From left to right: Deborah Weinswig, CEO and Founder of Coresight Research; Robert D’Loren, CEO and Chairman of Xcel Brands; Gerald Storch, Founder and CEO of Storch Advisors and former CEO of Hudson’s Bay Company; and William Taubman, COO of Taubman Centers

Source: Coresight Research

Talking Retail Real Estate

This week, the Coresight Research team is attending the ICSC RECon convention, which bills itself as the world’s largest global gathering of retail real estate professionals. The conference, produced by the International Council of Shopping Centers (ICSC), is taking place in Las Vegas May 20–23. In this brief report, we summarize observations from a panel session that included Coresight Research CEO and Founder Deborah Weinswig, and note 10 key takeaways from our extensive discussions with retail real estate executives at the event.

Converging and Accelerating Technologies

Jeffrey Newman, Chair of the Real Estate department at law firm Sills Cummis & Gross, hosted a panel discussion titled “Retail Real Estate Through the Lens of Converging and Accelerating Technologies.” The panelists were Deborah Weinswig, CEO and Founder of Coresight Research; Robert D’Loren, CEO and Chairman of brand-management firm Xcel Brands; Gerald Storch, Founder and CEO of Storch Advisors and former CEO of department store retailer Hudson’s Bay Company; and William Taubman, COO at real estate firm Taubman Centers. The panelists’ observations included the following:

- Although the industry consensus is that retail square footage will shrink in the near term, microfactories—which make products on demand—could reverse this trend. Microfactories will allow for personalization, customization and improved on-shelf availability and, so, will support consumer demand for physical stores.

- In an uncertain and fast-changing retail sector, some technologies’ return on investment remains unproven, so real estate owners must invest their capital carefully.

- E-commerce can actually activate store-based commerce in a “new retail,” or omnichannel, environment. Retailers can achieve this by offering buy-online, pick-up-in-store and reserve-online, pick-up-in-store services; by partnering and collaborating with e-commerce players; and by simply making their stores better.

What We’re Hearing

These are our top 10 takeaways from the conversations we have had with executives and industry insiders at ICSC RECon this week:

1. Experiential retail and the reinvention of shopping centers are the dominant topics of conversation. The in-store experience and the mall experience have been widely discussed, and the ICSC invited retail-tech and property-tech startups to give presentations on ways to revive brick-and-mortar retail.

2. Many shopping centers are dedicating more space to food-service offerings, including

food halls. However, food service’s share of space has a natural cap. A popular view is that food service maxes out in the high teens in terms of percentage of US mall square footage that can be devoted to it in practical terms. This is in contrast to some Chinese shopping centers, where up to 30%–40% of space is dedicated to food service.

3. The mall experience is not just about food service, though. Malls’ diversification beyond retail involves much more than just building out food-service offerings.

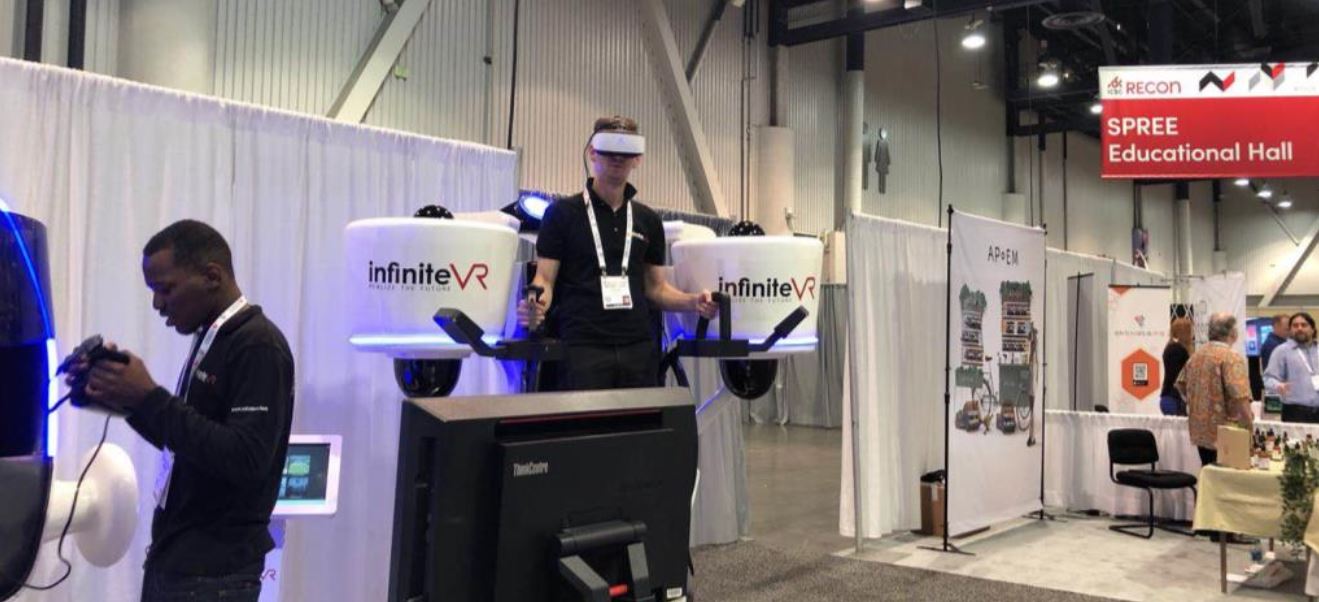

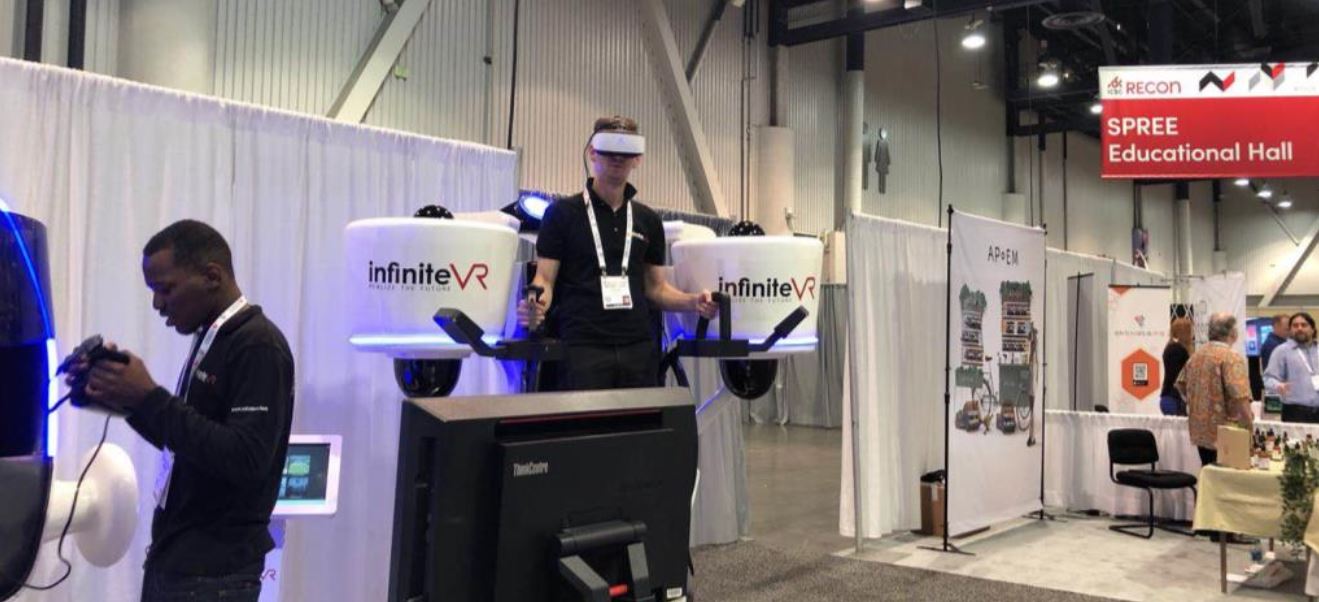

As we have recently noted, mall operators are moving beyond apparel stores clustered around anchor stores to create a mix of leisure and entertainment venues, gaming and virtual-reality concepts, art installations, business services (such as office coworking spaces) and other nonretail uses, such as medical centers and learning centers.

Entertainment concepts for shopping centers featured at ICSC RECon 2018

Source: Coresight Research

Entertainment concepts for shopping centers featured at ICSC RECon 2018

Source: Coresight Research

4. Shopping-center owners are building in permanent pop-up spaces to cater to shopper and retailer demand for offerings that change more quickly. And they are incorporating shorter leases to adapt to the faster pace of change in retail real estate.

5. Tourism is supporting US shopping-center traffic and spending. We have heard from both landlords and tenants that 2018 has seen solid domestic travel trends. The US Travel Association recently reported a 3.8% year-over-year increase in domestic leisure travel in March (latest) and noted that domestic business travel growth is accelerating. The association also reported a 3.4% year-over-year increase in international inbound travel and domestic travel in March and remarked on a spike in international inbound travel in the month.

6. We have heard polarized views on e-commerce this week. Some commentators predict that e-commerce penetration will reach as high as 50% in selected categories by 2025. (In categories such as media and electronics, we expect e-commerce’s share to be over 50% by that date.) However, other industry contacts still sound unconcerned about the rapid growth in e-commerce. They view the online channel as the “new catalog,” which implies it will be a niche channel and a complement to store-based shopping. (

We disagree.)

7. In the coming years, retailers will have more flagship stores in the US in second- and third-tier cities, but fewer stores overall. They will choose sites more carefully and will build stores that focus more on gamification and entertainment.

8. Some industry insiders feel that even if mid-tier B and C malls close down, “the dirt is good,” meaning that we will see mixed-use centers that blend retail and residential offerings emerge in their place. One executive we talked to observed that the demolition of closed malls in certain areas had actually supported occupancy rates at the remaining shopping centers in those areas.

9. Beauty is a

big focus for department stores, which are trying to offset weak performance in a highly competitive and sluggish apparel market. Some department stores are trying to ride the wildly popular K beauty trend that was initiated by South Korean beauty brands.

APoEM skincare brand exhibiting at ICSC RECon 2018

Source: Coresight Research

APoEM skincare brand exhibiting at ICSC RECon 2018

Source: Coresight Research

10. Finally, we have heard some positive comments from shopping-center landlords about store closures, whether they are a result of bankruptcies or closure programs. The strongest landlords view such closures as an opportunity to rebalance their tenant mix and improve their offerings with services such as fitness, lifestyle and entertainment formats. The shifting of the tenant mix is a subject we have covered extensively before and will continue to cover.

Entertainment concepts for shopping centers featured at ICSC RECon 2018

Source: Coresight Research

Entertainment concepts for shopping centers featured at ICSC RECon 2018

Source: Coresight Research APoEM skincare brand exhibiting at ICSC RECon 2018

Source: Coresight Research

APoEM skincare brand exhibiting at ICSC RECon 2018

Source: Coresight Research