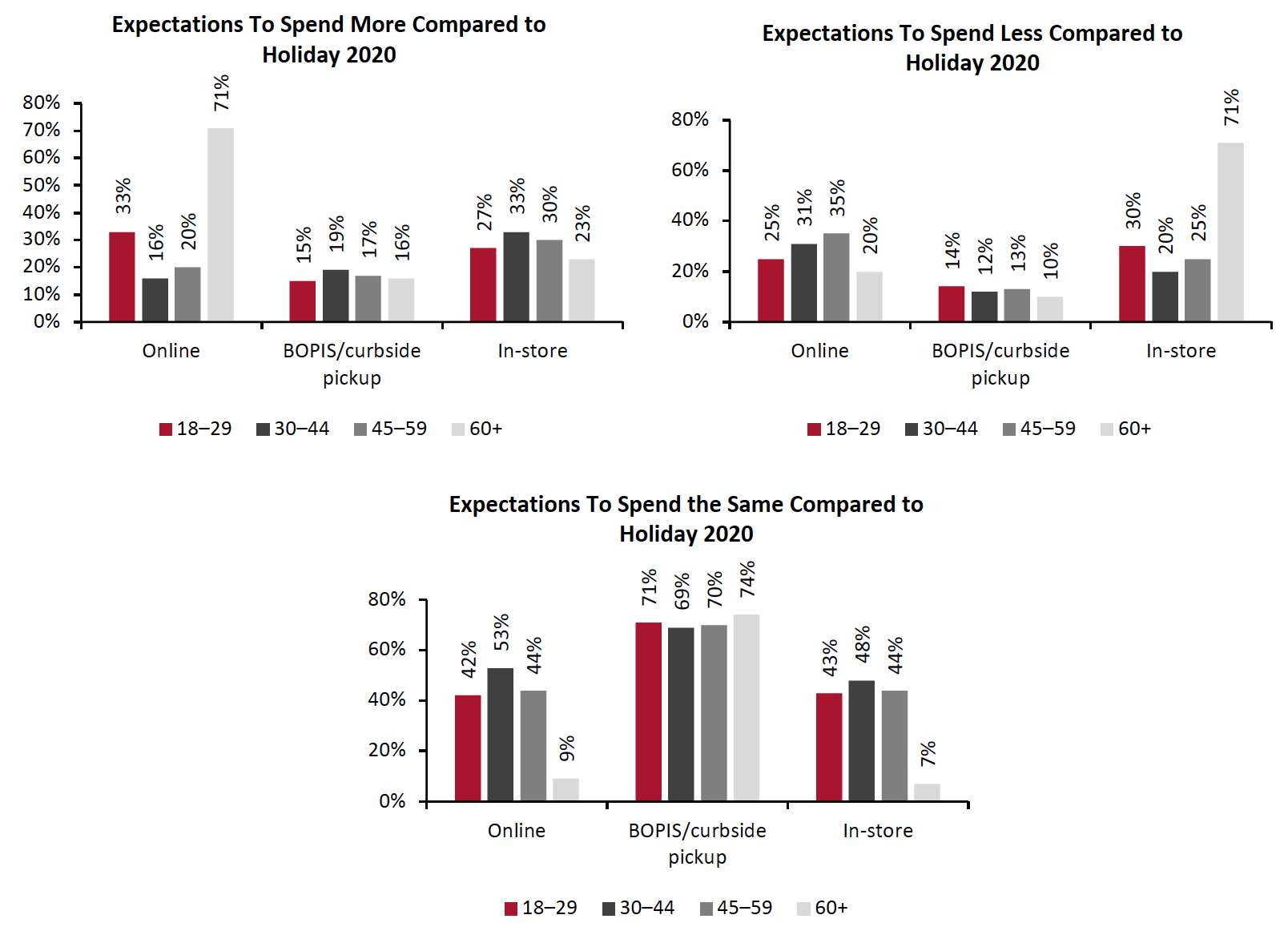

Interestingly, consumers over age 60 presented a significant shift in shopping expectations by channel for the upcoming holiday season. While in-store spending accounted for 71% of overall holiday shopping, on average, among this age cohort in 2020, this year will see the physical retail channel account for only 48% of overall holiday shopping. Cementing the shift, 71% of consumers aged over 60 expect to spend more on online orders for home delivery this holiday season than they did last year, and 16% said they will spend more on BOPIS/curbside-pickup orders. Retailers need to adapt their holiday strategy to cater to the online shopping needs and preferences of this increasingly digitally savvy group of consumers.

Bucking the trend somewhat, consumers aged 30–44 comprise the only age group in our survey that reported increased in-store share of spending for the 2021 holiday season compared to last year—with the brick-and-mortar channel set to take a 43% share of overall holiday shopping among this age group, on average, compared to 39% last year. In addition, one-third of shoppers aged 30–44 reported that they would spend more in-store than they did in the 2020 holiday season—a higher proportion than we saw among other age groups. As such, retailers targeting this age cohort should not neglect the physical store channel when executing marketing and promotional initiatives.

We present the age breakdown for our findings on holiday shopping by channel in Figure 2.

Figure 2. US Consumers’ Retail Spending Expectations by Channel for Holiday 2021, Breakdown by Age (% of Respondents Within Each Subset)

[caption id="attachment_134616" align="aligncenter" width="700"]

Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Source: January Digital/Coresight Research[/caption]

Online Will Be the Dominant Channel for Product Discovery

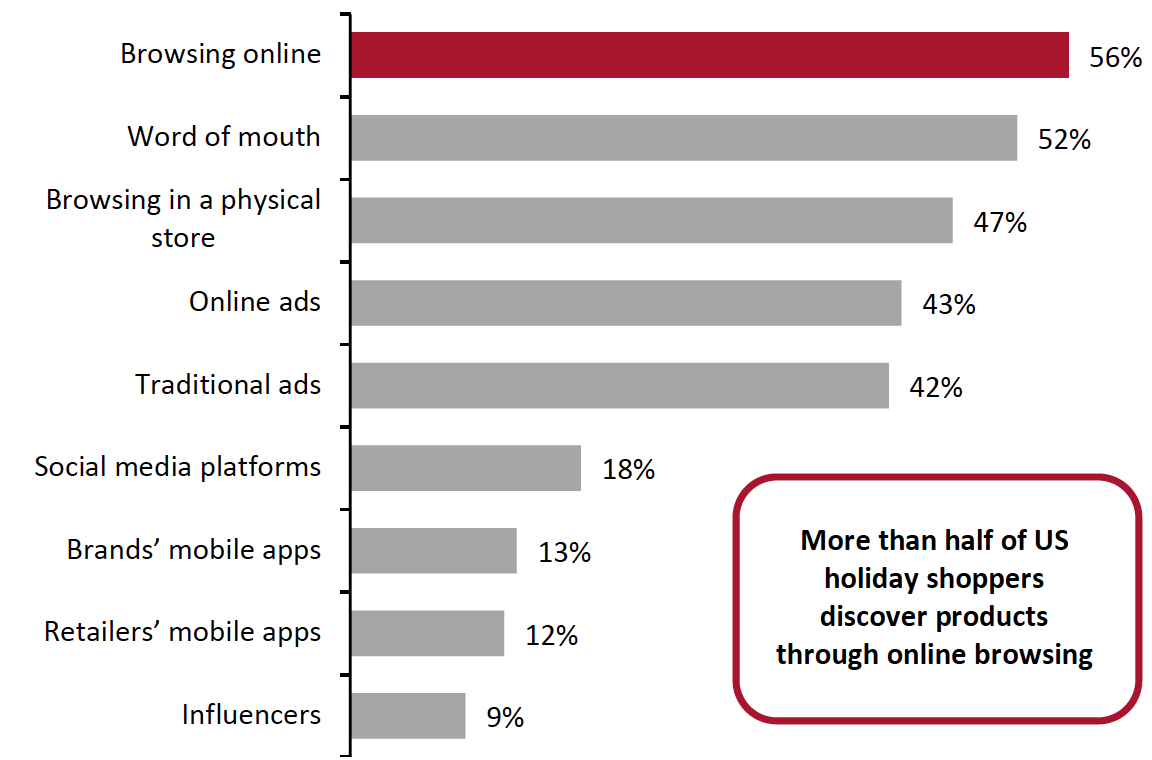

Beyond making purchases, the online channel is also a prominent means for shoppers to discover products: Our survey found that 56% of US shoppers discover new products by browsing online—making it the most popular option for product discovery.

Rounding out the top three product-discovery channels are word of mouth (52% of respondents) and browsing in a physical store (47%), as shown in Figure 3.

Figure 3. Channels Used by US Holiday Shoppers To Discover Products (% of Respondents)

[caption id="attachment_134617" align="aligncenter" width="550"] Respondents could choose multiple options

Respondents could choose multiple optionsBase: 1,000 US consumers that intend to shop for the 2021 holiday season

Source: January Digital/Coresight Research[/caption]

While the online channel is a key source for product discovery among consumers, the physical store should not be underestimated: Nearly half of US holiday shoppers reported that they discover products through physical stores. The brick-and-mortar channel enables consumers to touch and experience products before making a purchase, and brands can further connect with shoppers on a more personal level and drive sales through experienced store associates.

Social Media: Marketing to Today’s Consumer

Within the online channel, retailers cannot afford to ignore the influence of social media when marketing to US shoppers. When we asked our survey respondents about social media marketing, less than one-third of US shoppers said that they do not pay attention to ads on social media. Not surprisingly, this was weighted toward older consumers, with 40% of respondents aged over 60 reporting that they do not pay attention to ads on social media—almost double the proportion of respondents aged 18–29 that reported the same (22%).

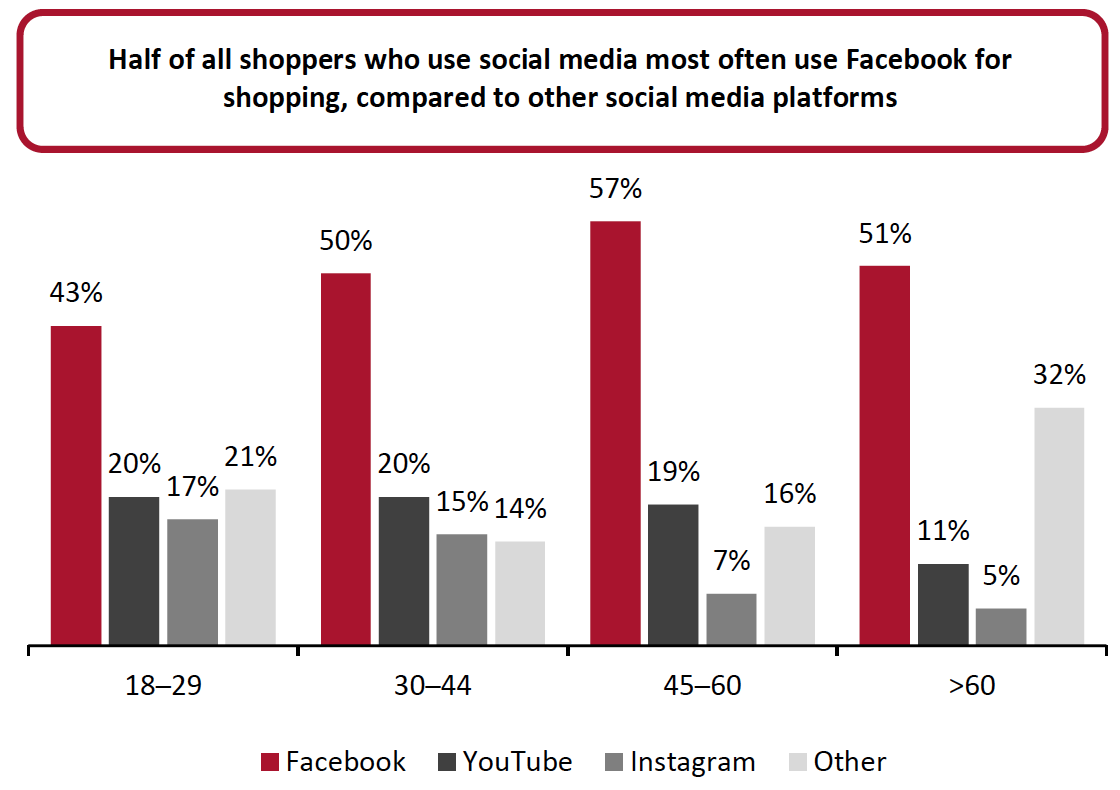

Facebook is the most popular social media platform for shopping, with 50% of shoppers that use social media reporting that they use Facebook for shopping most often. YouTube (18% of social media users) and Instagram (11%) are the next most used social media platforms for shopping. We break down the findings by age in Figure 4; Facebook is the most popular social media platform for shopping among all age groups.

- Facebook is expanding its efforts this holiday to keep brands/retailers and consumers engaged on its platforms: Facebook recently published its 2021 Holiday Marketing Guide to help marketers connect with, engage, entertain and inspire holiday shoppers through social media this season, offering tips on how to improve online product displays.

Figure 4. Social Media Platforms Most Often Used for Shopping*, Breakdown by Age (% of Respondents Within Each Subset) [caption id="attachment_134620" align="aligncenter" width="550"]

*For product discovery, research or making purchases

*For product discovery, research or making purchasesTotals may not sum to 100 due to rounding

Base: 897 US consumers that intend to shop for the 2021 holiday season and use social media

Source: January Digital/Coresight Research[/caption]

Influencers are a major part of social commerce, with our survey finding that nearly one in 10 US holiday shoppers discover products through influencers (as shown in Figure 3). Furthermore, younger consumers believe that social media posts from influencers/celebrities are more trustworthy than from brand representatives and store associates—with 18% of holiday shoppers aged 18–29, and 17% of those aged 30–44, reporting as such (compared to less than 10% in the older age cohorts). Brands and retailers should look to engage influencers as part of their social media strategies, to more effectively impact the purchasing decisions of younger holiday shoppers in particular.

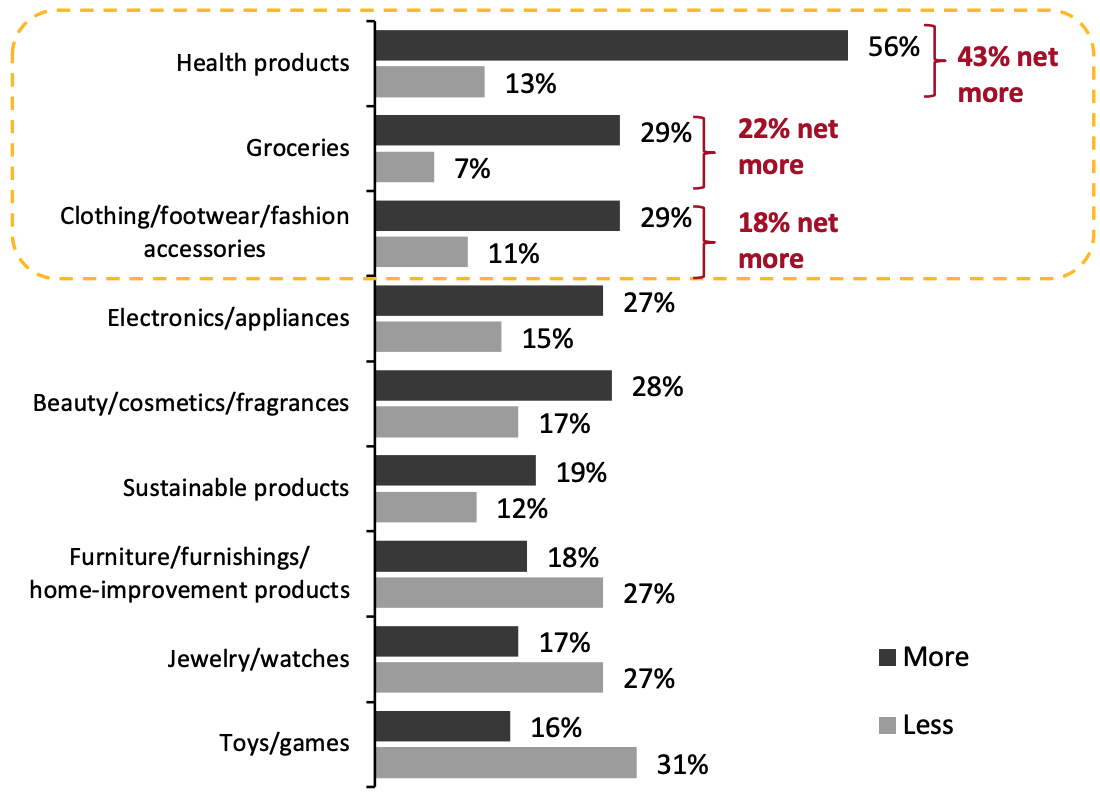

2. What Will Consumers Buy?Increased Spending on Health Products, Groceries and Fashion

Our survey found that the top three product categories with the highest expected net gain* in shoppers versus the 2020 holiday season are health products (43% net more), groceries (22% net more) and clothing/footwear/fashion accessories (18% net more), as shown in Figure 5.

Increased health consciousness, spurred by the Covid-19 pandemic, and US shoppers’ continued uncertainty around lockdown measures may explain the heightened purchase intent for health products and groceries (with consumers redirecting spending from food services). Fashion demand will likely be driven by consumers’ plans to meet family/friends and attend social events during the holiday season, as well as apparel being a potential gifting category.

Figure 5. US Consumers’ Plans To Spend More/Less for Holiday 2021 Than Holiday 2020, Breakdown by Product Category (% of Respondents)

[caption id="attachment_134641" align="aligncenter" width="600"] *To facilitate our analysis of product categories, we explore the differences in spending intentions by consumers: We use “net more” to denote if the proportion of consumers planning to buy more in a category in the 2021 holiday season compared to 2020 is higher than the proportion of consumers planning to buy less; we use “net less” to describe when plans to buy less exceed plans to buy more.

*To facilitate our analysis of product categories, we explore the differences in spending intentions by consumers: We use “net more” to denote if the proportion of consumers planning to buy more in a category in the 2021 holiday season compared to 2020 is higher than the proportion of consumers planning to buy less; we use “net less” to describe when plans to buy less exceed plans to buy more.Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Source: January Digital/Coresight Research[/caption]

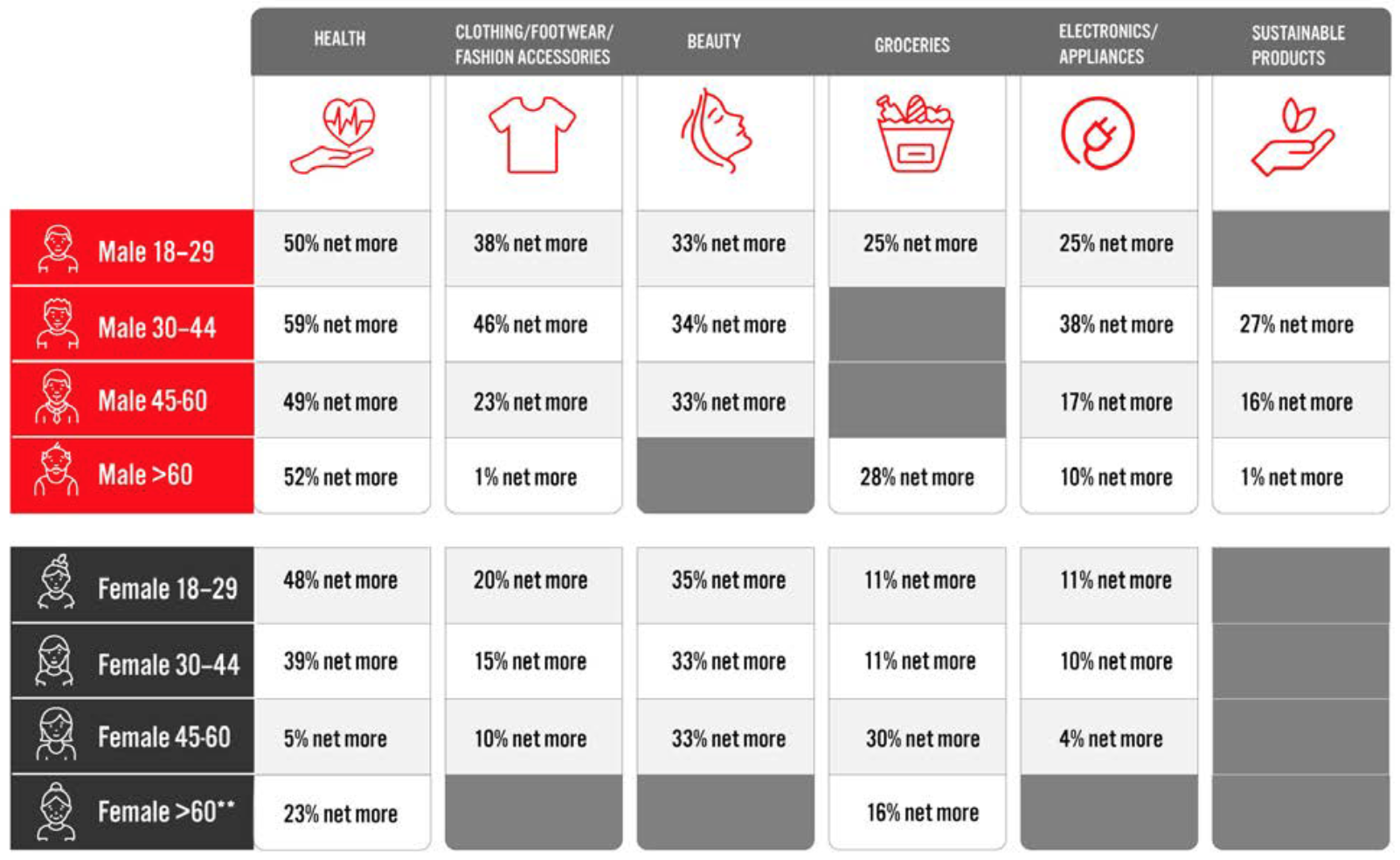

Opportunities To Target Specific Demographics

Understanding the top categories where US consumers plan to spend more this holiday season will guide the allocation of marketing spend and development of promotional campaigns. However, it is imperative for retailers to assess which product categories are set to be the most popular among their respective, most profitable, target markets. We present insights into shopping expectations below, broken down by the age and gender of survey respondents.

- More men (52% net more) than women (35% net more) expressed their intent to buy more health products this holiday season than they did in 2020.

- 33% net more of men aged 18–29 reported that they plan to buy more beauty/cosmetics/fragrance products this holiday season than in 2020, providing opportunity for beauty retailers to capture more sales by expanding their offerings beyond a women-focused assortment.

- In the over-60 age group, 93% of all consumers plan to buy the same amount or more groceries in the 2021 holiday season than they did last year.

Figure 6 illustrates the top five categories among different consumer demographics (in terms of the highest positive net difference between the proportion of consumers planning to spend more versus the proportion planning to spend less).

Figure 6. Top Five Categories* for 2021 Holiday Spending, Breakdown by Age and Gender (% of Respondents Within Each Subset)

[caption id="attachment_134622" align="aligncenter" width="700"] *Highest positive net differences between the proportion of consumers planning to spend more for holiday 2021 than they did in 2020 versus the proportion planning to spend less in each demographic

*Highest positive net differences between the proportion of consumers planning to spend more for holiday 2021 than they did in 2020 versus the proportion planning to spend less in each demographic**For the female >60 subset, only two product categories saw net more spending

Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Source: January Digital/Coresight Research[/caption] 3. How Will Consumers Choose Which Brands/Retailers To Shop?

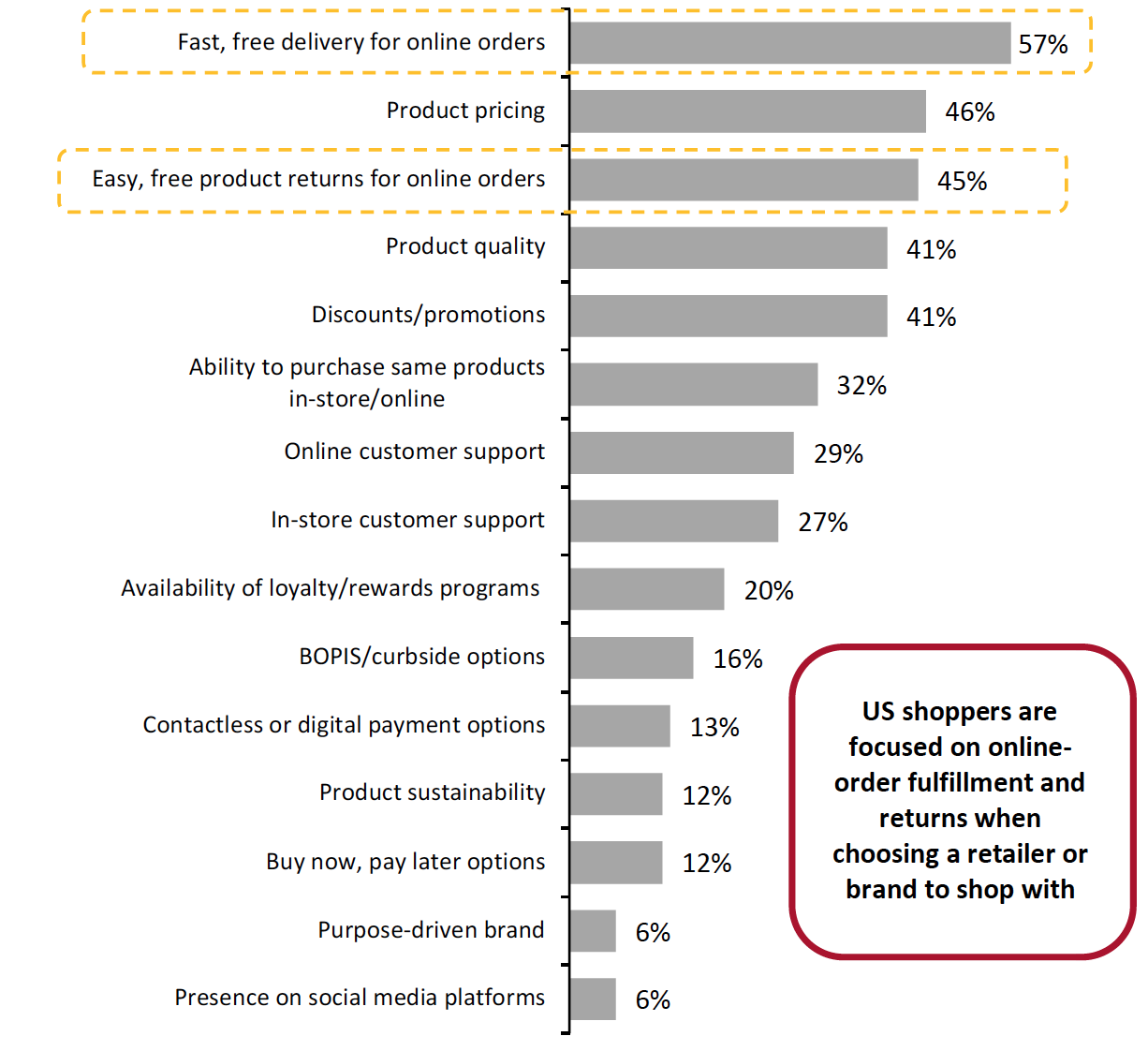

Convenience and Value in the Last Mile Are Key Differentiators

When choosing a brand or retailer to shop with this holiday season, most US consumers (57%) consider fast, free delivery for online orders to be one of the most important considerations—topping the list of important factors (see Figure 7). Easy, free product returns for online orders are considered important by nearly half of respondents (45%), showing that holiday shoppers are prioritizing convenience and value in the last mile—in e-commerce order fulfillment and returns in particular.

Reiterating consumers’ focus on costs, product pricing (46%) rounds out the top three most important factors among all respondents. We present the full list of factors in Figure 7 and discuss those related to online order fulfillment and returns in more detail below.

Figure 7. Factors That Shoppers Consider To Be the Most Important When Choosing a Brand/Retailer To Shop With for the 2021 Holiday Season (% of Respondents)

[caption id="attachment_134623" align="aligncenter" width="550"] Respondents could choose multiple options

Respondents could choose multiple optionsBase: 1,000 US consumers that intend to shop for the 2021 holiday season

Source: January Digital/Coresight Research[/caption]

Fast, Free Delivery for Online Orders

For this year’s holiday season, offering fast and free delivery for online orders may be challenging for brands and retailers for two main reasons:

- Logistics companies have announced plans to increase shipping costs due to increased delivery demand during the 2021 holiday season. USPS plans to temporarily inflate delivery charges between October 3 and December 26, 2021, to offset increased costs during the busiest shipping season of the year—ranging from an additional $0.75 for flat-rate boxes and envelopes to an incremental $5.00 for heavy packages. The new delivery surcharges could add extra pressure to retailers' operating costs as they must absorb the increases (partly or in full) if they are to cater to consumer demand for free (or subsidized) delivery.

- A shortage of truckers has led to increased labor costs, and occasional port shutdowns are causing delays to many deliveries.

To meet consumer demand and remain competitive, retailers must invest in resilient supply chains and last-mile logistics. While technology investments will no doubt be critical to improving supply chain transparency and data visibility, retailers should also look to bolster their workforce this holiday season to handle increased volumes of online orders. Walmart and Amazon are good examples of retailers planning ahead of the holiday season to offer fast and free online deliveries to consumers:

- Walmart has announced that warehouse workers will receive weekly bonuses as they ramp up for the holiday season, up to as much as $200 per week (Walmart warehouse workers already earn a higher rate than its store associates). The company is also set to hire 20,000 supply chain employees, such as freight handlers and lift drivers, to keep up with demand during the busy shopping season and beyond, as reported by CNBC.

- In September 2020, Walmart launched its Walmart+ membership program for $98 per year, or $12.95 per month, with unlimited free delivery from stores (on orders $35 or more), fuel discounts and a new Scan & Go feature for in-store shopping.

- Amazon announced in August 2021 that it doubled the number of cities in which it offers same-day delivery.

Easy, Free Product Returns for Online Orders

One of the benefits of offering easy, free product returns is that consumers are more likely to place an order even if they are not sure about a product—meaning increased sales potential for brands and retailers.

However, product returns are an ongoing retail challenge, and with the ongoing spike in e-commerce and heightened demand for convenience and value, managing reverse logistics is putting increasing pressure on brands and retailers. Product return costs cover customer care, shipping fees, inspection and sorting of goods, repackaging, repairs and storage. For retailers to minimize these costs, they must reduce excessive product returns and optimize returns management.

Sustainable Products and Purpose-Driven Brands Resonate with Millennials and Gen Z Consumers

Sustainability has become top of mind for multiple stakeholders—consumers, employees, investors, governments and NGOs (non-governmental organizations). It is important for brands and retailers to implement sustainable practices throughout their supply chain and communicate their efforts to customers.

Our survey found that millennial and Gen Z consumers are particularly focused on sustainability when shopping. Although only 9% net more shoppers overall plan to spend more on sustainable products this holiday season than they did in 2020 (as shown in Figure 4), this is heavily weighted toward the younger cohorts: A huge 19% net more shoppers aged 30–44, and 12% net more shoppers aged 18–29, plan to buy more sustainable products for holiday 2021. For comparison, there was a “net less” result among the over-60 age group. Interestingly, plans to spend more on sustainable products is also skewed toward male consumers (see Figure 6).

Aligning with these findings, holiday shoppers aged 30–44 are leading the drive toward sustainability in terms of choosing a brand/retailer to shop with this holiday season, with 17% of this age group considering product sustainability to be an important factor—followed by 11% in the 18–29 age group.

The interest in sustainability highlights the importance that holiday shoppers place on brand/retailer values, which is also evident in consumers’ demand for brands to be purpose-driven—meaning that they are focused on making positive social and environmental impacts. Our survey found that millennials and Gen Z are again driving such demand, with the 18–29 and 30–44 age groups showing the strongest preference for purpose-driven brands (9% and 6% of each age group, respectively, cited purpose-driven as an important factor when choosing a brand to shop with, compared to the overall 6%).

Our findings reveal that brands and retailers can attract holiday shoppers by communicating their values—particularly to millennials and Gen Zers.

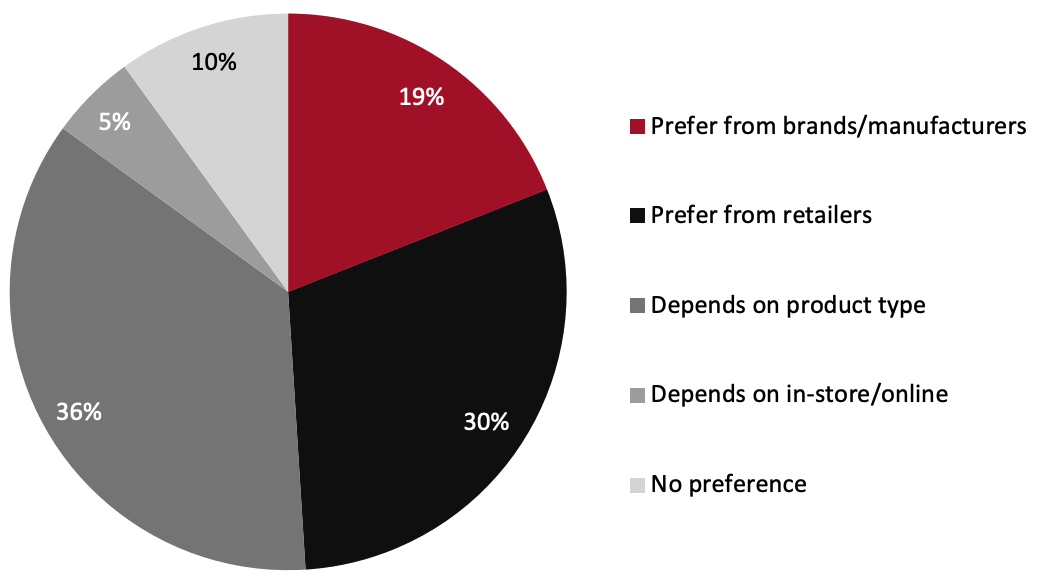

DTC vs. Retailers

Our survey found that consumers’ preference to buy from brands/manufacturers (the direct-to-consumer (DTC) channel) versus retailers is heavily dependent on the product type, as shown in Figure 8. However, 30% of holiday shoppers stated that they prefer buying from retailers—a higher proportion than indicated a preference for DTC (19%).

Figure 8. Shoppers’ Preference of Buying from Brands/Manufacturers versus from Retailers (% of Respondents) [caption id="attachment_134642" align="aligncenter" width="550"]

Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Base: 1,000 US consumers that intend to shop for the 2021 holiday seasonSource: January Digital/Coresight Research[/caption]

We asked consumers about the reasons behind their preferences; we summarize the top reasons in Figure 9. Brands and retailers should lean into their respective benefits when crafting their marketing and sales strategies for the holiday season and beyond, to gain an edge over the competition.

Figure 9. Top Five Reasons of Shoppers Buying Direct from Brand versus Buying from Retailers (% of Respondents)

[caption id="attachment_134625" align="aligncenter" width="550"] Base: 601 US consumers that prefer buying from brands/manufacturers or whose preference is dependent on different factors; 718 US consumers that prefer buying from retailers or whose preference is dependent on different factors

Base: 601 US consumers that prefer buying from brands/manufacturers or whose preference is dependent on different factors; 718 US consumers that prefer buying from retailers or whose preference is dependent on different factorsSource: January Digital/Coresight Research[/caption] 4. What Actions Can Brands/Retailers Take To Meet Consumer Preferences?

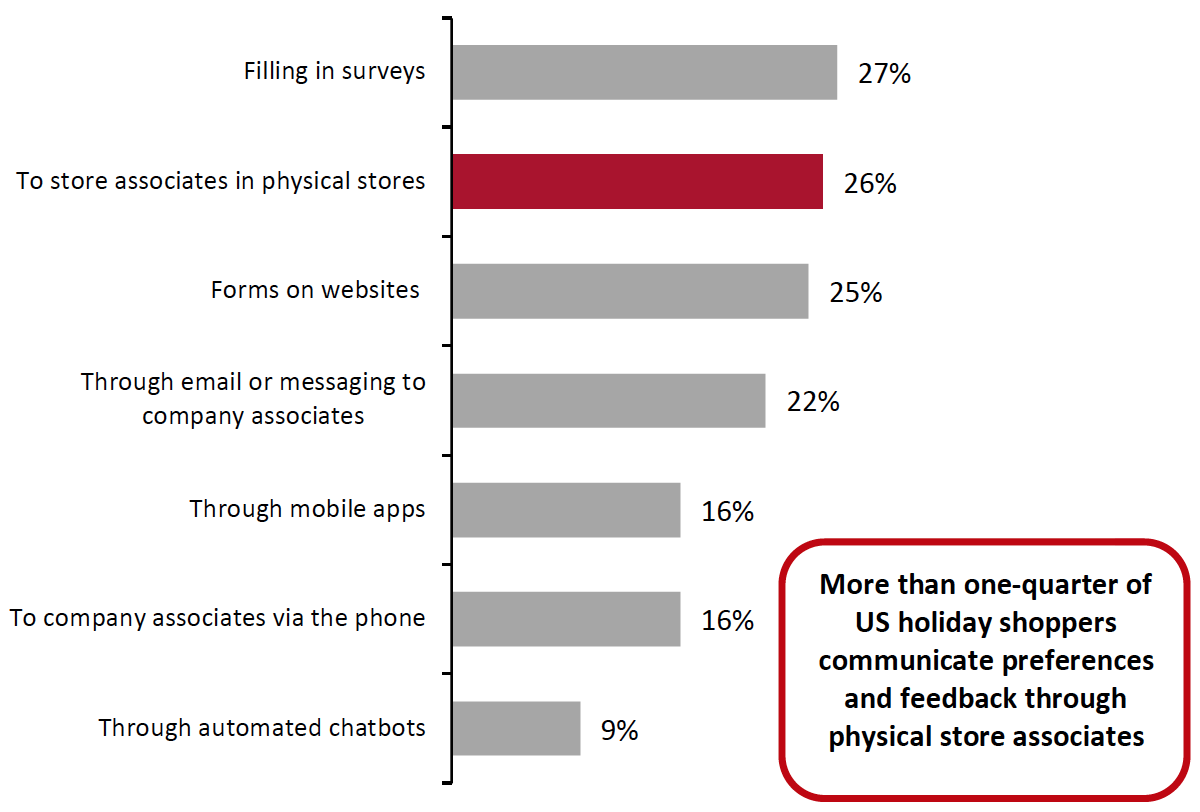

Gathering Consumer Feedback: The Importance of Store Associates

Post-purchase communication enables brands and retailers to gather insights into how they can improve their product and service offerings, and it is also critical in fostering a loyal customer base. As acquiring a new customer is typically more expensive than retaining an existing one, brands and retailers should not overlook this step in the shopping journey.

Our survey found that 69% of US consumers communicate their preferences and feedback to brands/retailers after they make a purchase. Filling in surveys is the most used means of providing feedback (27% of all respondents), closely followed by talking to store associates in physical stores (26%). Retailers should look to leverage in-store associates to communicate with customers before, during and after purchases. Retailers including Kohl’s and Walmart have announced plans to increase store associates as part of efforts to maintain good customer service in the brick-and-mortar channel during the holiday season.

We present the full list of communication channels in Figure 10 and break down our findings further below.

Figure 10. Communication Channels Used by US Consumers To Provide Post-Purchase Preferences and Feedback (% of Respondents)

[caption id="attachment_134626" align="aligncenter" width="550"] Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Base: 1,000 US consumers that intend to shop for the 2021 holiday seasonSource: January Digital/Coresight Research[/caption]

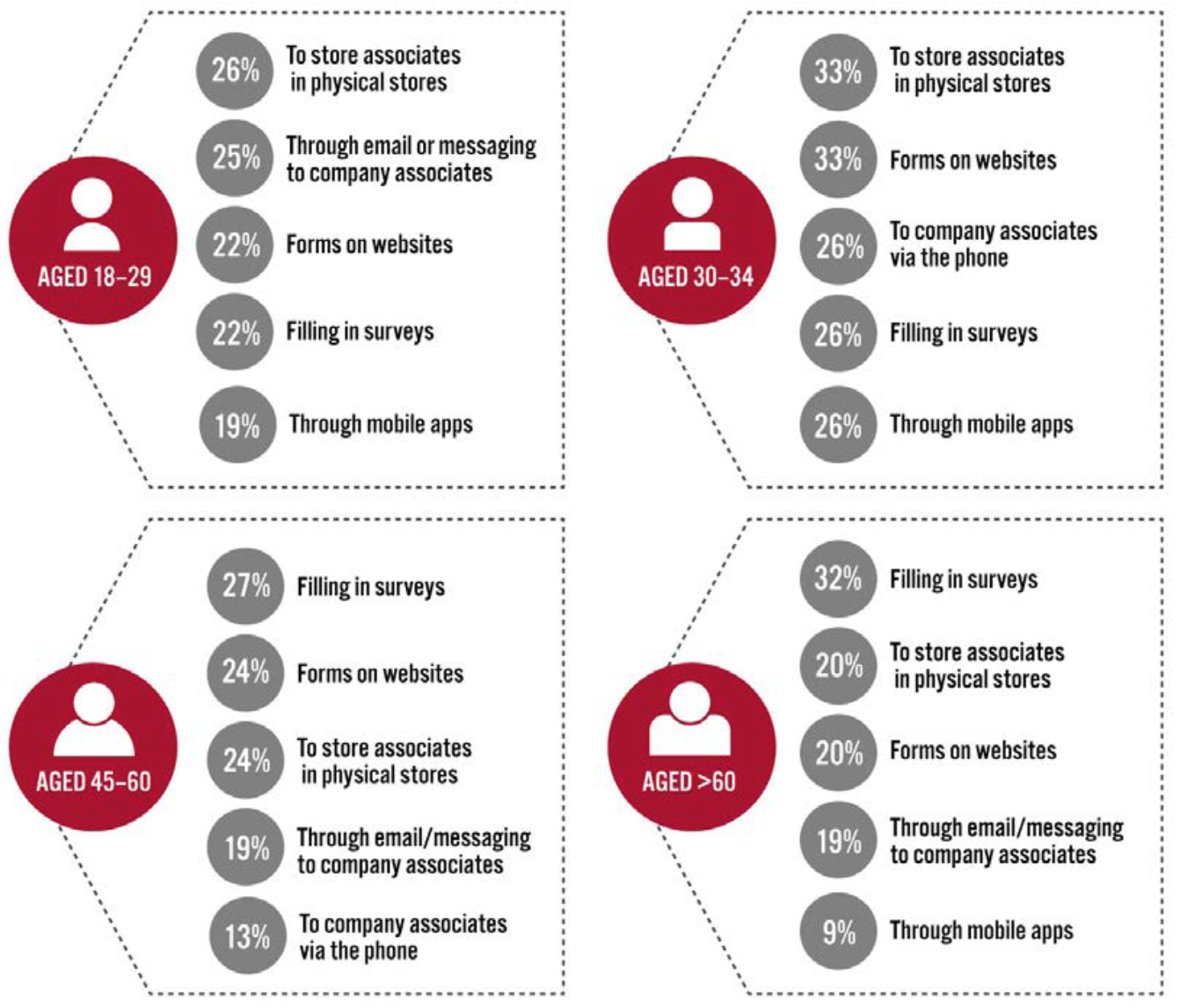

The ways shoppers choose to give feedback to brands and retailers differ between age groups, which retailers will need to take into consideration when communicating with customers (see Figure 11).

- Physical stores are the primary post-purchase touchpoint for the two younger consumer groups (spanning ages 18–44), highlighting the importance of store associates in representing a brand/retailer and retaining customers.

- For shoppers aged 45 and over, completing surveys is the primary way of communicating post-purchase preferences and feedback. Given the expected shift to e-commerce this holiday season, online surveys would be an effective tool for retailers to gain feedback from older shoppers when they make purchases digitally.

Figure 11. Top Five Communication Channels for Providing Post-Purchase Preferences and Feedback, Breakdown by Age (% of Respondents Within Each Subset)

[caption id="attachment_134627" align="aligncenter" width="700"] Base: 1,000 US consumers that intend to shop for the 2021 holiday season

Base: 1,000 US consumers that intend to shop for the 2021 holiday seasonSource: January Digital/Coresight Research[/caption]

What We Think

Implications for Brands/Retailers

- Online is the primary channel through which US consumers plan to shop for the 2021 holiday season. Brands and retailers should pay particular attention to shoppers aged 60 and over, as this age group is seeing a huge shift from in-store to online spending.

- Brands and retailers should seek opportunities to target specific consumer demographics when determining assortment and marketing products for the holiday season—for instance, we noted that one-third of young men plan to buy more beauty/cosmetics/fragrance products the coming holiday season than 2020; beauty brands should look to capitalize on this demand.

- Within the online channel, retailers cannot afford to ignore the influence of social media when marketing to US shoppers, particular younger consumers. Our survey found that Facebook is the primary social media platform used for product discovery among US holiday shoppers; brands and retailers should consider their social media presence and messaging in their marketing strategies for the holiday season.

- While the online channel is a key source for product discovery among consumers, the physical store should not be underestimated: Nearly half of US holiday shoppers reported that they discover products through physical stores. The brick-and-mortar channel enables consumers to touch and experience products before making a purchase, and brands can further connect with shoppers on a more personal level to drive sales through experienced store associates.

- It’s table stakes to provide value and convenience for holiday shoppers. When choosing a brand or retailer to shop with this holiday season, US shoppers prioritize fast, free delivery of online orders. To meet consumer demand for value and convenience in online fulfillment, brands and retailers should upgrade their last-mile capabilities and think about hiring more staff throughout the impacted supply chain in advance of the holiday season.

- More than two-thirds of our survey respondents reported that they communicate their preferences and feedback to brands/retailers after they have made a purchase. Brands and retailers should gather and analyze customer feedback to inform operational improvements. First-party data such as surveys, forms on retailers’ and brands’ websites or even brands’ own social media pages are good examples of ways to communicate with customers—but again, the physical store cannot be underestimated, with store associates providing a critical touchpoint for consumers.

What Lies Ahead in 2022?

Looking ahead to 2022, we expect to see more comprehensive offerings in the online fulfillment space, reflecting continued growth opportunities in e-commerce. Target uses its stores to fulfill close to 90% of online orders, according to the company, and it has announced plans to invest $4 billion annually over the next several years into store upgrades and the strengthening of its online business. Target expects to remodel 150 stores in time for the holiday season to cater to same-day fulfillment, as it seeks to better compete with Amazon and Walmart.

We also expect retailers to continue to offer BOPIS/curbside pickup as a fulfillment method. Supply chain disruptions and labor shortages lead to increased delivery times and increased logistics costs: By offering BOPIS/curbside pickup, retailers may be able to save last-mile delivery costs and shorten shipping timeframes to better meet customers’ expectations.

Despite a sustained shift to e-commerce—with our survey confirming that the online channel will remain popular among US shoppers this holiday season—there is still opportunity in the brick-and-mortar channel. One retailer that is looking to increase its physical presence is Amazon. The e-commerce giant is reportedly planning to open department stores in the US, selling apparel, household items, electronics and other merchandise. A department store format for Amazon may help the company better reach customers that like trying on products and will enable Amazon to offer more store-based fulfillment options such as BOPIS/curbside pickup.

Survey Methodology

The analysis presented in this report is based on findings from the Coresight Research x January Digital 2021 US Holiday Insights Survey, an online survey conducted on August 2–9, 2021. Respondents totaled 1,000 US consumers aged 18 or above that reported intentions to shop for the 2021 holiday season. The distribution of age groups among the respondents were as follows:

- Aged 18–29: 250 respondents

- Aged 30–44: 240 respondents

- Aged 45–59: 230 respondents

- Aged over 60: 280 respondents