albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Signs of Spectacular Retail Abound in New Flagship Stores In January, Coresight Research identified “spectacular retail” as one of our global retail trends for 2019 and we have seen this continue to play out in recent weeks. Spectacular retail represents a new generation of flagship stores, offering experience-rich shopping, a huge choice of product and add-ons such as customization and personalization. We envisaged this trend being driven by major brands going direct to consumer with “temples” to their brands, though it is applicable to premium-positioned multibrand retailers, too. In recent weeks, Coresight Research’s global team has visited a number of new spectacular retail stores: Nordstrom NYC, the new Wegmans grocery store in Brooklyn and the new Adidas flagship store in London. The new Nordstrom NYC offers a spectacular experience through its use of technology, collaborations and its promotion of sustainability and social engagement. Although the men’s NYC store opened 18 months ago, the store was complete only on October 24 with the opening of the women’s and children’s store. The new building occupies 32,000 square feet over seven floors, and includes several restaurants and bars. The Nordstrom store reinforces and enhances the brand through collaborations, such as with Everlane, Christian Louboutin, Burberry and Nike. The store’s experience offerings include six restaurants and bars, beauty services, piercing and a personalization studio. Other services include in-store pick-up, 24/7 express services, three-hour same-day delivery and express return kiosks, in addition to personal stylists. Social offerings include accepting donations of used clothing. The store also features cool new retail technology, such as a MAC augmented-reality try-on mirror, a fragrance-finder machine and virtual reality for visualizing custom-made men’s suits. The new NYC Wegmans grocery store represents the consummate execution of the grocery concept. Wegmans has achieved a cult following in the Northeast US due to its extended product assortment and great customer service, and the new NY store delivers on these fronts. Its modern architecture and logo visible from the main street and storefront reinforce the brand. While the store does not offer cooking classes or tasting stations, it has a huge footprint (74,000 square feet, nearly twice the 46,000 square-foot average grocery store size, according to the Food Marketing Institute) with a corresponding breadth of food offerings. The store feels spacious and has a high, open ceiling. The store offers prepared food including sushi (with an on-site chef), pizza, burgers, coffee shops and food for takeout. The only area in which the store falls short somewhat is in terms of technology: The store is fairly traditional in that regard. The new Adidas LDN flagship store opened on October 24 on London’s Oxford Street is another story: The shop brings together a brand-building experience, digital integration and product customization. The four-story, 27,000-square-foot flagship store offers more than 100 digital touchpoints powered by green energy. The store reinforces the brand by emphasizing new products, features and perks in the Adidas app and an introduction to the customization options available in the store. The store’s theme is soccer (or “football” as it is called in the UK) and its offerings include Adidas Originals and collaborations, such as with YEEZY, Y-3 and Stella McCartney. The in-store experience is enhanced with art installations from local artists plus localized, exclusive products. One installation consists of 30 overlapping transparent LED screens that span the first and second floors of the store; the displays toggle between Adidas products and localized content. As retail evolves, stores and their purpose are changing. Those brands and retailers with a premium positioning are increasingly investing in stores to support their brand-building efforts. And, as physical retail overall continues to see traffic soften, spectacular experiences can drive footfall and establish stores as destinations for shoppers who are spoilt for choice.

US RETAIL & TECH HEADLINES

VF Corp Makes Three New Appointments to Strengthen its EMEA Leadership

(November 4) retailgazette.co.uk

VF Corp Makes Three New Appointments to Strengthen its EMEA Leadership

(November 4) retailgazette.co.uk

- US apparel company VF Corp has made three new appointments to strengthen its EMEA leadership team. The new appointees took up their roles on November 1, 2019.

- Andrea Cannelloni has been appointed President, Product Platform, EMEA. Timo Schmidt-Eisenhart has been appointed President of Napapijri and VF, EMEA Digital Platform. Mariano Alonso has been promoted to VP and GM of Timberland, EMEA.

- Walgreens Boots Alliance is reviewing options to take the company private. The company has reportedly held talks with private equity firms including KKR & Co.

- Walgreens has a market capitalization of about $55 billion and $16.8 billion in debt. A deal could potentially be the largest buyout in history.

CVS Starts Prescription Deliveries Via Drones

(November 6) Reuters.com

CVS Starts Prescription Deliveries Via Drones

(November 6) Reuters.com

- CVS Pharmacy has worked with US logistics company UPS to offer delivery of prescriptions by drone. The company completed its first drone delivery to a private home and a retirement center on November 1.

- The drone delivery was approved by the US Federal Aviation Administration (FAA). President of CVS Pharmacy Kevin Hourican said “CVS is exploring many types of delivery options for urban, suburban and rural markets.”

- Costco has unveiled its holiday savings offers, which include Black Friday deals on televisions, electronics, gaming systems, jewelry and food. A number of deals are featured in-store and online, but there are many offers available online exclusively.

- The first sale starts on November 7 and will continue through November 21; the next sale will begin in Thanksgiving week and run through December 2. Additional deals will be available on Thanksgiving Day, Black Friday and Cyber Monday.

- Sportswear company Under Armour is being investigated by the US Department of Justice and the US Securities and Exchange Commission (SEC) over its accounting practices.

- The authorities will examine whether the company shifted sales between quarters. The company has denied any wrongdoing.

EUROPE RETAIL AND TECH HEADLINES

- British retailer Mothercare has filed a notice of intent to appoint administrators for its UK business, putting 2,500 jobs at risk.

- Notices to appoint administrators will apply only to its trading subsidiary Mothercare UK and its service provider Mothercare Business Services. Its global businesses will continue to operate as usual.

- UK-based clothing retailer Bonmarché is reportedly planning to close 100 of its 318 stores in the UK if it fails to find a buyer for its business.

- Its stores in Berwick-upon-Tweed in Northumberland, Market Harborough in Leicestershire and Kirkcaldy in Scotland, among others, have already put up “closing down sale” signs in their windows.

- UK retail sales increased 0.6% year over year in October, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales increased 0.1%. The BRC noted that after several disappointing months, any hints of growth are welcome.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended October, total food sales grew 1.6% and total nonfood sales were down 1.8%.

- UK-based online retailer Shop Direct has hired Ben Fletcher, formerly with footwear retailer Clarks, as chief financial officer. He will also join the company’s executive board.

- Fletcher will start January 6, replacing interim CFO Dominic Appleton, who will remain with Shop Direct as Finance Director.

- German fashion company Hugo Boss said it expects sales and operating profits to recover in the fourth quarter. The company’s third quarter results were below expectations due to a fall in sales in the US and Hong Kong.

- The company expects to leverage store modernization and expansion into mainland China to drive the recovery. The company believes its online business, which grew 36% in the third quarter, will continue growing into the fourth quarter.

ASIA RETAIL AND TECH HEADLINES

Shopclues Merges with Qoo10

(November 4) InsideRetail.Asia

Shopclues Merges with Qoo10

(November 4) InsideRetail.Asia

- Indian e-commerce company Shopclues has been acquired by Singapore based e-commerce platform Qoo10. Shopclues said the merger will offer new strategic opportunities for both companies as it opens up cross-border selling opportunities.

- Qoo10 reportedly paid between $50 million and $80 million to acquire Shopclues.

- Thailand-based retail conglomerate Central Group plans to invest over 20 billion baht ($663.13 million) in Vienna, Osaka and Turin.

- The company will form a joint venture with Austria’s Signa Group to develop a luxury mixed-used project in Vienna. The company will also jointly invest with Japanese firms Taisei and Kanden Realty & Development to develop a 515-room hotel in Osaka, and re-launch its Rinascente department store in Turin, Italy.

Amazon’s Deal to Acquire Future Retail Faces Hurdles

(November 3) DealStreetAsia.com

Amazon’s Deal to Acquire Future Retail Faces Hurdles

(November 3) DealStreetAsia.com

- Amazon is facing challenges in its planned acquisition of Indian retail conglomerate Future Group. In August, Amazon agreed to acquire a 49% stake in the company. However, the Competition Commission of India (CCI) has now raised queries about the acquisition, which could delay the deal.

- The CCI said, “In certain overlapping segments and areas of operation of the parties, the combined market share exceeds the threshold specified in the combination regulations.”

- Alibaba’s financial services company Alipay is opening its payment platform to international travelers in China. Tourists visiting China will now be able to download and use the platform during their trip.

- Tourists will need an overseas phone number, a valid visa to enter China and a bank card to sign up. Users can top up their accounts in increments up to ¥2,000 ($285) and can use the account for three months, after which any remaining money will be refunded.

Bubs Australia Partners with Alibaba

(November 6) News.Com.Au

Bubs Australia Partners with Alibaba

(November 6) News.Com.Au

- Alibaba has partnered with Australian baby formula maker Bubs Australia to import goat milk products into China. Bubs expects to sell A$10 million ($6.90 million) worth of product in China in the first year, and says it believes China’s goat milk market is worth over $1.3 billion.

- Alibaba’s Centralized Import Procurement (CIP) and its appointed distributor, The Land, will promote and distribute Bubs adult goat dairy range products across all Alibaba platforms.

LATIN AMERICA RETAIL AND TECH HEADLINES

Falabella Launches Gap in Colombia

(November 4) FashionNetwork.com

Falabella Launches Gap in Colombia

(November 4) FashionNetwork.com

- Chilean department store Falabella has partnered with US clothing retailer Gap to introduce Gap products in Colombia. This marks Gap’s return to the Colombia market after it closed all its stores in 2016.

- Gap’s adult garments are available at some of Falabella’s physical stores while Gap’s children’s garments are available via Falabella’s online store.

- European apparel retailer C&A plans to expand its used garment recycling program to 24 more stores in Mexico after it received positive response from a six-month pilot in 10 stores.

- The company may roll it out to all of its 78 stores in Mexico.

- Spanish clothing company Mango has opened a 23,600-square-foot logistics center in Mexico. The company will now be able to manage online order and delivery, and plans to incorporate other omnichannel services.

- Mango currently has 35 points of sale in Mexico and plans to open about 12 new stores in collaboration with Mexican department store El Palacio de Hierro by the end of 2021.

- French clothing brand Lacoste has launched an online store in Argentina – just in time to join the country’s 2019 Cyber Monday, which ran from November 4-6.

- Lacoste’s Regional Omnichannel Sales Director Olivier Dupuy said, “This launch is a great achievement…in a challenging environment that will offer a premium brand experience to our Argentine customers, and that will enhance our digital expansion in Latin America.”

- Latin American e-commerce platform Linio appointed Oscar Ardila as its Marketing Director for Colombia, effective October 31. The appointment took place just months after the company committed to omnichannel integration in Colombia.

- Oscar Ardila is an industrial engineer by profession with a master's degree in online marketing and electronic commerce and has over 13 years of experience in marketing and advertising management.

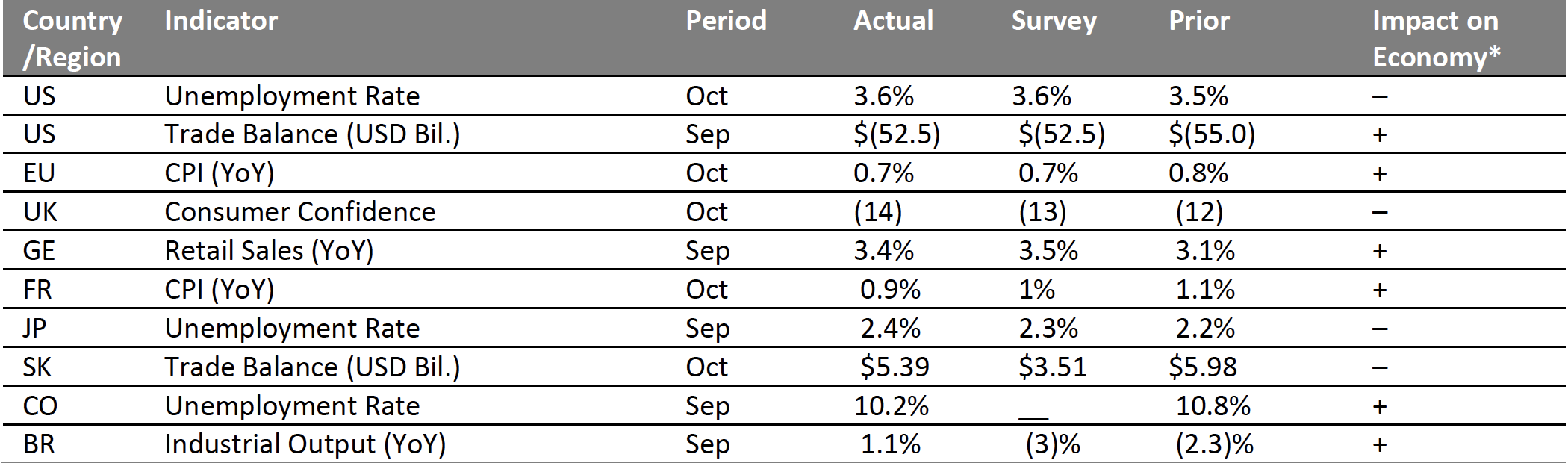

MACRO ECONOMIC UPDATE

Key global macro indicators released October 30-November 5, 2019:- US: The unemployment rate was 3.6% in October, slightly above the 3.5% reported in September, but in line with the consensus estimate. The trade deficit shrank to $52.5 billion in September from $55 billion in August.

- Europe: The eurozone Consumer Price Index (CPI) increased 0.7% year over year in October, slower than the 0.8% expansion in September. In Germany, total retail sales grew 3.4% year over year in September, slightly faster than the 3.1% increase in August, and marginally below the consensus estimate of 3.5%.

- Asia Pacific: Japan’s unemployment rate was 2.4% in September, up slightly from 2.2% in August. Korea’s trade surplus was $5.39 billion in October, versus the $5.98 billion surplus in September.

- Latin America: Colombia’s unemployment rate was 10.2% in September, down slightly from 10.8% in August. In Brazil, industrial output increased 1.1% in September, versus a 2.3% decrease in August and beating the consensus estimate of a 3% decline.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Census Bureau/Bureau of Economic Analysis, Department of Commerce/Eurostat/GfK/Destatis/INSEE/Statistics Bureau of Japan/Korean Customs Services/DANE/IBGE/Coresight Research[/caption]

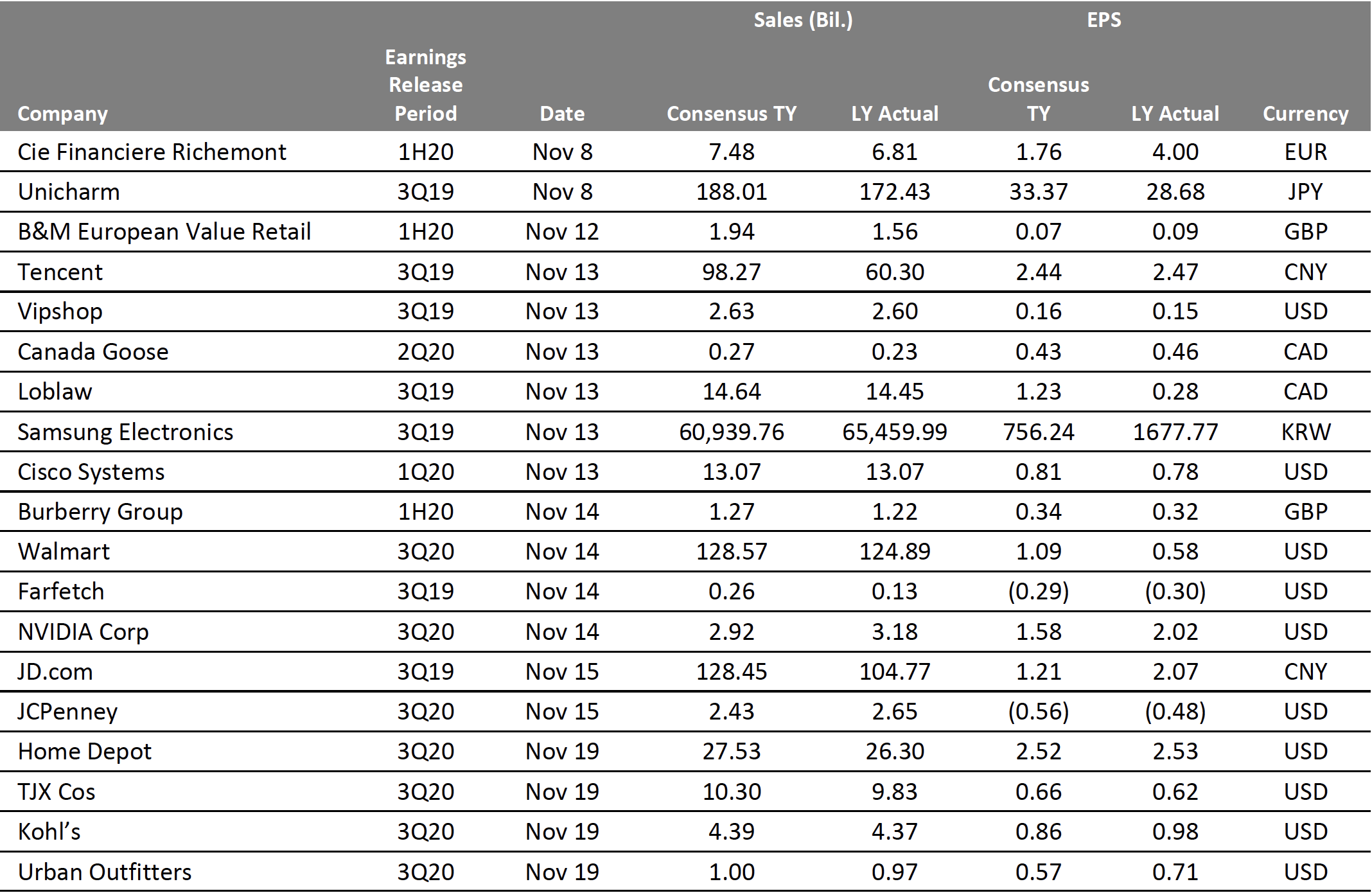

EARNINGS CALENDAR

[caption id="attachment_99231" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

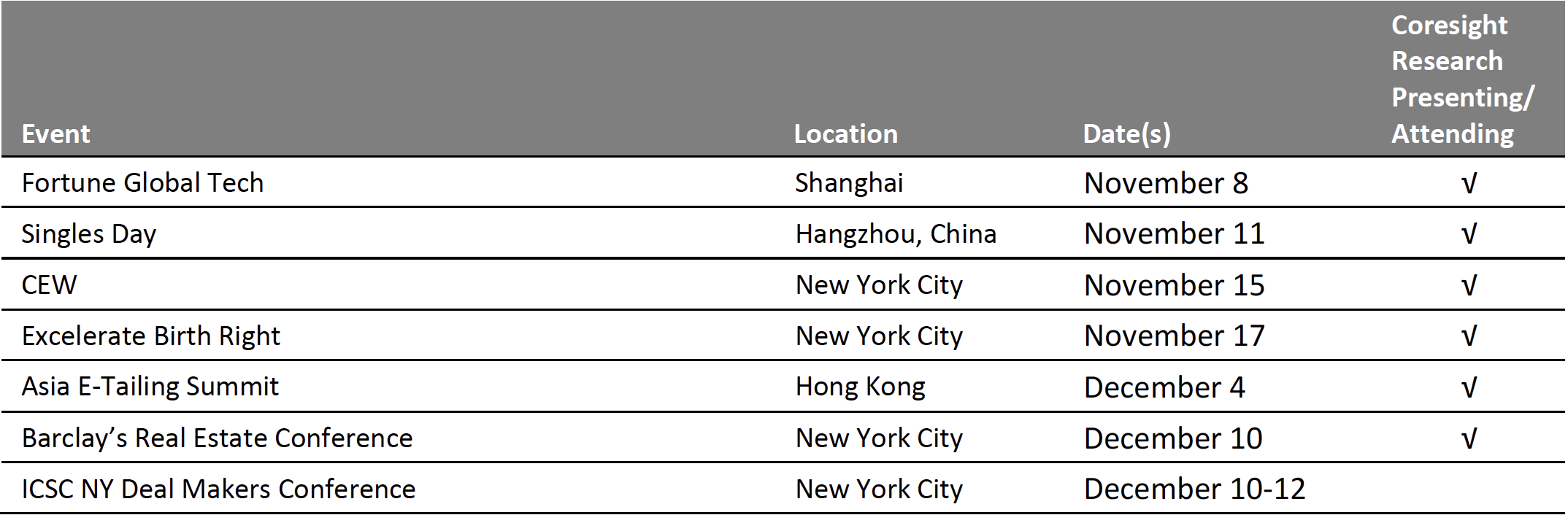

EVENT CALENDAR