DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Black Friday Has Already Begun Black Friday got its name from the surge in sales from the first day of the holiday season, pushing retailers “into the black,” i.e., the store turning profitable for the year after more than eleven months of losses. Particularly in the pre-Internet days, Black Friday sales were a major shopping event, offering “doorbuster” deals to get shoppers into the stores: shoppers crowded outside stores waiting for the doors to open to ensure they could snap up limited-quantity merchandise at discount prices. It’s not clear if any actual doors were broken down, although people have been injured. However, as the retail world has changed, so has Black Friday’s significance. Black Friday is no longer the biggest shopping day of the year in the US: Cyber Monday eclipsed Black Friday a couple of years ago, and Super Saturday (the last Saturday before Christmas) is also a significant shopping day, being the last weekend day to shop before the holiday. There has also been a blurring of holiday sales throughout the year. While savvy shoppers have long opportunistically taken advantage of sales to do their shopping throughout the entire year, the rise of e-commerce enhances convenience and reduces the urgency of getting into a store during the holiday period. The advent of newer shopping holidays such as Amazon Prime Day and Black Friday in July sales (offered by retailers such as Macy’s and Best Buy) has further blurred the lines between holiday and non-holiday shopping. Even shopping holidays from overseas, such as China’s Singles’ Day on November 11, present shopping opportunities. And, now, many retailers are jumping the gun and starting Black Friday sales early—and most have already released flyers online. Here are a few notable examples: Amazon is running two separate pre-Black Friday sales. On November 1, the company launched holiday deals via a blog post. In addition, the company launched “special deals and deep discounts on top products across fashion, toys and home starting today through November 21,” offering discounts on more than 1,000 items, which it calls HoliDeals. Amazon has also already released its list of Black Friday deals—which includes a long list of Amazon devices and brands—all of which will be available on November 22—a full week before Black Friday. Prime members get access to a special set of deals. Best Buy’s Black Friday sale runs November 28–30, bracketing the official shopping day, and its doorbusters (available both in-store and online) include TVs, iPads, laptops, Blu-ray movies, appliances, video games and more. Target is offering early access (two days early on November 27) to Black Friday deals to holders of its RedCard and members of its new Target Circle loyalty program. Its Black Friday flyer mentions RedCard holders can shop over 100 deals all day and that Target Circle members can shop selected deals starting 6:00 p.m. CST. Doorbusters include TVs, electronics, appliances, DVDs, toys, household goods and clothing. Walmart’s Black Friday deals start online on November 27 at 10:00 p.m. EST and in stores on November 28 (Thanksgiving) at 6:00 p.m. The retailer’s app features a color-coded store map that directs shoppers to Black Friday deals, and Walmart is encouraging shoppers to come at 4:00 p.m. on Thanksgiving for coffee, hot cocoa and snacks. Its flyer breaks down the deals into apparel, entertainment, general merchandise, home and toys. Black Friday no longer represents a narrow window of opportunity in which shoppers have to wait in the cold and sprint into stores to get unmissable deals. While some retailers still offer in-store-only deals, many deals are available online, in many cases long before and a while after Black Friday. Holiday shopping now occupies much of November and has warmups much earlier in the year, as holiday shopping increasingly becomes a year-round activity.

US RETAIL & TECH HEADLINES

Kroger Partners with German Vertical Farming Startup

(November 19) Company press release

Kroger Partners with German Vertical Farming Startup

(November 19) Company press release

- Supermarket chain Kroger has partnered with Berlin-based vertical farming startup Infarm to install vertical farming units inside its supermarkets. The units use hydroponic technology to grow produce on site, eliminating the need for transportation.

- Kroger plans to launch the living produce farms at 15 of its Quality Food Centers (QFCs), starting with the Bellevue and Kirkland QFC stores in Washington state this month.

7-Eleven Adds Voice-Ordering Via Google Home and Amazon Echo

(November 18) Company press release

7-Eleven Adds Voice-Ordering Via Google Home and Amazon Echo

(November 18) Company press release

- Convenience store chain 7-Eleven has launched “7Voice,” a voice-powered feature that lets customers place delivery orders through the 7NOW app using Amazon Echo or Google Home smart speakers.

- Once the customer places and pays for a 7NOW voice order, it is delivered in about 30 minutes or less for a fee of $3.99. The service is available round the clock and there is no minimum order value.

Albertsons Hires Chris Rupp as EVP and Chief Customer and Digital Officer

(November 18) Company press release

Albertsons Hires Chris Rupp as EVP and Chief Customer and Digital Officer

(November 18) Company press release

- Grocery retailer Albertsons has appointed Chris Rupp as EVP and Chief Customer and Digital Officer, effective December 3. Rupp will join Albertsons from Microsoft, where she most recently served as general manager of the company’s Xbox Business Engineering team.

- Rupp will be responsible for driving the e-commerce business, the company’s enterprise data strategy and data science capabilities.

Amazon to Open its Second Mississippi Fulfilment Center

(November 18) Company press release

Amazon to Open its Second Mississippi Fulfilment Center

(November 18) Company press release

- Amazon has announced plans to open its second Mississippi fulfilment center in DeSoto County. The new facility spans more than one million square feet and will create 500 new full-time roles.

- Separately, Amazon committed to investing more than $700 million to train 100,000 US employees for in-demand jobs.

Coty and Kylie Jenner Announce Strategic Partnership

(November 18) Company press release

Coty and Kylie Jenner Announce Strategic Partnership

(November 18) Company press release

- Beauty company Coty and American beauty influencer Kylie Jenner have entered into a long-term strategic partnership. Under the terms of the agreement, Coty will pay $600 million for a 51% stake in Jenner's beauty business.

- Coty expects the agreement to increase net revenues in its fragrance, cosmetics and skin care portfolio by more than 1% annually over the next three years. The transaction is expected to close in the third quarter of the fiscal year 2020.

EUROPE RETAIL AND TECH HEADLINES

Groupe Casino Signs New €2 Billion Revolving Credit Facility

(November 19) Company press release

Groupe Casino Signs New €2 Billion Revolving Credit Facility

(November 19) Company press release

- French retailer Groupe Casino has announced is secured a new €2 billion ($2.2 billion) revolving credit facility. Twenty-one French and international banks took part.

- The credit facility matures in October 2023 and forms part of the company’s refinancing plan announced on October 22, 2019. It improves group liquidity by increasing the average maturity of the credit facilities the company has in France from 1.6 to 3.6 years.

Moss Bros Appoints New CFO

(November 19) TheRetailBulletin.com

Moss Bros Appoints New CFO

(November 19) TheRetailBulletin.com

- British menswear retailer Moss Bros has appointed Bill Adams as CFO, effective February 2020. Currently, Adams is interim CFO of Ted Baker and was previously CEO of digital retailer Ideal Shopping Direct.

- Adams will replace Tony Bennett, who will step down in February 2020 for personal reasons.

Pam Panorama to Open 60 Pam Local Stores

(November 18) ESMMagazine.com

Pam Panorama to Open 60 Pam Local Stores

(November 18) ESMMagazine.com

- Italian discount retailer Pam Panorama plans to open 60 Pam Local convenience stores as part of its strategic development plan for financial year 2020–21. The Pam Local stores offer customized meals and home delivery.

- Pam Panorama also plans to open five supermarkets and superstores next year and will start to overhaul its oldest stores by 2021. The team is also testing Pam City stores, a format that provides a broader range of takeaway food.

John Lewis and Waitrose to Launch Experiential Concept Store

(November 18) RetailGazette.co.uk

John Lewis and Waitrose to Launch Experiential Concept Store

(November 18) RetailGazette.co.uk

- John Lewis and Waitrose are trialing a new “experience playground” concept store within the John Lewis Southampton store. Highlights of the new concept include stay-and-play gadget areas, beauty and fashion gift experiences including personalized packaging and the first-ever Waitrose Cookery School inside a John Lewis store.

- It also offers paid and free photography, barista-skills, wreath-making and modern calligraphy short courses. If successful, the experience playground model could be rolled out nationwide.

- Italian luxury fashion house Prada has launched a revamped version of its website prada.com. The website offers an interactive experience through short videos.

- As part of the revamp, Prada will launch the Prada Time Capsule section in December 2019, which will initially be available only to European consumers. The new section will release a limited-edition product each month, available to purchase exclusively on its website and within a 24-hour window.

ASIA RETAIL AND TECH HEADLINES

Nintendo Opens Flagship Store in Japan

(November 20) BusinessInsider.in

Nintendo Opens Flagship Store in Japan

(November 20) BusinessInsider.in

- Japanese consumer electronics company Nintendo opened a flagship store at the Shibuya Parco department store in Tokyo on November 22.

- The new store offers exclusive products featuring Nintendo characters and showcases consoles customers can use to try out the latest Nintendo games.

E-mart to Open its First Overseas No Brand Store in the Philippines

(November 19) KoreaHerald.com

E-mart to Open its First Overseas No Brand Store in the Philippines

(November 19) KoreaHerald.com

- Korean retailer E-mart will open its first overseas No Brand store (E-mart’s private label) in Manila on November 22 in partnership with local franchisee Robinsons Retail Holdings.

- Under the franchise deal, the company targets 25 No Brand stores by 2020 and 25 stores dedicated to its beauty brand Scentence during the same period.

Alibaba Closes Books Early For its $13 Billion Hong Kong Share Sale

(November 19) MarketWatch.com

Alibaba Closes Books Early For its $13 Billion Hong Kong Share Sale

(November 19) MarketWatch.com

- Alibaba closed the books for its $13 billion Hong Kong secondary listing at 12 noon EST on November 19 as demand outstripped available shares. It originally planned to close at 4 p.m.

- Institutional investors in Asia could submit bids until 4 p.m. Hong Kong time and investors in Europe until 4 p.m. London time on November 19. Alibaba will finalize the price of the Hong Kong shares on November 20 and trading will begin November 26.

Flipkart Invests in EasyRewardz

(November 19) EconomicTimes.IndiaTimes.com

Flipkart Invests in EasyRewardz

(November 19) EconomicTimes.IndiaTimes.com

- Walmart-owned e-commerce company Flipkart has invested about INR 290 million ($4 million) in customer engagement services platform EasyRewardz, which will begin offering customer engagement services to sellers on Flipkart.

- EasyRewardz said it will use the funds to drive new product development and accelerate global expansion in areas such as Asia Pacific.

Burberry Partners with Tencent to Open Social Retail Concept Store in Shenzhen

(November 18) Rli.Uk.com

Burberry Partners with Tencent to Open Social Retail Concept Store in Shenzhen

(November 18) Rli.Uk.com

- UK luxury goods brand Burberry has partnered with China’s Tencent (owner of WeChat) to open a social retail concept store in Shenzhen in the first half of 2020.

- The new Burberry store, powered by Tencent technology, will combine social media and retail to create an interactive retail experience.

LATIN AMERICA RETAIL AND TECH HEADLINES

Cencosud Appoints New Corporate General Manager

(November 20) FashionNetwork.com

Cencosud Appoints New Corporate General Manager

(November 20) FashionNetwork.com

- Chile-based multinational retailer Cencosud has appointed Matías Videla Solá as Corporate General Manager effective December 1, filling the position Andreas Gebhardt Strobel vacates on November 30.

- Matías Videla Solá is currently Corporate Manager of Administration and Finance and has been working with the company for 20 years in various roles.

Amazon Launches Amazon Hub Lockers in Mexico

(November 20) FashionNetwork.com

Amazon Launches Amazon Hub Lockers in Mexico

(November 20) FashionNetwork.com

- Amazon has launched a new delivery method called “Amazon Hub Lockers” in Mexico: Similar to Amazon Lockers (mostly located in stores), Amazon Hub Lockers will be in apartment complexes.

- Customers can select the Hub Locker as their delivery option during checkout, after which they receive an email notification with a code they use to open the locker. If not retrieved within three days, Amazon retrieves the package and issues a refund.

GPA Partners with Local Brewery to Launch Its Own Craft Beer

(November 19) Reuters.com

GPA Partners with Local Brewery to Launch Its Own Craft Beer

(November 19) Reuters.com

- Brazilian retailer Grupo Pao de Acucar (GPA) has partnered with a local brewery to launch a craft beer called Fábrica 1959.

- Director of GPA Exclusive Brands Samir Jarrouj said “We sell almost 20 million bottles of craft beer per year, and it is a market with high growth potential, as consumers increasingly migrate from mainstream brands.”

7 For All Mankind Plans Expansion into Latin America

(November 18) FashionNetwork.com

7 For All Mankind Plans Expansion into Latin America

(November 18) FashionNetwork.com

- US denim brand 7 For All Mankind plans to expand into Latin America with a store in Uruguay set to open the first week of December. The company also plans to open two stores in Mexico City in 2020.

- In Brazil, the company plans to open two stores, one in the Iguatemi Mall in São Paulo and another in the Village Mall in Rio de Janeiro. It will also launch an e-commerce platform in Brazil in the coming year.

Victoria’s Secret Opens a Second Full-Concept Store in Panama

(November 18) FashionNetwork.com

Victoria’s Secret Opens a Second Full-Concept Store in Panama

(November 18) FashionNetwork.com

- US lingerie and beauty products retailer Victoria’s Secret has opened a second full-concept store in Panama at the Albrook Mall on November 22, in partnership with its Latin American partner Grupo David.

- The new store offers Victoria’s Secret lingerie collections as well as accessories and beauty products. It also employs trained and experienced specialists who offer personalized fitting advice.

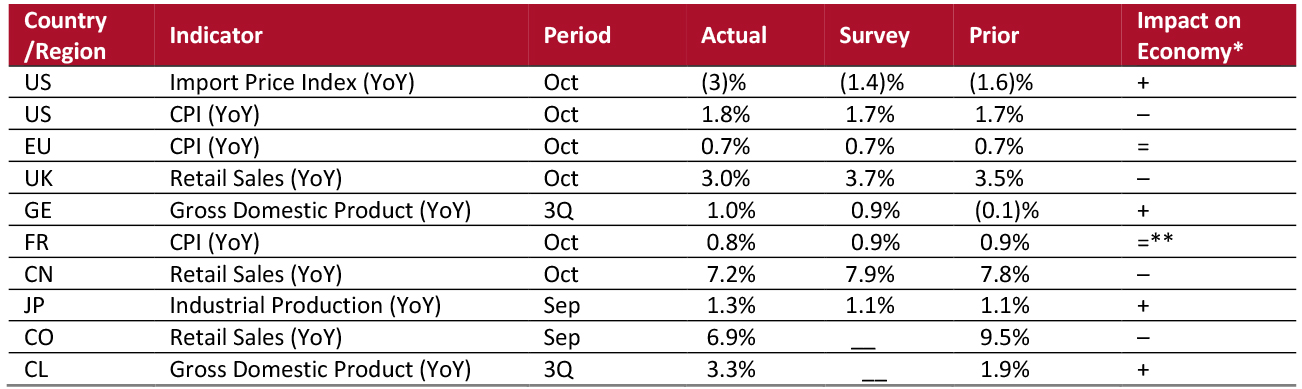

MACRO ECONOMIC UPDATE

Key points from global macro indicators released November 13–19, 2019:- US: The Import price index decreased 3% year over year in October, versus a 1.6% decrease in September. The Consumer Price Index (CPI) was up 1.8% year over year in October, versus a 1.7% increase in September.

- Europe: In the eurozone, the CPI was up 0.7% year over year in October, the same rate as the previous month. In Germany, gross domestic product (GDP) was up 1.0% year over year in the third quarter, versus a 0.1% decline in the previous quarter.

- Asia Pacific: Retail sales in China grew 7.2% year over year in October, slower than the 7.8% rate in September and below the consensus estimate of 7.9%. In Japan, industrial production was up 1.3% year over year in September, higher than 1.1% growth in August and ahead of the consensus estimate of 1.1%.

- Latin America: Retail sales in Colombia grew 6.9% year over year in September, slower than the 9.5% growth in August. In Chile, GDP expanded 3.3% year over year in the third quarter, versus 1.9% growth in the previous quarter.

**Consumer prices in France slowed for the fourth consecutive month. The short-run impact cannot be evaluated. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

**Consumer prices in France slowed for the fourth consecutive month. The short-run impact cannot be evaluated. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Department of Labor/US Bureau of Labor Statistics/Eurostat/Destatis/INSEE/National Bureau of Statistics of China/National Bureau of Statistics of China/Ministry of Economy, Trade and Industry/DANE/Banco Central de Chile/Coresight Research [/caption]

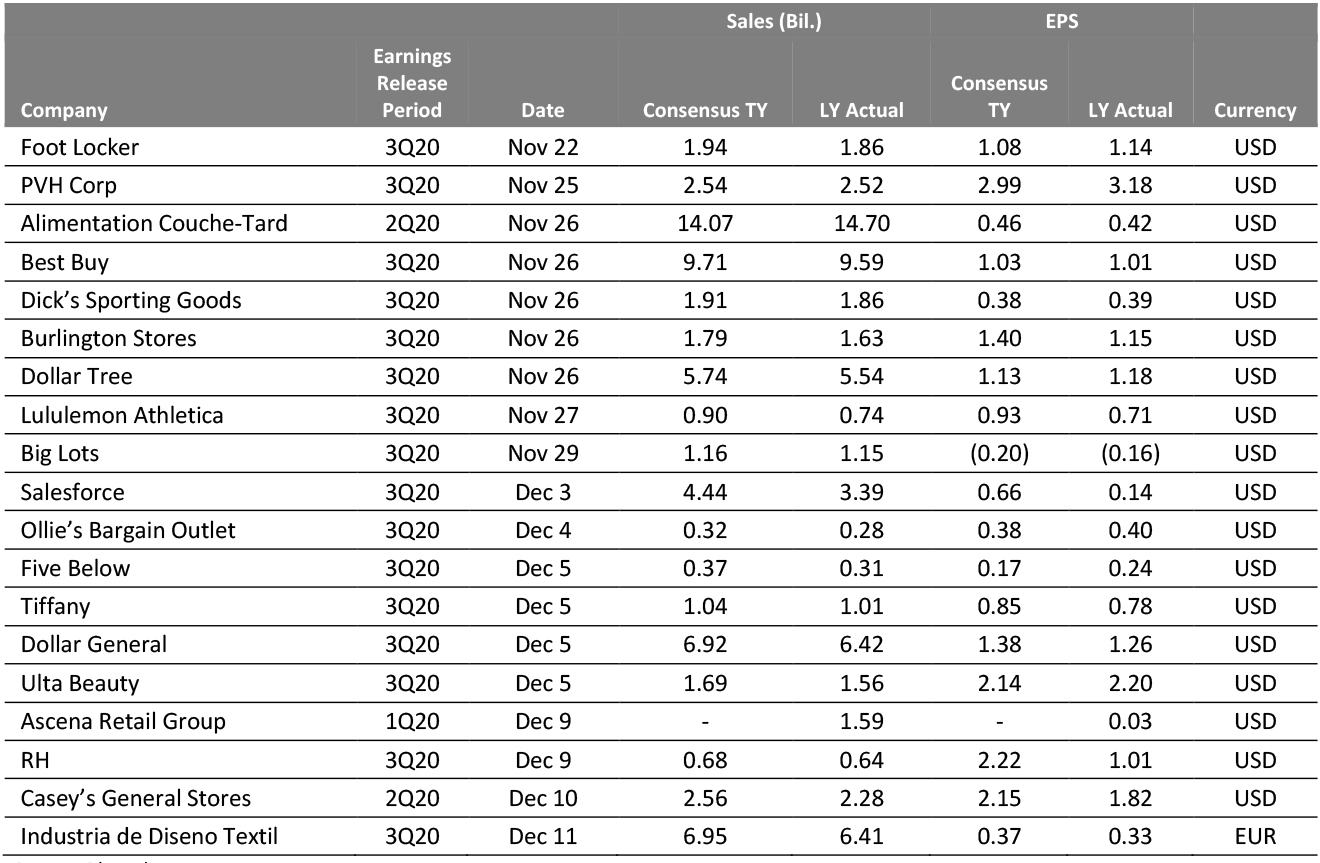

EARNINGS CALENDAR

[caption id="attachment_100230" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

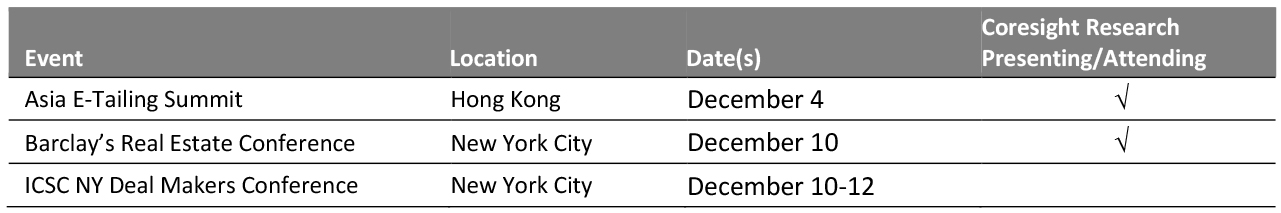

EVENT CALENDAR