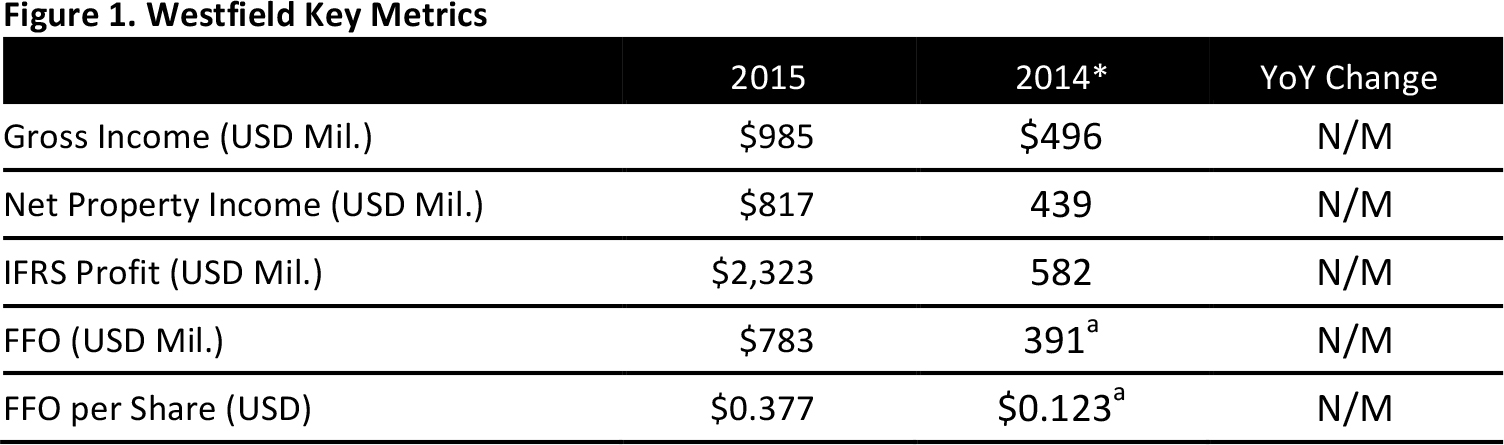

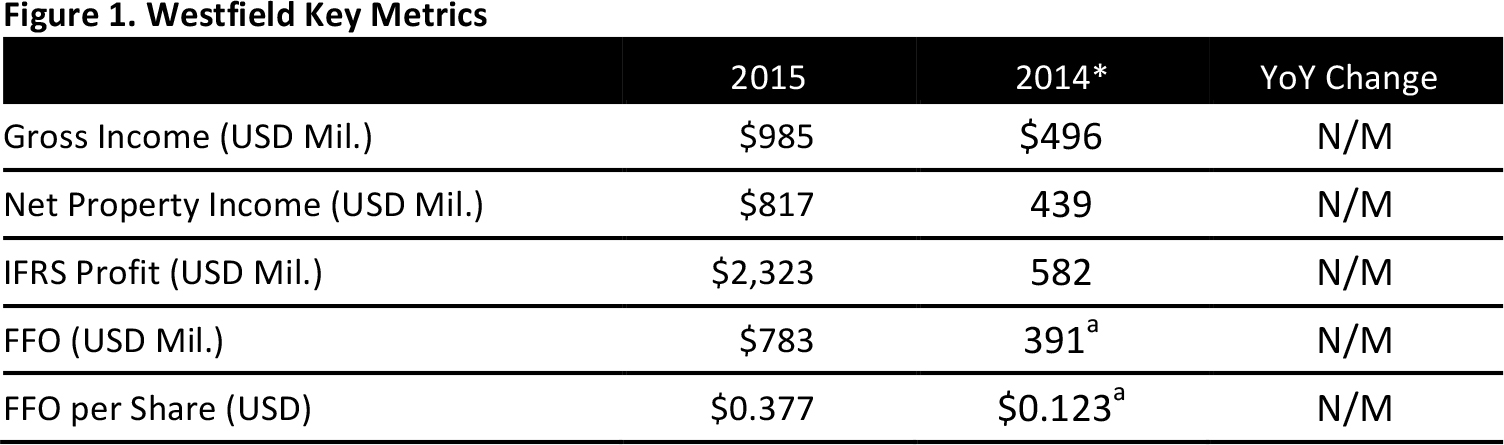

Source: Company reports

Note: Westfield Corporation was established on June 30, 2014 as a result of a restructuringand the results for 2014 arenot representative of ongoing Westfield Corporation operations.

*For the six monthsended June 30, 2014

2015 RESULTS

In 2015, the company:

- Completed more than US$1 billion worth of projects.

- Launched US$2.5 billion worth of projects, including Westfield Century City in Los Angeles, Westfield UTC in San Diego and Westfield London.

- Completed a US$925 million joint venture of three regional assets in the US.

- Divested six noncore assets for US$1.3 billion.

In the year, Westfield’s portfolio recorded specialty sales of US$726 per square foot, up 6.4%. Specialty sales in its flagship portfolio were US$902 per square foot, up 8.0%, and regional portfolio specialty sales were US$454 per square foot, up 3.2%.

Comparable net operating income for the portfolio increased by 3.9%, comprising the flagship portfolio, which was up 4.2%, and the regional portfolio, which was up 2.7%.

Westfield’s portfolio was 95.9% leased as of December 31, 2015.

Westfield has US$3.7 billion worth of projects in progress, including:

- The US$1.4 billion Westfield World Trade Center in New York.

- The US$800 million redevelopment of Westfield Century City in Los Angeles.

- The US$585 million expansion of Westfield UTC in San Diego (Westfield’s share is US$293 million).

- The £600 million (US$841 million) expansion of Westfield London (Westfield’s share is £300 million).

The distribution for 2015 is expected to be US$0.251 per security.

GUIDANCE

The company provided the following guidance for 2016:

- FFO of US$0.342–US$0.345 per security, representing pro forma growth of 3%–4%. This guidance incorporates dilution from noncore asset divestments in late 2015 and lost income from the Westfield Century City development.

- A distribution forecast of US$0.251 per security.