Web Developers

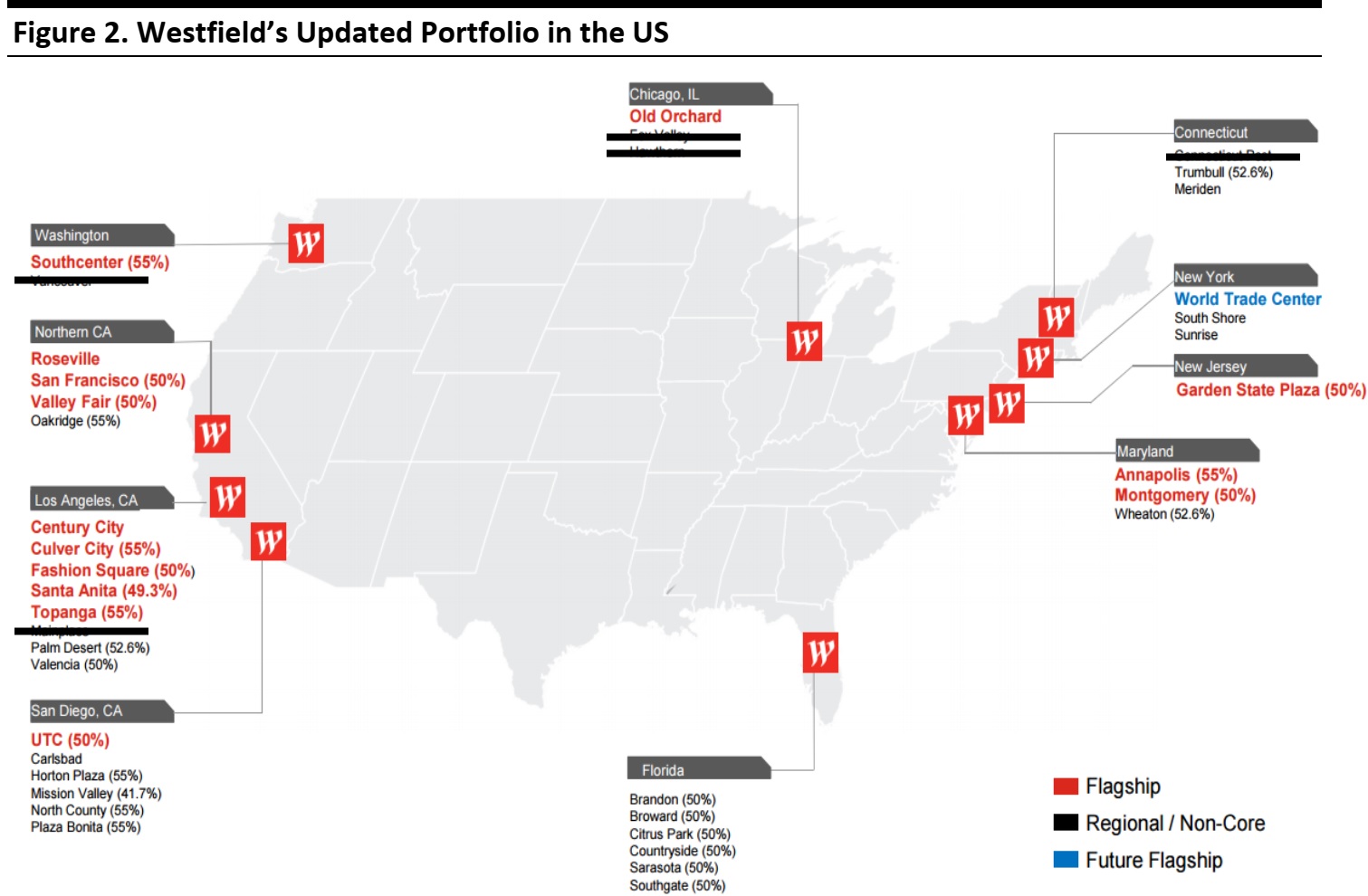

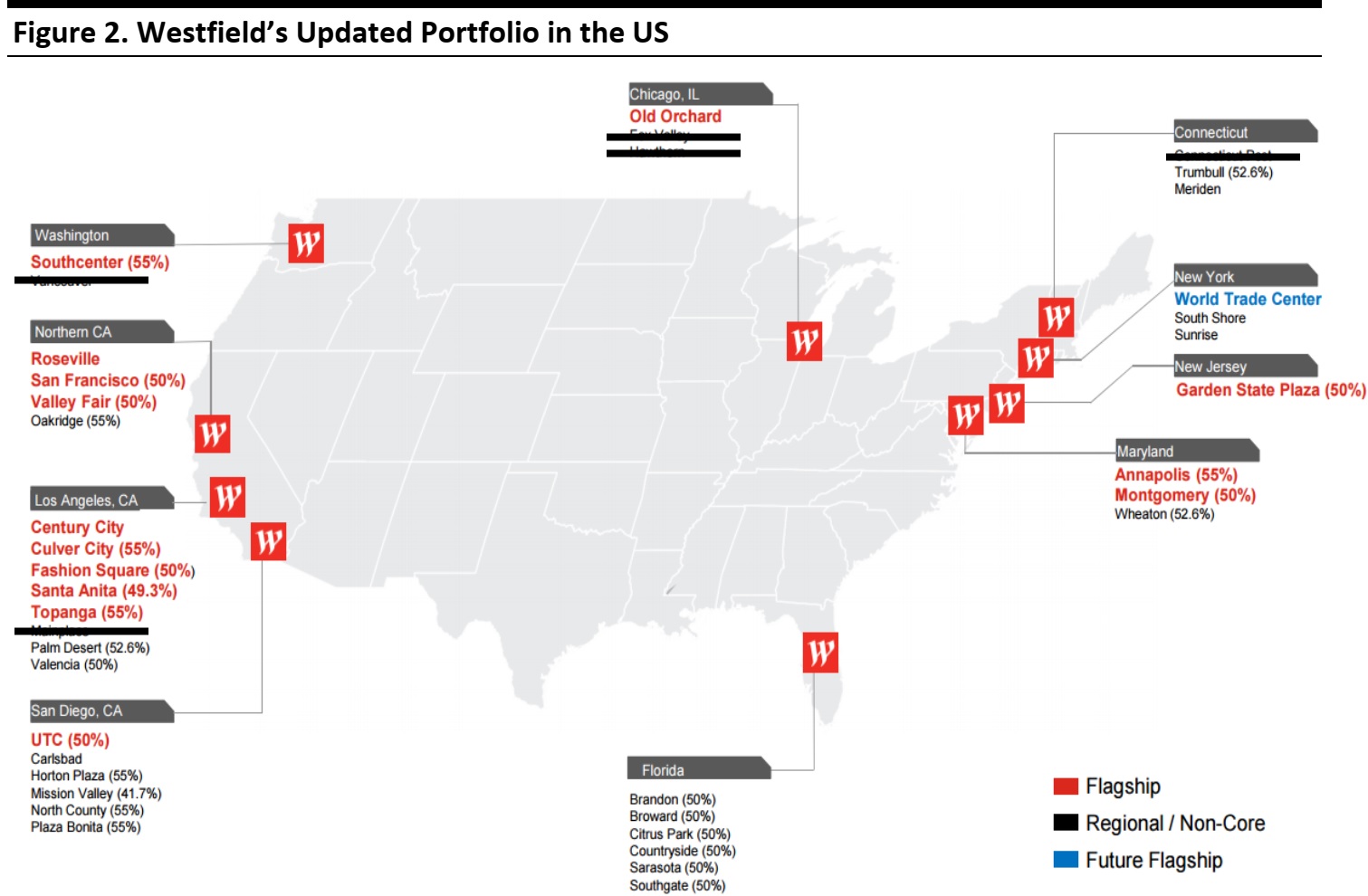

On Friday, Westfield Corporation announced the divesture of five noncore assets of its US portfolio. The properties are the Connecticut Post in Milford, CT; MainPlace in Santa Ana, CA; Hawthorn in Vernon Hills, IL; Fox Valley in Aurora, IL; and Vancouver in Vancouver, WA.

The Australian company is one of the world’s largest shopping center operators, with iconic properties in London and New York. Westfield will use the proceeds to reduce debt exposure and to fund its US$11.4 billion development program, which will rebalance its portfolio to focus more on flagship properties.

“Our strategic focus is to create and operate flagship assets in leading markets and divest noncore assets,” Westfield Co-Chief Executive Peter Lowy said in a statement.

The divested assets total more than 6 million square feet of retail space across four US states and are said to be operated at 97% occupancy. The shopping centers feature an array of fashion brands and retailers, with JCPenney and Macy’s serving as anchor tenants in all of the properties, and Sears present in all but one.

Source: Company websites/FBIC Global Retail & Technology

The buying side of the transaction consists of Dallas-based Centennial Real Estate Company, Montgomery Street Partners in Washington and USAA Real Estate Company in Texas. Montgomery Street is an affiliate of investor Richard Blum’s San Francisco–based Blum Capital Partners. USAA is a subsidiary of the USAA financial services company. Centennial will be the managing company responsible for the shopping centers’ daily operations. Westfield’s most recent investor presentation indicates that the sale will reduce gearing, or the debt-to-equity-capital ratio, by 3%, bringing it down to 29.2%. Centennial CEO Steven Levi commented on the future plan for the properties, saying, “A mall can’t just be about shopping anymore. Understanding the needs of your market is the cornerstone of creating a one-of-a-kind experience that guests can’t get online or anywhere else.” The divestiture comes at a time when shopping malls are undergoing an existential transformation from purely shopping destinations to experiential entertainment centers as operators seek to address evolving consumer demands and changing shopping behavior.