DIpil Das

Introduction: The CORE Framework in Beauty Retail

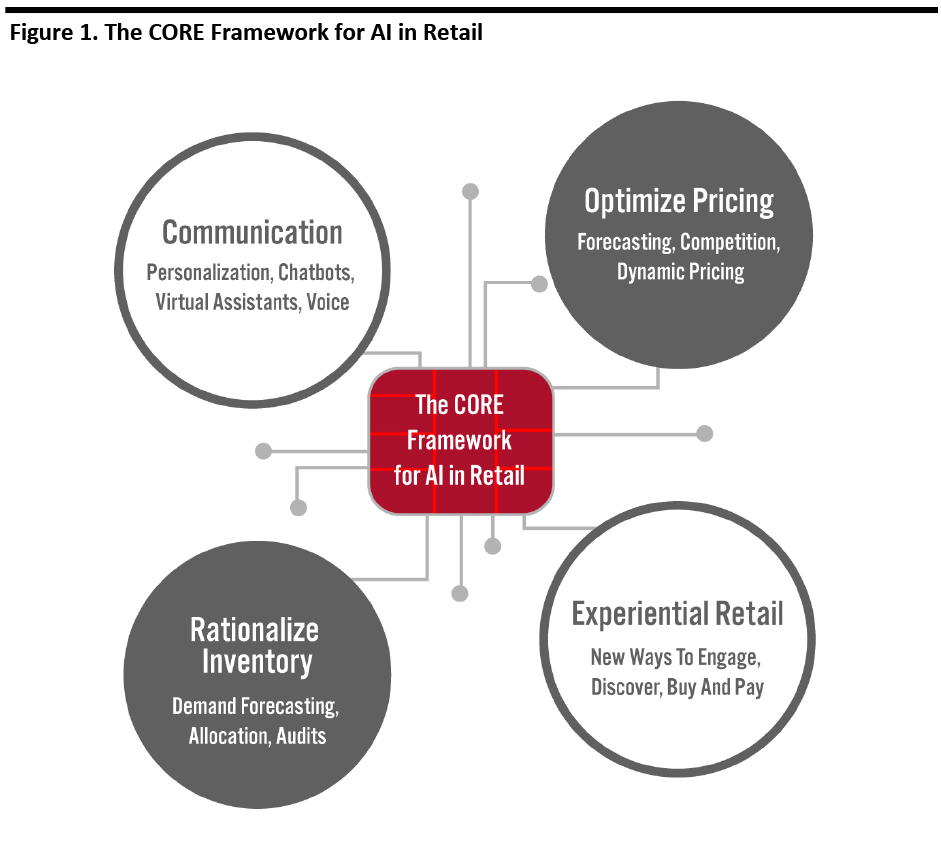

The Coresight Research CORE framework highlights the potential application of AI in four areas of retail across the supply chain, including front-end (consumer-facing) and back-end (fullfillment and supply chain) operations:- Commication

- Optimize pricing

- Rationalize inventory

- Experiential retail

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Communication

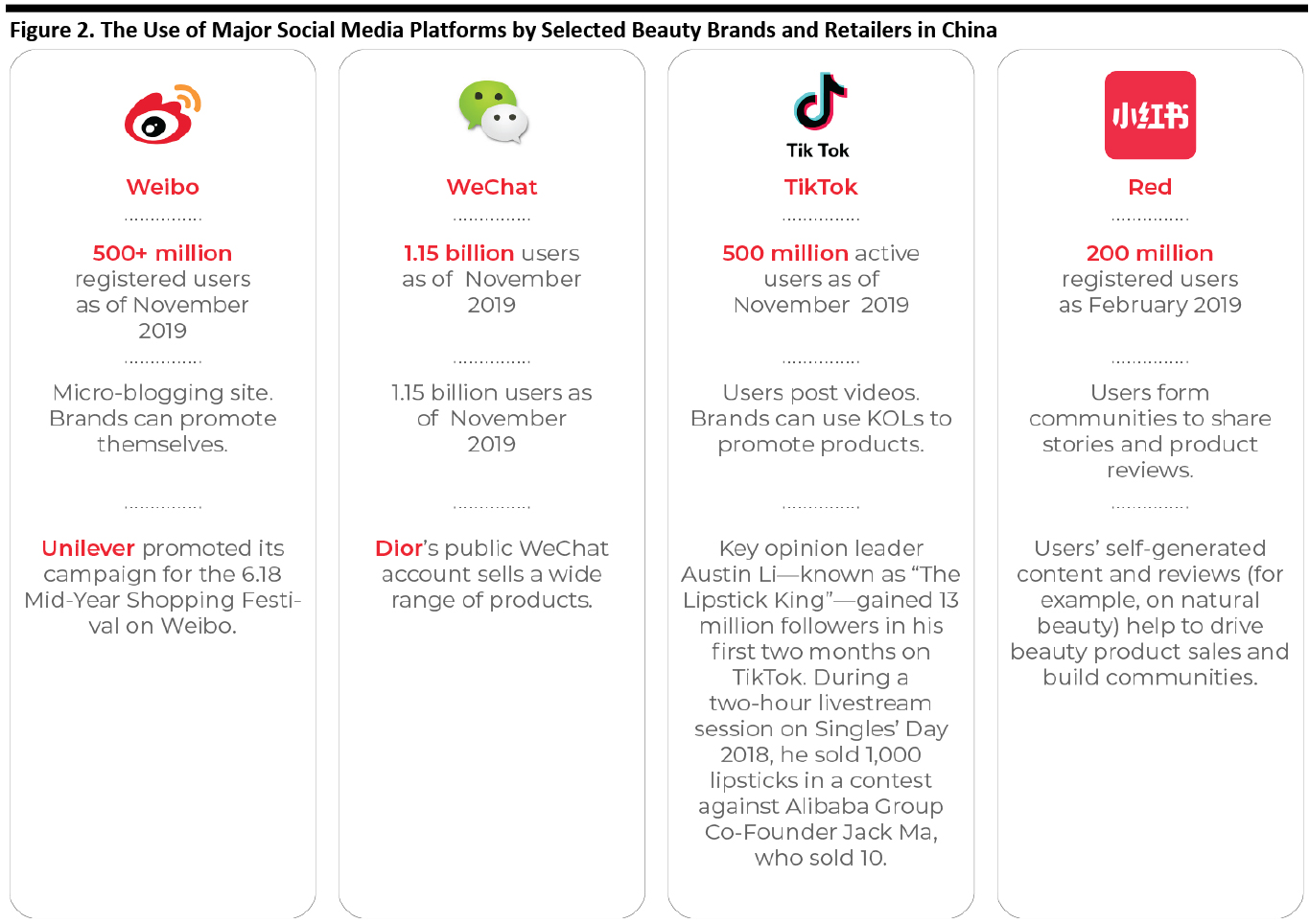

“Communication” includes how a brand or retailer is conveyed to customers through social media, for example, and also how they are reaching consumers through targeted messaging. Beauty brands are using smart digital strategies that combine multiple elements of communication: social media platforms; key opinion leaders (KOLs)/influencers; AI-driven personalization; and games, contests and shopping festivals. AI-driven personalization Using data-driven technology, beauty brands are able to provide customized content for consumers on e-commerce platforms, helping them to discover products that would appeal to them. Retailers and brands are using AI to identify and target consumers based on their purchase history. For example, AI-driven personalization enables a beauty retailer’s online landing page to be personalized at the consumer level, displaying special content and offers. It may include loyalty rewards offered to individuals based on their recent orders, reminders to check out if a cart is abandoned, and frequent, targeted promotions based on search history and past purchases. For instance, consumers will receive reminders from merchants in Alibaba’s Taobao app to remind them that they have left items in their digital shopping cart. AI-driven personalization helps to connect retailers and consumers, bringing the two closer together. Specifically, AI is helping retailers to understand more about the consumer, and it is bringing convenience to consumers. Having a data-centric strategy drives conversion and engagement rates, because consumers are more likely to feel like a brand that uses personalized messaging is one that “understands their needs.” Social media In China, beauty companies and influencers are effectively realizing smart digital strategies through social media platforms, as can be seen below. [caption id="attachment_99785" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

By developing smart digital strategies, beauty retailers can access the beauty community to determine trends and products that are resonating with consumers. Brands can use social media platforms as a channel of direct communication with their consumers, and take advantage of the popularity of KOLs to promote products.

Events and festivals

Retailers are also using shopping festivals and other retail events to promote beauty products. Festivals are particulary popular in China—for example, Alibaba’s annual Singles’ Day on November 11 reported a total gross merchandise volume of ¥268.4 billion ($38.4 billion) in 2019.

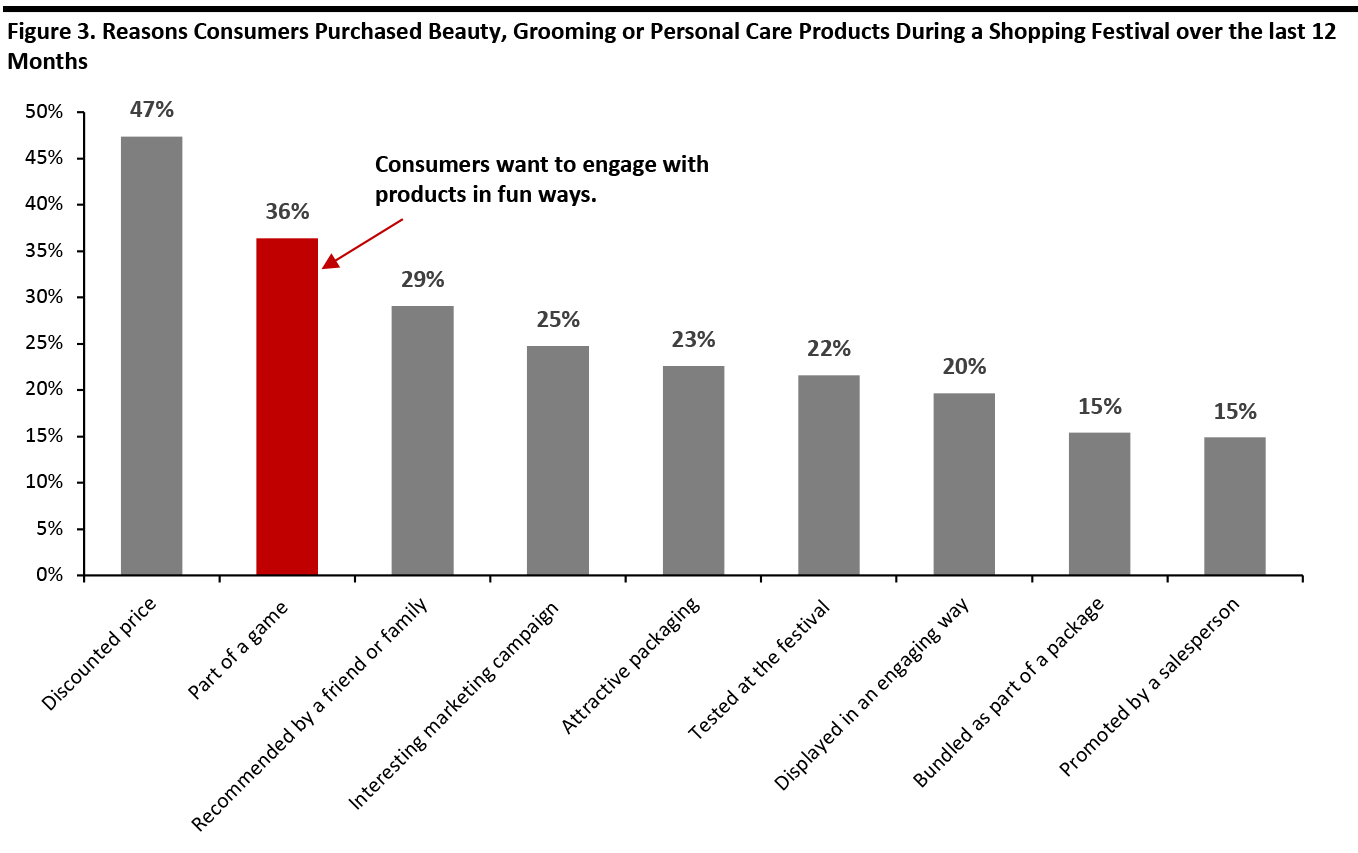

According to Coresight Research’s October 2019 survey, over 82% of Chinese purchasers of beauty, grooming or personal care products had bought such products at a shopping festival within the past 12 months. Festivals provide opportunities for consumers to try new products and discover brands. Furthermore, they may able to engage with a product in a new, fun way, such as through a game—after discounted prices, this was the second-most popular reason given by survey repondents for purchasing a beauty, grooming or personal care product during a shopping festival.

[caption id="attachment_99786" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

By developing smart digital strategies, beauty retailers can access the beauty community to determine trends and products that are resonating with consumers. Brands can use social media platforms as a channel of direct communication with their consumers, and take advantage of the popularity of KOLs to promote products.

Events and festivals

Retailers are also using shopping festivals and other retail events to promote beauty products. Festivals are particulary popular in China—for example, Alibaba’s annual Singles’ Day on November 11 reported a total gross merchandise volume of ¥268.4 billion ($38.4 billion) in 2019.

According to Coresight Research’s October 2019 survey, over 82% of Chinese purchasers of beauty, grooming or personal care products had bought such products at a shopping festival within the past 12 months. Festivals provide opportunities for consumers to try new products and discover brands. Furthermore, they may able to engage with a product in a new, fun way, such as through a game—after discounted prices, this was the second-most popular reason given by survey repondents for purchasing a beauty, grooming or personal care product during a shopping festival.

[caption id="attachment_99786" align="aligncenter" width="700"] Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male)

Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male) Source: Coresight Research [/caption] Following the trend of shoppers expressing interest in interactive or otherwise engaging promotional strategies, the way in which a product was displayed drove 20% of Chinese consumers to make a purchase, and 22% decided to buy after being given the opportunity to test the product.

Optimize Pricing

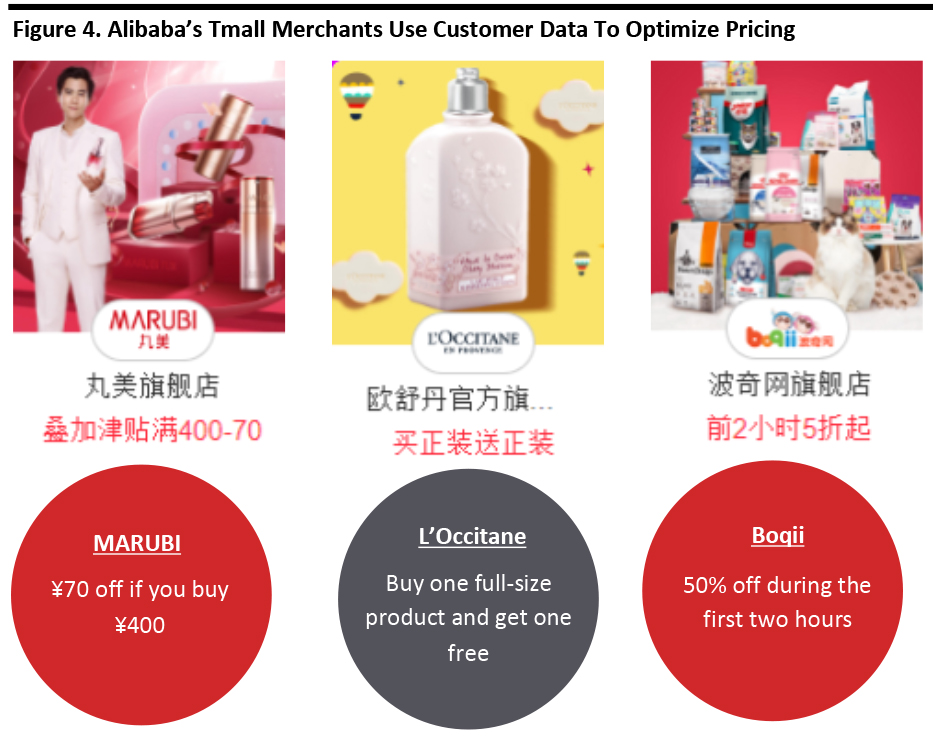

Pricing optimization is a fundamental driver of sales, and it can be achieved through a number of means: personalizing offers, forecasting demand and implementing multi-channel promotions. Pricing optimization is more than offering discounts; it uses AI to understand consumer patterns of searching, purchasing and basket abandonment—in other words, it can help beauty brands to identify the products that consumers prefer and match those preferences with optimally priced products across multiple channels. In China, Alibaba uses an AI operating platform called “ET brain” for demand forecasting and pricing on its Tmall business-to-consumer online retail platform. The system personalizes the offerings of the merchants that host online stores on the platform, particularly for shopping holidays such as Singles’ Day, as shown in Figure 4. [caption id="attachment_99787" align="aligncenter" width="700"] Promotions on Singles’ Day 2019 on Tmall

Promotions on Singles’ Day 2019 on Tmall Source: Alibaba Tmall [/caption] Alibaba also has an auto-procurement and allocation system that uses data to forecast regional demand, based on an algorithm that combines consumer order history, time of day, pricing and the popularity of beauty products to offer various discounts. According to our survey of beauty, grooming and personal care shoppers, 78% of Chinese consumers will wait for a beauty, grooming or personal care product to be discounted before they make a purchase: 42% will “often” wait; 25% will “very often” wait; and 11% will “always” wait. We can therefore see that price is important to consumers, so beauty brands and retailers should look to offer various promotions to consumers across different channels. This can be done by implementing a discount pricing-optimization strategy that makes use of AI to factor in demand forecasting.

Rationalize Inventory

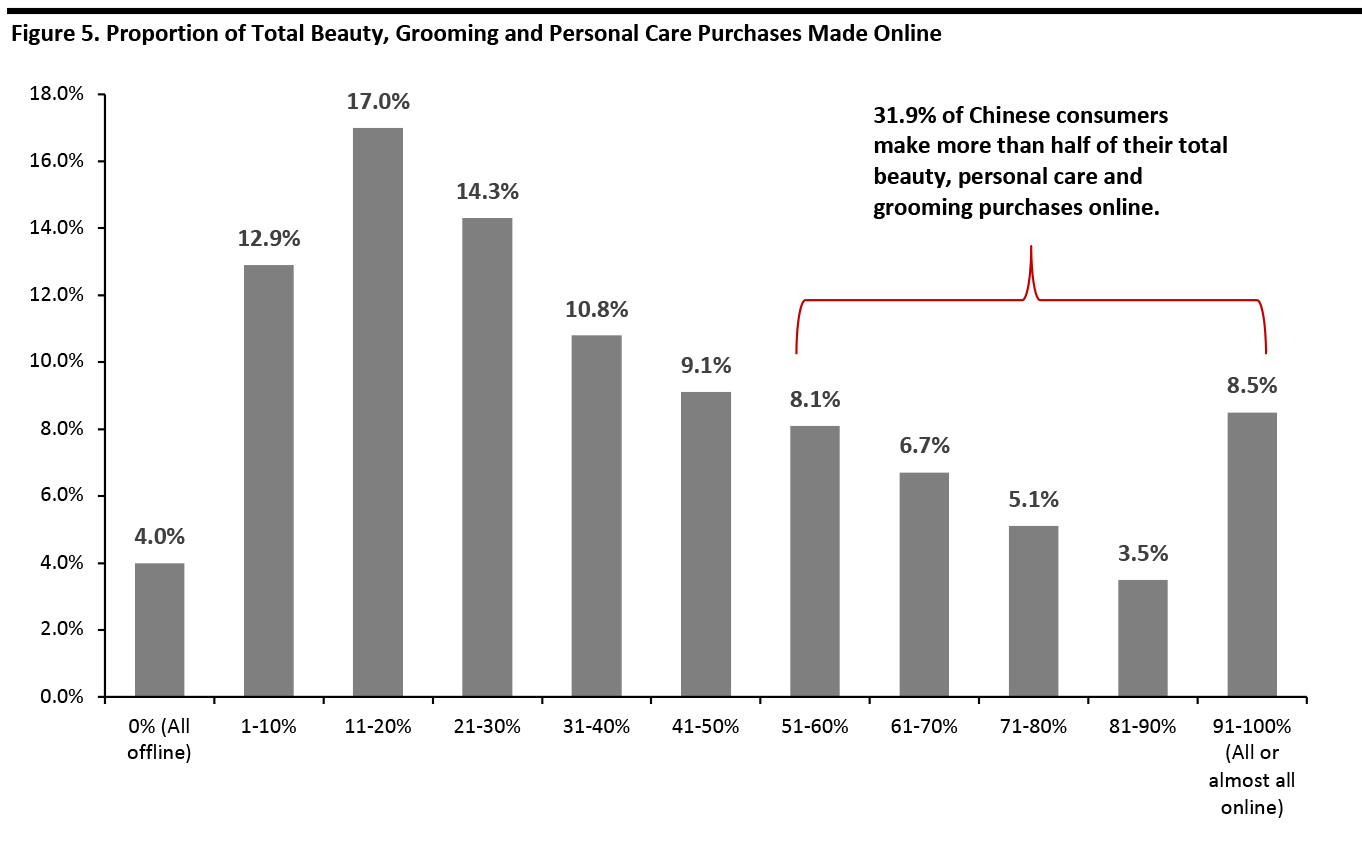

Rationalizing inventory helps retailers to streamline the fulfillment process and deliver products more efficiently to consumers using automated warehouses, on-demand fulfillment and human-robot teams. In the beauty sector, where consumers once preferred to make purchases in store, shopping is increasingly moving online. In fact, 31.9% of Chinese consumers make more than half of their total beauty, personal care and grooming purchases online, according to Coresight Research survey data. [caption id="attachment_99788" align="aligncenter" width="700"] Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male)

Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male) Source: Coresight Research [/caption] As online spending increases, retailers’ back-end logistics networks, warehousing and inventory systems must work in tandem to meet consumer demand for ever-faster delivery times. Cainiao, Alibaba’s smart logistics company in China, uses technology to determine the fastest and most cost-effective delivery routes in a variety of complex road networks, including both rural villages and crowded urban areas. In October 2019, Cainiao opened the largest robotic smart warehouse in China. It utilizes more than 700 robots and automated vehicles (which are directed using Internet of Things technology to drive, load and unload) and was built to meet the anticipated demand of Singles’ Day 2019. The company processed 1.3 billion orders during the shopping holiday on November 11. [caption id="attachment_99789" align="aligncenter" width="700"]

Technology in Cainiao’s warehouse connects orders with equipment and workers, including warehouse and delivery robots.

Technology in Cainiao’s warehouse connects orders with equipment and workers, including warehouse and delivery robots. Source: Alizila [/caption] The Cainiao warehouse uses a “Sky Eye Program” to monitor the entire delivery process, which utilizes data from cameras in logistics stations across the country and employs an algorithm to enable delivery companies to identify abnormalities in the logistics process and locate idle resources. In May 2019 at Cainiao’s fifth annual Global Smart Logistics Summit in Hangzhou, Daniel Zhang, Alibaba’s CEO, said that the future of logistics lies in digitizing all components of the value chain. “Digitizing parcels is not enough,” he said. “We are working with partners to digitize warehouses, equipment, transportation vehicles [and] warehouse pickers’ handheld devices.” Retailers in the beauty sector could look to adopt AI technology across the back-end supply chain—such as warehouse robots, automated guided vehicles and smart cameras—to facilitate on-demand fulfillment.

Experiential Retail

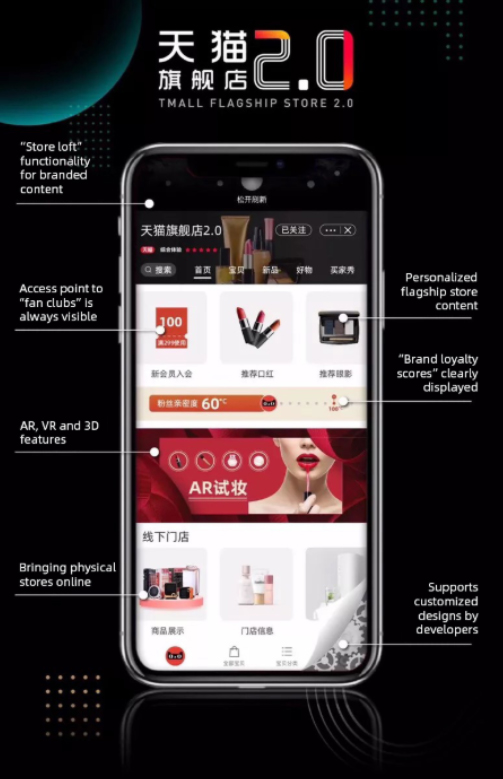

Experiential retail is the concept of enhancing the shopping experience for consumers throughout the shopping process, including how customers are engaging with products in stores and online, and how they discover and pay for products. The product lifecycle is being modernized through the application of technologies such as AI, algorithms, augmented reality, smart mirrors and 3D printing. Where is this impacting beauty? In China (and in the rest of the world), experiential retail is in its emerging stages but is growing rapidly. Alibaba launched “Tmall Flagship 2.0,” which is designed to give consumers more personalized experiences; on their homepages, brands are able to feature content powered by augmented reality and 3D imaging, such as “magic” mirrors that allow shoppers to virtually try on make-up, as well as AI-powered skin tests. [caption id="attachment_99790" align="aligncenter" width="503"] Alibaba’s Tmall Flagship 2.0, featuring augmented reality, virtual reality and 3D features

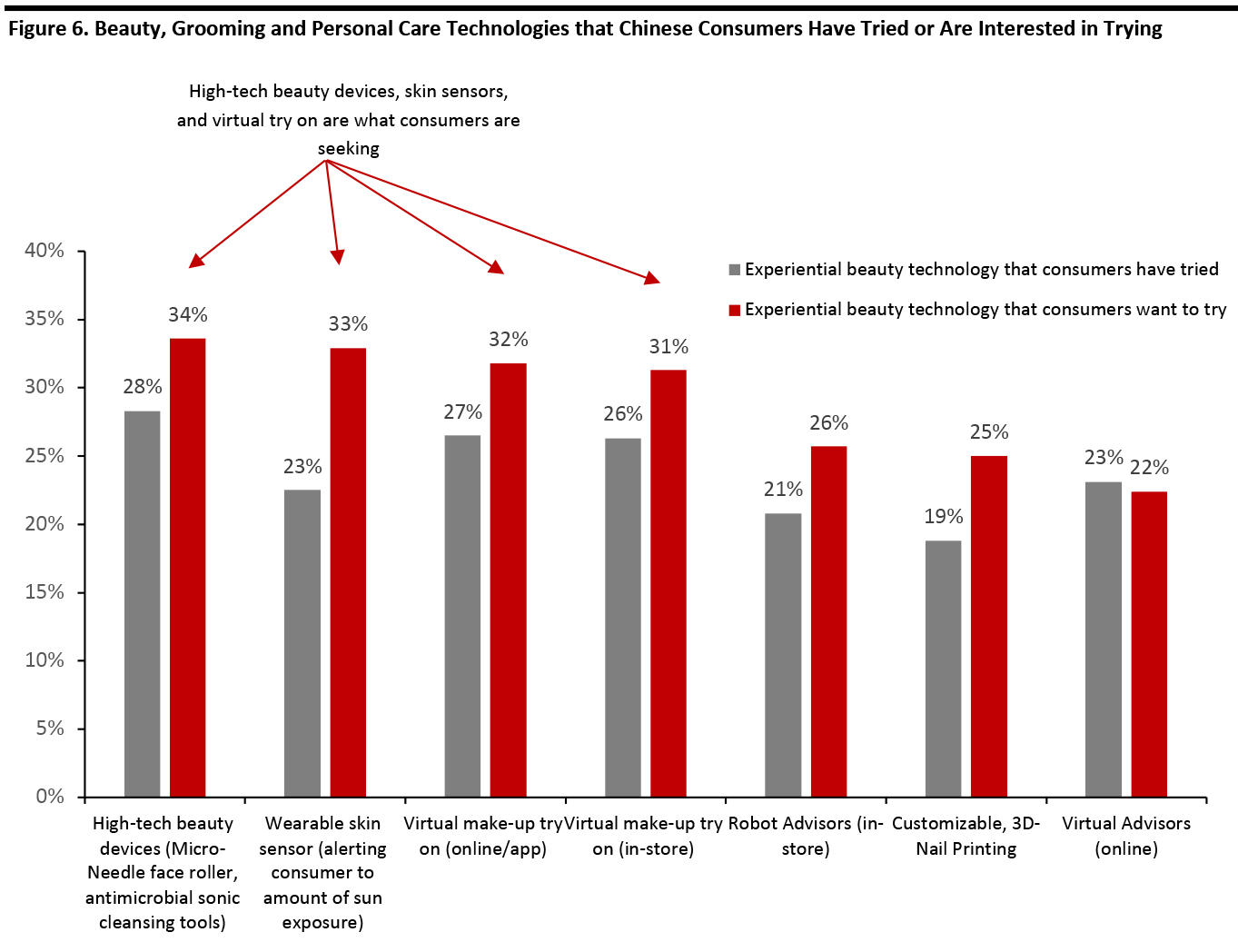

Alibaba’s Tmall Flagship 2.0, featuring augmented reality, virtual reality and 3D features Source: Alizila [/caption] In the beauty sector, Chinese consumers are interested in trying these new beauty experiences, according to Coresight Research survey data. This is particularly true for high-tech beauty devices and technology that determines skin health using AI algorithms and skin sensors. [caption id="attachment_99791" align="aligncenter" width="700"]

Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male)

Base: 1,000 Chinese smartphone users aged 18 and above who have purchased beauty, grooming or personal care products in the past 12 months (524 female, 476 male) Source: Coresight Research [/caption]