Nitheesh NH

A Not-So-Merry Brexmas for UK Retailers

With the passing of Halloween, the UK missed another scheduled date for departing the European Union (EU), compounding uncertainty for consumers and businesses. The country is now on its third extension, having originally been scheduled to leave on March 29, which was extended to April 12, then again to October 31. Moreover, a parliamentary election is now in the mix, after parliament this week agreed to Prime Minister Boris Johnson’s request for a public vote.

The delay is bad news for Britain’s retailers looking to the approaching holiday peak. As we noted in our recent UK holiday outlook, the uncertainty created by a further extension of the UK’s departure is a negative for consumer spending. An on-schedule exit from the EU at the end of October would have provided some (perceived) finality to consumers, in the best case releasing pent-up consumer demand.

Our estimates for UK holiday sales were based on the assumption of an October 31 Brexit. We had estimated total retail sales to grow by around 3.5-4.0% year over year, versus a 3.1% increase last year, with the potential for stronger growth following a Brexit resolution. However, we see further Brexit delays as a drag on retail sales growth, providing potential downside to our original estimates. We could see November and December retail sales growth soften to around 3%.

Adding to the uncertainty is the December 12 general election. This will be held before parliament can vote on the latest version of the EU withdrawal agreement, which parliament must pass for the UK to leave the EU. While retailers want consumers focused on feel-good holiday shopping, the media (and many, but not all, Brits) will likely be more focused on what are likely to be heavily divisive election campaigns. The election result could result in Boris Johnson having an easier time getting the withdrawal agreement passed, or, if the election delivers more seats to parties opposed to Brexit (or the terms), the debate could continue for some time.

Even a decisive election result would provide a greater degree of certainty only in time for the final lap of the holiday season. And, the new parliament would still have to pass the bill to enact the UK’s withdrawal from the EU, which means the final Brexit settlement will likely come too late to boost holiday sales.

“Brexmas” uncertainty is likely only to further compound challenges for midmarket store-based retailers such as department stores, and could provide a small boost to the structural shifts in spending toward price-competitive channels such as discount and e-commerce.

We continue to expect Internet pure play retailers to be a principal driver of total retail growth and to outpace the increase in all online sales this holiday season. We estimate mid-to-high-teens growth for online-only retailers, outpacing not only the estimated circa-2% rise in sales at store-based retailers but an estimated circa-12% growth in total Internet retail sales. Pure plays will therefore drive further gains for e-commerce: This holiday season, we expect the online channel (in total) to capture 22.2% of all retail sales (versus 20.5% last year) and fully 32.6% of nonfood sales (versus 29.9% last year).

Political turbulence aside, the UK consumer is in a good place to spend. Across a number of metrics relevant to the consumer economy, we see a more positive environment than last year: wage growth has strengthened considerably even as inflation has moderated, unemployment is down, and consumer confidence has improved year over year.

This positive context suggests that we could see pent-up consumer demand released in early 2020, providing a post-holiday boost, especially to big-ticket categories. Assuming, of course, Brexit is finally resolved.

Kroger Teams Up with UPS, the USPS and FedEx To Test Parcel Delivery

(October 29) BusinessInsider.com

Kroger Teams Up with UPS, the USPS and FedEx To Test Parcel Delivery

(October 29) BusinessInsider.com

Amazon to Provide Free Grocery Delivery for US Prime Subscribers

(October 29) ChargedRetail.co.uk

Amazon to Provide Free Grocery Delivery for US Prime Subscribers

(October 29) ChargedRetail.co.uk

Forever 21 to Shut 200 Stores

(October 29) CNN.com

Forever 21 to Shut 200 Stores

(October 29) CNN.com

Walgreens to Close 150 In-Store Clinics and Add 100 Jenny Craig Locations Nationwide

(October 28) USAToday.com

Walgreens to Close 150 In-Store Clinics and Add 100 Jenny Craig Locations Nationwide

(October 28) USAToday.com

Walmart and Green Dot Extend Partnership and Form Fintech Accelerator

(October 28) Company press release

Walmart and Green Dot Extend Partnership and Form Fintech Accelerator

(October 28) Company press release

Marks & Spencer Launches Instalment Payment Option

(October 29) ChargedRetail.co.uk

Marks & Spencer Launches Instalment Payment Option

(October 29) ChargedRetail.co.uk

Tesco Launches New Loyalty Card Scheme

(October 29) RetailGazette.co.uk

Tesco Launches New Loyalty Card Scheme

(October 29) RetailGazette.co.uk

Italian Discounter MD to Target 1,000 Stores by 2021

(October 28) ESMMagazine.com

Italian Discounter MD to Target 1,000 Stores by 2021

(October 28) ESMMagazine.com

Barclay Brothers to Consider the Sale of Shop Direct

(October 28) RetailGazette.co.uk

Barclay Brothers to Consider the Sale of Shop Direct

(October 28) RetailGazette.co.uk

Lidl to Invest £25 Million in EV Rapid Charging Points in 300 UK Locations

(October 28) ChargedRetail.co.uk

Lidl to Invest £25 Million in EV Rapid Charging Points in 300 UK Locations

(October 28) ChargedRetail.co.uk

Foodpanda Singapore Expands into Grocery Delivery

(October 30) BusinessTimes.com

Foodpanda Singapore Expands into Grocery Delivery

(October 30) BusinessTimes.com

Amazon Invests $631 Million in its India Business

(October 29) DealStreetAsia.com

Amazon Invests $631 Million in its India Business

(October 29) DealStreetAsia.com

JD.com Launches 5G-Powered Logistics Park

(October 29) Zdnet.com

JD.com Launches 5G-Powered Logistics Park

(October 29) Zdnet.com

Galeries Lafayette Plans to Expand in China

(October 29) InsideRetail.Asia

Galeries Lafayette Plans to Expand in China

(October 29) InsideRetail.Asia

Cartier to Open Pop-Up Store in Singapore

(October 29) InsideRetail.Asia

Cartier to Open Pop-Up Store in Singapore

(October 29) InsideRetail.Asia

Mercado Libre Collaborates with Despegar in Peru

(October 28) America-Retail.com

Mercado Libre Collaborates with Despegar in Peru

(October 28) America-Retail.com

Natura Launches E-Commerce Platform in Peru

(October 28) FashionNetwork.com

Natura Launches E-Commerce Platform in Peru

(October 28) FashionNetwork.com

FEMSA’s Net Profit Increases 55% in the Third Quarter

(October 28) Reuters.com

FEMSA’s Net Profit Increases 55% in the Third Quarter

(October 28) Reuters.com

Grupo Axo Launches Bath & Body Works Online Store in Mexico

(October 29) Fashionnetwork.com

Grupo Axo Launches Bath & Body Works Online Store in Mexico

(October 29) Fashionnetwork.com

Avon Tests Drone Delivery Program in Colombia

(October 29) FashionNetwork.com

Avon Tests Drone Delivery Program in Colombia

(October 29) FashionNetwork.com

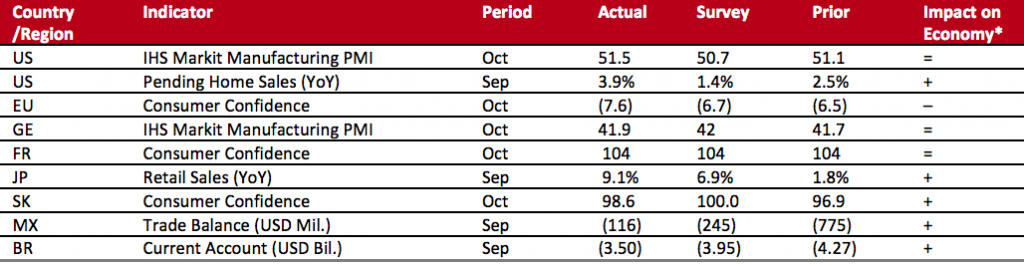

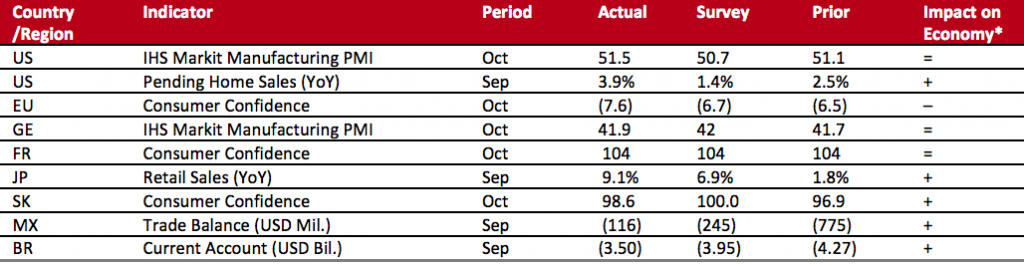

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit Economics/National Association of Realtors/European Commission/Destatis/INSEE/Ministry of Economy, Trade and Industry, Japan/Bank of Korea/INEGI/Banco Central de Chile/Banco Central do Brasil/Coresight Research[/caption] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

US RETAIL & TECH HEADLINES

- US supermarket chain Kroger has teamed up with package delivery companies UPS, the USPS and FedEx to test parcel delivery services in its stores. The trial program, called Kroger Package Services (KPS), will be tested in about 220 Kroger stores in 2019.

- During the trial, customers can pick up packages from UPS, the USPS and FedEx at Kroger stores. Customers can also drop off pre-labeled parcels for shipping.

- Amazon has announced that Prime members in 2,000 locations in the US are now entitled to free two-hour grocery delivery. Previously, customers had to pay an additional charge of $14.99 a month to use AmazonFresh.

- Amazon has also streamlined its AmazonFresh and Whole Foods Market ordering onto a single website. The service will be implemented in stages and will launched on an invitation-only basis for Prime members who are already subscribed to AmazonFresh or have regularly ordered groceries from Whole Foods.

- Forever 21 reportedly plans to close 200 stores as part of its restructuring after it voluntarily filed for Chapter 11 bankruptcy protection on September 29. Currently, Forever 21 has 549 stores in the US and 251 stores in other countries.

- Forever 21 has put forward a plan to withdraw from most international markets, including Canada, Europe, and Asia, emerging from bankruptcy and focuse on a smaller store base in the US, Mexico and Latin America. The retailer has entered into more than 130 vendor support agreements, providing crucial support for the company.

Walgreens to Close 150 In-Store Clinics and Add 100 Jenny Craig Locations Nationwide

(October 28) USAToday.com

Walgreens to Close 150 In-Store Clinics and Add 100 Jenny Craig Locations Nationwide

(October 28) USAToday.com

- Walgreens plans to shut 150 in-store clinics by the end of 2019, but will keep open more than 200 run in partnership with health care providers.

- Walgreens also plans to open 100 locations for the nutrition company Jenny Craig at its stores nationwide, starting in January. The retailer is seeking to reduce costs and believes that venturing into other businesses will attract more people through its doors.

Walmart and Green Dot Extend Partnership and Form Fintech Accelerator

(October 28) Company press release

Walmart and Green Dot Extend Partnership and Form Fintech Accelerator

(October 28) Company press release

- Walmart has entered into two new agreements with US fintech company Green Dot. Green Dot will continue to be the issuing bank and program manager for the Walmart MoneyCard program for an additional period of seven years, effective January 1, 2020.

- In addition, Walmart and Green Dot have agreed to jointly set up a new fintech accelerator called TailFin Labs.

EUROPE RETAIL AND TECH HEADLINES

Marks & Spencer Launches Instalment Payment Option

(October 29) ChargedRetail.co.uk

Marks & Spencer Launches Instalment Payment Option

(October 29) ChargedRetail.co.uk

- Marks & Spencer has partnered with online payment service provider Clearpay to launch an online instalment payment service for its UK customers. The payment option will be available from mid-November and can be used for purchases of over £30 ($38.6) on M&S clothing and homeware products.

- Clearpay is a free service and does not require a loan application. In-store and online customers can use the facility to pay via interest-free installments over six weeks.

- Tesco has announced plans to launch a new customer loyalty plan, Clubcard Plus, on November 8. Clubcard Plus will give customers benefits and discounts in grocery stores, at Tesco Bank and Tesco Mobile.

- Customers can join the new Clubcard Plus program for £7.99 ($10.27) per month. The plan offers a 10% discount for two purchases of up to £200 ($257.3) each in a month, allowing shoppers to save up to £40 ($51.5) a month.

Italian Discounter MD to Target 1,000 Stores by 2021

(October 28) ESMMagazine.com

Italian Discounter MD to Target 1,000 Stores by 2021

(October 28) ESMMagazine.com

- Italian discounter MD has announced plans to open 180 new stores in Italy by 2021. MD also plans to restructure over 100 Italian branches.

- MD will invest over €1 billion ($1.1 billion) in the expansion. In addition, MD will invest €80 million ($88.7 million) to build its largest distribution and logistics hub in Cortenuova, Italy.

Barclay Brothers to Consider the Sale of Shop Direct

(October 28) RetailGazette.co.uk

Barclay Brothers to Consider the Sale of Shop Direct

(October 28) RetailGazette.co.uk

- The Barclay family is reviewng ownership of the family’s holdings, which includes UK online retailer Shop Direct. The review is part of a restructuring strategy to generate capital to purchase a controlling share in the company from other family members.

- The news surfaced shortly after Shop Direct announced that its full year pre-tax losses had increased significantly in the fiscal year ending June 30, 2018, linked to extraordinary expenses, of which more than two-thirds were due to customer claims for the mis-selling of payment protection insurance.

Lidl to Invest £25 Million in EV Rapid Charging Points in 300 UK Locations

(October 28) ChargedRetail.co.uk

Lidl to Invest £25 Million in EV Rapid Charging Points in 300 UK Locations

(October 28) ChargedRetail.co.uk

- German discount retailer Lidl plans to invest over £25 million ($32 million) to install rapid electric vehicle (EV) charging stations at more than one quarter of its UK stores over the next three years. The charging stations are installed at 40 locations, but that will grow to 300 locations by 2020.

- Lidl has partnered with UK-based charging infrastructure provider Pod Point to operate the new charging stations, that are capable of charging 80% of the vehicle in about 50 minutes. The retailer can operate the charging station through the Open Charge mobile app and charges approximately £0.23 ($0.3) per kWh.

ASIA RETAIL AND TECH HEADLINES

Foodpanda Singapore Expands into Grocery Delivery

(October 30) BusinessTimes.com

Foodpanda Singapore Expands into Grocery Delivery

(October 30) BusinessTimes.com

- German mobile food delivery company Food Panda has announced it has expanded into grocery delivery services in Singapore. Food Panda partnered with about 1,000 local retailers to offer grocery delivery across Singapore in under 25 minutes.

- Foodpanda Singapore has also hired about 100 engineers to prepare its delivery platform for the new expansion and has employed more than 8,000 delivery people.

- Amazon has invested a total of $631 million in its Indian units — Amazon Seller Services, Amazon Pay and Amazon Retail — according to filings with the Registrar of Companies.

- The investments come after Amazon India reported a 9% drop in losses in fiscal year ended March 31.

JD.com Launches 5G-Powered Logistics Park

(October 29) Zdnet.com

JD.com Launches 5G-Powered Logistics Park

(October 29) Zdnet.com

- com has launched a logistics park powered with 5G networks in Beijing. The new 5G powered monitoring system will improve site operations and advance its industrial Internet of Things strategy.

- The 5G system will also facilitate “smart parking” that guides vehicles to a parking space and a “digital docking bay” that monitors the loading and unloading of goods into trucks in real time.

- French department store chain Galeries Lafayette announced plans to expand in China with the opening of 10 new stores by 2025.

- Galeries Lafayette CEO Nicolas Houze said China is its second largest market after France and is at the core of its international expansion strategy. He added Chinese customers account for 20% of the company’s sales in France.

- French luxury jewelry company Cartier is set to open a pop-up store “Clash De Cartier” in Singapore at the STPI Art Gallery from November 15 to 17.

- The store will be Cartier’s first and largest ever pop-up in Southeast Asia. The pop-up store also features a “Record Store” in which customers can get a personalized Japanese haiku poem, or listen to songs from the Clash de Cartier playlist.

LATIN AMERICA RETAIL AND TECH HEADLINES

Mercado Libre Collaborates with Despegar in Peru

(October 28) America-Retail.com

Mercado Libre Collaborates with Despegar in Peru

(October 28) America-Retail.com

- Argentine online marketplace Mercado Libre has teamed up with travel agency Despegar to boost both companies’ e-commerce by offering promotions on products in their respective apps in Peru.

- From October 28, Despegar’s app and Mercado Libre’s app will offer international trips, starting from $159 and Mercado Libre products at a discount of up to 20% for customers who pay using Interbank credit cards.

Natura Launches E-Commerce Platform in Peru

(October 28) FashionNetwork.com

Natura Launches E-Commerce Platform in Peru

(October 28) FashionNetwork.com

- Brazilian cosmetics company Natura has launched an e-commerce platform in Peru. Natura’s consultants, who are resellers, can create their own store within the e-commerce site. However, delivery will be managed directly by the company.

- Natura’s General Manager Eduardo Eiger said, “Direct selling has always been a social network and it was time to revitalize it by living this synergy and transcendence in the online world.”

- Mexican beverage and retail company FEMSA reported a net profit increase of 55% in the third quarter ended September 30, 2019. The company reported a net profit of MXN 7.27 billion ($369 million) in the third quarter.

- Revenue grew 10.2% year over year to MXN 130.5 billion ($6.82 billion), fueled by robust growth across all operations.

Grupo Axo Launches Bath & Body Works Online Store in Mexico

(October 29) Fashionnetwork.com

Grupo Axo Launches Bath & Body Works Online Store in Mexico

(October 29) Fashionnetwork.com

- Mexican multi-brand company Grupo Axo has launched an online Bath & Body Works store in Mexico. Bath & Body Works entered the Mexico market with Grupo Axo in 2015 and has over 10 single brand stores across the country.

- The online store, created by software companies Vicom and Vtex, features over 400 products under four categories and offers payment options such as credit cards and Mercado Pago, an online payments platform of Mercado Libre.

- US beauty and personal care retailer Avon is testing a drone delivery program in Colombia which aims to reduce the shipping time by 84%.

- The drone delivery program is a more cost-effective logistics alternative for the company.

MACRO ECONOMIC UPDATE

Key points from global macro indicators released October 23–29, 2019:- US: The IHS Markit manufacturing Purchasing Managers’s Index (PMI) increased slightly to 51.5 in October from 51.1 in September, and came in above the consensus estimate of 50.7. Pending home sales increased 3.9% year over year in September, higher than the 2.5% growth in August.

- Europe: In the eurozone, consumer confidence was (7.6) in October versus (6.5) in September. In Germany, the IHS Markit manufacturing PMI increased slightly to 41.9 in October from 41.7 in September, but below the consensus estimate of 42.

- Asia: In Japan, retail sales increased 9.1% year over year in September, higher than the 1.8% increase in August and above the consensus estimate of 6.9%. In Korea, consumer confidence was 98.6 in October, higher than 96.9 in September but lower than the consensus estimate of 100.

- Latin America: Mexico registered a trade deficit $116 million in September, versus the $775 million deficit registered in August. In Brazil, the current account deficit was $3.50 billion in September, versus the $4.27 billion deficit in August.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: Markit Economics/National Association of Realtors/European Commission/Destatis/INSEE/Ministry of Economy, Trade and Industry, Japan/Bank of Korea/INEGI/Banco Central de Chile/Banco Central do Brasil/Coresight Research[/caption]

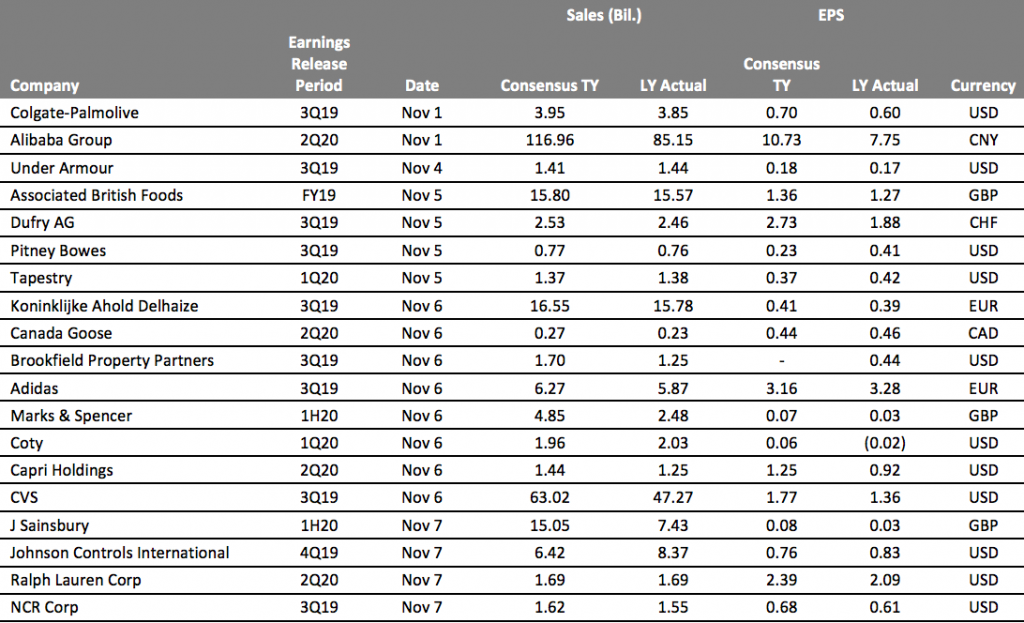

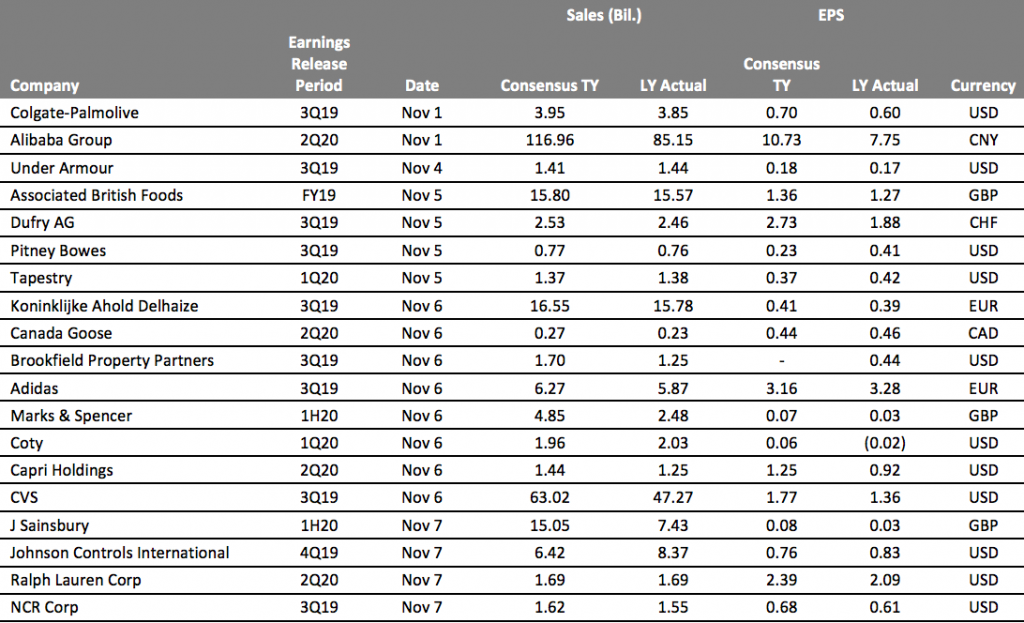

EARNINGS CALENDAR

[caption id="attachment_98872" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR