Nitheesh NH

What’s the Story?

In this report, we look at key trends in the US digitally native DTC (direct-to-consumer) clothing and footwear market and examine what brands are doing to better serve this market and leverage the opportunities it presents. Born online, digitally native brands sell directly to consumers, initially via their own websites, with many then expanding to include a brick-and-mortar presence—we include such companies in this report, which are often referred to as digitally native vertical brands (DNVBs). We exclude digitally focused apparel service providers, such as rental company Rent the Runway, and marketplaces such as The Verticale.Why It Matters

Over the past few years, many digitally native DTC apparel brands in the US have risen to prominence. The lower costs of selling products online have enabled brands such as AdoreMe, Allbirds and Everlane to stand out and offer high-quality products at affordable prices. Once established, many digitally native DTC apparel brands look toward offline expansion to complement their online models with the benefits of physical stores. However, as the US economy and the overall retail environment has changed in 2020 due to Covid-19 pandemic-driven disruption, digitally native DTC apparel brands have reported mixed operating results. Some brands hit a growth wall and reported challenges in business expansion, while others saw a sales surge due to the casualization trend and booming e-commerce. Against this backdrop, we provide insights into the key trends that we are seeing in the digitally native DTC clothing and footwear market in the US, and we consider how brands can best position themselves for future success.The US Digitally Native DTC Apparel and Footwear Market: A Deep Dive

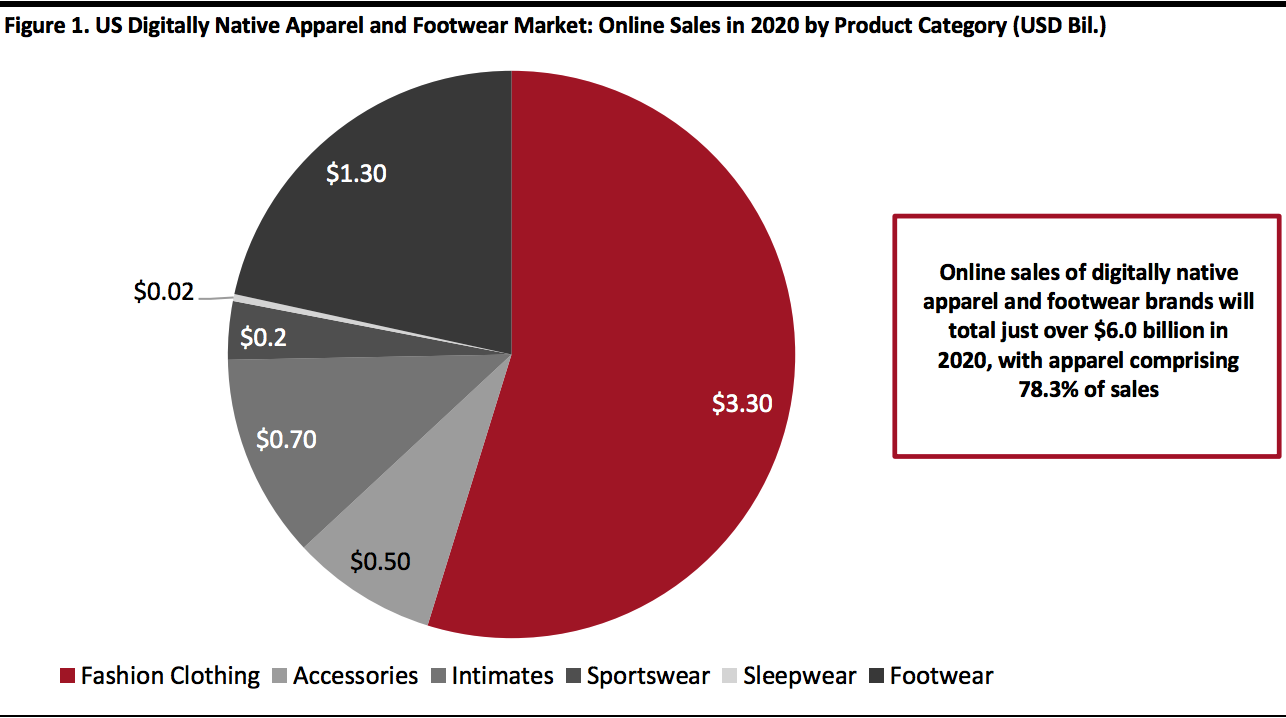

Market Size and Growth Projections We expect US online sales of apparel by digitally native DTC apparel and footwear brands to total just over $4.7 billion in 2020, while footwear sales will generate $1.3 billion—amounting to just over $6.0 billion and accounting for 2.2% of estimated overall US apparel and footwear consumer spending ($270.9 billion), according to Fung Business Intelligence and Coresight Research. We estimate that the US digitally native DTC apparel and footwear segment will grow by 4.5% to $6.3 billion in 2021, driven by a continued consumer shift to online shopping. However, we expect the overall US apparel and footwear market to grow by 9% in 2021, outpacing the digitally native DTC apparel segment, which faces fierce competition from traditional retailers and brands. Figure 1 shows a breakdown of the digitally native DTC apparel and footwear market’s online sales for 2020 by category. Fashion clothing (all clothing excluding intimates, sleepwear and sportswear as defined by Fung Business Intelligence) is the largest category, with estimated sales of $3.3 billion in 2020. [caption id="attachment_120833" align="aligncenter" width="700"] Note: The market size includes online sales of apparel and footwear brands that are digitally native and sell apparel and footwear products directly to consumers via their own websites. The market size excludes offline sales generated by digitally native DTC apparel and footwear brands and apparel service providers.

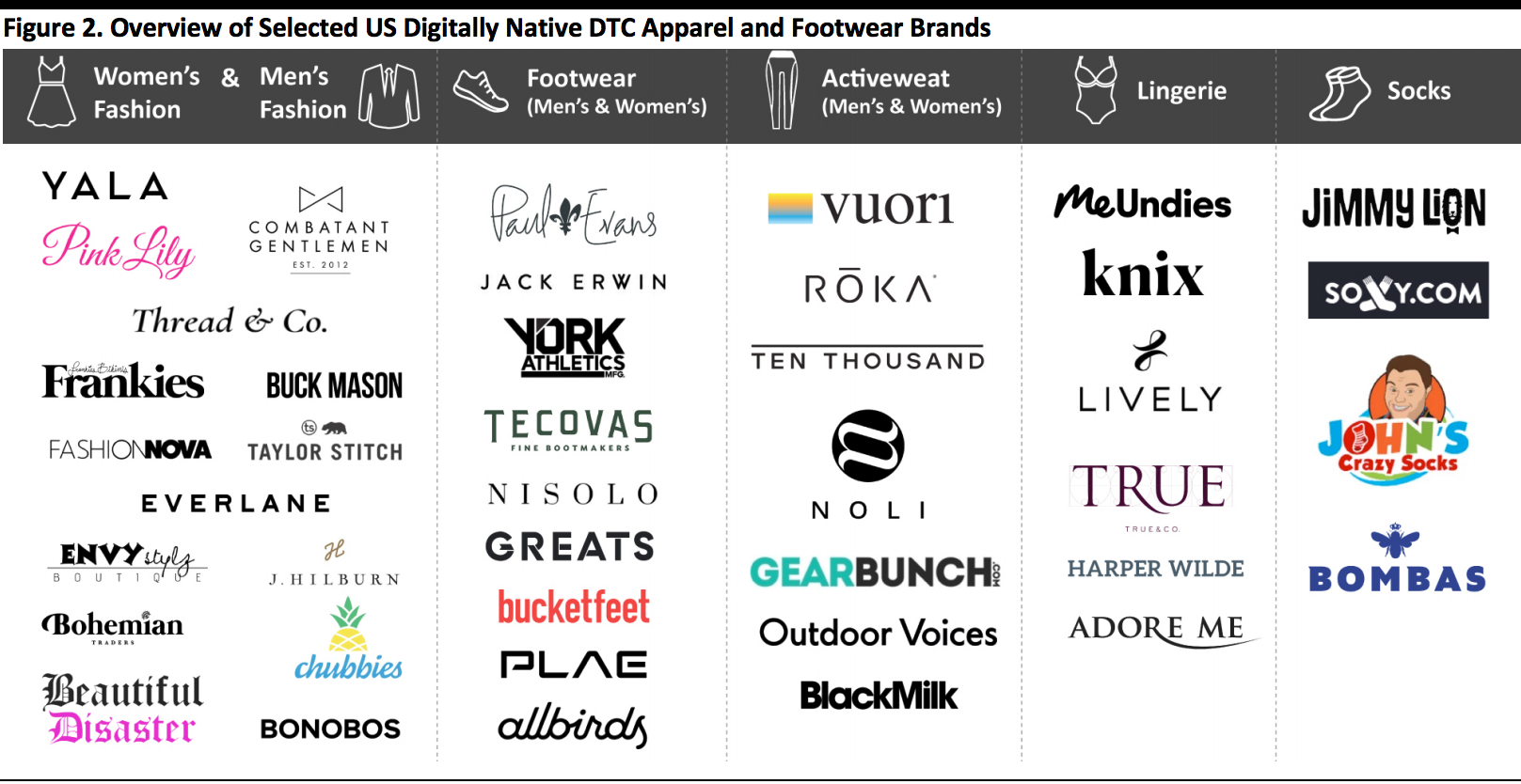

Note: The market size includes online sales of apparel and footwear brands that are digitally native and sell apparel and footwear products directly to consumers via their own websites. The market size excludes offline sales generated by digitally native DTC apparel and footwear brands and apparel service providers.Source: Fung Business Intelligence/Coresight Research[/caption] Figure 2 provides an overview of selected brands in the US market by product category. Many digitally native apparel brands have opened physical stores or showrooms, such as Allbirds, Bonobos and Everlane. Allbirds has become a unicorn company, as it is worth more than $1 billion. [caption id="attachment_120834" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Five Key Trends

We discuss five trends in the US digitally native DTC apparel market and present a number of cases that exemplify our insights.

1. Growth Drivers for 2021: Price, Quality and Convenience

We estimate that e-commerce sales will comprise almost 19% of total retail sales in the US in 2020. We expect the pandemic-driven acceleration in e-commerce to see a sustained consumer shift to online shopping in 2021, which aligns well with the online-first approach of digitally native DTC brands—particularly for first-mover brands such as Adore Me, Allbirds and Everlane. According to the DTC Purchase Intent Index published in October 2020 by third-party content marketing company Diffusion, 79% of US consumers plan to increase the number of online purchases they make in 2021, and clothing and apparel is the top DTC category that they intend to shop next year.

Alongside the long-term trend of online growth, we expect the success of the current generation of digitally native DTC apparel brands to be driven by other factors—namely quality, price point and convenience.

Source: Coresight Research[/caption]

Five Key Trends

We discuss five trends in the US digitally native DTC apparel market and present a number of cases that exemplify our insights.

1. Growth Drivers for 2021: Price, Quality and Convenience

We estimate that e-commerce sales will comprise almost 19% of total retail sales in the US in 2020. We expect the pandemic-driven acceleration in e-commerce to see a sustained consumer shift to online shopping in 2021, which aligns well with the online-first approach of digitally native DTC brands—particularly for first-mover brands such as Adore Me, Allbirds and Everlane. According to the DTC Purchase Intent Index published in October 2020 by third-party content marketing company Diffusion, 79% of US consumers plan to increase the number of online purchases they make in 2021, and clothing and apparel is the top DTC category that they intend to shop next year.

Alongside the long-term trend of online growth, we expect the success of the current generation of digitally native DTC apparel brands to be driven by other factors—namely quality, price point and convenience.

- Quality

- Price point

- Convenience

Source: Company reports/Coresight Research

3. Best of Both Worlds: New Approaches to Combining Online with Offline For several years in the US, Instagram has been an important digital channel for marketing digitally native DTC apparel products. Although many brand discoveries happen online through social media channels such as Instagram, we anticipate that digitally native DTC apparel brands will still have faith in physical stores and are adjusting their strategies to better combine online with physical retail. Brick-and-mortar sales growth is unpredictable, but we expect that having a physical footprint will help brands to improve overall operating performance in terms of sales, traffic and customer acquisition and retention. We expect to see more digitally native DTC brands employ omnichannel strategies to leverage opportunities for consumer engagement, such as by launching spaces where consumers can enjoy brand-related experiences. In Figure 4, we highlight several strategies for brick-and-mortar business expansion that we have recently seen from digitally native DTC apparel and footwear brands in the US—with many turning to alternative ideas such as showrooms, pop-ups and curated decorations to attract more customers. Figure 4. Selected US Digitally Native DTC Apparel and Footwear Brands: Strategies for Brick-and-Mortar Expansion [wpdatatable id=634]Source: Company reports/Coresight Research

4. Working with Third-Party Marketplaces and Retailers Digitally native brands typically start selling through their own e-commerce websites. In recent years, these brands have been expanding their businesses to sell on third-party marketplaces (such as Amazon) or online through retailers (such as Target and Walmart) and department stores (such as Nordstrom). We expect to see more brands look beyond a single webstore and sell their products on marketplaces to leverage their existing audiences and gain the benefits of increased traffic, enhanced loyalty programs and improved buyer trust. It will remain important for digitally native brands to diversify their selling channels and capture more market share among e-commerce competition—even as that dilutes their “DTC” differentiation and brings their distribution strategies closer to those of traditional brands. Figure 5. Selected US Digitally Native DTC Apparel and Footwear Brands: Footprints on Third-Party Retail Sites or Marketplaces [wpdatatable id=635]Source: Company reports/Coresight Research

In addition, digitally native DTC apparel brands such as Blume, GLDN and Huron are working with new vertical marketplaces such as Thingtesting and The Verticale, which focus on selling DTC brands. The Verticale was launched in November 2020 and features 50 digitally native DTC brands; its aims to become the DTC version of a shopping mall, according to the company. Engaging with its user community, The Verticale has organized several discussions on its Instagram page on topics including female empowerment, inclusivity and sustainability. The company claims that the story behind every brand is where it draws its motivation to curate its marketplace. In the next three to five years, we expect to see the emergence of more vertical-focused DTC marketplaces and further close collaboration between brands and marketplaces. [caption id="attachment_120837" align="aligncenter" width="700"] The Verticale’s women’s clothing website page

The Verticale’s women’s clothing website pageSource: The Verticale[/caption] 5. Community Building To Connect with Target Consumers The focus of digitally native DTC apparel brands will still be online, meaning that brands that want to win loyal customers will need to appeal to potential customers through personalized, valuable and interesting online experiences and community building. Many purpose-led apparel brands have seen success during the crisis in 2020 by connecting with customers on an emotional level and attracting them to the product offerings that align with their changing lifestyles. Brands and retailers can build communities to support marketing success. Authentic and engaging brand communities can enable consumers to foster common interests and creating meaningful connections. Brands that build ways to connect to, or resonate with, their target consumers are likely to improve customer loyalty and improve sales, alongside promoting their brand message or philosophy. Figure 6. Examples of Community Building from Selected US Digitally Native DTC Apparel and Footwear Brands [wpdatatable id=636]

Source: Company reports/Coresight Research

What We Think

Implications for Digitally Native DTC Apparel Brands and Retailers- We forecast that online sales of digitally native apparel and footwear brands will reach just over $6.0 billion in 2020, with fashion clothing contributing $3.3 billion—representing just over half of total sales. We expect the potential 4.5% growth of the market in 2021 to be driven by a sustained consumer shift to e-commerce, as well as increased expectations around quality, price and convenience. Brands should optimize their service offerings and further diversify their product mix by expanding into different categories, in order to broaden their customer base.

- While digitally native DTC apparel companies are focused on online business expansion, physical stores still remain an important factor in capturing market share. Innovative ways of attracting offline traffic include launching engaging and experience-focused retail spaces, such as showrooms or pop-ups, at popular locations.

- It is important for brands to offer a community with themes that echo consumer sentiment. Community building allows brands to create meaningful connections with consumers and engage in lifestyle themes related to the brand.

- Apparel shoppers will continue to buy from big brands, given the wide product selection and ease of accessibility both online and offline. Nonfood middle-ground private label brands will be challenged by the structural shift toward brands, especially for apparel. We expect retailers to seek out partnerships with, and acquisitions of, strong brands, including DTC brands. For example, Amazon, Target, Urban Outfitters and Walmart are already carrying DTC apparel brands in their portfolio. We anticipate that more apparel retailers and brands will carry DTC brand offerings or collaborate with them on co-branded products.

- Brand resonance has become important for both DTC and non-DTC brands and retailers. Whether for big brands such as NIKE or niche brands such as Allbirds, finding ways to engage with customers is vital. Consumers are seeking our brands that resonate with their lifestyle choices more than ever: We expect to see more retailers and brands adopt new retail models such as livestreaming and selling on Instagram, as well as reinventing their offline stores to enhance consumer engagement.