albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

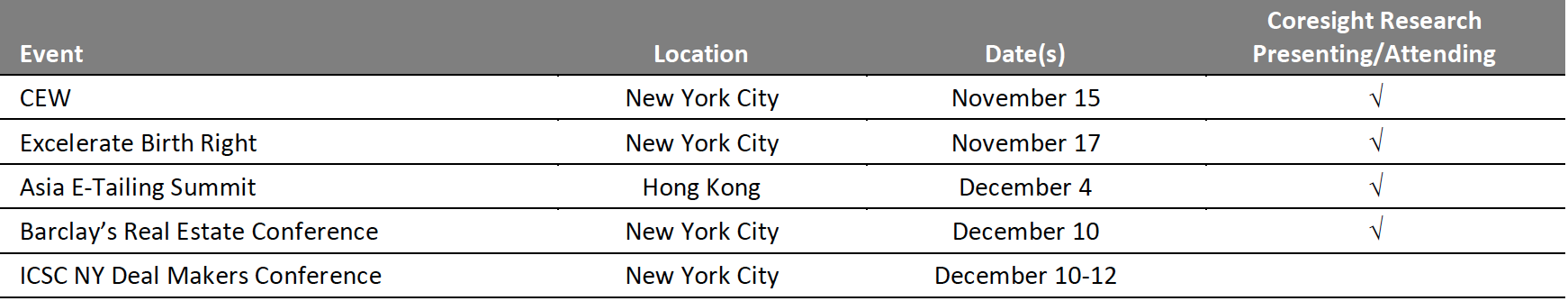

Singles’ Day 2019: What We Saw and What It Means for Western Retailers The Coresight Research was in Hangzhou, China, for Alibaba’s Double 11 Influencer Program to support the 2019 Singles’ Day. We saw first-hand the scale of Singles’ Day for Alibaba, as sales ticked up minute by minute, hour by hour. These are some of the key insights we gleaned about what made this year’s Singles’ Day another record-breaker – and what Western retailers can learn from it. [caption id="attachment_99750" align="aligncenter" width="700"] Source: Company reports[/caption]

Growth held up well. Alibaba reported total sales grew 26% this year, which compares very solidly to 27% last year. The “law of large numbers” would naturally imply a slowdown as the base for growth increases — and we have previously seen more sharp decelerations in growth, such as between 2017 and 2018. As we note below, a push on newness and tailoring of Singles’ Day to lower-tier cities supported this growth.

No indications of impact from the trade conflict. The top five countries selling into China through Alibaba’s cross-border platforms were Japan, the US, Korea, Australia and Germany. This is the same top five, in the same order, as last year, suggesting the US-China trade dispute had limited or no impact on demand for imports from the US. Moreover, Alibaba noted that some of the top-selling brands this year included Apple, Estée Launder, Gap, Levi’s, Nike and Under Armour — all major US brands.

Attention begins to turn to sustainability. Being the world’s biggest shopping festival implies a substantial environmental impact, through the transportation and consumption of hundreds of millions of products. However, sustainability was a focus of Alibaba this year. Alibaba’s logistics affiliate, Cainiao, and its express-courier partners set up 75,000 recycling stations for consumers to drop off cardboard boxes. Tmall also hosted special trade-in programs to recycle used electronics from 250 brands.

Livestreaming moves front and center. Livestreaming may seem niche to readers in some western countries, but Singles’ Day 2019 proved it generates big business in China. More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories (the pre-sales period is the time leading up to Singles’ Day, during which companies promote deals and consumers can also buy products – but have to wait till Singles’ Day to settle the transaction). Alibaba said beauty product pre-sales period orders from livestreaming were 50 times 2018’s total. Livestreaming on Alibaba’s Taobao platform generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

Everything new. For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched one million new products for Singles’ Day this year, and thousands of brands rolled out upgraded storefronts on Tmall 2.0 to offer more personalized shopping experiences. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers: shoppers from lower-tier cities.

Lower-tier cities drive growth. Alibaba expected most of the anticipated 100 million new consumers for this year’s Singles’ Day to come from lower-tier cities, in which traditionally incomes are lower. To capture shoppers in those markets, the company partnered with multinational brands such as L’Oréal and P&G, as well as Chinese manufacturers, to create new products based on consumer analytics and targeting local tastes.

Find Coresight Research’s full, unrivalled coverage of Singles’ Day here and look out for our series of reports analyzing key themes from Singles’ Day 2019 next week.

Source: Company reports[/caption]

Growth held up well. Alibaba reported total sales grew 26% this year, which compares very solidly to 27% last year. The “law of large numbers” would naturally imply a slowdown as the base for growth increases — and we have previously seen more sharp decelerations in growth, such as between 2017 and 2018. As we note below, a push on newness and tailoring of Singles’ Day to lower-tier cities supported this growth.

No indications of impact from the trade conflict. The top five countries selling into China through Alibaba’s cross-border platforms were Japan, the US, Korea, Australia and Germany. This is the same top five, in the same order, as last year, suggesting the US-China trade dispute had limited or no impact on demand for imports from the US. Moreover, Alibaba noted that some of the top-selling brands this year included Apple, Estée Launder, Gap, Levi’s, Nike and Under Armour — all major US brands.

Attention begins to turn to sustainability. Being the world’s biggest shopping festival implies a substantial environmental impact, through the transportation and consumption of hundreds of millions of products. However, sustainability was a focus of Alibaba this year. Alibaba’s logistics affiliate, Cainiao, and its express-courier partners set up 75,000 recycling stations for consumers to drop off cardboard boxes. Tmall also hosted special trade-in programs to recycle used electronics from 250 brands.

Livestreaming moves front and center. Livestreaming may seem niche to readers in some western countries, but Singles’ Day 2019 proved it generates big business in China. More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories (the pre-sales period is the time leading up to Singles’ Day, during which companies promote deals and consumers can also buy products – but have to wait till Singles’ Day to settle the transaction). Alibaba said beauty product pre-sales period orders from livestreaming were 50 times 2018’s total. Livestreaming on Alibaba’s Taobao platform generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

Everything new. For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched one million new products for Singles’ Day this year, and thousands of brands rolled out upgraded storefronts on Tmall 2.0 to offer more personalized shopping experiences. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers: shoppers from lower-tier cities.

Lower-tier cities drive growth. Alibaba expected most of the anticipated 100 million new consumers for this year’s Singles’ Day to come from lower-tier cities, in which traditionally incomes are lower. To capture shoppers in those markets, the company partnered with multinational brands such as L’Oréal and P&G, as well as Chinese manufacturers, to create new products based on consumer analytics and targeting local tastes.

Find Coresight Research’s full, unrivalled coverage of Singles’ Day here and look out for our series of reports analyzing key themes from Singles’ Day 2019 next week.

US RETAIL & TECH HEADLINES

- On November 15, footwear chain Famous Footwear, a subsidiary of Caleres, opened a new flagship at Herald Square in New York City. The 8,400-square-foot store stocks nearly 24,000 pairs of footwear and Famous Footwear’s largest collection of accessories and shoe care products.

- Shoppers can access special events, discounts and “Famously You Rewards” loyalty program benefits. They can also request home delivery of products that are not in stock or can buy online and pick up in store.

Xoom Partners with Walmart and Ria to Provide Domestic Money Transfers

(November 12) CNet.com

Xoom Partners with Walmart and Ria to Provide Domestic Money Transfers

(November 12) CNet.com

- PayPal-owned electronic funds transfer provider Xoom has partnered with Walmart and Ria, a US-based money transfer company, to provide quick and affordable domestic fund transfers to low-income shoppers.

- Customers can use the Xoom mobile app or website to send cash to friends and family, which can be picked up at any of Walmart’s 4,684 stores or Ria’s 175 stores.

Nike to Stop Selling Directly to Amazon

(November 12) WSJ.com

Nike to Stop Selling Directly to Amazon

(November 12) WSJ.com

- Sportwear brand Nike has said it will stop selling apparel and sneakers on Amazon, ending a pilot program started in 2017. Nike will continue to use Amazon’s cloud-computing unit, Amazon Web Services, to power its apps and Nike.com services.

- Nike agreed to sell goods on Amazon in exchange for stricter anti-counterfeiting and limits on unsanctioned purchases in 2017. The deal was part of Amazon's attempt to court premium fashion brands.

Walmart Collaborates with Apple to Introduce Voice Technology for Online Grocery Purchases

(November 11) Company press release

Walmart Collaborates with Apple to Introduce Voice Technology for Online Grocery Purchases

(November 11) Company press release

- Walmart has collaborated with Apple to develop “Walmart Voice Order,” a service that gives consumers an option to add items to their online grocery carts by using voice commands.

- Customers need to link their Walmart accounts to the phone and can use Siri, Apple’s voice technology, to add items directly to the cart. The service is available on iPhone, iPad, Apple Watch, Mac, HomePod and CarPlay.

- Amazon reportedly plans to launch its own low-cost grocery format with a store in Woodland Hills, Los Angeles, in 2020. It said the brand will be different from Amazon’s Whole Foods and its checkout-free Amazon Go stores.

- Amazon posted job openings for a store lead, grocery associates and food service associates at the new store.

EUROPE RETAIL AND TECH HEADLINES

- Discount retailer B&M is undertaking a strategic review of its loss-making German unit Jawoll to determine the future of the business. On Tuesday, Jawoll reported a 3.2% rise in sales – but lost £12.2 million ($15.7 million).

- B&M said Jawoll performed poorly in its first half ending September 29, due to trading and operational issues. B&M has 98 Jawoll stores in Germany.

- British clothing retailer Quiz has collaborated with Boston-based artificial intelligence-powered fashion-tech startup True Fit to deliver its custom fitting solution across its entire online collection. With the size recommendations, Quiz aims to enhance the online experience – and reduce returns.

- True Fit uses data from groups of anonymous customers who provide detailed reviews on the exact fit and style of the brand’s products.

- Stockholm-based menswear designer and retailer Tiger of Sweden has appointed Linda Dauriz CEO, effective December 1. Dauriz currently serves as Director of Customer Experience and Corporate Development at Hugo Boss.

- Dauriz will succeed Moa Strand, who was appointed as Interim CEO after Hans-Christian Meyer resigned in February 2019. She will be responsible for increasing the brand's value in key markets and enhance its product and digital capabilities.

- German sportwear retailer Adidas has announced plans to shut its robotic production factories (“Speedfactories”) in Ansbach, Germany and Atlanta, by April 2020. It intends to install Speedfactory technology at two of its suppliers in Asia by December 2019.

- The factories use robots and 4D printing to manufacture affordable and flexible athletic footwear. The use of highly automated processes offers high-speed production, customization and faster supply to sales outlets.

Lidl to Fast-Track UK Expansion

(November 10) TheTimes.co.uk

Lidl to Fast-Track UK Expansion

(November 10) TheTimes.co.uk

- On Monday, Lidl UK revealed plans to speed its UK expansion by opening 230 new stores in the next three years, which will bring the total UK store count to 1,000.

- Lidl previously announced plans to open 50-60 stores each year. At the beginning of June, Lidl announced plans to invest £500 million ($641 million) to expand in London.

ASIA RETAIL AND TECH HEADLINES

- Japanese streetwear and sneaker brand Atmos is set to open a store in Indonesia at the Plaza Indonesia mall in Jakarta, its first in the island nation.

- The new store will offer products exclusive to Indonesia, as well as similar collections to its Japanese stores. The company is also looking to collaborate with local designers and brands.

- US fashion house Kenneth Cole has opened its first flagship store in India with local partner Brandzstorm India Marketing at Infiniti Mall in Malad, Mumbai. It plans to open 10 stores across India in the next three years.

- Brandzstorm will design, manufacture, distribute and retail Kenneth Cole products not only in India but also in neighboring countries such as Bangladesh and Sri Lanka. The company also plans to sell online, through department stores and multi-brand boutiques.

- Indian e-commerce company Snapdeal is in talks with Japanese multinational conglomerate SoftBank and other investors to raise about $100 million.

- Snapdeal is working with Bank of America Merrill Lynch as its adviser and talking to both local and global investors, targeting a valuation ranging from $800 million to $1.2 billion. Snapdeal posted net revenue of $140 million in fiscal 2019.

- During Singles’ day 2019, Alibaba generated ¥268.4 billion ($38.4 billion) in gross merchandise volume (GMV), a 26% jump over last year’s GMV of ¥213.5 billion ($30.8 billion).

- The total number of deliveries processed by Alibaba’s Cainiao Network this year was up 24% from last year at 1.292 billion. Some 299 brands each reached ¥100 million ($1.43 million) in GMV, including Apple, Nike, Estée Lauder and Giorgio Armani.

- Alibaba has announced plans to open a Taobao store in Malaysia called Taobao Store by Lumahgo, at the MyTOWN Shopping Center in Kuala Lumpur.

- Customers got a sneak preview of the store via a pop-up which offered products from local brands such as Redtick, BigboxAsia, Vivid Malaysia, DirectD Malaysia and Deep Furniture. These brands also joined Singles’ Day for the first time.

LATIN AMERICA RETAIL AND TECH HEADLINES

Magazine Luiza Conducts $1.1 Billion Share Offering

(November 13) Reuters.com

Magazine Luiza Conducts $1.1 Billion Share Offering

(November 13) Reuters.com

- Brazilian retailer Magazine Luiza raised $1.1 billion selling shares on November 12, pricing its shares at R$43 ($10.3) a piece.

- The company raised a total of 4.7 billion reals ($1.1 billion), 4.3 billion reals from new shares and 400 million reals from shares currently held by the Trajano family, the company’s controlling shareholders. The company says it will use the proceeds to expand e-commerce operations, open new stores and for future acquisitions.

- Mexican premium fashion brand distributor Sportmex launched an online platform. The site will run seasonal discounts and special promotions with free shipping all over Mexico.

- Sportmex says brands such as EA7 Emporio Armani, Le Coq Sportif, Scotch & Soda, Butterfly Twist, B3D, Swims and Hedgren are available on its platform.

- Brazilian artificial intelligence start-up TEVEC raised R$4 million ($1.2 million) in its latest investment round. TEVEC will use the investment to develop its SeeB4 platform to offer high-tech solutions.

- The SeeB4 platform automates supply chain planning and provides restocking recommendations.

- Google has launched the latest version of its Google Nest Mini smart speaker in Brazil priced at R$349 ($85).

- Head of Google/Nest devices Partnerships in Latin America Vinicius Dib said, “We see Brazil growing in this segment, and other launches may happen in the future given the priority given to the country.”

- Danish jeweller Pandora has launched a new store concept called “Evolution” by refitting its existing store at the Santafé shopping center in Medellín, Colombia.

- The company is also refitting its store at the Gran Estación shopping center in Bogotá.

MACRO ECONOMIC UPDATE

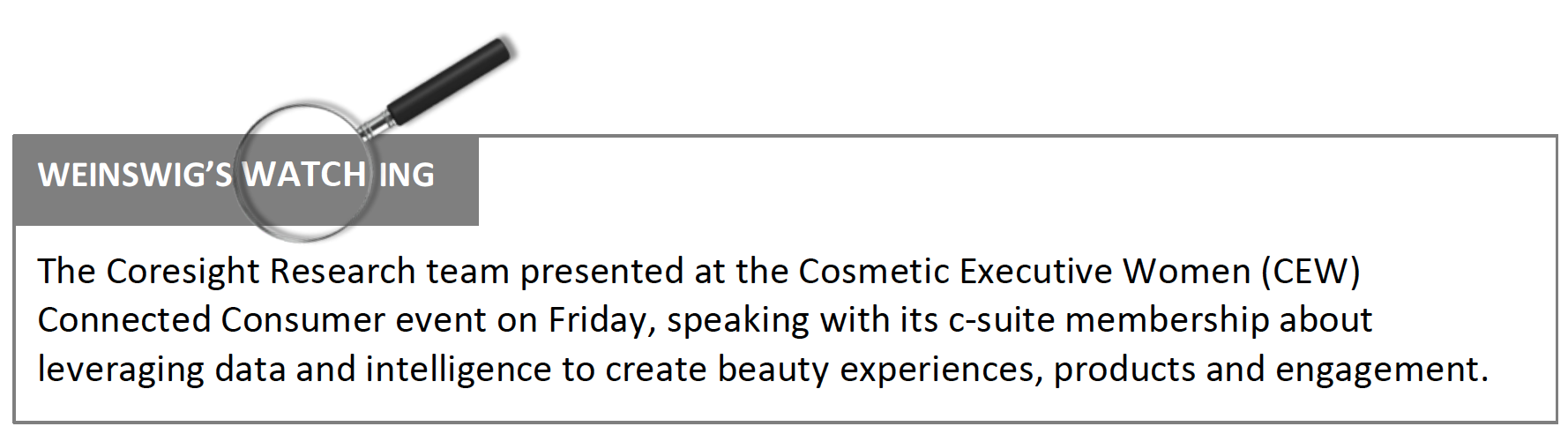

Key points from global macro indicators released November 6-12, 2019:- US: Continuing jobless claims in the US fell to 1.689 million in the week ended October 26 from 1.692 million in the previous week. Consumer credit increased $9.51 billion in September, slower than the $17.84 billion increase in the previous month and below the consensus estimate of $15 billion.

- Europe: In the eurozone, retail sales increased 3.1% year over year in September, higher than the 2.7% growth in August and above the consensus estimate of 2.5%. In Germany, industrial production fell 4.3% year over year in September, versus a 3.9% decrease in August.

- Asia Pacific: In China, the consumer price index (CPI) was up 3.8% year over year in October, versus the 3.0% increase in September. In Japan, bank lending was up 2% in October, the same rate as the previous month.

- Latin America: In Colombia, the CPI was up 3.86% in October, versus a 3.82% rise in September. In Mexico, consumer confidence was 43.89 in October, lower than 44.7 in September and below the consensus estimate of 45.9.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Department of Labor/Board of Governors of the Federal Reserve System/Eurostat/Office of National Statistics/Destatis/Ministry of Finance/National Bureau of Statistics of China/Bank of Japan/DANE/INEGI/Coresight Research[/caption]

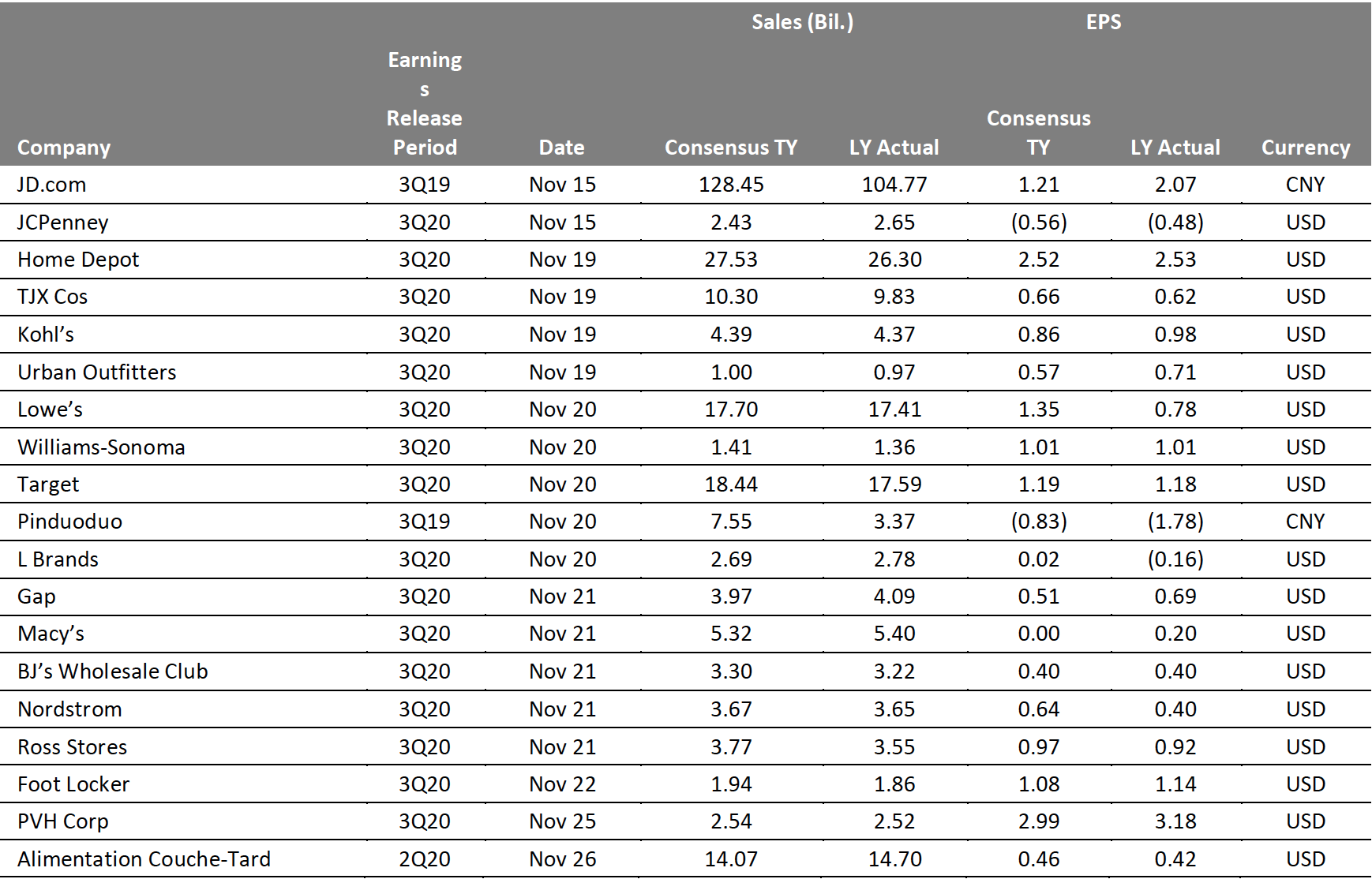

EARNINGS CALENDAR

[caption id="attachment_99748" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR